Could it be that Benjamin Franklin was wrong when it comes to the American Dream?

Is achieving the American Dream easier after earning a college degree? Or is a college education overvalued, and no longer worth the associated time, costs, and energy?

The skepticism about the true value of earning a degree is real. Pundits and authorities are offering up a myriad of seemingly sensible and legitimate reasons to skip school and eschew an eventual cap and gown fitting.

- 56% of Americans say earning a four-degree isn’t worth the cost, according to a recent Wall Street Journal survey.

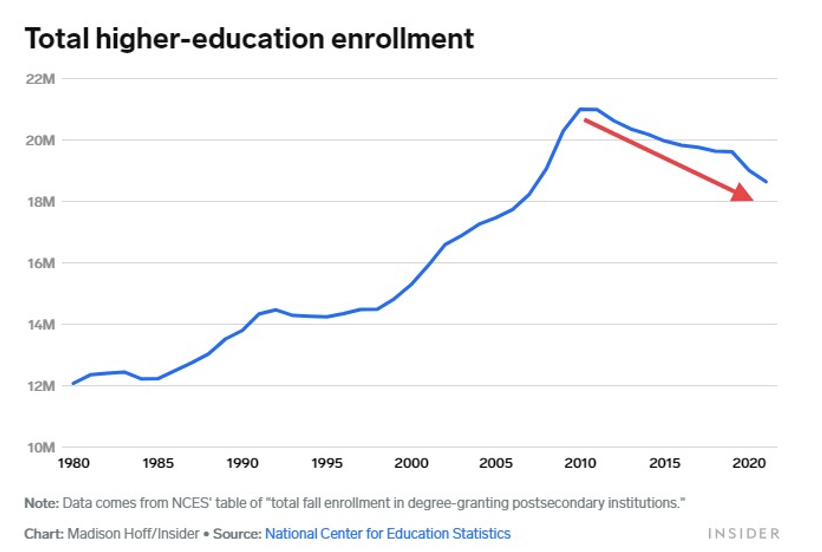

- College enrollment in the United States has declined over the past decade, dipping from 21 million students in 2011 to 18.7 million in 2021.

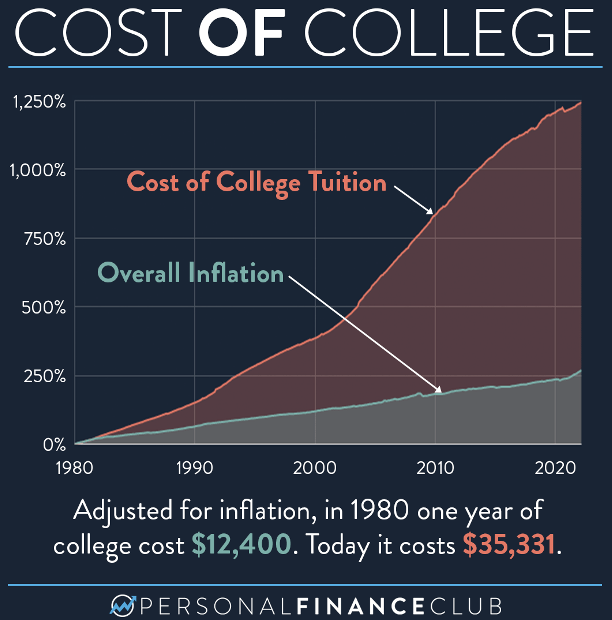

- Declining college affordability can be a significant barrier for many individuals, as the high costs of tuition, fees, housing, and living expenses associated with college can be prohibitive.

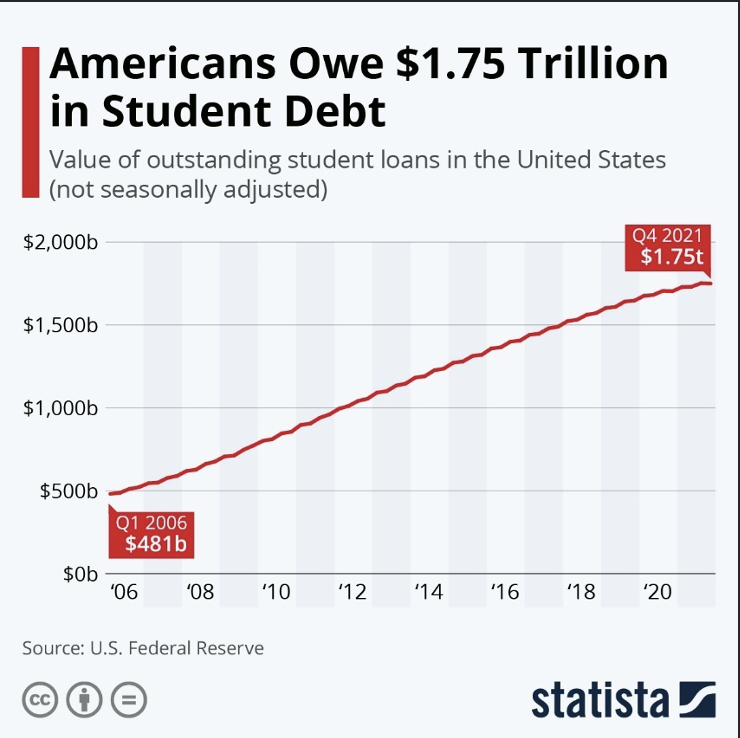

- Student debt has spiraled, acting as a deterrent for many individuals considering higher education. The prospect of accumulating significant student loans and entering the workforce with a mountain of financial obligations has reshaped the way people view the value of a college degree.

In addition to the above-listed obstacles and impediments, personal considerations such as alternative career goals, family obligations, individual learning styles, political ideologies, entrepreneurial pursuits, and the desire for immediate income (“why learn when you can earn”) can also factor into whether or not a college degree is considered an important component in the pursuit of the American Dream.

But wait! Our commentary and our graphs are not meant to be a screed against the importance of obtaining a college education in pursuit of the American Dream; instead, at Towerpoint Wealth, we believe that perception is not always reality, and while there certainly are upfront opportunity costs (economic and otherwise) of pursuing a college degree, the evidence that a college degree significantly improves one’s employment prospects and earnings potential is overwhelming:

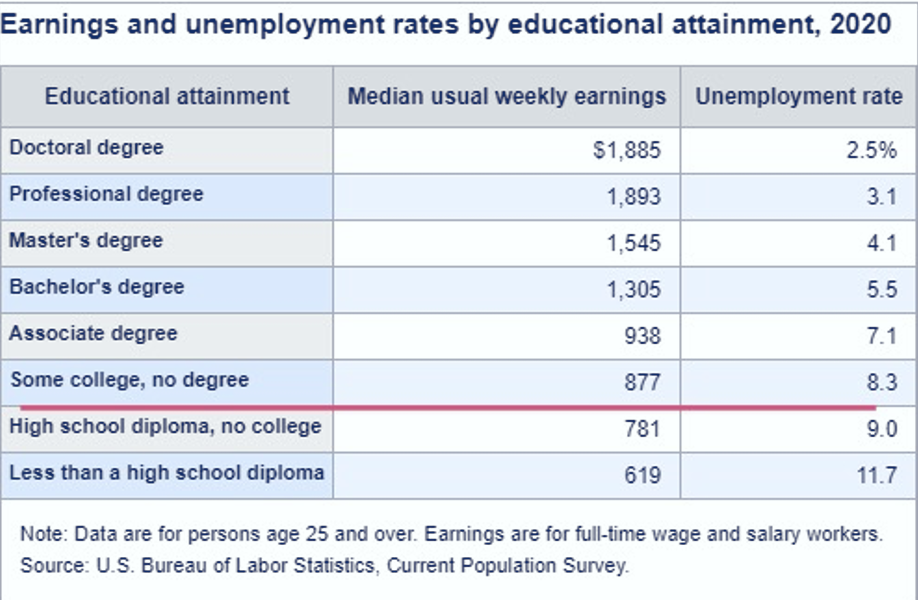

1. Higher weekly/monthly earnings

Even in the best economic times, data show that workers who have higher levels of education typically earn more and have lower rates of unemployment compared with workers who have less education.

