Sacramento has long been a hidden gem in California’s real estate market, but today, it may no longer be a secret.

Investors are paying close attention to home prices, rental demand, interest rates, and economic growth — all of which are shaping the city’s real estate landscape.

With affordability concerns continuing to push Bay Area residents eastward, Sacramento remains a prime destination for rental demand and long-term real estate investment potential. But with higher mortgage rates, shifting market conditions, and new real estate laws, investors must be more strategic than ever.

So, what does this mean for you?

Whether you’re considering buying your first rental property, expanding your real estate portfolio, or simply trying to navigate the current market trends, understanding where Sacramento real estate is headed in 2025 is key to making informed investment decisions.

In this article, we’ll break down:

- Home price trends and whether Sacramento real estate is a smart investment.

- The state of the rental market and how investors can capitalize on strong demand.

- How interest rates, policy changes, and economic trends could impact your strategy.

- The best real estate investment strategies to maximize returns in 2025.

Despite market shifts, Sacramento remains one of California’s most resilient real estate markets. But the key to success? Making objective, data-driven decisions and aligning your real estate investments within your overall longer-term financial strategy.

If you want to be confident that your next real estate move is a smart one, we’re here to provide you with tools to help you assess rental income potential, and develop a real estate investment strategy tailored to your financial goals.

What’s Driving the Sacramento Real Estate Market in 2025?

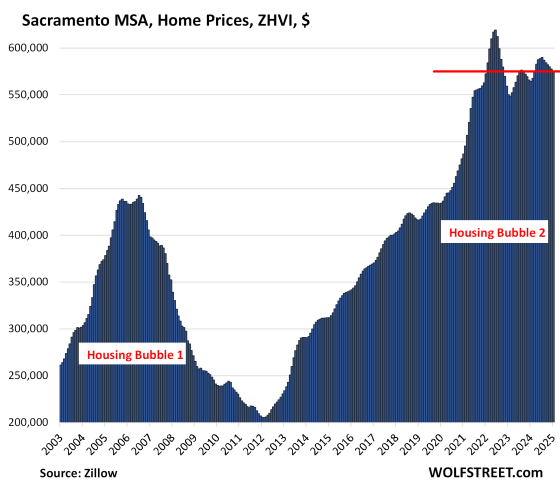

The Sacramento real estate market has been somewhat of a rollercoaster over the past few years. Surging home prices, rising interest rates, and shifting migration patterns have reshaped the landscape, leaving many investors wondering: Is now the right time to invest?

As we move through 2025, the market presents both challenges and opportunities. While affordability concerns and economic uncertainty linger, Sacramento continues to attract buyers, renters, and investors looking for a strong return on investment.

Though Sacramento is experiencing its usual seasonal uptick in listings and sales, the intensity of the market remains more subdued than in previous years. The typical spring momentum is present, but at a slower pace, making this a more balanced market for buyers and investors compared to the aggressive conditions of past years.

Here’s what’s shaping the market this year.

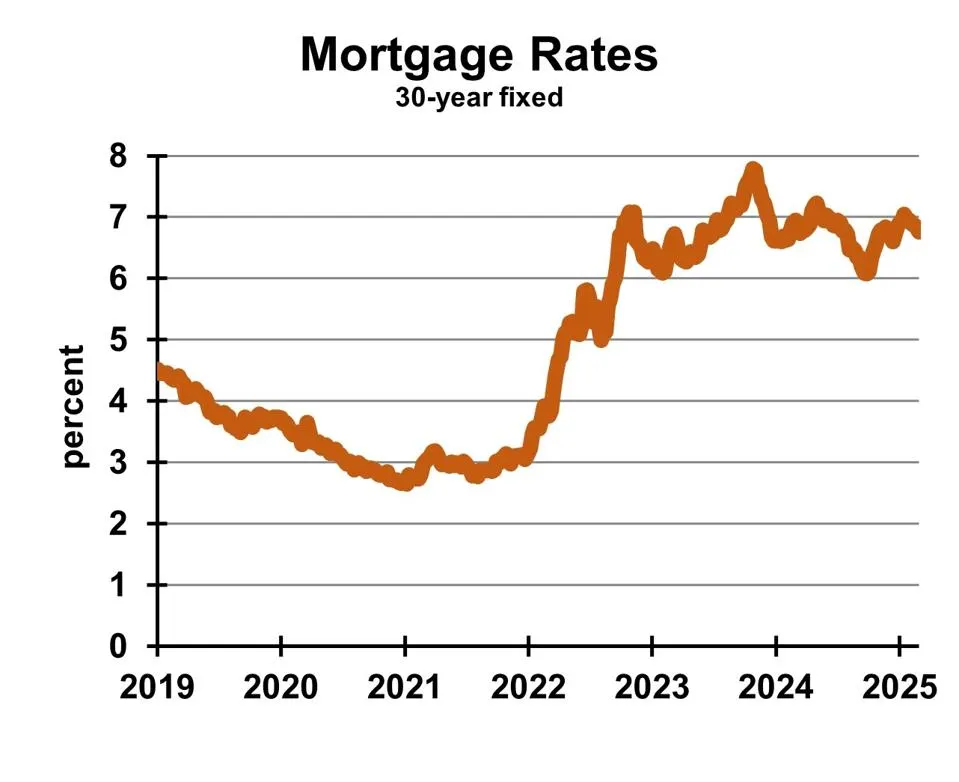

Interest Rates and the Cost of Borrowing

Interest rates remain a defining factor for real estate investors in 2025. Mortgage rates are still elevated compared to historic lows, making financing more expensive and placing greater importance on cash flow analysis. Investors can no longer rely on rapid price appreciation to drive returns — rental income must support the investment.

