Right now, do you trust your investing instincts?

Or, as Jerry said to George in one of the highest rated episodes of the iconic Seinfeld series, “If every instinct you have is wrong, then the opposite would have to be right!”

Do you think the stock market is a safe place to invest money right now? Is now a good time to channel your inner George Costanza?

Yes, we are currently in an extremely unsettled and unpredictable investment climate, and yes, it stinks when economic and investment “visibility” is poor, account balances are declining, and the daily headlines are less than sanguine.

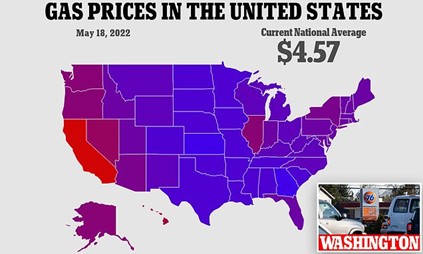

On the flip side, the labor market is extremely tight – so described when there are more job openings and fewer unemployed people. Indeed, the unemployment rate is extremely low. Consumer activity continues to pick up on the back of the “global reopening,” and China has resumed both monetary and fiscal stimulus. And in a true contrarian sense, we believe the financial markets have fully “priced in” today’s extremely high oil and gas prices, and an ongoing war in Ukraine- if either shows signs of abating, it could be an unexpected source of positive stimulus.

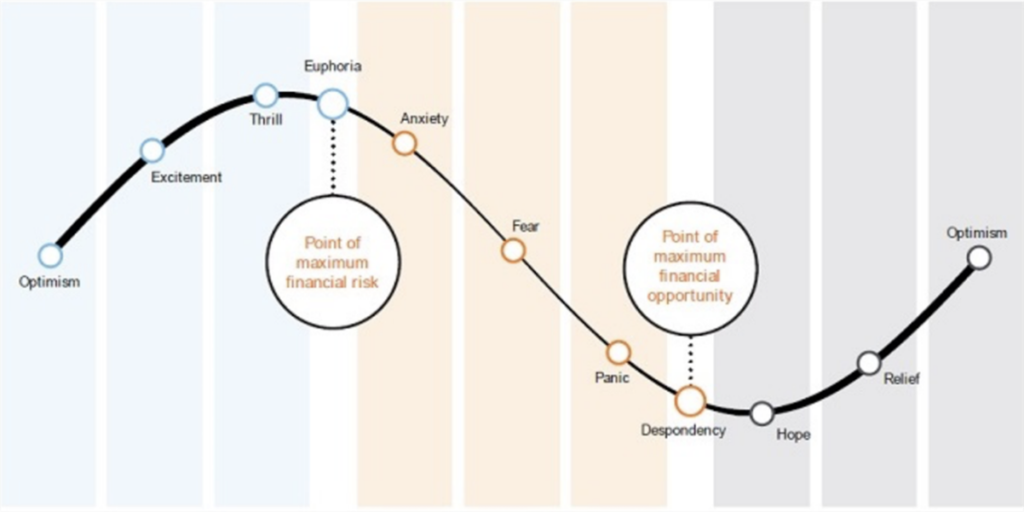

Putting aside the negatives and positives of the current investment and economic climate, we will go out on a very small limb and make the assumption that many of you have some level of internal temptation right now to “stop the bleeding” or “take a breather” from what seems like anything but a safe place to invest money right now: today’s stock market.

It is not only understandable, it is natural to feel this way. It’s human nature to fix an injury, to stanch bleeding, and lately, most investors are feeling punctured. In this environment, the temptation to sell when prices are low can manifest quickly, begging the question – do you have the intestinal fortitude to:

1. Not give in to the compulsion to sell

2. Go against the herd, making yourself feel even more uncomfortable, and a la George Costanza, do the opposite of what feels right (read: buy when prices are low)

To be clear, everyone has a unique set of personal and financial circumstances, and everyone has different sensitivities to market gyrations and investment risk. This message to “do the opposite” is not intended to be prescriptive. We are not making blanket recommendations to thousands of different people, nor are we specifically directing anyone to head out for a pre-weekend stock market shopping spree. We are simply attempting to convey the importance of the idea of contrarianism, and how going against the herd, while quite difficult, can pay large dividends over time.

