If your goal is to successfully build net worth, and you harbor concerns that a market correction (when stocks fall 10% or more from a recent high) is coming, perhaps MAD® Magazine’s Alfred E. Neuman’s catchphrase may be appropriate for you:

Over the course of 67 years, from 1952 until 2018, MAD® published 550 regular magazine issues, as well as countless reprint “Specials”, original-material paperbacks, reprint compilation books, and other print projects. And during that same time span (while unrelated, of course), the value of the S&P 500 index grew from 23.80 to 2,506.85.

And while our point is not to celebrate Mr. Neuman and his brash and sophomoric antics, if you are at all familiar with the content of MAD® magazine, it is tempting to equate its raw satire and derision with today’s unsettled, unpredictable, and vexing global financial markets and economic environment. And for some, paging through an issue of MAD® might be as objectionable as tolerating the painful and inevitable declines that are inextricably linked to the attractive longer-term growth prospect that owning and investing in equities can provide. There is little doubt in our mind that having a strong stomach is necessary if you truly want to build net worth.

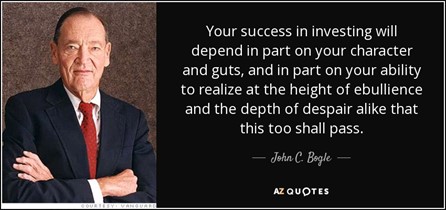

Today’s newsletter is not meant to “talk you off the ledge,” or be a diatribe instructing you to not panic. Frankly, if you are distraught about a four week decline (the length of the pullback so far in 2022), then it may actually clarify for you that owning stocks and investing in the stock market is not going to suit you very well. To quote famed investor and founder of Vanguard, John Bogle:

Additionally, a key element to success when working to build net worth is discipline. It is very important to remember to not think in terms of days, weeks, months, quarters, or even years, but instead, decades:

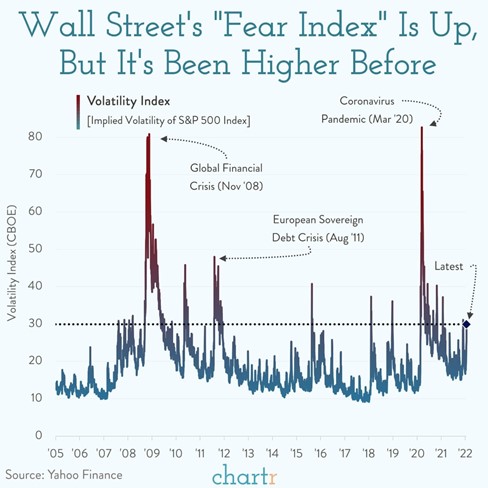

Fortunately, 2022’s pullback, while uncomfortable and sobering, hasn’t been too scary (not yet, at least) for most investors:

A popular measure of investor nerves is known as the VIX, or the Volatility Index, which projects the volatility of the S&P 500. While the VIX has increased significantly in four weeks, moving from 17.22 (right around its historic average) as of December 31 to 24.83 as of Thursday’s close, it is a far cry from the 80+ readings that it was clocking during the 2008-2009 Global Financial Crisis, or during the beginning of the coronavirus pandemic in March of 2020.

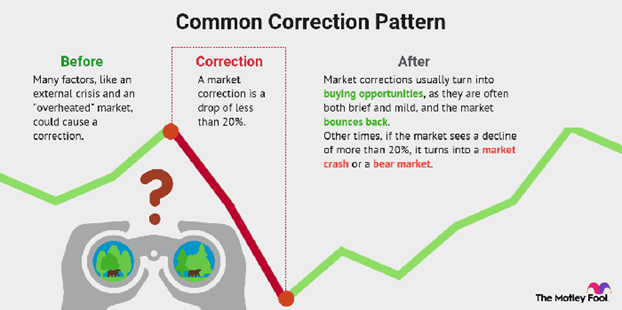

While we believe that working to build net worth is simple, we also understand that it certainly is not easy. And independent of whether or not a market correction is coming, is a head fake, or is already here, below are three important takeaways and reminders that should be internalized in your quest to build net worth:

