4 Reasons You Might Fall Short of Your Retirement Plan

When you find yourself daydreaming about retirement, does your dream retirement entail traveling the world? Dedicating time to beloved hobbies? Helping your children and grandchildren? Will you have enough money to retire this way? Dreams like these can become your reality, but numerous planning mistakes often cause retirement plans to fall short.

Everyone deserves a great retirement, but prudent planning and saving enough for the lifestyle you aspire to are critical to making it possible.

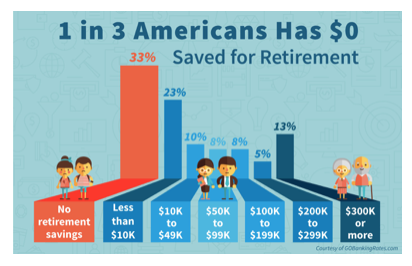

According to recent studies, retirement savings look grim for many Americans. One survey showed that just 24% of Americans feel like their savings are on-track for retirement, and 20% don’t have any retirement savings at all. The 2024 Northwestern Mutual Planning & Progress Study showed that there are large gaps between what people think they’ll need to retire and what they’ve saved. Financial planners recommend investing at least 10-15% of your income in a retirement account to be on track.

If you have started saving for retirement, you are definitely ahead of the curve. But don’t rest on your laurels just yet: You may still be engaging in some of the most common retirement planning mistakes without even realizing it. Here are four retirement planning mistakes to avoid:

Four Retirement Planning Mistakes to Avoid

Mistake #1: Not Saving Consistently

Most people are not saving as much as they need in order to maintain their current lifestyle in retirement. One of the worst retirement mistakes to avoid is saving too little now and hoping to “catch up” in the future. The truth is, catching up rarely happens and unexpected life circumstances can make doing so nearly impossible.

According to the median retirement account balance for 55 to 64-year-olds was just over $144,000 in 2019. Sound like enough money to retire? Well, if this money had to stretch over 20 to 25 years (read our blog post which discusses the financial complexities of longer life expectancies), it amounts to only ~$545 per month to live on.

To save more: create a budget, cut out unnecessary spending, open a retirement plan, such as a 401(k) through your employer, or an individual retirement fund as a self-employed individual, and save extra money with each raise or bonus you receive from work.

Mistake #2: Focusing on the Return Rate

If you have an investment that produces a high rate of return, it is easy to get caught up in always

Rather than chasing a high rate of return, we recommend shifting your focus to creating a diversified portfolio that spreads out investments through a variety of fund types and asset classes. Working with a financial advisor who helps you diversify and measure and manage the risk of your portfolio can help protect your retirement savings if/when the economy goes sideways.

Mistake #3: Not Factoring Taxes into the Equation

Another common mistake made during retirement planning is not considering taxes and their impact on your savings. In order to maximize retirement success, a retiree will need a plan to efficiently manage taxes in retirement. Consider speaking with a financial advisor regarding the creation and implementation of a tax-efficient retirement strategy.

Mistake #4: Retiring Too Early

Many people approach retirement age and realize they haven’t saved as much as they needed to maintain their current lifestyle (or pursue their dreams) in retirement. If this sounds like your situation, consider staying in the workforce a little longer to further add to your retirement nest egg. (You might ask, is $2 million enough to retire? It might be, but it might not.)

Staying in the workforce longer may also allow you to delay taking your Social Security benefits, allowing your eventual Social Security guaranteed income stream to continue to grow. (Note: Social Security data shows that around 33% of retirees live until 92 years old, yet 75% of retirees apply for benefits as soon as they hit 62).

Of course, pushing back retirement is not always the best or most attractive option for everyone. Health issues or other life circumstances may encourage an early retirement.

Whether you plan to retire early or need to retire later than expected, working with a financial advisor can help you determine the best way to prepare yourself for your specific retirement needs.

We Are Here To Help

Want to avoid other retirement saving mistakes and create a personalized, comprehensive retirement plan? Please call (916-405-9140) or email us (info@towerpointwealth.com) for a complementary consultation.

Sources

https://www.fool.com/retirement/general/2016/01/26/20-retirement-stats-that-will-blow-you-away.aspx

https://news.northwesternmutual.com/planning-and-progress-study-2024