Introducing Fiduciary Focus, Towerpoint Wealth’s new newsletter for the fiduciary community.

Welcome to the first edition of Towerpoint Wealth’s Fiduciary Group’s Newsletter – Fiduciary Focus. Our growing team is excited to share our brand new newsletter and insightful information with the fiduciary community.

At Towerpoint Wealth, our Fiduciary Group brings together 27 years of collective experience in guiding Professional Private Fiduciaries, Third-party Trustees, Conservators, Administrators, and family members through the intricate aspects of Trust Administration, Special Needs Planning, Conservatorships, and Estate Administrations. We are dedicated to helping you meet your fiduciary responsibilities with precision, adhering to the stringent guidelines of the Uniform Prudent Investor Act and California State Probate Code.

And most important, as an independent Registered Investment Advisory firm, we’re bound by the same fiduciary standard as the fiduciaries we work with. Our dedication is to you.

Fiduciary Finance 101 Tip

The Foundation of Finance – A Fiduciary’s Guide to Diversification

In the complex world of finance, where markets fluctuate and economic landscapes shift, one principle stands as a beacon of stability: diversification. For professional fiduciaries tasked with safeguarding their clients' financial futures, understanding and implementing diversification is not only paramount, but a requirement outlined in the California Probate Code and Uniform Prudent Investor Act.

“Section 16048. In making and implementing investment decisions, the trustee has a duty to diversify the investments of the trust unless, under the circumstances, it is prudent not to do so.”

Diversification is more than just a buzzword; it's a fundamental strategy that spreads investment risk across a range of assets, mitigating the impact of volatility in any single investment. By diversifying, fiduciaries help shield their clients from the full brunt of market downturns while positioning them to benefit from potential upswings.

Here are three key reasons why diversification is a cornerstone of financial success:

1. Risk Management: Diversification is the bedrock of effective risk management. By spreading investments across various asset classes such as stocks, bonds, real estate, and commodities, fiduciaries can reduce the overall risk exposure of their clients' portfolios. When one asset class underperforms, others may hold steady or even thrive, helping to offset losses.

2. Smoothing Out Volatility: Markets are inherently volatile, subject to fluctuations driven by economic, political, and global events. Diversification helps smooth out this volatility by ensuring that a portfolio isn't overly reliant on the performance of any single investment or sector. Instead, it provides a buffer against market turbulence, fostering stability and preserving wealth over the long term.

3. Maximizing Returns: While diversification is primarily about risk management, it also has the potential to enhance returns. By spreading investments across different asset classes with varying risk-return profiles, fiduciaries can optimize the risk-return tradeoff within their clients' portfolios. This balanced approach aims to capture upside potential while minimizing downside risk, ultimately working towards the achievement of financial goals.

As fiduciaries, it's our duty to act in the best interests of our clients, and diversification is a powerful tool in fulfilling that obligation. By incorporating diversification into investment strategies, fiduciaries can help their clients navigate uncertain markets with confidence, laying the groundwork for long-term financial security and prosperity.

2023-2024 Tax Season Tip

Have your clients made their 2023 Traditional or Roth IRA contributions yet? If not, it’s not too late!

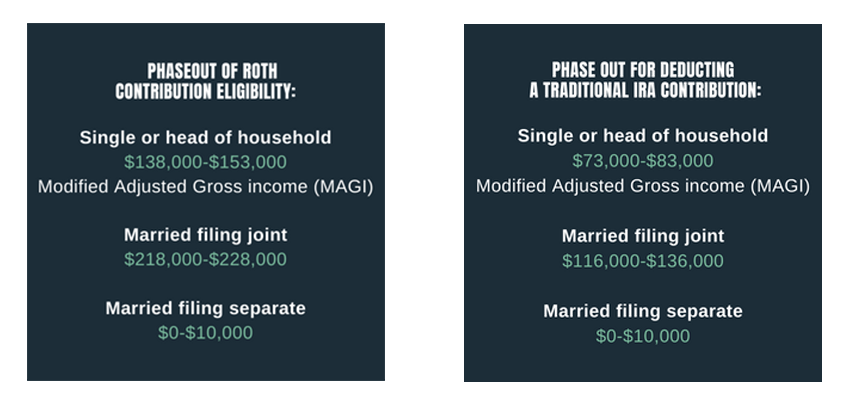

The deadline for both 2023 Traditional and Roth IRA contributions is April 15, 2024. Before contributing, ensure your client’s income doesn’t exceed the following income limitations:

What’s the difference between a Traditional vs. Roth IRA?

- Traditional IRA contributions are made pre-tax or in other words, are tax-deductible. The income and capital gains grow tax deferred until a client withdraws the funds. Withdrawals are taxed at the client’s ordinary income tax rates at time of withdrawal.

- Roth IRA contributions are made post-tax or not tax-deductible. BUT, not only do Roth investments grow tax-free, but they are TAX FREE upon withdrawal making Roth IRAs a powerful retirement tool.

Focus on this

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to contact us at any time, or call or email us at fiduciary@towerpointwealth.com with any questions, concerns, or needs you may have.

We enjoy social media, and are actively growing our online community!

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity. We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on YouTube

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on X

Click HERE to follow TPW Podcast : A Wealth of Knowledge