Harris vs. Trump: 2024’s Election TAX Impact on You!

With only two and a half months separating us from the result of the upcoming 2024 US presidential election, it has become an exceedingly unnerving time for some investors. Proposed tax law changes and market sentiment related to the election can considerably impact the financial landscape, making investors anxious as November 5th approaches.

The effect that elections can have on investors is undeniable. Changes in tax policy can alter your financial, investment, and tax planning, particularly when considering changes in the proposed tax on capital gains, dividend taxation, and estates. As candidates finish up their campaigning, it’s important that you, as an investor, understand how a win on either side could affect your portfolio and overall net worth position.

How might the policies of a Democratic or Republican administration reshape your financial and personal economic position? And, with the political environment more polarized than ever, how likely are these proposed changes to stick?

In this article, we’re going to discuss key tax proposals from both Kamala Harris and Donald Trump and the effects that these policy changes could have on you and your assets.

Why does tax policy matter for investors?

Tax policy isn’t just a hot talking point for politicians – it’s oftentimes a critical factor for voters that can have a major impact on your bottom line. Whether you’re managing your personal investments, planning for retirement down the line, running a business, or making arrangements for your estate, the taxes that you pay on capital gains, dividends, and other income can significantly impact the growth of your nest egg and portfolio.

A higher capital gains tax could erode your profits from selling stocks, which would, in turn, alter the amount of money you need to have set aside to offset this tax increase, and/or the timeline of your eventual withdrawals. Changes in dividend taxation could make income-generating assets more or less attractive. Estate taxes could dramatically impact how much wealth you can pass on to future generations, and how you establish and coordinate your estate.

All of this is to say that tax policy changes aren’t just numbers and talking points that politicians exchange views on – they will affect the material dollars in YOUR pocket.

How have previous elections affected investors?

Historically, we can see how previous elections and the tax policy changes created by elected officials have shaped the way investments are taxed now. For example, in 2017, the Tax Cuts and Jobs Act (TCJA) signed by President Donald Trump slashed corporate tax rates and provided corporations with bonus depreciation opportunities following an advancing stock market. This, in turn, boosted corporate investment and economic growth.

Similarly, the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) signed by President George W. Bush made significant changes to overall tax rates and retirement planning. This Act placed new limits on estate taxes, allowed for higher IRA contributions, and created new employer-sponsored retirement plans. These changes greatly altered retirement planning in subsequent years, and its results are still being experienced today.

Democratic Party Tax Proposals 2024

Each party running for office has its own set of policy proposals that can have a long-term impact on you as an investor.

When it comes to the 2024 Election, The Democratic Party as a whole appears to support the movement to increase taxes on corporations and the rich. The party has also boasted its plans to support workers’ rights and support the middle class.

The Democratic Party Nominee

The Democratic nominee for president is Kamala Harris, currently the Vice President of the United States under President Joe Biden. Harris built her platform on her firm stances on reproductive rights, climate concerns, and border reform.

As a Senator, Harris proposed tax legislation – the LIFT (Livable Incomes for Families Today) the Middle Class Act – that would provide a $3,000 per person ($6,000 per couple) refundable tax credit, or economic boost, for most middle and working-class Americans. This legislation would have cost taxpayers approximately $3 trillion over a decade, which the Act intended to offset by repealing the aforementioned TCJA provisions that tended to benefit those earning over $100,000 a year.

How would a Harris win affect investors and the overall economy?

When it comes to changes in economic policy we can expect if Harris wins in November, there are a few significant policy proposals that are worth keeping your eye on. In her economic agenda, Harris outlines her plans for affordable housing, relieving medical debt, lowering the cost of prescription drugs, lowering grocery costs, and cutting taxes for middle-class families with children.

By increasing the child tax credit (CTC) and following through with her many other tax-related proposals, many middle-class families would expect to see reduced tax liabilities. According to the non-partisan Tax Foundation, this plan would have a minimal impact on GDP; however, it appears that corporations and wealthy individuals may be footing the bill.

According to the NY Times, Vice President Kamala Harris has endorsed a comprehensive tax policy aimed at raising nearly $5 trillion in revenue over the next decade, primarily targeting the wealthiest Americans and large corporations. Her proposal includes:

- Increasing the corporate tax rate from 21% to 28%

- Raising the minimum tax on corporations' reported income to 21%

- Doubling the global minimum tax on multinational companies to 21%.

