Top 5 Ways to Recession-Proof Your Portfolio!

Is the United States economy on the verge of slipping into a recession?

Or is the exact opposite happening – is the economy continuing to recover, more robust than it is getting credit for?

A broad measure of the “stock market,” the S&P 500 ended 2021 at 4,766.18. It then proceeded to “correct” down to 4,173.11 on March 14. However, since 3/14, the market has notched an impressive rally, sailing back out of correction territory in less than a month.

So what gives? Are we looking towards an economy in recession, or are we more recession proof than many economists believe?

It should come as no surprise to our clients and to TPW friends and colleagues that we take this volatility with a grain of salt. We pay attention, but rarely react, to these short-term movements. Daily, weekly, and monthly market movements are much more important to, and are scrutinized more closely by, traders and speculators, as opposed to investors interested in taking a disciplined approach to building and protecting wealth. As Warren Buffett said:

However, we do seem to be at an odd inflection point in our economy, and unsurprisingly, there is anything but consensus on what happens next.

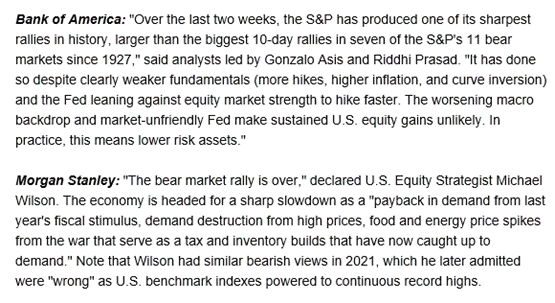

While the Towerpoint Wealth Investment Committee remains cautiously optimistic and sanguine (a favorite adjective used often in the investment community by analysts and talking heads who want to sound extra intelligent) about the future of the US economy and financial markets, not everyone agrees with us.

While it currently seems fashionable to portray a bearish / negative outlook for the US economy and financial markets, we believe that record corporate profits, plentiful jobs, significant declines in coronavirus cases, wage increases, and excess consumer savings will outweigh the economic risks of inflation, interest rate increases, Ukraine-Russia geo-political and supply-chain concerns, and potentially higher US federal income taxes.

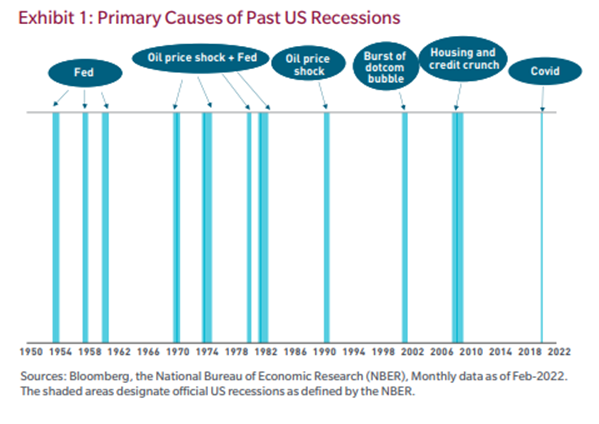

At Towerpoint Wealth, we firmly believe that a possible slowdown does not have to mean recession, and we also firmly believe that when you have an economy in recession, truly, almost by definition, it involves job losses and high unemployment. In today’s environment, it is not hard to see that the absolute opposite is currently true.

Click the thumbnail below to read an excellent report from T. Rowe Price discussing why recession in the US appears unlikely amid our reopening economy.

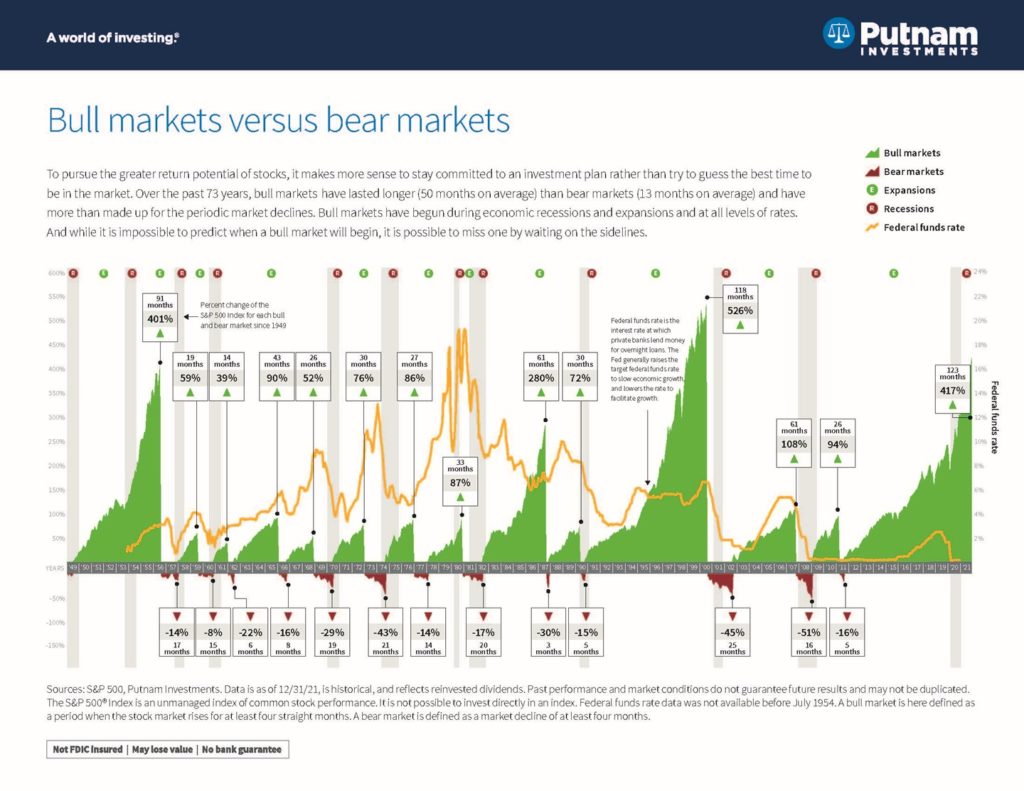

We also believe that Putnam’s graph below, illustrating economic expansions and recessions, and concurrently, bull (rising) and bear (declining) markets, does an excellent job of helping our clients to understand:

- Economic expansions (above the line, in green) are much more robust than recessions (below the line, in red)

- Over the past 73 years, bull markets have lasted longer (50 months, on average) than bear markets (13 months, on average), and have more than made up for periodic market declines

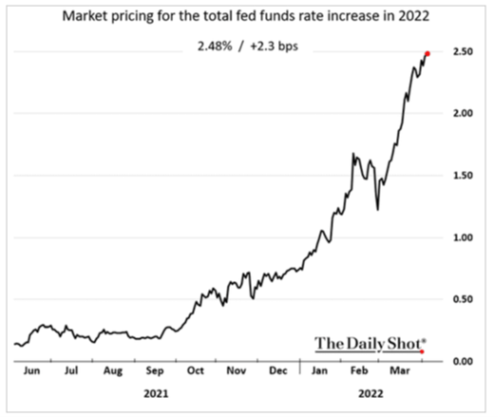

However, at Towerpoint Wealth, we don’t want to say that we have a recession-proof economy – we fully recognize that the risk of a recession is not zero, and that it is important to be mindful of and have a plan to protect against the possibility that the Fed “slams on the brakes” by aggressively increasing interest rates (and concurrently the cost, or “price,” of borrowing money), which would result in a rapid slow-down of our economy.

What to do to recession-proof your portfolio? Read on!

1. Own and have exposure to blue-chip equities (stocks)

Investors almost always find blue chip stocks attractive, but especially during a recession. They typically pay attractive dividends, which provides a tangible return in the form of consistent income. Blue chip stocks also tend to be larger companies with more stable and predictable streams of revenue and profits, which can lessen the impact on the price of a stock during a market pullback or recession.

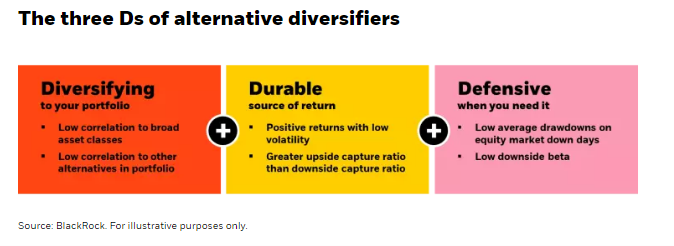

2. Harness the power of low-correlation investments and alternative diversifiers

Owning or adding to your portfolio investments whose price and value tend to “zig” when more traditional stocks and bonds “zag” can help lower your risk, especially during a recessionary period. Commodities, precious metals, timber, commercial real estate, cryptocurrency and digital assets, hedge funds, private equity and debt, timber, and art are just a few examples of low-correlation investments.

3. Increase your exposure to non-US equities

Owning international stocks is another way to recession-proof your portfolio. While the economies, and stock markets, of the major developed countries and economies around the globe seem to be more correlated than ever before, the discounted valuations, and currencies, that oftentimes can be found within international stock markets can be an excellent hedge against a possible US recession. Additionally, international markets oftentimes offer more exposure to structural growth opportunities than the US market, and can be an excellent hedge against rising inflation here in the US.

4. Cash is (or can be) king!

Cash adds “bubble wrap” to your portfolio, especially during a recession. Having cash allows an investor to further recession proof their portfolio by cushioning against volatility and market declines. Smart investors also can utilize this “dry powder” to take advantage of attractive investment opportunities as they arise during a market pullback or correction, especially if they believe a recession is coming.

Cash is considered “oxygen” for a portfolio, as it becomes more and more important to have as temporary market declines occur during a recession. Lastly, while checking, savings, and money market accounts have paid little if any interest over the past few years, things are quickly changing, and as interest rates rise throughout 2022, you should earn higher rates on your cash and money market deposits.

5. Be properly diversified

Through maintaining a portfolio allocation across a diversified group of asset classes, investors can position themselves, and their portfolios, to better weather market and economic volatility. Additionally, being properly diversified allows for the benefits of disciplined portfolio rebalancing, helping an investor to recession proof their portfolio by buying low and selling high when transitioning their portfolio back to its original strategic targets. Plus, who wants all of their eggs in just one or two baskets when a recession is coming? Not us…

What's Happening at TPW

A BIG congratulations to our Partner, Wealth Advisor, Jonathan LaTurner, and his new bride, Katie McDonald, who tied the knot last week in Tulum, Mexico! We couldn’t be happier for both of them!

And of course our President, Joseph Eschleman, was in attendance to help the happy couple celebrate!

It’s not a Happy Friday without a McDonald’s McNuggets Happy Meal!

Ethan, the son of our Director of Research and Analytics, Nathan Billigmeier, keeps getting more and more adorable as the months pass! #heartbreaker

What else is happening with the Towerpoint Wealth family? Follow us on Facebook to find out!

TPW Taxes - 2022

While here in California, state income tax rates continue to climb, this is not the norm and not the case throughout many parts of the US. A dozen states introduced measures to REDUCE corporate or personal income tax rates last year. Click the two images below to read examples from states that are doing the opposite of what California is doing – cutting the state taxes their residents have to pay.

We are officially in the Tax Day 2022 “home stretch,” as the filing deadline to submit 2021 tax returns, or an extension to file and pay tax owed, is Monday, April 18. As we have mentioned previously, we welcome and look forward to directly interfacing and collaborating with you, and/or your tax advisor.

Towerpoint Wealth’s Director of Tax and Financial Planning, Steve Pitchford, CPA, CFP® is our resident tax expert, and we invite you to simply click his image below to reach out to him about any specific income tax-related need, issue, service or document request, or question.

TPW News You Can Use

1. A New COVID Mystery – Why Haven’t Cases Started Rising Again in the US? – NY Times – 4.6.2022

To many people’s surprise, new COVID-19 cases in the US have not begun to rise. Over the past two weeks, they have held roughly steady, falling about 1%, even as the highly contagious BA.2 subvariant of Omicron has become the dominant form of COVID in the US.

2. Making it Rain – Yankees, Mets Both Have the Obscene Payrolls NY Teams Need – NY Post – 4.5.2022

The Mets and the Yankees will combine to spend $532 million on baseball players this year, and if that seems outrageous… well, sure, it probably is.

3. The Remarkable Brain of a Carpet Cleaner Who Speaks 24 Languages – SF Gate – 4.5.2022

Vaughn Smith, a real, live hyperpolyglot (a person who can speak several languages), is fluent in eight languages and conversational in another 25!

Chart / Infographic of the Week

Incremental change – small micro-actions, when done repeatedly, over a long period of time, can cause massive improvements. Also known as baby steps!

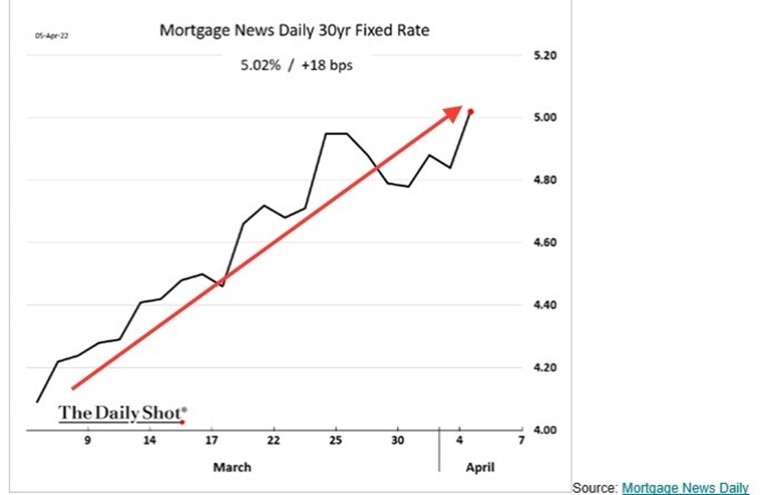

Also, if you haven’t heard, rampant inflation is one of the central reasons that interest rates continue their upwards march, as borrowing for a mortgage has quickly become much more expensive…

Quote of the Week

Very consistent with the theme of the Chart/Infographic of the Week found above, we love NBA legend and Hall of Famer Jerry West’s quote and outlook on life found below.

Trending Today

As the 24/7 news cycle churns, twists, and turns, a number of trending and notable events have occurred over the past few weeks:

- President Biden extends the moratorium on student loan payments until the end of August

- The first commercial drone deliveries in the U.S. took off on Thursday, as Alphabet’s ‘Wing’ unleashed its aircraft over the suburban towns of Frisco and Little Elm

- LeBron James and the Los Angeles Lakers are eliminated from this year’s NBA playoffs

- 2022 NCAA College Basketball championship pulls more viewers than Oscars, Grammys

- Katanji Brown Jackson is seeing some bipartisan support to become the 116th justice of the Supreme Court

- Scientists have mapped the final eight percent of the human genome sequence, a quest that took 20 years

- Police arrest a third suspect in Sacramento mass shooting that left six dead

- Elon Musk files Form 13D, admits that his Twitter investment is not passive, and has a goal of ‘effecting change’ at the company

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph, Jonathan, Steve, Lori, Nathan, and Michelle

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity. We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on Twitter