While 2020 will rightfully be remembered for the challenging and unprecedented COVID-19 battle we have all been impacted by, at Towerpoint Wealth we have continued to proactively work with clients to identify economic opportunities presented by the coronavirus crisis. Specifically, we have identified a “silver economic lining” tax planning strategy this year, one that is designed to take advantage of today’s low income tax rates, which we feel are temporary, while at the same time leave our clients better positioned for tomorrow’s higher income tax rates, which we feel are inevitable. This white paper will discuss what a “Roth IRA conversion” is, who may benefit from a Roth conversion, why 2020 is a potentially great year to do a Roth conversion, and how to utilize important tax planning tools to evaluate this opportunity.

Roth IRA Conversion

A Roth conversion is a retirement and tax planning strategy whereby a taxpayer “converts” some, or all, of their “regular” pre-tax retirement assets into tax-free Roth retirement assets. It is important to note that ordinary income taxes are owed on the tax-deferred contributions and earnings that are converted.

While the most common Roth conversion strategy is a pre-tax IRA to a Roth IRA, two other popular methods exist:

- Convert pre-tax employer-sponsored retirement plan assets (401k, 403b, 457, etc.) to Roth IRA assets (if the taxpayer has separated from service from the employer).

- Convert pre-tax 401k assets to Roth 401k assets (if the employer retirement plan allows for an in-plan conversion).

A Roth conversion, when utilized properly, is a powerful tax planning strategy for the following reasons:

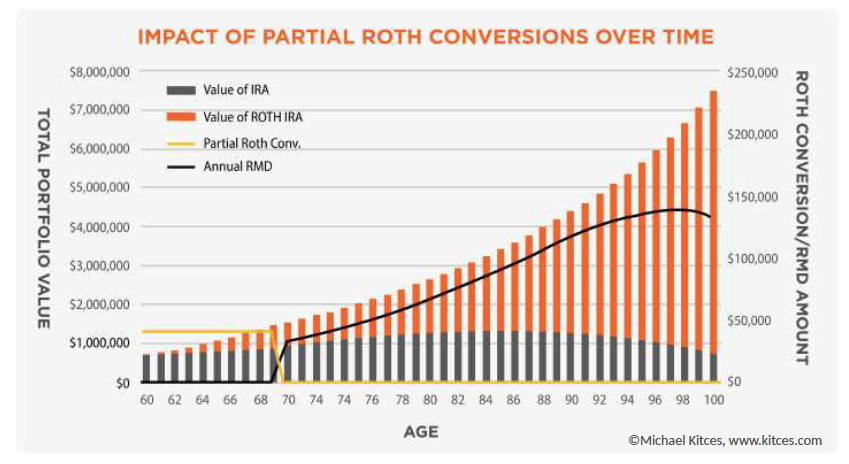

• It maximizes the tax-free growth within a taxpayer’s investment portfolio.

• As distributions from Roth retirement accounts are tax-free, a Roth conversion provides a hedge against possible future tax rate increases.

• As Roth IRAs do not have required minimum distributions (RMDs), it reduces taxable RMDs on pre-tax retirement assets that a taxpayer is annually subject to after reaching the age of 72.

• It leaves a greater tax-free financial legacy to heirs.

However, even understanding these benefits, a Roth conversion may not always be in a taxpayer’s best long-term economic interests if:

• The current tax cost of the conversion is prohibitively high. A Roth conversion, in its simplest sense, is a trade-off between paying taxes now vs. paying taxes later. For the strategy to be impactful, the current tax cost of the conversion should not be so expensive that it outweighs the benefit of any expected future tax-free investment growth.

• The taxpayer is making regular and material withdrawals from their pre-tax IRA.

• The taxpayer does not have the cash to pay the tax due on conversion.

Towerpoint Tip:

We recommend converting shares of investment positions rather than selling investments in the IRA and then converting cash proceeds. This ensures that the taxpayer continues to have market exposure during the conversion process, and also saves on the transaction fees that may be levied when selling an investment position.

2020 – A Perfect Year for Roth Conversions?

There are three reasons why we believe 2020 is a great year for Roth conversions:

- While no one has enjoyed this year’s market volatility, material intra-year market pullbacks, such as the one we experienced in March, provide a unique opportunity to convert pre-tax investments to Roth IRA at a time when their value is, we believe, temporarily depressed.

Performing a Roth conversion with these temporarily depressed assets “locks in” the income taxes owed at their lower value upon conversion. While we are humble in recognizing we do not have a crystal ball, we strongly believe that crisis events are temporary, and given time, these assets will recover in value. Thus, this tax strategy results in paying a lower tax price when converting investments to a tax-free Roth IRA. - Understanding the uncertainty surrounding the upcoming Presidential election, and given the government's need to raise funds to offset its massive 2020 stimulus packages, there is certainly no guarantee that income tax rates will stay this low in future years.

- Given that the CARES Act eliminated RMDs for 2020, this is a uniquely low tax year for those taxpayers who are ordinarily subject to RMDs, allowing them to convert a greater amount of assets while remaining in low income tax brackets.

Towerpoint Tip:

At Towerpoint Wealth, pairing a Roth conversion with the "frontloading" of a Donor-Advised Fund (DAF) has been a powerful tax planning strategy, allowing our clients to convert more to tax-free Roth assets at lower tax rates, while also allowing taxpayers who would not ordinarily itemize deductions to "hurdle" the standard deduction – this ensures that they receive at least a partial tax deduction for their charitable contributions.

Executing a Roth conversion

When determining the optimal amount to convert to tax-free Roth assets, there is no “one size fits all” approach.

A taxpayer’s unique personal and financial circumstances should drive the conversion discussion. For one taxpayer, recognizing any amount of conversion income may not make tax or economic sense, while for another, particularly those who want their heirs to inherit assets tax-free, converting a sizeable amount (even at a material tax cost) may be attractive.

One window of time in which we look to help clients aggressively execute a Roth conversion is immediately upon retirement, before they begin filing for Social Security benefits. This is often a uniquely low income-tax window of time, where a taxpayer is still young enough to potentially enjoy many future years of tax-free growth that Roth assets allow.

If a Roth conversion is worth evaluating for a client, many CPAs and tax professionals assemble customized tax projections to optimize the decision-making process.

And while Towerpoint Wealth is not a public accounting firm, we regularly utilize BNA Income Tax Planner, a powerful tax projection software, to assemble Roth conversion tax projections for our clients, in order to streamline collaboration with their CPAs and tax professionals. If our client prepares their own tax returns, we work directly with them to evaluate these Roth conversion scenarios.

Towerpoint Tip:

Under the Tax Cuts and Jobs Act (TCJA), the IRS eliminated the ability to recharacterize (i.e. undo) a Roth conversion after it has been made. For this reason, we generally recommend waiting until closer to the end of a tax year, when taxable income is clearer, prior to executing a Roth conversion. However, in unique tax years such as 2020, we have been strategically executing Roth conversions throughout the year to ensure we are taking advantage of market volatility and pullbacks, while also looking for an opportunity to “top up” the conversion later in the year.

How Can We Help?

Towerpoint Wealth is a fee-only certified financial planner near Roseville, Rocklin, Granite Bay, Folsom, Gold River, El Dorado Hills, East Sacramento, Curtis Park, Land Park, Elk Grove, and Rancho Murietta. At Towerpoint Wealth, we are a fiduciary to you, and embrace the legal obligation we have to work 100% in your best interests. We are here to serve you and will work with you to formulate a comprehensive and tax-efficient retirement strategy.

Are you searching “certified financial planner near me?” You’ve found Sacramento independent financial planner Joseph Eschleman, as well as certified financial planner Steve Pitchford, CPA, CFP®, and our entire independent wealth management team.

We serve clients primarily in the Northern California region. Glad you’re here! Please contact us with any questions you have about our wealth management process.