- Increasing the top marginal federal tax rate from 37% to 39.6%.

- Raising the current preferential tax rate on capital gains and dividends, for those with annual income exceeding $1MM for couples, $500K for single filers.

- Increasing the Medicare surtax from 3.8% to 5% for Americans making more than $400,000.

These proposals build on the Biden administration's recent budget plan, emphasizing a commitment to addressing wealth inequality and generating revenue to fund government initiatives.

Despite the ambitious nature of these proposals, they may face significant hurdles in Congress; however, these proposals demonstrate the initiatives of the Harris campaign when it comes to tax policies.Despite the ambitious nature of these proposals, they may face significant hurdles in Congress; however, these proposals demonstrate the initiatives of the Harris campaign when it comes to tax policies.

Harris has also announced that she intends to fight corporate price-gouging for groceries and prescription medications. While this could help to make these products more affordable for middle-class Americans, it would also make it more difficult for corporations to invest in growth initiatives and remain competitive against other businesses.

Overall, these policies aim to shift toward a greater income distribution but could have a significant impact on the overall economy.

Under these policies, the wealthiest investors could see a substantial increase in their tax liabilities, particularly those who rely heavily on growth in their investment portfolios, i.e. capital gains. While the middle class might not see as dramatic an impact on their taxes, some believe that higher corporate taxes could lead to lower stock market returns, which could, in turn, affect retirement account balances and mutual funds.

Your retirement planning could look a bit different as an effect of potential income tax changes and slower stock market growth. The increased income for middle and lower-class workers could allow for more capital to be allocated to retirement savings; however, higher earners would have less disposable income to contribute to their retirement plans.

Republican Party Proposed Tax Changes 2024

For the 2024 Election, the Republican Party has expressed its intentions to boost the US economy by investing in all forms of energy production, championing innovation, and reducing illegal immigration.

The Republican Party Presidential Nominee

The Republican nominee for president is former President Donald Trump. Trump served as the 45th United States President after winning the electoral vote in the 2016 Presidential Election and ran again against Biden in the 2020 Election.

President Trump has built his platform on supporting corporations, tightening border security, and increasing military budgets.

How would a Trump win affect investors and the overall economy?

If Trump wins the role of United States President in November, he appears to have intentions to lower even further the corporate tax rate, from 21% to 20%, and extend the effects of the TCJA. Trump also has announced his intention to eliminate income taxes on tips.

Trump also suggests imposing large tariffs on United States imports from China and imposing a universal baseline tariff on all imports.

Under these policies, US corporate profits may grow, potentially resulting in higher stock prices and increased dividends for shareholders. Extending the TCJA could continue to benefit higher-income investors by maintaining lower tax rates on income – which could encourage continued investment in equities.

However, Trump's proposed tariffs on imports could have more complex effects on the overall economy and investments. While these tariffs are aimed at protecting domestic industries from foreign competition, they could also lead to higher costs for businesses that rely on these imported goods. Many also believe that these tariffs could lead to a tariff war, resulting in other countries imposing tariffs on U.S. exports.

Some advisors suggest that their clients look at sector rotation, as some believe that Trump’s plans may negatively impact multinational corporations and those who depend on the global supply chain to operate.

It appears that while Trump’s policies may provide short-term gains for certain investors and workers, the long-term effects could cause increased economic volatility and uncertainty.

The catch – nothing is set in stone!

As you are likely well aware, today’s political climate seems more polarized than ever. This polarization can make it incredibly difficult for candidates (from either side) to implement their policies effectively. With both parties deeply entrenched in their own ideals, it can be tricky to attain bipartisan cooperation on policies. This can lead to frequent changes in laws as power shifts between parties.

Many of these policies proposed by either party could be rejected or altered in order to pass through Congress. Keep in mind that these proposed policies are also not set in stone once a candidate wins in the polls in November.

It’s also worth mentioning that candidates don’t always deliver on their campaign promises. Whether there is a blockage coming from Congress creating a disagreement on how to handle a certain issue or implement proposed legislation, or a change resulting from policy negotiations, nothing is official until it is signed into law.

Our final thoughts

As the 2024 Election looms, investors need to be aware of the implications that a win from either side could mean for them and their portfolios. By staying vigilant and informed, you can better prepare for political changes and adapt your investment strategy as needed.