Higher borrowing costs have also made it more challenging to find cash-flow-positive properties. While Sacramento remains more affordable than other California metros, investors need to be more selective when leveraging debt.

Data courtesy of Freddie Mac

Analyzing rental yields, adjusting financing structures, and considering alternative lending options — such as seller financing or adjustable-rate mortgages — can help navigate this environment.

For those considering new investments, understanding how financing affects returns is essential. Running detailed cash flow projections before purchasing can help ensure that a property is a strong long-term investment.

For help with analyzing the profitability of an investment property, check out our Rental Property Analysis Calculator.

Sacramento Home Prices and Market Movement

Sacramento’s home prices have stabilized after years of rapid appreciation. While active listings have increased compared to last year, inventory levels remain below historical averages, which we believe has prevented a major price correction. Many homeowners with low fixed mortgage rates are reluctant to sell, limiting new inventory and keeping home prices from falling significantly.

While luxury home prices have softened, mid-tier and entry-level properties remain competitive as both first-time buyers and investors look for opportunities. Demand in historically overlooked neighborhoods is increasing, offering potential value for investors willing to explore emerging areas.

Despite higher interest rates, Sacramento’s strong rental market and steady population growth continue to support longer-term home values. Investors who take a disciplined approach — focusing on rental income and long-term potential rather than speculation — may still be able to find opportunities in the current market.

The Rental Market: Demand, Yields, and Regulatory Factors

Sacramento’s rental market remains strong, driven by affordability relative to the Bay Area. With rising mortgage rates keeping more people in rentals, demand continues to support stable rental income for investors.

Multifamily properties, in particular, have gained popularity as investors seek higher rental yields and diversified tenant bases. Duplexes, triplexes, and small apartment buildings offer stronger cash flow potential than single-family homes in many cases.

Accessory Dwelling Units (ADUs) have also become a key investment strategy, with California laws making it easier for property owners to build and rent these secondary units.

One segment facing particular challenges is the condominium market. Rising HOA fees have made condos less affordable for buyers, leading to slower sales volume and declining prices in certain subdivisions. Investors considering condo purchases should factor in increasing HOA costs and shifting demand toward single-family rentals or multifamily properties with fewer shared expenses.

Investors should also keep an eye on regulatory developments. Sacramento remains more landlord-friendly than cities like San Francisco or Los Angeles, but new rent control measures or tenant protections could impact longer-term cash flow projections.

For real estate investors looking for stable cash flow and long-term rental demand, Sacramento continues to present attractive opportunities.

How Sacramento Compares to Other California Real Estate Markets

Sacramento remains one of the strongest investment markets in California, offering a balance of affordability and rental demand that is increasingly difficult to find in major coastal cities.

Compared to other regions:

- San Francisco & Los Angeles: Sacramento’s lower home prices and higher rental yields make it an attractive alternative for investors seeking better cash flow.

- Bay Area Migration: The continued influx of residents moving from the Bay Area supports housing demand and rental stability.

While Sacramento remains a strong investment market overall, price trends vary by neighborhood. Some areas are seeing stable or slightly rising prices, while others may be experiencing flat or modestly declining values, making local market research critical for investors.

For investors looking to diversify within California’s real estate market, Sacramento offers a unique mix of affordability, growth potential, and rental income stability.

Is 2025 a Good Time to Invest in Sacramento Real Estate?

Unsurprisingly, we believe that real estate investors in 2025 need to approach the market with a strategic, longer-term mindset. While shorter-term price growth has slowed, Sacramento remains a viable market for investors focused on rental income and wealth-building over time.

- Longer-term investors can benefit from Sacramento’s steady appreciation and strong rental demand.

- Short-term flippers may face challenges due to higher financing costs and slower price growth.

- Investors should prioritize cash flow and tax-efficient strategies to maximize returns.

While competition still exists in the Sacramento market, it is less intense than in past years. Investors may have more negotiation power, especially in segments like luxury homes and condominiums, where buyer demand has softened.

With interest rates still elevated, understanding cap rates, financing options, and tax advantages is key to making smart investment decisions. Investors who adapt their strategies to current market conditions will be best positioned to succeed.

Strategies for Investing in Real Estate in Sacramento, California

The Sacramento real estate market presents opportunities for investors who are willing to adapt their strategies to today’s economic environment.

While rising interest rates and a shifting housing market create new challenges, investors who take a disciplined, data-driven approach can still find strong opportunities for longer-term wealth building.

Here are some key strategies investors may want to focus on in 2025:

1. Prioritize Cash Flow Over Appreciation

In recent years, many investors have relied on home price appreciation to drive returns. However, 2025 is not a speculative market. With higher financing costs and slower home price growth, investors need to ensure that rental income supports their investment, rather than banking on rapid appreciation.

Investors should focus on factors like:

- Cap rates and net operating income (NOI) to ensure a property generates sustainable returns.

- Tenant demand and rental growth potential, especially in areas attracting new residents from the Bay Area.

- Conservative financial models that account for potential vacancies or unexpected costs.

For investors leveraging financing, higher borrowing costs make rental income a more critical factor than ever. Ensuring a healthy rent-to-price ratio and targeting properties with long-term tenant demand will be key to navigating 2025’s market conditions successfully.

2. Explore Multifamily and Value-Add Properties

Multifamily properties are gaining popularity among investors as rising mortgage rates make it harder for individuals to afford single-family homes. The increased demand for rental housing has made duplexes, triplexes, and small apartment buildings an attractive alternative to traditional single-family rentals.

- Multifamily properties offer more stable cash flow due to multiple income streams.

- Rising rents and limited housing inventory may make these properties a more solid longer-term investment.

- Strategies to add value to these homes, such as renovations or improved property management, can help investors to enhance rental yields.

Another key trend is the rise of Accessory Dwelling Units (ADUs). California laws have made it easier for investors to build and rent out ADUs on existing properties, creating an additional income stream while increasing overall property value.

For investors looking to maximize cash flow while maintaining flexibility, multifamily and value-add investments may provide additional opportunities in 2025.

3. Consider Off-Market Deals and Creative Financing

With rising mortgage rates, traditional financing is becoming more expensive, leading many investors to explore alternative acquisition and funding strategies.

- Seller financing may be an attractive alternative, allowing investors to secure more favorable loan terms directly from sellers.

- Partnerships and joint ventures can help investors pool resources and limit their personal financial exposure.

- Distressed properties and foreclosure opportunities may present discounted buying opportunities, particularly as some homeowners struggle with refinancing at today’s higher rates.

Finding off-market deals through direct seller negotiations, networking, and working with real estate professionals can help investors identify opportunities before they hit the open market — and avoid bidding wars in competitive areas.

4. Use Tax-Efficient Investment Strategies

Tax planning is an essential but often overlooked part of real estate investing. Investors who understand how to structure their real estate holdings for tax efficiency can maximize returns while minimizing unnecessary tax liabilities.

Some key tax strategies to consider in 2025 include:

- 1031 exchanges to defer capital gains taxes when selling and reinvesting in new properties.

- Cost segregation studies and other depreciation strategies to reduce taxable income on rental properties.

- Self-directed IRAs for tax-advantaged real estate investments.

- Qualified Business Income (QBI) deductions for eligible rental property owners.

A tax-efficient investment strategy can significantly impact overall returns, making it crucial for investors to work with a trusted fiduciary financial advisor to help optimize their real estate portfolio.

Final Thoughts

The Sacramento real estate market continues to be a strong investment opportunity; however, investing in Sacramento real estate in 2025 requires a more strategic approach than in previous years. With rising interest rates, shifting home prices, and a competitive rental market, real estate investors need to focus on long-term sustainability rather than speculative growth.

Economic uncertainty and shifting consumer confidence will continue to influence the Sacramento housing market. Investors should watch for changes in employment, interest rates, and housing policies, as these factors could impact pricing trends and rental demand throughout 2025.

Towerpoint Wealth’s key takeaways for investors:

- Prioritize rental income and cash flow over appreciation. The days of rapid price increases driving easy returns appear to be over — smart investors may want to focus on properties that generate reliable rental income.

- Consider multifamily properties and ADUs. These property types are better positioned for strong returns in today’s market, as they provide multiple rental streams and hedge against vacancies.

- Be creative with financing and acquisitions. With borrowing costs higher, investors should explore seller financing, off-market deals, and partnerships to secure better investment terms.

- Optimize your tax strategy. Tax planning can make a major difference in long-term profitability, and investors should take full advantage of strategies like 1031 exchanges, depreciation benefits, and tax-advantaged investment structures.

As with any investment, real estate decisions should align with a broader financial strategy. Whether you’re investing in Sacramento real estate for the first time or looking to expand your portfolio, working with a fiduciary financial advisor can help ensure your investment approach is structured for both longer-term wealth growth and tax efficiency.

At Towerpoint Wealth, we specialize in helping investors navigate complex market conditions while ensuring their real estate investments align with their overall financial goals.

If you want to make data-driven investment decisions and ensure that your real estate strategy is positioned for success in 2025, we invite you to schedule a 20-minute “Ask Anything” conversation with our team today.