Welcome to the Halloween edition of Trending Today!

While this spooky season is often about tricks, treats, and eerie surprises, when it comes to investing, the real question is whether your choices lead to tricks or treasure.

In this article, we’ll explore the allure of owning gold and precious metals in your portfolio — assets that can feel like treasure, but might hold some tricky surprises if you don’t fully understand them.

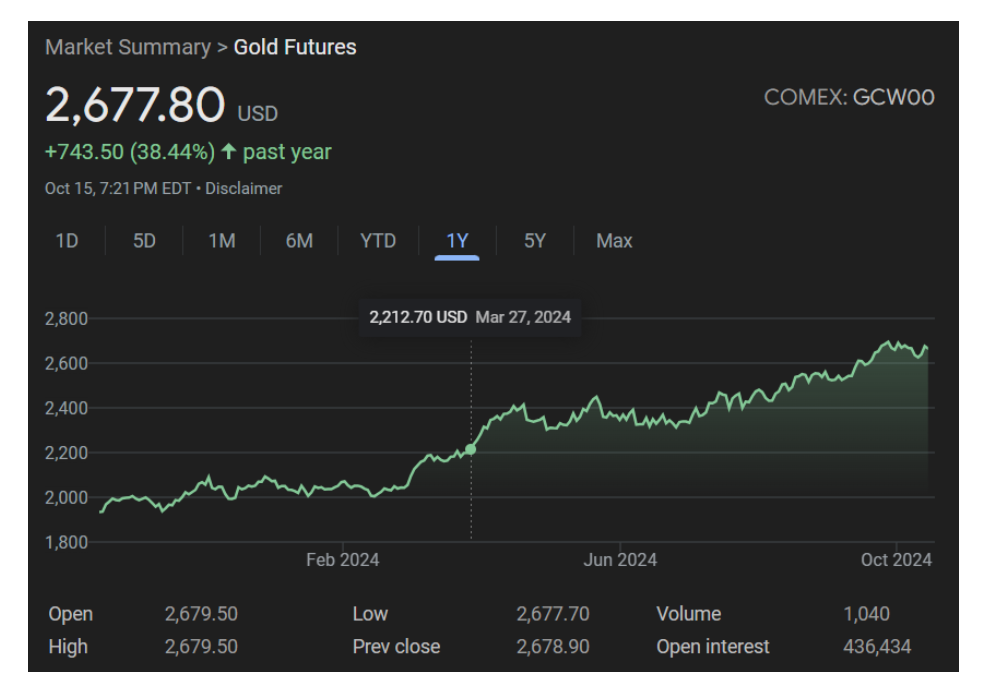

Over the past 12 months, gold has increased more than 38%, drawing more investors seeking protection from market volatility and inflation. But is it really the treasure your portfolio needs? Or could it be a tempting trick? Let’s talk about it!

Key Takeaways

- Gold has seen significant price increases in 2024, driven by inflation concerns, economic uncertainty, and market volatility.

- Gold is traditionally viewed as a safe haven during inflationary periods, helping to preserve purchasing power over time.

- Gold can act as a stabilizing asset, reducing overall portfolio risk by providing a counterbalance to other investments.

- Investors can invest in gold through various methods, including physical gold, gold ETFs, digital gold platforms, and gold mining stocks.

- Alternatively, the lack of income generation can be a turnoff for investors, as gold doesn’t produce dividends or interest like stocks or bonds. Investors rely solely on price appreciation for returns, which can limit growth during periods of low gold prices.

A Timeless Treasure

Gold’s appeal as a store of value dates back thousands of years, long before the invention of modern currencies or financial markets.

Ancient civilizations used gold not only as a medium of exchange, but also as a symbol of wealth and power. As a tangible asset that cannot be printed or artificially produced, gold's finite supply has helped it maintain its status as a trusted store of wealth throughout human history.

Beyond gold, precious metals like silver, platinum, and palladium have also played essential roles in both economies and industries. While gold is often seen as a safe haven during times of economic and political uncertainty, other metals have more specialized purposes.

For example, silver’s value is driven by both its industrial applications and its use in jewelry, while platinum and palladium are crucial in automotive manufacturing, particularly in catalytic converters for reducing emissions.