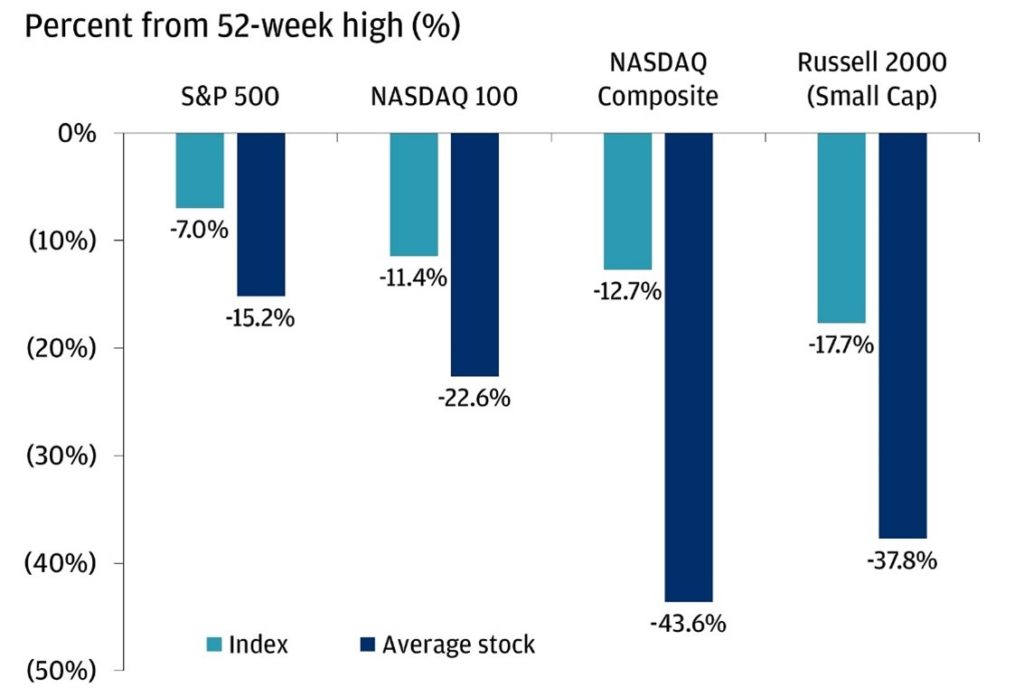

1. Diversification is your friend when corrections occur and volatility is elevated.

The risk of larger losses is much greater when owning individual stocks, as opposed to owning a more diversified basket of equities, or index fund:

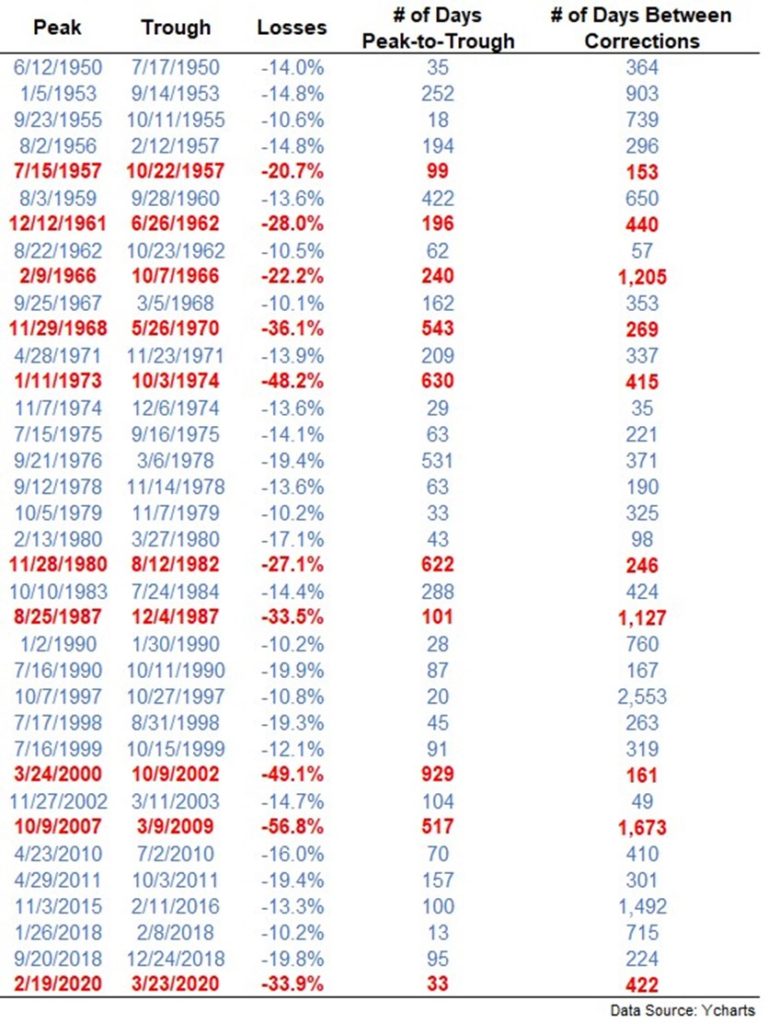

2. Remember, corrections happen (a lot) – on average, once every other year!

It may be tempting to try and stop the bleeding by selling while prices are depressed, but it almost always exacerbates the pain. In order to come out of this ahead, you’d have to precisely and correctly time your exit from AND your re-entry into the market. In other words, you have to be right twice.

Can you 1.) get out at – or close to – the top, and 2.) also then have the intestinal fortitude to buy back in at – or close to – the bottom, when prices are lower but things are even scarier? This is extremely difficult to do once, yet alone regularly, which is a virtual impossibility.

The S&P 500 has experienced ten bear markets of -20%, and 36 corrections of -10% or more since 1950! It is advisable instead of fearing or worrying about them, to be expecting (and embracing) them. This chart shows the peaks and troughs of all corrections from 1950 to 2020. The ones in red are bear markets, those that were over a 20% decline.

3. Lock away the password to your 401(k) and other online accounts, and keep your nose out of them.

We’re not saying that burying your head in the sand is a good solution, but sometimes, from a behavioral standpoint, intentional ignorance can indeed be bliss. At a minimum, remembering that market and economic events that are occurring today, while important, will ultimately represent just a small “blip on the radar screen” over your entire investing career as you strive to build net worth. As Peter Lynch says:

Yes, inflation is rising, we are still firmly entrenched in the pandemic, there are heightened tensions between Ukraine, Russia, the United States, and NATO, and corporate earnings growth has slowed. All excellent excuses for a shorter-term trader to sell stocks, which clearly has happened so far in 2022. However, longer-term investors should also recognize that there are plenty of excuses to buy stocks, as interest rates are still historically low, real estate values continue to appreciate, the economy (and concurrently, corporate profits) will hopefully grow more rapidly as the omicron variant subsides and people start spending more money, and unemployment and layoffs remain extremely low.

Whether or not you are a believer that a market correction is coming, we encourage you to channel your inner Alfred E. Neuman, and not overthink it! No worry!

Our advice hasn’t wavered: Be patient, be disciplined, be humble about your ability to consistently and accurately predict the future, teach yourself to tolerate (and embrace) corrections, and maintain the resolve and the confidence that the next recovery will happen.

What's Happening at TPW?

Just out together for a nice lunch, or auditioning for a new job at Il Fornaio??!!

We are hopeful, as are our TPW clients, that our Client Service Specialist, Michelle Venezia, and our Director of Operations, Lori Heppner, aren’t considering a career change!!

Raise your hand if you own appreciated real estate!

If you believe prices might be close to their highs, and that selling your appreciated investment real estate might be a good idea, doing a tax-free 1031 exchange is oftentimes a very attractive option!

If you are considering a 1031, are you familiar with Delaware Statutory Trusts, or DSTs?

Towerpoint Wealth has partnered with a number of leading DST sponsors such as Versity Investments and partners like Brad Davidson (pictured with our President, Joseph Eschleman, CIMA®) to help us help our clients gain exposure to commercial real estate, and its potential diversification, cash flow, and capital appreciation benefits.

TPW continues to seek innovative products and solutions such as DSTs to empower our clients to capture upside and keep Uncle Sam at bay, despite the uncertain future of real estate values and interest rates.

TPW Taxes - 2022

What exactly is a Form 1099, why can they be so frustrating to process, and how do you manage the problem of receiving an amended 1099 in March or April? (Hint – don’t file your taxes too soon.)

Click the image or button to read the white paper written by Steve Pitchford, our Director of Tax and Financial Planning, about handling the frustrations of Form 1099. Read White paper

TPW News You Can Use

Useful and interesting content we read the past two weeks:

1. Crime, Homelessness, Taxes: Hollywood Big Shots Fleeing L.A. – The Wrap – 1.26.2022

Why are executives and elites becoming disillusioned with Los Angeles? Rising crime, homelessness, and California’s anti-business policies are all cited by Hollywood’s rich and famous.

2. Experts Are Ringing Alarms About Elon Musk’s Brain Implants – The Daily Beast – 1.25.2022

As Elon Musk’s brain-implant startup, Neuralink, gears up for human trials, scientists are worried about the company’s oversight, the potential impact on trial participants, and whether society has meaningfully grappled with the stakes of fusing Big Tech with human brains.

3. 12 Bucket List Hikes in Northern California, One for Every Month of 2022 – 7x7 – 1.24.2022

There aren’t many regions in the U.S., let alone in the world, with the kind of ecological diversity of Northern California. With not one but three national parks in the Sierra Nevada, moody redwood forests, and a dreamy coastline teeming with whales and sea lions, you don’t have to try too hard to find a landscape that inspires.

2022 Market Perspective

In her latest market note, Liz Ann Sonders, Charles Schwab’s chief investment strategist, noted that the stock market’s decline so far in January is “glaring” (and the month isn’t over yet), and she expects the Fed to take note of the weakness and the slowdown in the U.S. economy.

She expects the Fed to start hiking interest rates in March. The uncertainty about the pace and veracity of this shift in policy could add volatility to the stock market. Click the image below to read Smoke on the Water… Fire Down Below for additional insights about Liz Ann’s perspective of 2022.

Chart / Infographic of the Week

Think cryptocurrency and digital assets are a volatile new asset class?

While we do not necessarily disagree, it is important to note that in a long-term study recently done by Van Eck, Associates, more than a quarter of S&P 500 companies had a HIGHER volatility than Bitcoin!

Quote of the Week

The overall return you ultimately earn over a lifetime of investing is largely determined by how you behave (or do not behave) when the market gets wild and crazy, like it is right now. Analogous to being a successful longer-term investor and creator of net worth, Napoleon’s definition of a “military genius” rings true:

The ultimate market irony: All past market declines look like opportunities in hindsight; all future market declines look like risks.

Trending Today

As the 24/7 news cycle churns, twists, and turns, a number of trending and notable events have occurred over the past few weeks:

- The worst January slump for the NASDAQ since 2008

- Boris Johnson’s political future hangs in the balance as the British Prime Minister faces calls to resign over “partygate” revelations

- With the news of Justice Breyer’s retirement, eyes turn to President Biden’s potential replacements

- The NFL Divisional Round - Most exciting weekend of NFL playoff football ever??!!

- President Biden is among other Western leaders preparing for Russian military action in Ukraine

- Pfizer and BioNTech announce plans to test omicron-specific COVID-19 vaccine in adult trials

- Twitter forced 4.7MM Tweet removals that violated Twitter’s rules during the first half of 2021

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph, Jonathan, Steve, Lori, Nathan, and Michelle

| We enjoy social media, and are actively growing our online community! Follow us on any of these platforms, message us there and let us know your favorite charity. We will happily donate $10 to it! Click HERE to follow Towerpoint Wealth on LinkedIn Click HERE to follow Towerpoint Wealth on Facebook Click HERE to follow Towerpoint Wealth on Instagram Click HERE to follow Towerpoint Wealth on Twitter Click HERE to follow Towerpoint Wealth YouTube Click HERE to follow Towerpoint Wealth Podcast A Wealth of Knowledge |