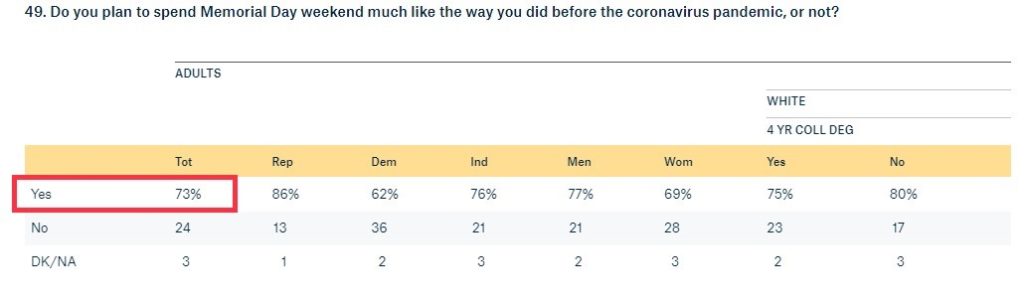

As we sit on the eve of 2021's Memorial Day Weekend, 73% of those in a Quinnipiac poll said their plans are similar to the ones they had pre-pandemic. The light at the end of the pandemic tunnel is getting brighter and brighter by the day!

We're looking at plunging COVID-19 case and death rates and widening vaccination uptake rates here in the United States, in addition to an uptake in exuberance and economic optimism by investors that has driven the stock market to all time highs. And, as is typically true during periods of market extremes, the talking heads, market strategists, investment gurus, and even your brother-in-law Frank seem to have all the answers as to why this is happening, and what lies around the corner. Our advice to you: Ignore this nonsense, and ignore them all.

Rather than become enamored by these predictions and/or fall prey to a well-articulated story spun by a seemingly well-credentialed "expert," we encourage you to tune out this noise, and not worry nor think too much or too hard about interest rates, cryptocurrencies, inflation, China, large caps and small caps, mask mandates, or the U.S. deficit. Don't worry about what the "new normal" means, and don't get too worked up about "getting your share" of the possible American Jobs Plan or the American Families Plan stimulus packages (we're purposefully not even linking to any of these themes). Instead, let's channel our energy and attention into things that we have control over.

While we do believe you should always be ready for the unexpected, we also feel it is way more important to understand and internalize a number of foundational investing and wealth building principles. Ask yourself if you can succinctly and confidently answer the following questions:

- Can I remain objective and rational, and recognize when you are being fearful, greedy, and emotional about your money? Your worst investment enemy is usually found by looking in the mirror. The limbic system is a wonderfully complex set of brain structures that deal with emotions, but activating your fight or flight response in reaction to fear, greed, and anger is not conducive to successful investing or successful longer-term wealth building.

- Do I understand that my neighbors, friends, and co-workers are perhaps confused and delusional? Not only do they probably spend too much and boast too much about their portfolio, but the chances their financial decisions are rooted in any of the principles listed here are quite low.

- Am I trying to simply make money, or am I working to build and protect my wealth? We equate the former to gambling, and the latter to investing. While anything can happen on a daily, weekly, monthly, and even annual basis, we believe your odds of success increase significantly if you establish and follow a disciplined longer-term wealth building plan.

- What am I doing to proactively insulate my downside from a major catastrophe during a market correction? We believe this is way more important than hitting a home run during a period of market strength. While his two rules are a bit binary, the spirit of Warren Buffett's quote should resonate:

- Why am I investing, and do I have a plan? For obvious reasons, it is invaluable to not only think through, articulate, and quantify the goals and vision you have for your and your family's future, but also to have a methodology for how you attend to your personal financial decision-making. And this methodology will be different than your friend's, neighbor's, or co-worker's, as we all obviously have different things that motivate us and that we ultimately want out of life. This is assuming that your friend, neighbor, or co-worker even has a plan at all.

- Do I recognize that costs, fees, expenses, and taxes matter? At Towerpoint Wealth, we call them "necessary evils" to helping clients grow and protect their net worth. And while we can never eliminate the drag that costs, fees, expenses, and taxes creates, we certainly can work to identify, and reduce, these friction points.

- Am I aware that saving money is the single most effective way to build my wealth and to retire? While you need to have balance between saving for tomorrow and living your life today, the capital you spend today is capital no longer available to fund your retirement. Saving money equals peace of mind.