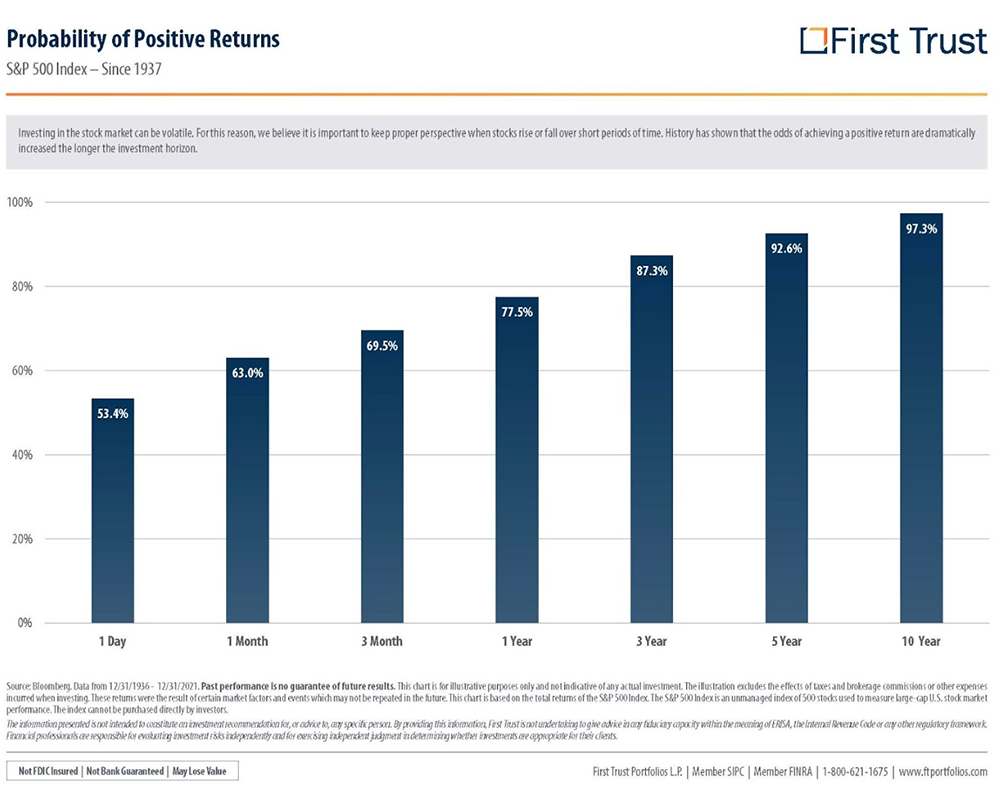

In the face of potential political changes, it can be tempting for investors to make drastic decisions to try to avoid a loss. You may be tempted to avoid investing in the stock market, steer clear of certain sectors, or even panic-sell your assets; however, if history has shown us anything, it’s that reacting impulsively to short-term shifts often does more harm than good, and that good, well-run, profitable companies will probably stay good, well-run, and profitable, regardless of whether Harris or Trump wins in November.

While the proposed policies by each candidate may seem significant, these proposals often undergo considerable modification or can even be shut down before becoming law. Political discourse, Congressional negotiations, and unforeseen events (like a global pandemic or disruptions in supply chains) can drastically alter the political and economic climate.

Investors can’t see the future, which is why you must continue to diversify your portfolio and systematically invest, regardless of who wins the upcoming election. The stock market has proven itself resilient time and time again – so you don’t want to miss out on long-term financial gains due to short-term political predictions.

If you’re worried about how a win for either Democrats or Republicans could affect your portfolio, seek guidance from a trusted financial advisor. Having the insights of an expert, and the support and counsel of an experienced advisor who is a legal fiduciary to you, can help provide clarity and confidence in your financial plan, helping to balance out some of the emotions that can drive hasty decision-making.

By maintaining a diversified portfolio and consulting with your financial professional, you can better position yourself to weather potential challenges, while capitalizing on opportunities that may arise from political policy changes.

At Towerpoint Wealth, we help you remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement. If you are worried about how the 2024 election could affect your financial future, we welcome talking further with you about your personal situation.Worried about increased taxes as a high earner? Check out our “Minimizing "The Necessary Evils" of Investing” Guide, with strategies for high-income earners that will help you reduce your taxes and investment expenses.

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity. We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on YouTube

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on X

Click HERE to follow TPW Podcast : A Wealth of Knowledge