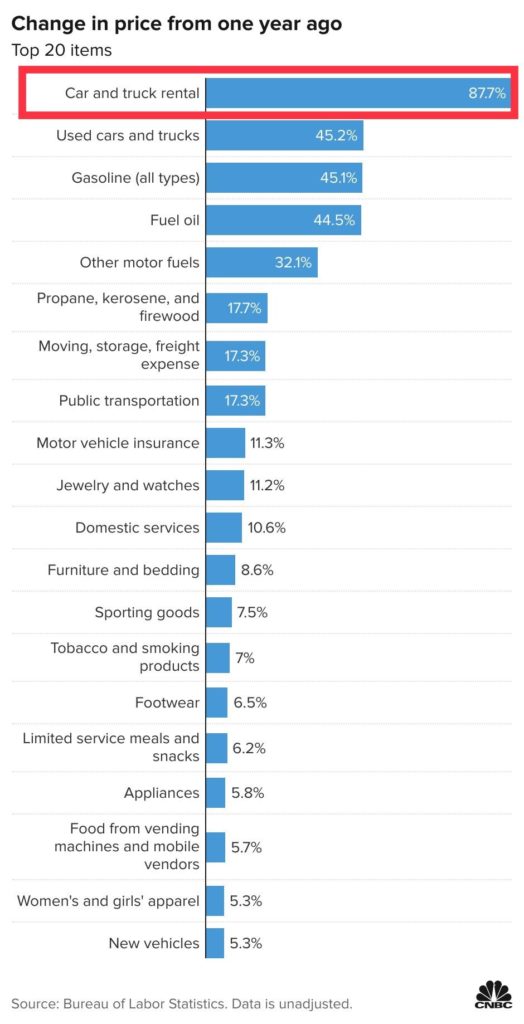

Have you tried to rent a car lately?

Inflation Chart 2021

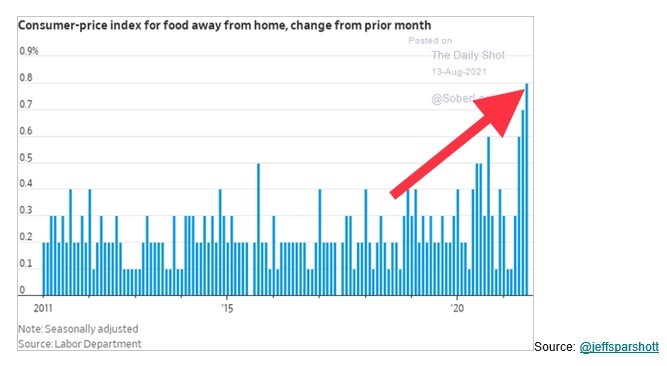

Go out to eat?

Inflation Chart This Year

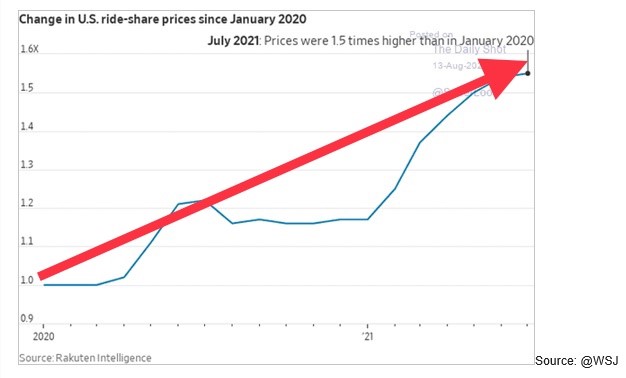

Take an Uber or Lyft?

As our economy continues to open up after massive lockdowns, there is no question we are feeling the effects of inflation.

Now at a 13 year high, the overall measure of CPI for the month of July matched the highest reading of headline CPI since 2008 - an estimated rise of 5.4% over last year!

What does inflation mean? Is inflation good or bad?

How can inflation affect interest rates? All important questions, especially in the current environment of rising prices that we find ourselves in.

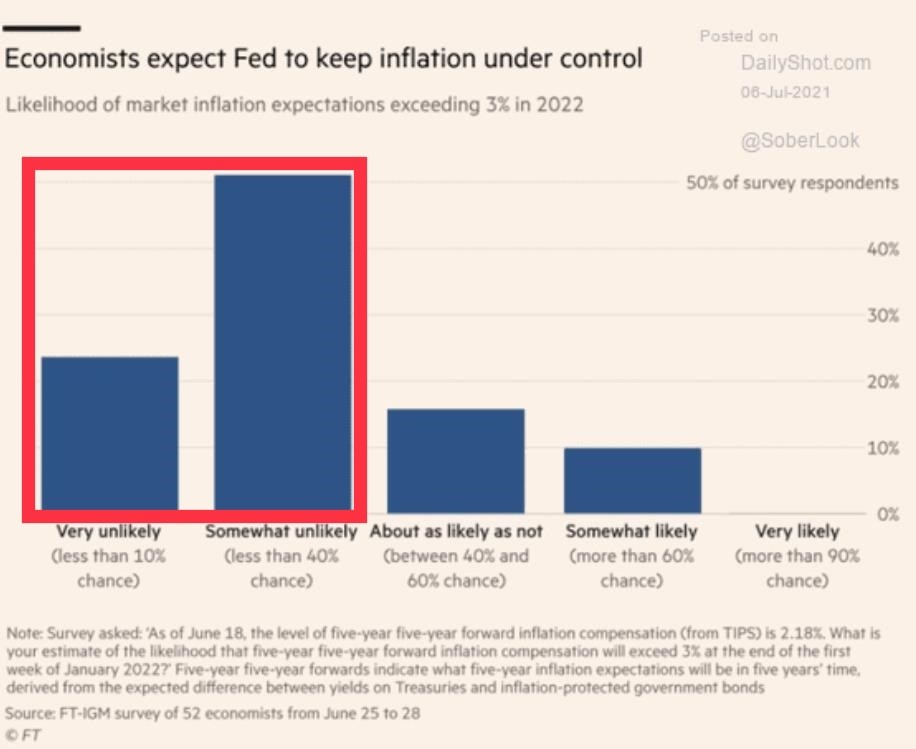

Opinion remains divided on whether consumer and producer price inflation rates will be "transitory" or "enduring" in the months ahead, and at Towerpoint Wealth, we believe the jury is still out in terms of arriving at a definitive conclusion. Putting aside our skepticism about the ability of experts to accurately predict the future, a late June, 2021 survey of 52 economists found that 70% estimated the likelihood of inflation exceeding 3% in 2022 to be "somewhat unlikely" or "very unlikely."

The answers to the questions "What does inflation mean?" and "Is inflation good or bad" can be succinctly summarized like this:

- Inflation erodes purchasing power, as it represents a decrease in the purchasing power of a currency due to a rise in prices

- Inflation encourages spending and investing, as people buy and invest now, rather than later

- Inflation raises the cost of borrowing, as interest rates tend to increase when inflation occurs (good for savers, bad for borrowers)

- Inflation reduces unemployment, as unemployment falls, employers are forced to pay more for workers, and as wages rise, consumers tend to spend more

- Inflation increases growth, as consumers and businesses have an incentive to spend and invest today, rather than tomorrow, when prices are assumedly higher

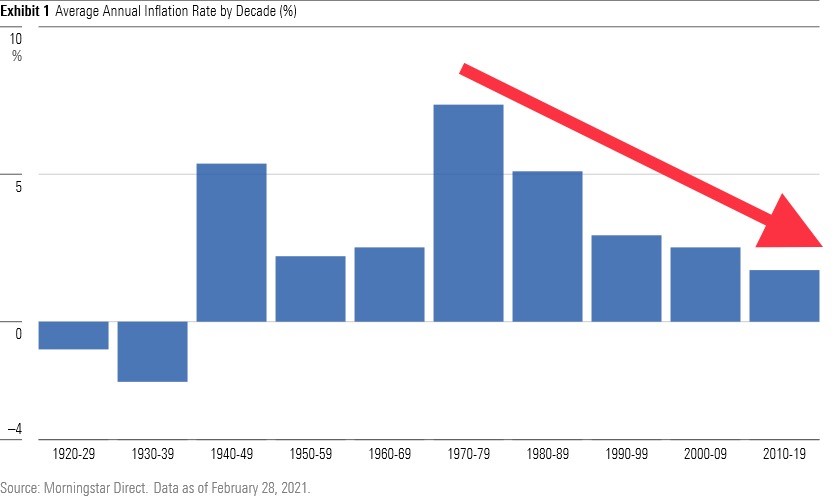

Before the pandemic, inflation had been in a secular decline since the 1970's:

Clearly 2021 has been different, and at least for the time being, this secular decline is over. Understanding that inflation is an important force that can dictate the performance and stability of an economy, we have our fingers crossed that the "slow and steady" inflationary environment of the past three decades returns, subsequent to our economy continuing to normalize after the roller coaster it has been on since March of last year.

What’s Happening at TPW?

Our Client Service Specialist, Michelle Venezia, moved from crabbing to clubbing while on her Norwegian Cruise Line cruise through Alaskan waters earlier this month, with Ketchikan being the port of call!

You look great in both photos Michelle, glad to see you having so much fun on your vacation!

Alaska has definitely been the theme at Towerpoint Wealth, as our Director of Tax and Financial Planning, Steve Pitchford, went on an epic adventure with his partner, Katie, touring and hiking through Denali National Park and Preserve late last month!

Illustrations/Graphs of the Week

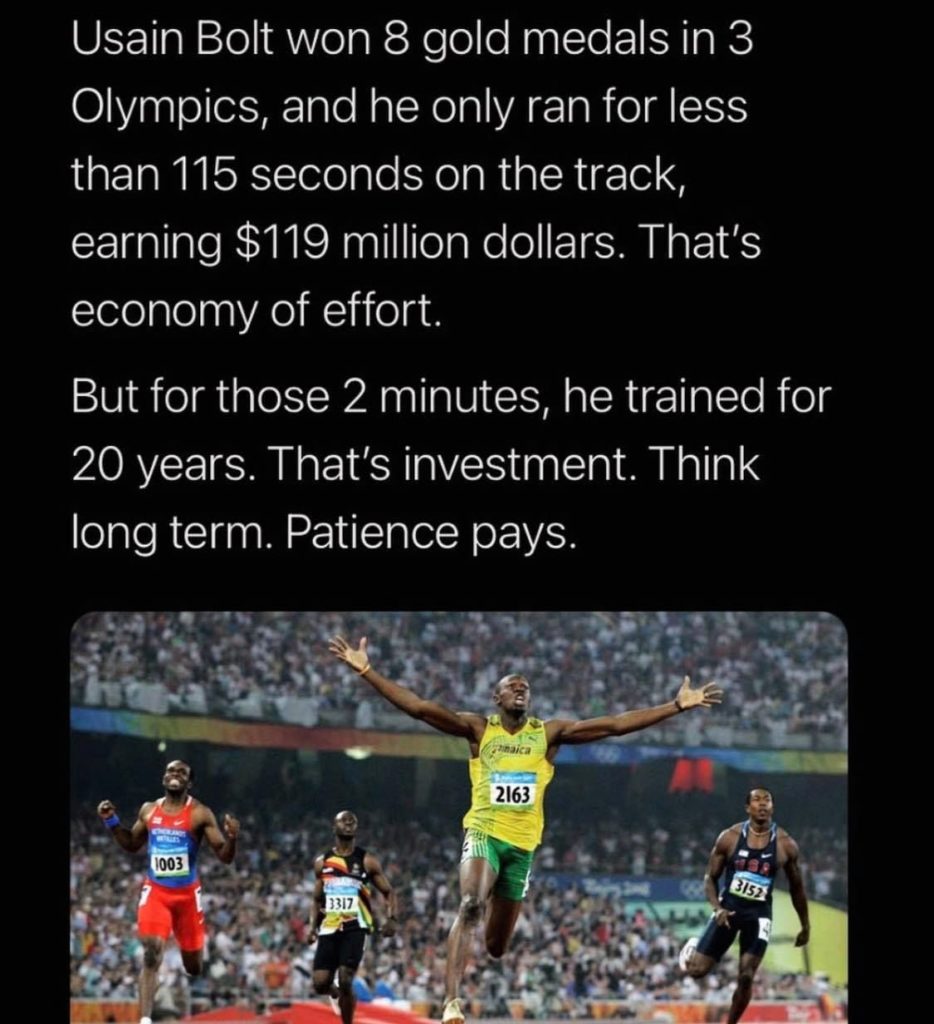

Think long term. Patience pays...

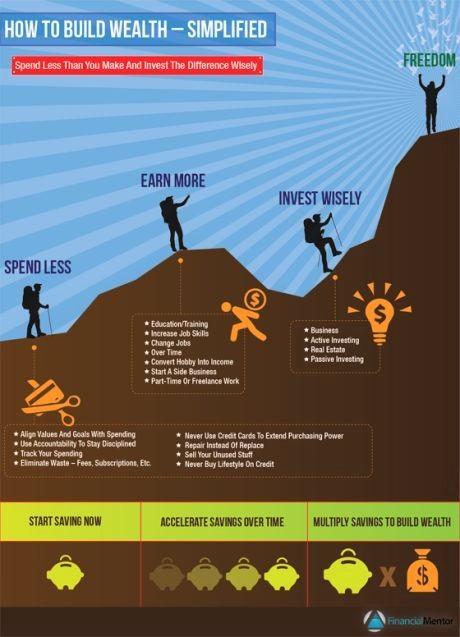

Broken record - think long term - patience pays! How to Build Wealth

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph, Jonathan, Steve, Lori, Nathan, and Michelle