Navigating the Tax Laws to Maximize | Your Beneficiary’s Inheritance | Comprehensive Estate Planning

When most individuals are establishing an estate plan, they generally only think about the tax consequences to themselves. But a truly comprehensive estate plan is one that takes planning a step further and considers the tax consequences the beneficiaries of the estate may face. When creating an estate plan, having a clear understanding of, and properly planning for these taxes will help ensure your beneficiaries get the largest inheritance possible.

Need more information on what estate planning documents do I need?

When one inherits money as a beneficiary of an estate, there are three different taxes that oftentimes need to be understood and accounted for:

Let’s take a look at these individually:

Estate and Gift Tax

• The 2021 federal estate tax exemption (commonly known as the unified tax credit) amount is $11,700,000 per individual.

• Only the deceased taxpayer is subject to the estate tax when the estate value is greater than the unused exemption.

• Even if the decedent did not have a taxable estate, the estate of the decedent survived by a spouse should file Form 706, Estate Tax Return, to pass any remaining/unused unified tax credit exemption to the surviving spouse.

• When someone dies, their assets become property of their estate. Any income those assets generate is also part of the estate, and may trigger a requirement to file Form 1041, Income Tax Return for Estates and Trusts.

• An inheritance is not considered taxable income to the beneficiary.

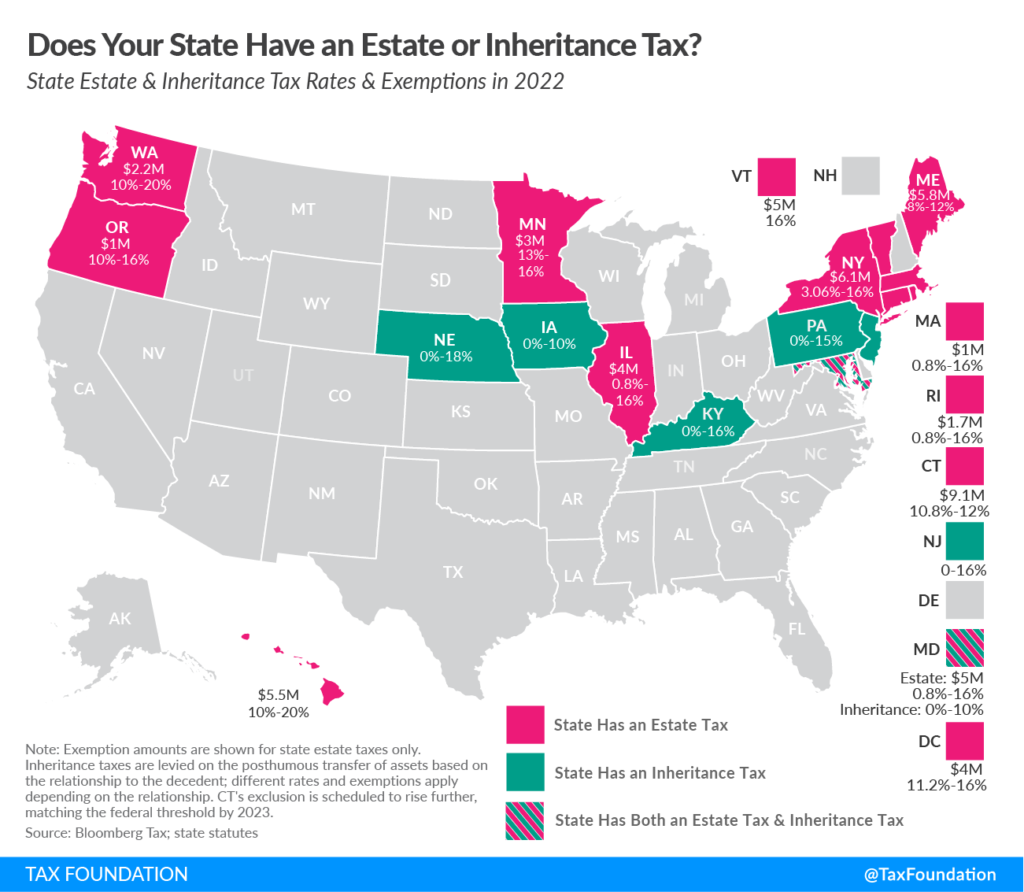

• Currently, in addition to estate taxes assessed at the Federal level, 12 states and the District of Columbia also collect an estate tax. California does not currently have an estate tax.

Inheritance Tax

• Only six states currently collect this tax (Iowa, Kentucky,Maryland, Nebraska, New Jersey, and Pennsylvania).

• Property passing to a surviving spouse is exempt from inheritance taxes in all six of these states.

Income Tax

• Inherited retirement account distributions are subject to ordinary income taxes.

• If you sell or dispose of inherited property that is a capital asset, you will be subject to either a long-term capital gain or loss, regardless of how long you, as the beneficiary, have held the asset.

Additional considerations

Inherited Pre-Tax Retirement Accounts

• Eligible Designated Beneficiaries and Non-Eligible Designated Beneficiaries are subject to different required distribution rules.

• Consider Roth conversions to allow the beneficiaries to take tax-free distributions.

Lowering the Value of Your Estate – Gifting

• Make annual cash gifts to your children, grandchildren, other family members, and even friends. You can also contribute cash to a 529 plan to help pay for future school to any individual you would like. The receipt of cash is non-taxable to the recipient, and, if the gift is below the $18,000 annual exclusion amount, you will not eat into your above-mentioned $11,700,000 lifetime estate and gift tax exemption amount.

Lowering the Value of Your Estate – Philanthropy

• If you are charitably inclined, you can make gifts of any size at any time while alive directly to charities or to a Donor Advised Fund. The donation of appreciated securities provides not only an immediate deduction of the fair market value of the stock at the time of contribution, but also avoids capital gains tax upon sale.

• Charitable contributions due to the death of the taxpayer result in a dollar for dollar reduction of the taxable estate.

• Additional vehicles available include Charitable Remainder Trusts or Charitable Lead Trusts.

Life Insurance

• If you are considering buying life insurance to either pay for the estate tax liability or provide more for your beneficiaries, set up a life insurance trust and have it purchase the policy so the death benefit isn’t included in your taxable estate.

Step-Up in Cost Basis - Take Advantage!

If you have appreciated stock or property and gift it to someone, the recipient gets the carried over basis and will have to pay capital gains when he or she sells the asset. Instead of gifting before your death, have them inherit it after your passing so they get a “step up” in basis and recognize a smaller gain on future disposition.

The Future of Estate Taxes Under the Biden Administration

• During his campaign, President Biden discussed the possibility of decreasing an individual's federal estate tax exemption amount either to $5 million per individual (and $10 million for a married couple) or to the pre-Tax Cuts and Jobs Act amount of$3.5 million per individual (and $7 million for a married couple). This decrease in lifetime exemption could be paired with an increased top tax rate of 45 percent.

• President Biden also proposed eliminating stepped-up basis on death and possibly taxing unrealized capital gains at death at the proposed increased capital gains tax rates.

How Can We Help?

At Towerpoint Wealth, we are a legal fiduciary to you, and embrace the professional obligation we have to work 100% in your best interests. If you would like to learn more about Towerpoint Wealth and how we can help you achieve your financial goals, we encourage you to call (916-405-9166) or email (spitchford@towerpointwealth.com) to open an objective dialogue.