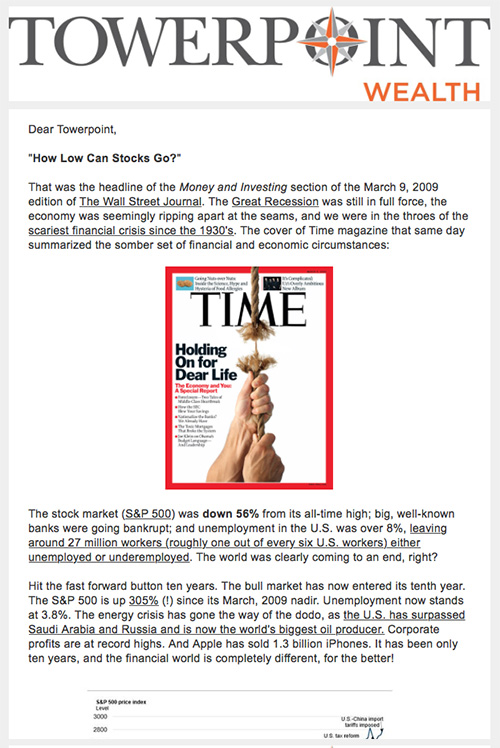

That was the headline of the Money and Investing section of the March 9, 2009 edition of The Wall Street Journal. The Great Recession was still in full force, the economy was seemingly ripping apart at the seams, and we were in the throes of the scariest financial crisis since the 1930's. The cover of Time magazine that same day summarized the somber set of financial and economic circumstances:

The stock market (S&P 500) was down 56% from its all-time high; big, well-known banks were going bankrupt; and unemployment in the U.S. was over 8%, leaving around 27 million workers (roughly one out of every six U.S. workers) either unemployed or underemployed. The world was clearly coming to an end, right?

Hit the fast forward button ten years. The bull market has now entered its tenth year. The S&P 500 is up 305% (!) since its March, 2009 nadir. Unemployment now stands at 3.8%. The energy crisis has gone the way of the dodo, as the U.S. has surpassed Saudi Arabia and Russia and is now the world's biggest oil producer. Corporate profits are at record highs. And Apple has sold 1.3 billion iPhones. It has been only ten years, and the financial world is completely different, for the better!

The only problem with this ten-year advance? A large swath of regular investors, acting out of fear, either completely missed or did not fully participate in this advance. We know this to be true, because reliable data regarding stock ownership shows that since the 2008 financial crisis, hundreds of billions of dollars have been pulled from U.S. stock funds. Also, Gallup, which annually polls to discover the percentage of Americans who own stocks in one way, shape, or form, found that ownership has dropped: From 62% of Americans in 2008, to 54% as of 2017.

The world continues to evolve, and economies continue to develop and revolutionize way more quickly than any of us are aware of, driving economic growth and global stock markets over time. We urge you to not let fear cause you to miss out, as the fun part is imagining where we will be ten years from now. Our guess is that we would barely recognize what our economy, society, and markets look like compared to today, but that it will be much better than any of us can even imagine.

While exciting, the much-talked-about ten year bull-market anniversary has not been the only newsworthy story over the past two weeks, as a plethora of notable events have occurred:

Lastly, we encourage you to take three or four minutes to review the curated content found below, highlighted by:

- A timely article discussing the Top 10 Tax Facts in 2019 you need to know.

- A well-written article discussing how a robust IPO market this year may drive real estate prices even higher in and around San Francisco.

- A straightforward fact sheet outlining why at Towerpoint Wealth we affectionately call CDs certificates of depreciation.

The fact remains: The world is a very complicated place, and we encourage you to call (916-405-9140), email (info@towerpointwealth.com), or Tweet (@twrpointwealth) with any concerns, questions, or needs you have. We continue to be here for you, and look forward to connecting with, helping, and being a direct, fully independent, and objective expert financial resource for you.