The long-lasting appeal of these metals comes from their intrinsic value and scarcity, which can make them resilient against the devaluation of paper currencies and financial instability in the market.

Gold as a Hedge Against Inflation

Much of the allure of gold (aside from the allure of gold itself!) comes from the perception that gold is a powerful hedge against inflation.

Inflation occurs when the cost of goods and services rises over time, eroding the purchasing power of money. A postage stamp today costs $0.73. It would have only cost you $0.10 to mail that same letter in 1974!

For investors, inflation poses a significant risk because it can diminish the real value of the return on your portfolio, especially for assets like bonds or cash, which have fixed or low returns.

When inflation rates rise, the value of paper money tends to decline, but gold — a tangible asset — is believed to hold or increase in value. This is because gold’s supply is relatively limited, and its value is not tied to any particular currency or government policy.

Thanks to gold’s relatively low, or even negative, correlation to other assets, gold tends to be a place to run for investors worried about maintaining the value of their portfolios.

Historically, during periods of high inflation, investors have flocked to gold to preserve their wealth. For instance, during the inflationary 1970s, gold prices in grams surged, providing refuge for those looking to protect their purchasing power.

Does this mean you should stockpile gold when inflation runs high?

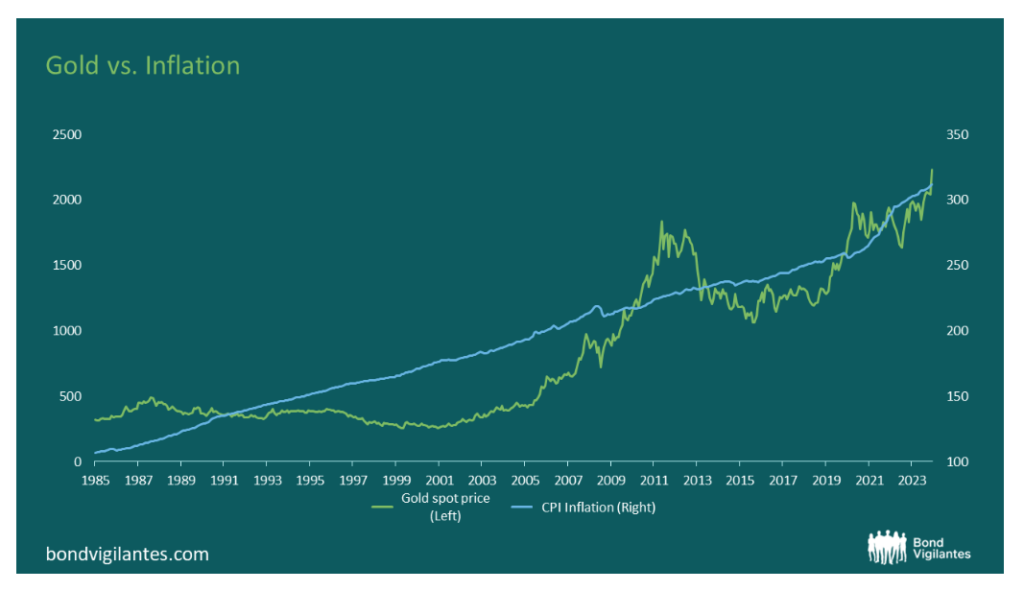

Well, since the 1970’s, gold has been less effective as an inflation hedge. In some low inflation or even deflationary environments, gold may underperform, and has appeared to do so in recent years.

Since 1972, the average ratio of gold’s price to the Consumer Price Index (CPI) was about 3.6. In 2024, that ratio is around 6.4, which tells us that gold’s value does not remain relatively constant compared to the CPI — as you would expect from a reliable inflation hedge.

As you can see from the chart above, the price of gold is not always stable against the rise in prices — or inflation.

This doesn’t entirely rule gold out, though! Some studies do suggest that gold can be an effective hedge against inflation over longer time horizons. This is why it is essential to consider gold as a complementary part of a broader, well-diversified investment strategy rather than a standalone solution.

Diversifying with Gold

While gold and other precious metals may not be the most effective safeguard against inflation in every scenario, they can have their place in a well-diversified portfolio.

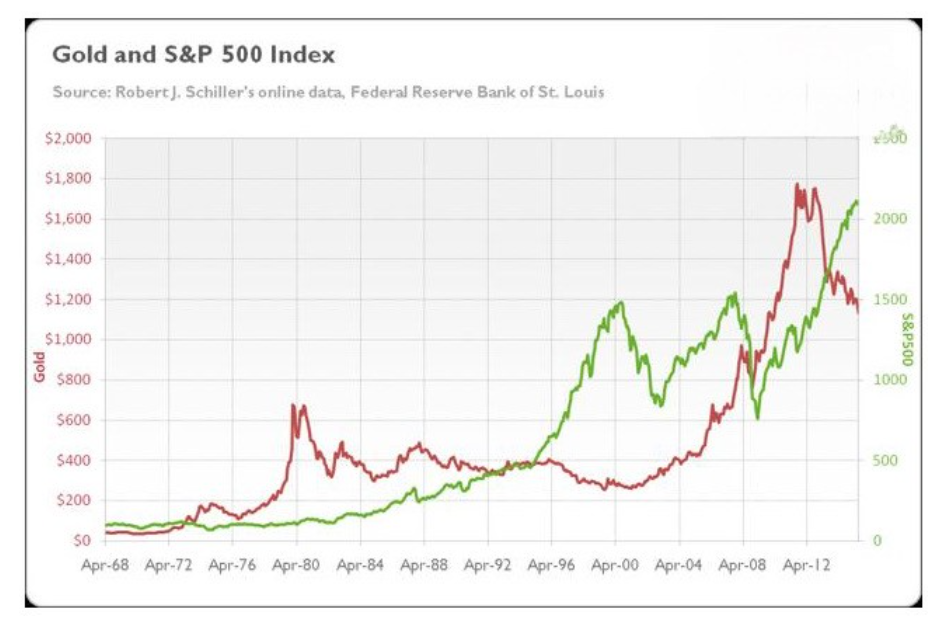

Diversification is a cornerstone of sound investing. By allocating investments across different asset classes, investors can reduce the overall risk of their portfolio, helping to insulate against unexpected declines in any one particular asset class. Gold, and precious metals more broadly, play an important role in this context because of their low or negative correlation with traditional assets like stocks and bonds.

We’ve seen this in periods of economic stress or financial market downturns, when gold prices often move in the opposite direction of other assets.

For example, during the global financial crisis of 2008, stock markets plummeted, but gold prices surged as investors sought safety in a reliable store of value. While you shouldn’t bet on gold to grow your portfolio, it can act as insurance to cushion your assets from inevitable changes in the market.

While gold will not provide you with dividend income — or any real economic use for that matter — it can potentially benefit your portfolio through price appreciation. As investors gravitate to gold in periods of economic uncertainty, the gold in your portfolio can become much more attractive.

What About Gold Prices in 2024?

Gold prices in 2024 have experienced considerable growth. In fact, since the start of the year, gold prices in 2024 have gone up by a whopping 25%, breaking numerous price records in the process!

People have even been buying gold bars at Costco, causing them to fly off the shelf — WOW.

Many investors are interested in purchasing gold to cash in on the potential for higher prices in the future. With prices projected by some to continue growing into 2025, and gold’s history of being effective at storing value, gold is seen as an excellent shorter-term and longer-term investment for many investors right now.

While individual investors are seeking gold investments to help protect their wealth and shield them from inflation, central banks globally are increasing their gold reserves, further driving demand for the precious metal.

This rise in its nominal price highlights gold’s reputation as a safe-haven asset, helping to solidify its place in a diversified investment strategy.

How Can I Add Gold to My Portfolio?

If you’re looking to add gold to your own portfolio, you have a few options as an investor, especially in the digital age.

Physical Gold

The most typical way to acquire gold is by buying the physical metal, or buying gold bars. Buying physical gold in the form of bullion, coins, or bars is the most direct way to invest. This provides tangible ownership and removes counterparty risk.