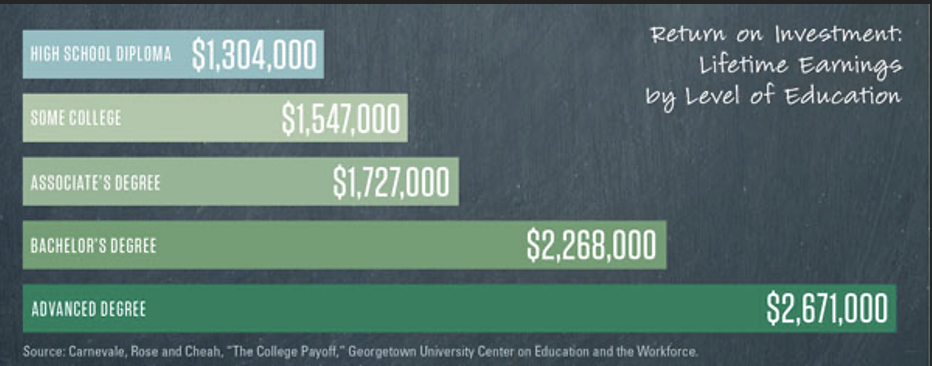

2. Higher lifetime earnings

Your earning potential is extremely likely to increase with your level of education. College graduates on average make $1.2 million more over their lifetime than those whose highest degree is a high school diploma.

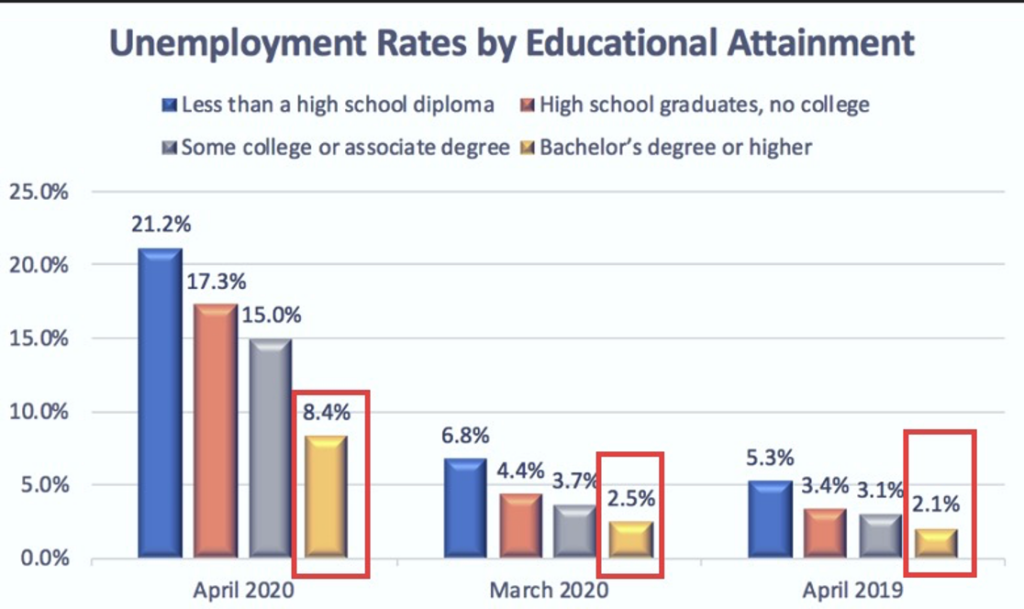

3. You’re more likely to have a job

College graduates are half as likely to lose their jobs as compared with people who have just a high school diploma.

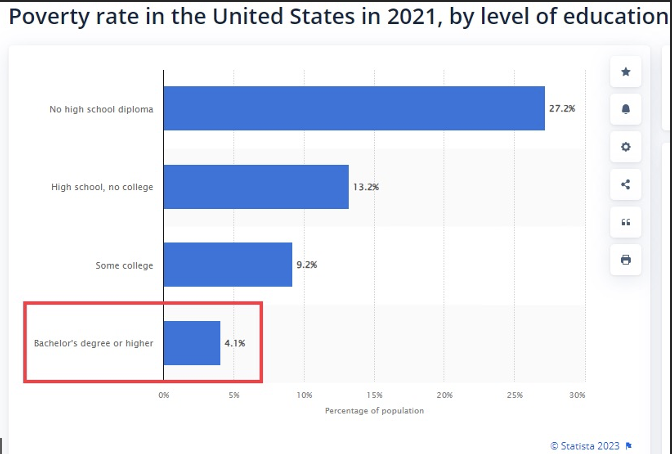

4. You’re less likely to be poor

The incidence of poverty declines significantly as the level of education increases – only 4% of people with a Bachelor’s degree or higher were living below the poverty line in 2021.

5. More access to job opportunities, and to jobs with better benefits

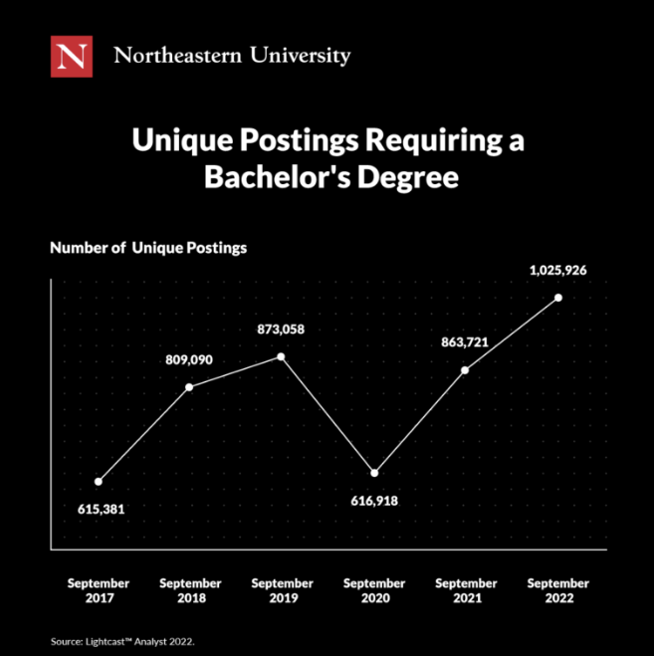

Having a college degree opens up opportunities that might otherwise have been inaccessible. College graduates see 57% more job opportunities than non-graduates, and the number of job postings requiring a Bachelor’s degree has increased significantly.

Even if you don’t start in a career that requires a college diploma, your degree can greatly expand the scope of your future opportunities to promote and earn.

Better-paying jobs which usually require a college degree oftentimes also offer better perks, such as 401(k) and retirement contribution matching, health insurance, tuition reimbursement, and commuter benefits.

While it's important to acknowledge the drawbacks and challenges associated with pursuing a college education while pursuing the American Dream, it's equally essential to recognize that the benefits often far outweigh these concerns, and we agree with Congressman Bobby Scott (D, VA):

The list price of tuition does not tell the full story, as the net price of college is often much less than the “sticker price". A college degree can serve as a gateway to expanded opportunities, higher earning potential, and a broader perspective on the world. Beyond the academic knowledge, college offers a platform for personal growth, critical thinking, and networking that can be invaluable in both professional and personal spheres. Moreover, the diverse range of experiences, exposure to different cultures and ideas, and the development of essential life skills can contribute to a more well-rounded and fulfilled individual. While the decision to attend college should be made with careful consideration of individual circumstances, the potential rewards of a college education, both in terms of career advancement and personal enrichment, often make it a worthwhile investment of time and money.

Episode 04: Reducing the Necessary Evils of Investing Expenses and Taxes

In this episode, our President, Joseph F. Eschleman, CIMA®, and our Director of Tax and Financial Planning, Steven Pitchford, CPA, CFP®, unravel the complexities of managing and reducing the “necessary evils” of investing: expenses and income taxes.

Click the below image to listen! Joseph and Steve share valuable insights and practical strategies to empower you as an investor. Discover how to take control of your financial destiny in your pursuit of the American Dream by minimizing expenses and optimizing your tax planning.

Click the images below to get caught up on some of our most recent trending moments at Towerpoint Wealth you might have missed!

Alternative Investments

For virtually all investors, 2022 was a challenging and frustrating year. Persistently high inflation has resulted in an environment of quickly rising interest rates, leading to a “double-whammy” of twin selloffs across both stocks and bonds. After increasing more than 31% in 2019, 18% in 2020, and 28% in 2021, the S&P 500, an often-cited proxy for the stock market, declined 18.32% in 2022. And to make matters worse, the bond market, as measured by the Bloomberg U.S. Aggregate Bond Index, suffered through declines not experienced in more than 50 years.

Put differently, investing in conventional stock and bond asset classes did not work very well in 2022. Not surprisingly, these declines led to an increase in demand for “supplemental” investment opportunities outside of these traditional areas, and led more and more people to inquire about alternative investments. Put simply, an alternative investment is any financial asset that does not classify as a traditional stock, bond, or cash. While they can vary widely in their accessibility and structure, alternatives can provide an opportunity to 1.) boost returns, 2.) generate income, 3.) provide potential tax benefits, and 4.) reduce risk in a portfolio. Institutions like pension funds and endowments have been utilizing them for years, and today, more and more individual investors are questioning why they have no alternative investments, and whether they should change their investment plan to include them.

Click the thumbnail image below to watch a webinar that we recently produced, and learn answers to the following questions:

- What are alternative investments?

- Is it important to have exposure to “alts” in your current portfolio?

- Is it bad if you do not own any alternatives?

- I heard alternative investments can be expensive – is that true? Does it matter?

- What are the risks and benefits of adding alts to your investment strategy?

Tax Credits (and a Deduction) for College Students

Tax credits for college students are a crucial component of the financial aid landscape, offering much-needed relief to students and their families grappling with the soaring costs of higher education. These credits, often referred to as education tax credits, provide eligible individuals with an opportunity to offset a portion of their qualified education expenses, thereby reducing their overall tax liability. Two prominent tax credits that have significantly eased the financial burden of college attendance are the American Opportunity Tax Credit and the Lifetime Learning Credit. The American Opportunity Credit, which is usually available for the first four years of post-secondary education, grants a credit of up to $2,500 per eligible student. This credit covers expenses like tuition, fees, and required course materials, making it especially beneficial for undergraduate students pursuing a degree. On the other hand, the Lifetime Learning Credit offers a more flexible option, applying to a broader range of educational pursuits, including graduate studies, continuing education courses, and skill enhancement programs. With a potential credit of up to $2,000 per tax return, this credit accommodates students seeking to further their education throughout their lives.

You can also take a tax deduction for the interest paid on student loans that you took out for yourself, your spouse, or your dependent. This benefit applies to all loans (not just federal student loans) used to pay for higher education expenses, with the maximum deduction being $2,500 a year. If you are single, head of household or a qualifying widow(er), your student loan interest phase-out starts at $75,000 MAGI, and ends at $90,000. If you are married you can make $150,000 before phase-out begins. You can earn up to $180,000 which is the level at which the phase-out ends.

View our 2023 Tax Reference Guide, and download an excellent resource intended to help you stay on top of and organized with your tax planning this year!

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to contact us at any time, or call or email us (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Worried about whether you have enough set aside to retire? Check out our “Retiring with 2 Million Dollars” guide to learn five specific steps you can take immediately to work to grow your net worth!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast