Most of us recognize that taking a diversified approach to investing is a sound philosophy. There are a myriad of different ways for investors to build and grow their net worth, each with its unique set of risks, rewards, tax consequences, and considerations. Traditionally, in addition to building a portfolio of stocks, bonds, and mutual funds, one of the best and most popular avenues to diversify your investments is to own and invest in real estate.

In addition to adding diversification, real estate investing can provide numerous benefits to investors, including the potential for long-term appreciation, debt paydown, inflation protection, and passive cash flow.

And let’s not ignore the tax benefits of real estate investing. Investing in real estate does provide a unique advantage, as the tax benefits of real estate investing can oftentimes be superior to those of stocks, bonds, and mutual funds. To be clear, we believe that reducing your taxes should never be a primary goal when investing and building net worth; however, we also believe that it is hugely important to recognize that it’s not what you make, but what you keep that builds financial security. To ignore the significance of minimizing your obligation to Uncle Sam is a huge mistake.

Additionally, the tax benefits of real estate investing are one its most appealing aspects. These tax benefits can significantly reduce an investor's tax liability, and increase their net, after-tax return on investment. The tax benefits of real estate investing can range from deductions for expenses related to the property to the ability to do tax-free Section 1031 exchanges of properties and avoid capital gains. In this way, real estate investing can be a tax-efficient strategy for both building wealth and generating income.

Itemized below are nine strategies to maximize the tax benefits of real estate investing. These are elaborated upon in the presentation that our Associate Wealth Advisor, Megan Miller, and President, Joseph Eschleman, recently delivered to the West Sacramento Real Estate Investor Meet Up group.

Watch the full presentation below, and reference the list of the most compelling tax benefits of real estate investing!

1. Start a real estate business – it’s easy.

2. Leverage business expense tax deductions and credits.

3. Take advantage of Qualified Business Income (QBI).

4. Make it a family business!

5. Utilize the “Double Dip” on rentals.

6. Move in! Leveraging the primary residence capital gain exclusion.

7. Know and take advantage of cost segregation.

8. Consider Section 1031 exchanges and Delaware Statutory Trusts (DSTs).

9. Open and fund a tax advantaged retirement account.

While this list is by no means an exhaustive one, we believe it is clear that the tax benefits of real estate investing provide a myriad of opportunities to keep Uncle Sam at arm’s length while striving to maximize profits and compound the growth of your net worth.

It is important for investors to consult with qualified tax and financial professionals to ensure they are taking advantage of all available tax strategies while staying compliant with relevant tax laws and regulations. The tax benefits of real estate investing make it a lucrative and attractive investment and diversification option for individuals and businesses alike.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients save and invest for retirement while minimizing taxes.

What’s the fastest path to retiring with $2 million?

A 2020 survey from Schwab Retirement Plan Services found that the average worker expects to need roughly $1.9 million to retire comfortably. Are you almost there? Have a long way to go? Is retiring with 2 million dollars a reasonable goal for you?

Is this enough for you to be happy and comfortable? We’ve put together 5 steps you can take to increase the size of your nest egg and considerations for a well-thought out, customized, retirement income plan in this white paper. We’re happy to offer it to you here.

Click HERE to message us with any questions or concerns you may have about your retirement right now.

Click the images below to get caught up on some of our most recent trending moments at Towerpoint Wealth you might have missed!

Are you really a long term investor?

Or do you just say you are but behave more like a trader or a gambler, and fail to apply long term investment strategies to your portfolio?

In this video, our President, Joseph F. Eschleman, CIMA®, discusses exactly what it takes to truly behave like a long term investor, and what specific long term investing strategies and philosophies need to be developed and internalized to be a successful long term investor. Trying to successfully build, and protect, your wealth and “nest egg?” Watch this video to listen to Joseph outline seven key long term investing strategies and philosophies, as well as the exact emotional and behavioral characteristics needed to be a successful long-term investor.

Click HERE to browse TPW’s library of other wealth-building and wealth-protecting educational videos.

Sometimes, it’s just easier to keep it simple! Credit to Michael Kitces for the quote.

Gifting to UTMA accounts

An UTMA, or Uniform Transfers to Minors Act, is a legal arrangement that allows parents or guardians to transfer assets to their children. One of the main advantages of using an UTMA is the potential tax benefits. UTMA accounts are taxed at the child's tax rate, which is typically lower than the parents' tax rate. This means that investment gains and income generated by assets held in an UTMA account can be taxed at a lower rate, allowing for more tax-efficient growth. Additionally, the first $1,250 of unearned investment income generated by an UTMA account is tax-free, and the next $1,250 is taxed, but at the child's usually lower tax rate.

Another tax benefit of an UTMA is the ability to shift assets out of a parent's estate for estate tax purposes. By transferring assets to an UTMA, parents can remove those assets from their estate and potentially reduce their estate tax liability. In addition, the assets in an UTMA account are considered the child's property, not the parent's, which can be advantageous for financial aid purposes. Up to $17,000 can be transferred, per person, into an UTMA account without being subject to gift taxes. Overall, an UTMA can be a valuable tool for parents looking to minimize their tax liability while transferring assets to their children.

Have questions or concerns about filing your 2022 tax return? We welcome connecting with you and are happy to help. Click the banner below to message Steve Pitchford, Steve Pitchford, Director of Tax and Financial Planning.

1. The Robots Have Come for This Newsletter | Wall Street Journal – 4.13.2023

Okay…maybe the bots haven't come for this newsletter just yet. But recent advances in artificial intelligence certainly have many of us scrambling to predict what’s next. For centuries, new waves of automation have been greeted by warnings of widespread job loss and disruption, and those predictions have proven to be wrong. But the revolutionary nature of ChatGPT begs us to consider the possibility that this time could be different.

According to some industry executives, it already is.

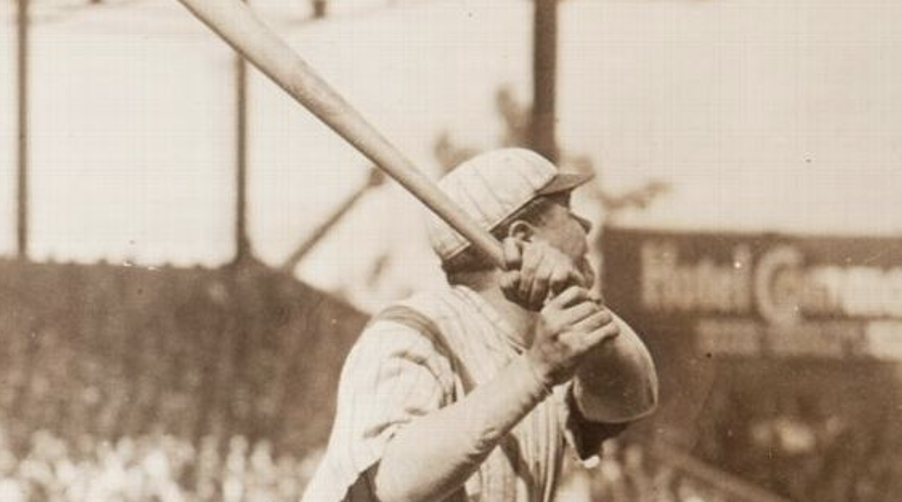

2. Babe Ruth Bat Sells for Record $1.85M After ‘Photographic Corroboration’ | ESPN – 4.5.2023

Hunt Auctions has announced the private sale of a bat used by Babe Ruth circa 1920-21 for $1.85 million, a record price for a baseball bat. The previous record also belonged to a Ruth bat, one that sold privately for $1.68 million by Heritage Auctions last August.

According to Hunt Auctions, the new record holder is the "only known example to offer photographic corroboration."

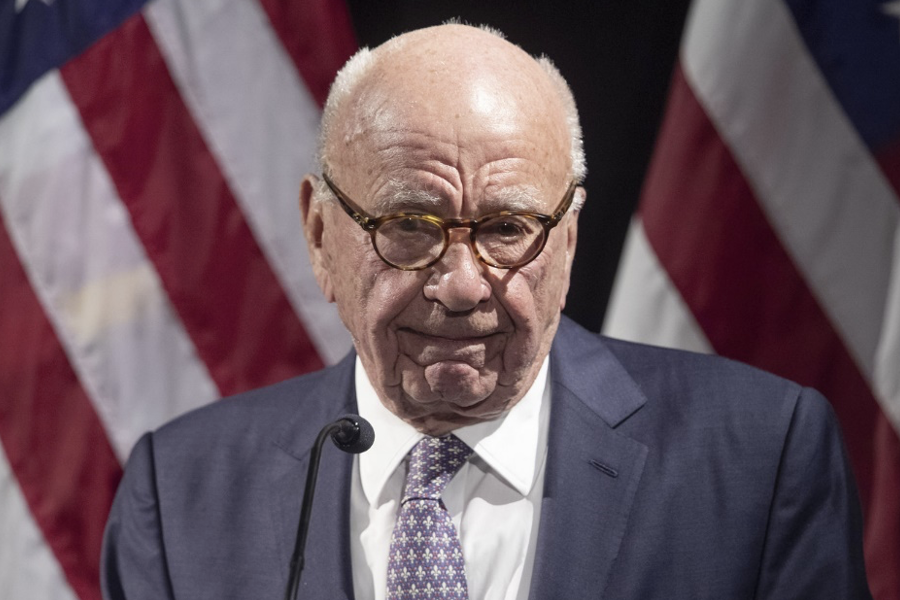

3. Rupert Wins Again | Politico – 4.18.2023

If it seems fairly daft to congratulate Rupert Murdoch on settling the Dominion Voting Systems defamation case at a cost of $787.5 million, you probably need to be brought up to speed on how the tycoon excises malignancies when they threaten his core businesses.

For the media mogul, the massive Dominion settlement fee is just the cost of doing business.

A wonderful cartoon illustrating how emotions can trump objectivity during volatile periods in the economy and markets!

In light of how unsettled the economy and markets are, are you concerned or worried about the level of risk you are taking in your portfolio?

Message us to discuss your circumstances.

If you want to feel confident in your retirement planning decisions, reach out to us and schedule a 20-minute “Ask Anything” call - we are confident it will be time well spent!

At Towerpoint Wealth, we help you remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement. If you are worried about how the 2024 election could affect your financial future, we welcome talking further with you about your personal situation.

Worried about whether you have enough set aside to retire? Check out our “Retiring with 2 Million Dollars” guide to learn five specific steps you can take immediately to work to grow your net worth!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast