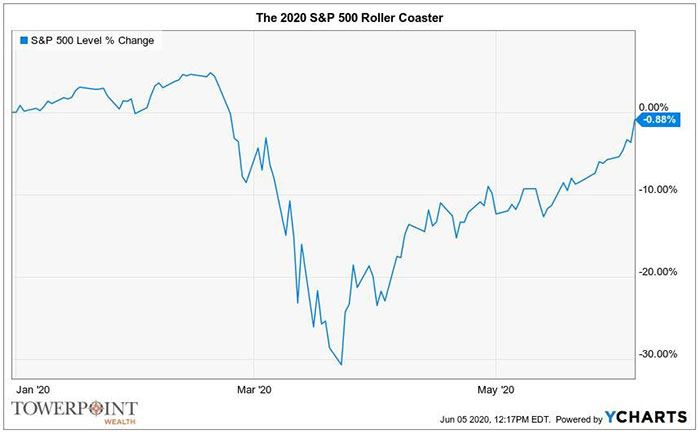

"There are no roller coasters that can replicate what stocks have done so far in 2020."

- Ryan Detrick, Senior Market Strategist, LPL Financial

"Why is the market doing so well when our economy is doing so poorly?"

"How can this bounce back possibly continue?"

"Don't you think it has come too far, too fast?"

All familiar questions we have recently heard from even the most seasoned and level-headed of Towerpoint Wealth clients, and seemingly for good reason. As of Wednesday, it had been 50 trading days since the S&P 500 hit its COVID-19 crash intraday low (2,191.86) back on March 23. Since then? The index is up almost 40%, marking the biggest 50-day move since 1952! If today's huge advance holds, the S&P 500 will be just a stone's throw away from reaching breakeven for 2020, and quickly reapproaching the all-time highs it hit back in February. While not necessarily an enjoyable one for many investors, it certainly has been an epic roller coaster ride.

As unemployment and joblessness have soared in the U.S., so has the stock market. The coronavirus pandemic and the social distancing measures implemented to contain it have adversely affected both the overall demand and overall supply of goods and services in the economy, causing output to plunge. However, the deepest recession since the Great Depression looks increasingly likely to be the shortest. While a full recovery from COVID-19 and the Great Lockdown is not expected until at least 2022, the "green shoots" of recovery have already sprouted, highlighted by today's historic jobs report.

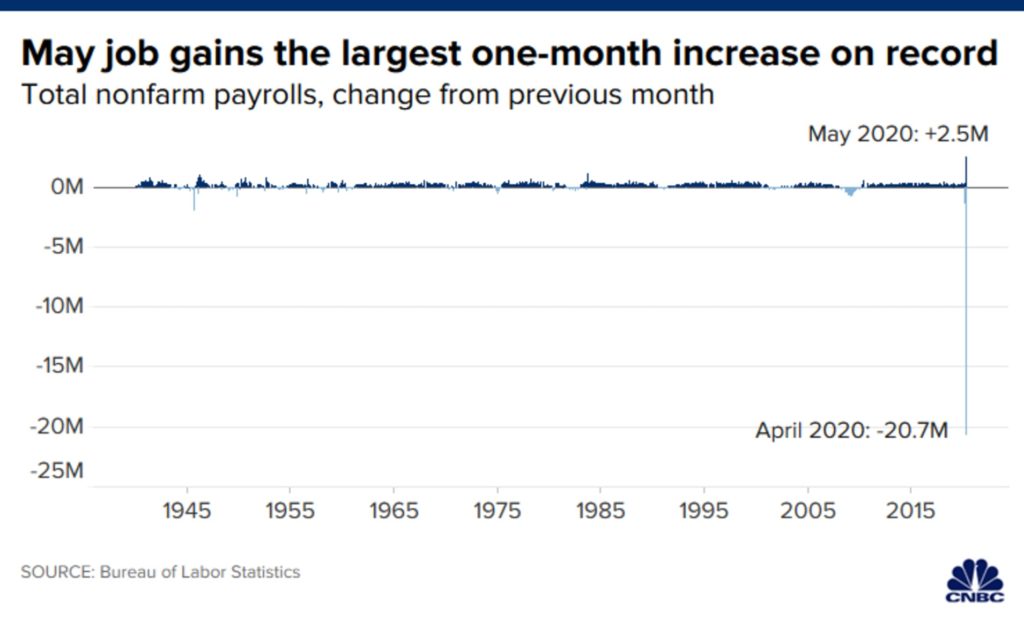

After losing 20.7 million jobs in April (by far the worst monthly decline on record), the Bureau of Labor Statistics yesterday morning reported that the United States unexpectedly gained 2.5 million jobs in May, the biggest jobs increase ever:

While one month certainly does not make a trend, yesterday's employment report provides further evidence about how nascent this economic recovery is, and how unpredictable it is, as economists expected a loss of 8 million jobs in May. Nobody said accurately predicting the future is easy! Regardless, this is truly a blowout number, providing hope for a "V" shaped recovery, and clearly the catalyst for the Dow's 800+ point advance yesterday.

Not convinced? Perhaps noting these additional pieces of information - evidence of economic "green shoots" - will help:

- The TSA said that 268,867 passengers went through security on May 30, up 39% from two weeks before, and up an 187% from the worst Saturday, April 11

- Low mortgage rates and movement from multifamily homes to single family homes in the suburbs have led to increases in mortgage applications to purchase a home, which were up 5% for the past week and a stunning 18% from a year ago, according to the Mortgage Bankers Association

- China's demand for oil has already recovered to more than 90% of pre-COVID-19 levels in April, a robust rebound that is expected to be mirrored elsewhere as more countries emerge from lockdown

- U.S. car sales were up 24% from the second week in May to the third, according to Foureyes

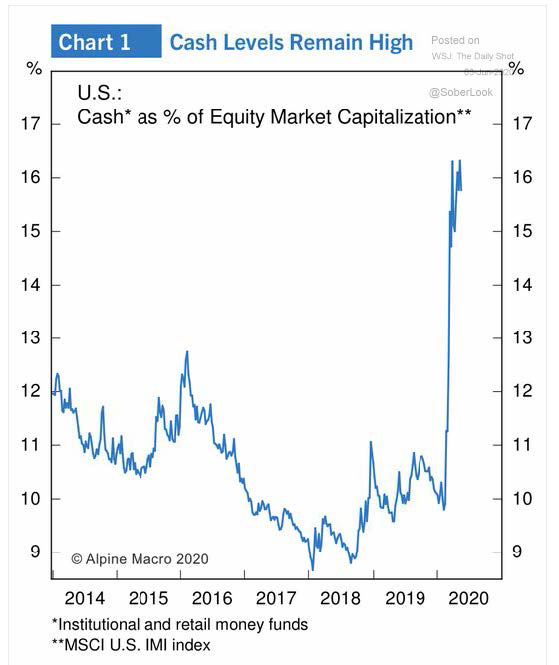

While some investors believe the market is on a "sugar high" due to the vast amounts of government stimulus ($9 trillion globally, so far) that has been doled out, we remain optimistic that the underpinnings of a more substantive - and sustainable - economic recovery are in place. And while virtually all measures of economic activity remain substantially lower than where they were last year at this time, a recovery does have to start somewhere. Additionally, investors have hoarded cash in 2020, providing an ample amount of dry powder to potentially be redeployed elsewhere (and more productively) as investor confidence increases and the recovery takes hold:

While the pace of the growth of these green shoots of economic (and employment) recovery will remain a question for some time yet, at Towerpoint Wealth it seems clear to us that this recession, while unprecedented in its depth, will prove to be short-lived and temporary. And around the corner? Hopefully the foundation for a brighter future again for all of us.

What's Happening at TPW?

A couple of familiar faces, back together!

From the left in the photo below, our Partner, Wealth Manager, Jonathan LaTurner, our Director of Research and Analytics, Nathan Billigmeier, our Director of Tax and Financial Planning, Steve Pitchford, and our President, Joseph Eschleman, all enjoyed going out to eat together for a business lunch earlier this week at Sauced BBQ and Spirits in downtown Sacramento.

While the crew was missing both our Director of Operations, Lori Heppner, and our Client Service Specialist, Raquel Jackson, who were working from home, the boys enjoyed BBQ and southern-style side dishes as the lockdown in California continues to ease.

In addition to green shoots and collard greens, a number of trending and notable events occurred over the past few weeks:

- This photo selection highlights some of the more hopeful images of the last week: Police take a knee in solidarity with George Floyd protesters

- The NHL is the first major sports league with plans to return, with 24 teams competing for the Stanley Cup in two hub cities

- The NBA is looking to restart its season on July 31, and if approved, will have 22 teams playing in Orlando to determine the seeding for a complete 16-team playoff field

- Astronauts are riding into space once again!

- United States military brass openly and publicly clashing with President Trump

- Wes Unseld, legendary NBA Hall of Fame center, dies of pneumonia at age 74

The lockdown is ending. Life will be different for the foreseeable future, but opportunities to be back together in person with those we have been missing are growing. And as always, whether in person or via a Zoom teleconference, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have - the world continues to be an extremely complicated place, and we are here for you to help you make sense of it.

- Nathan, Raquel, Steve, Joseph, Lori, and Jonathan