Towerpoint Wealth Turns Four!

On May 26, 2017, with zero clients and $0 in assets under management, we officially launched Towerpoint Wealth. Classified as a "bold," "risky," "fearless," and "courageous" decision by our clients and colleagues, it fortunately turned out to be a prescient and extremely positive one based on the feedback we continue to receive and strategic growth we continue to experience.

Today, we are approaching $350 million in assets under management, and continue to be thrilled to serve YOU, always striving to expand your peace of mind by helping you remove the hassle of properly coordinating your financial affairs.

What’s Happening at TPW?

The Towerpoint Wealth crew recently spent some time in a professional photo shoot with Tim Engle, of Tim Engle Photography - below is one of our favorite shots from the session.

We hold our collective noses to the grindstone at Towerpoint Wealth ~ 97% of the time. However, the culture we have built at the firm is also predicated on spending time outside the office and having fun together as a work family, which is why we regularly schedule fun teambuilding events.

We had an enjoyable "hooky afternoon" earlier this month, pedaling through midtown Sacramento on the Sacramento Brew Bike, with pit stops at Public House Downtown, Kupros, and The Golden Bear. A well-behaved and fun afternoon!

TPW Service Highlight – RETIREMENT - Building wealth

We only semi-jokingly say that you can retire any time you want, but will you be able to with the lifestyle and income stream you desire?

At Towerpoint Wealth, we believe that everyone deserves a secure retirement, and we stand ready to help you with a myriad of retirement-specific tools and planning considerations. The cornerstone of this process is the development of a customized retirement and financial plan using our modeling software from RightCapital(R).

Click HERE to review a sample customized RightCapital financial plan.

Additional retirement-specific services include sustainable and tax-efficient retirement income planning, "black swan" event planning and modeling, customized Social Security benefit election optimization analysis, corporate pension modeling and optimization, fixed/variable/immediate annuity analysis, and optimal-retirement-age projections.

Chart of the Week

Real estate values continue to be on fire! Click HERE to watch an excellent video in which our President, Joseph Eschleman discusses the white hot Sacramento real estate market with long-time Sacramento realtor, Brian Kassis.

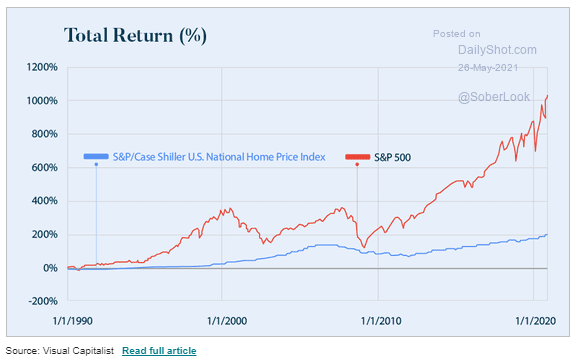

And while there is no question about the tremendous price increases homeowners have experienced over the past year and a half, the chart below makes an interesting comparison between the value of the stock market (using the S&P 500 as a proxy) and the value of residential real estate (using the Case Shiller U.S. National Home Price Index as a proxy) over the past 30 years.

Understanding the importance of owning both real estate AND equities when working to build net worth, and recognizing that people seem to be more relational to the increases in the value of their home, the chart below from Visual Capitalist is an eye-opener!

Trending Today

In addition to home prices going up and U.S. COVID numbers going down, a number of trending and notable events have occurred over the past few weeks:

- Will there be a Capitol riot commission? It has been decided today

- Will rising COVID-19 infections in Tokyo cause officials to cancel the 2020 Olympics?

- The Wuhan lab-leak theory is now being taken seriously regarding the origin of COVID-19 - here's why.

- You think your kid is smart? This two-year-old from Los Angeles is the youngest member of American Mensa, after scoring a 146 on the IQ test

- The cicada plague of 2021 - here is a map identifying exactly where billions of mid-Atlantic cicadas will emerge this spring

- Fed Chair Janet Yellen suggests current higher inflation rates will last for another several months, but will be temporary

- A sold-out Indianapolis Motor Speedway will host 135,000 racing fans on Sunday for the Indianapolis 500

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph, Jonathan, Steve, Lori, Nathan, and Michelle