You want to keep in mind that storing physical gold safely can be a challenge, and selling large amounts of gold may be difficult without the right buyer, so buying gold bars isn’t always the most practical choice for investors.

Gold ETFs (Exchange-Traded Funds)

For a simpler and more liquid investment, many investors turn to gold ETFs, with GLD and IAU being the two most popular.

These exchange-traded funds track the price of gold and are traded like stocks, offering a low-cost way to invest in the metal without needing to store it. If you’re looking to start investing in gold, ETFs are convenient, but they come with management fees, and investors do not have direct ownership of the actual metal.

Gold Mining Stocks and Mutual Funds

Investors looking for exposure to gold often turn to mining stocks or mutual funds that invest in gold mining companies. These investments tend to move with the price of gold, but they also introduce additional risks, such as operational challenges or geopolitical factors affecting mining companies.

This approach can offer higher returns, but the volatility can also be higher, making it important to assess your risk tolerance before diving in. In the wrong environment, these stocks can feel more like a trick than a treasure, so you don’t want to start adding gold mining stocks to your portfolio without consulting a trusted financial advisor.

Digital Gold Platforms and Gold Options

Digital gold platforms offer a convenient way to invest in gold without physically holding it. Through online accounts, investors can buy, sell, and store fractional amounts of gold, making it accessible to a broader audience.

These platforms provide flexibility, allowing users to trade gold at any time, and they typically include secure storage options. One key advantage is the ability to invest with smaller amounts of money compared to purchasing physical gold.

If digital gold platforms seem like the way to go for you, you have to also consider fees for storage and transaction charges that may apply. Investors also must trust the platform's solvency and security if they choose to invest this way. Despite these risks, however, digital gold is gaining popularity in today’s digital era.

You can also consider gold futures and options, which allow you to speculate on gold’s price without owning the physical metal.

Futures contracts involve agreeing to buy or sell gold at a set price on a future date, offering profit potential but also carrying high risk. Options contracts, on the other hand, give investors the right — but NOT the obligation — to buy or sell gold at a specific price, providing a less risky way to bet on price movements.

Both strategies can generate significant returns but are complex, oftentimes speculative, and best suited for experienced investors who already understand gold market volatility.

Should I Invest in Gold?

While gold is very popular right now, and has historically been used as a hedge against market volatility and inflation, investing in gold comes down to your unique preferences and circumstances, and does not come without risks.

Risks of Buying Gold

Gold does not generate income, such as dividends or interest, which can make it less attractive during bull markets. Its value can also be volatile since it is influenced by factors like currency fluctuations, geopolitical events, and changes in supply and demand.

Over-allocating to gold can limit your portfolio’s growth potential, so a balanced approach is key. Investing in gold works best when it plays a supporting role in a broader, well-diversified investment strategy.

How Much Gold Should I Buy?

Some financial experts recommend that gold should make up around 5-10% of a well-diversified portfolio, as this allocation is typically enough to enjoy the benefits of diversification without overexposing your portfolio to the risks associated with precious metals. The right allocation mix for you is an important conversation that you should have with your financial advisor.

It is also advisable to rebalance your portfolio regularly. As the price of gold fluctuates, your portfolio’s allocation may drift from your target. Rebalancing ensures that you maintain the proper mix of assets and don’t allow your gold holdings to dominate the rest of your portfolio.

The Future of Gold Prices

The future performance of gold and other precious metals will depend on a variety of factors. Rising interest rates could weigh on gold prices, while ongoing inflation concerns, geopolitical tensions, and central bank policies may continue to support the growing demand for gold as a hedge.

Meanwhile, advancements in technology and industrial demand for metals like silver, platinum, and palladium may drive long-term growth in these markets.

Let’s Help You Decide!

Towerpoint Wealth is a leading fiduciary wealth management advisory firm located in Sacramento, CA. We help our clients develop a customized plan to make informed financial and investment decisions that align with their preferences, unique personal situations, and longer-term financial goals.

We believe in helping you remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement.

If you’re considering adding gold to your investment strategy, or have any other questions regarding your wealth management, we encourage you to schedule an initial 20-minute “Ask Anything” discovery call with us!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast