Big Oil. A somewhat-pejorative name used to describe the world's six largest publicly traded oil and gas companies:

BP, Chevron, ExxonMobil, Royal Dutch Shell, TotalEnergies, and ConocoPhillips.

These "supermajors" are facing intense challenges, specifically to their oil reserves and production. Pressure to cut back traditional upstream spending and redirect capital into renewable energy projects is intense, which we believe will drive oil supply down and oil prices higher.

Oil production growth outside of OPEC+ has been extremely difficult to achieve, and recent ESG pressures have exacerbated these problems. In what the New York Times dubbed a "stunning defeat" for ExxonMobil, and a huge win for ESG proponents, activist investor Engine No. 1 secured three new directors (out of 12 total) to ExxonMobil's board of directors, with a specific mandate to reduce the company's carbon footprint by curtailing capital investments into its upstream oil and gas businesses. At about the same time, a Dutch court ruled that Royal Dutch Shell must cut its CO2 output by 45% by 2030 to align company policy with the Paris Climate Accord.

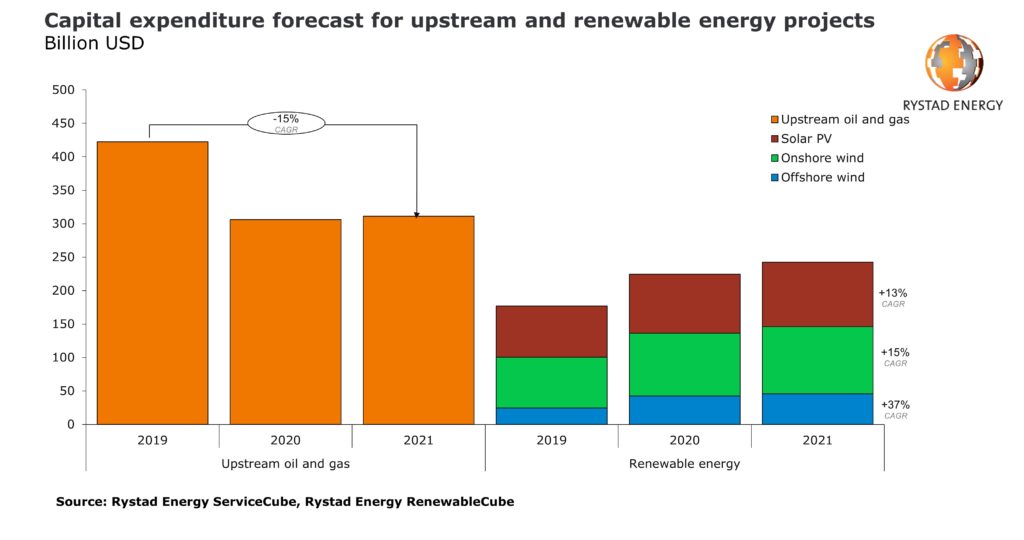

What will happen when the other supermajors are also forced comply with mounting ESG and governmental pressures and reduce upstream spending? We believe non-OPEC production will continue to decline, further paving the way towards increased capital expenditures for renewable energy projects. A Rystad Energy analysis forecasts renewable energy projects to set a new record in 2021 ($243 billion), narrowing the gap with oil and gas spending (projected to be relatively flat at $311 billion).

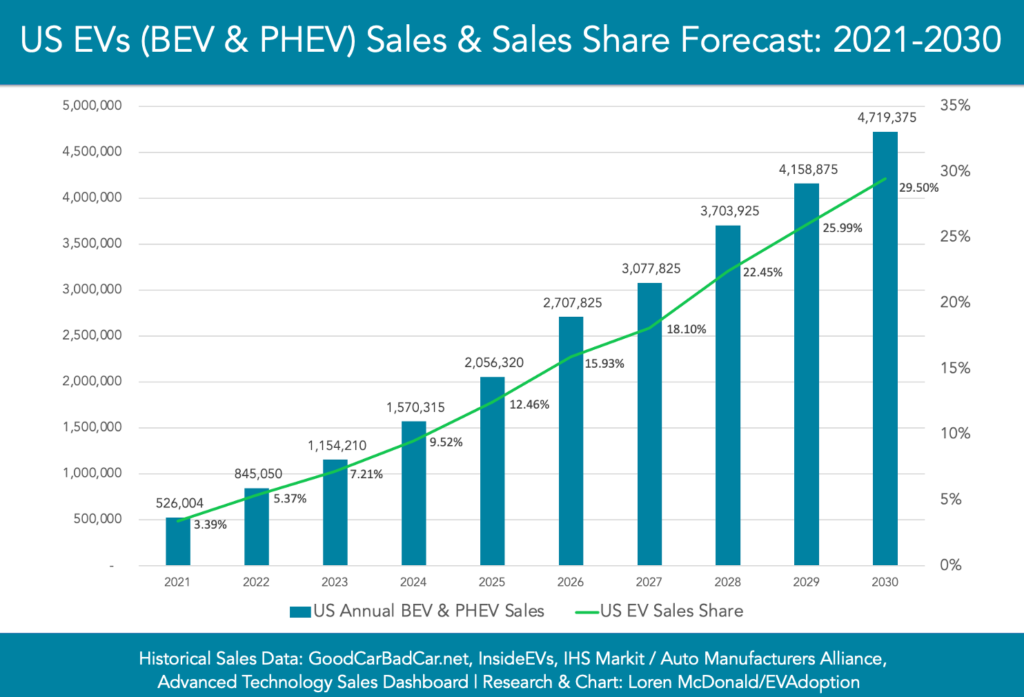

These facts all align with the multi-step strategy that President Biden announced just earlier this month: By 2030, half of all new vehicles sold in the US should be electric. And while this goal is a bit loftier than the EV sales projections found below, the transition from oil to electric is obviously no longer a trend, but instead a full-blown movement.

Underscoring this movement was the pledge made by executives from the three largest US auto companies: 40 to 50% of their new car sales would be electric by the end of the decade. Understanding that gas-powered vehicles are the single biggest source of greenhouse gases in the US (producing more than 25% of our total emissions), a rapid shift from combustion engines to EVs continues to aggressively take place. Need further confirmation?

- GM announced in January that it will be phasing out all of its petroleum-powered cars by 2035

- Ford introduced an electric version of the best-selling vehicle in the US, the F-150 pickup truck

- Shifting from electric-first to electric-only, Mercedes Benz is ready to go all-electric at the end of the decade

The question certainly remains: Will consumers buy them?

At Towerpoint Wealth, we recognize there are obstacles: higher sticker prices, the lack of widespread charging stations (needed for longer-distance drivers), stress to the country's power grid (if every American drove an EV today, the US could end up using about 25% more electricity than it does today), and pressure from labor unions (EVs have 30-40% fewer moving parts, and require fewer workers to assemble) are all headwinds to this movement. However, we also believe it is just a matter of time before combustion-engine vehicles take their place next to rotary phones, VCRs, and the folding maps.

What’s Happening at TPW?

Three generations of Eschleman men!

Our President, Joseph Eschleman, attended the Philadelphia Phillies / Tampa Bay Rays game on Wednesday evening at Citizens Bank Park in Philly, with his father Eric and his 11-year-old son, Henry.

The Phils blew the game in the ninth inning, but all three Eschlemans had a great time together!

In an effort to maximize our productivity as a firm, we were early to adopt Salesforce as our customer relationship management (CRM) software.

Salesforce forms the backbone of our operations, allowing us to efficiently administer and manage all of our interactions with clients, colleagues, prospects, and friends.

A huge thank you to Ryan O'Connell, Dynasty Financial Partners' CRM specialist (in the photo, "sandwiched" between Michelle Venezia and Lori Heppner after lunch yesterday) for being on site this week to assist with a Salesforce instance upgrade, helping us to stay ahead of the curve and better interface and communicate with each of our clients!

Illustrations/Graphs of the Week

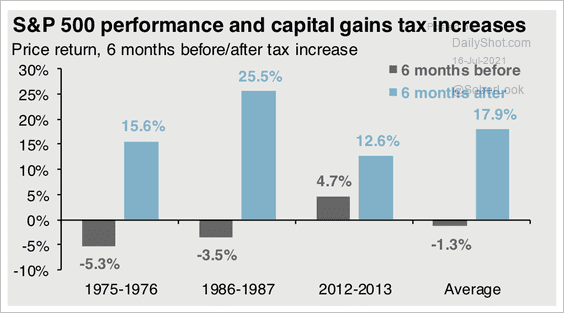

Have you heard that federal capital gains taxes may soon be increasing?

Although the final details of President Biden's American Families Plan to potentially increase capital gains taxes (to pay for some portion of the various US Congressional domestic priorities such as education and child care) are not yet specified, they are likely to influence securities prices and financial market conditions.

Oddly, the chart below depicts the price return of the S&P 500 index six months before and six months after capital gains taxes were increased.

By far (and we feel, surprisingly), the six months BEFORE capital gains taxes are increased represent the periods of most risk to equity prices.

Trending Today

As the 24/7 news cycle churns, twists, and turns, there have been a number of trending and notable events that have occurred over the past few weeks:

- Twin bomb attacks by Islamic State terrorists at the Kabul airport killed at least 90 people, including 13 US troops

- In a victory for property owners, the US Supreme Court halted the Biden administration's pandemic eviction moratorium

- RIP Charlie Watts, the drummer and "heartbeat" of the Rolling Stones, dead at the age of 80

- The U.S. Agency for International Development announces $32 million more in humanitarian aid for Haiti earthquake victims

- 2,900 firefighters are attacking the blaze as gusty winds drive the Caldor Fire to within 14 miles of South Lake Tahoe

- Lieutenant Michael Byrd, the Capitol Police officer who fatally shot Ashli Babbitt during the January 6 storming of the US Capitol, speaks publicly for the first time

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph, Jonathan, Steve, Lori, Nathan, and Michelle