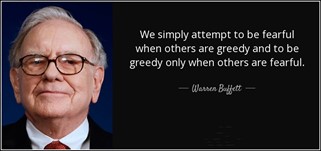

While buying low is simple, it certainly is not easy. It definitely falls into the easier said than done category. Yet doing so has proven to pay the largest dividends over time, supporting two timeless quotes from two extremely successful investors:

Is the stock market a safe place to invest money? While safe is a binary word, and while there is no exact, correct binary answer to that question, we strongly encourage you to remind yourself that the stock market is always a safer place to invest when prices are lower.

What's Happening at TPW?

Our President, Joseph F. Eschleman, CIMA® , spent an intensive three days last week at the Massachusetts Institute of Technology (MIT), learning (and practicing) how to be a better leader and CEO as an invitee and participant in Dynasty Financial Partners’ Advisor-to-CEO program.

- Click the link and scroll to see the full MIT Advisor-to-CEO event agenda.

- Visit the Towerpoint Wealth YouTube page (don’t forget to click the SUBSCRIBE button!) to see a video “short” containing a full panoramic recap of another incredible visual white board from the course curriculum, similar to the one seen below!

Administered through the MIT Sloan School of Managementt, the Advisor-to-CEO program contained a spectacular curriculum of experiential executive coursework on a variety of topics, including diversity & inclusivity (D&I), leadership, entrepreneurship, and strategic design thinking, as well as:

✅ Collective ambition

✅ Leadership and culture

✅ The longevity economy

✅ Adaptability quotient (AQ)

✅ Client experience and innovation

Our firm, and ultimately and most importantly, our TPW clients, will undoubtedly benefit from Joe’s continued growth as the President of Towerpoint Wealth, as we are already beginning to integrate a number of ideas that Joe brought back with him from Boston!

Click the image below to watch a short YouTube video and learn about the visual work management and visual project design (a.k.a. Post-It Note project planning!) that Towerpoint Wealth is implementing.

What else is happening with the Towerpoint Wealth family?

TPW Taxes - 2022

The word audit can strike immediate fear into a person, even if they are on the “up-and-up” and haven’t fudged their income taxes. And although the chances of being audited are rare (the IRS audit rate has dropped from 0.93% in 2010 to 0.39% in 2019, to a low of 0.20% in 2020 due to a number of COVID-19 concerns), and half of all audits happen to those people making over $1,000,000, it is certainly still useful to know what triggers the IRS.

Click the image below to read an excellent article from Bloomberg Tax that itemizes some of the more common characteristics of a return that may make it more likely to be selected for audit, including some features highlighted in the IRS’s 2022 Annual Audit Plan.

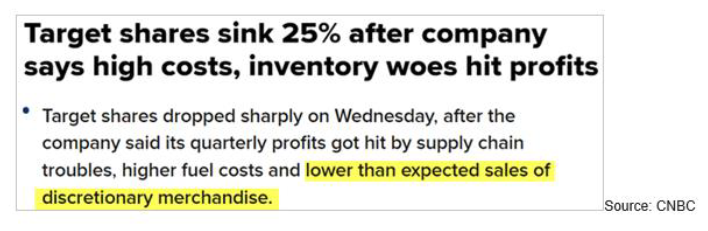

TPW News You Can Use

Useful and interesting content we read the past two weeks:

1. The Crazy Housing Market Is Finally Slowing Down – Axios – 5.16.2022

The red-hot housing market is starting to cool this spring, after nearly two years of soaring prices and shrinking inventories. Homebuyers and renters should begin to have more choices and fewer bidding wars, if only just a little.

2. Twisted Diary of Alleged Buffalo Shooter Reveals His Online Radicalization – NY Post – 5.17.2022

The avowed white supremacist who killed 10 people at a Buffalo supermarket first became radicalized during the early days of the COVID-19 pandemic by scouring extremist internet messaging boards, according to his twisted online diary.

The 18-year-old spent months reflecting on his plans to conduct a mass shooting in the digital journal and said his exposure to 4Chan, an online message board known as a hotbed for extremism, kept him motivated to stick to his plans.

3. How a Trash-Talking Crypto Bro Caused a $40 Billion Crash – NY Times – 5.18.2022

Do Kwon, a South Korean entrepreneur, hyped the Luna and TerraUSD cryptocurrencies. Their failures have devastated some traders, though not the investment firms that cashed out early.

TPW Chart of the Week

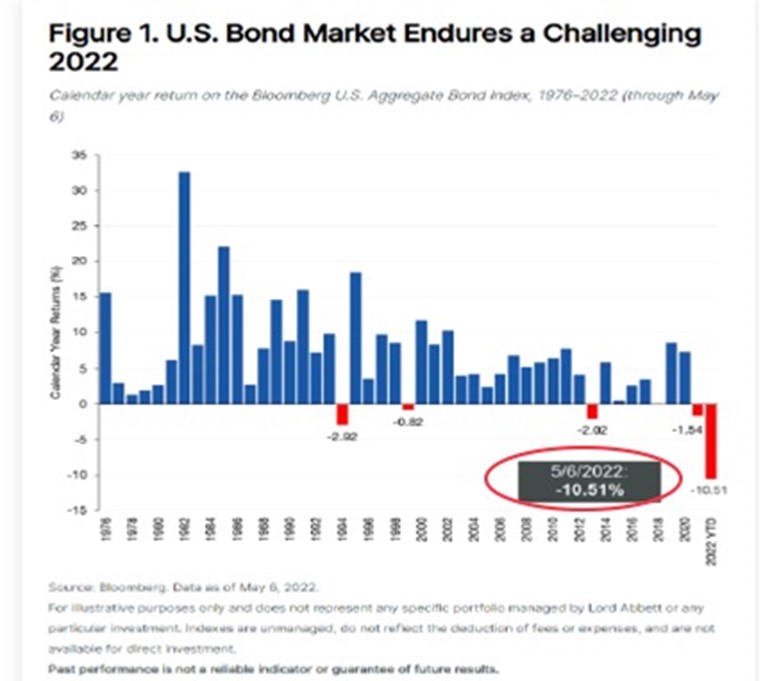

Year-to-date returns on US bonds (as measured by the Bloomberg US Agg) through May 6 have been worse than any calendar year on record since 1976.

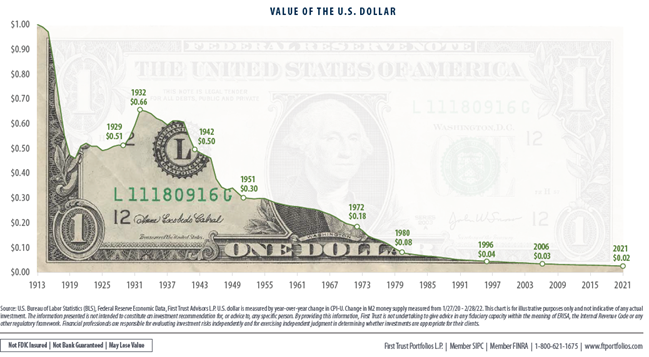

Over time, inflation hurts purchasing power – A LOT.

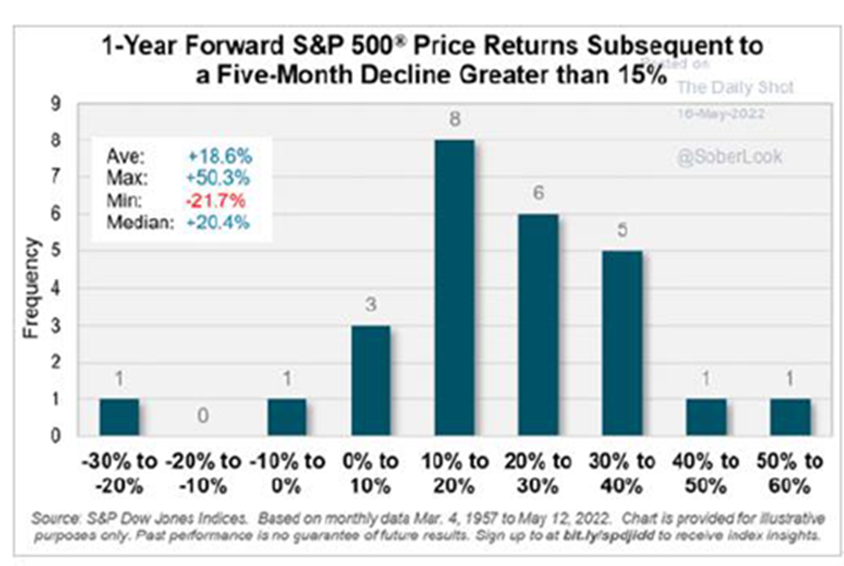

An excellent graph below from our friends at Bespoke Investment Group, reflecting the forward one-year price return of the S&P 500, subsequent to a five-month decline of greater than 15% (i.e. what has happened so far in 2022):

Quote of the Week

No caption needed…

Trending Today

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph, Jonathan, Steve, Lori, Nathan, and Michelle

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity.

We will happily donate $10 to it!