Coming as a surprise to virtually no one, and as you have probably read or heard, Elon Musk is attempting to terminate his $44 billion takeover of Twitter.

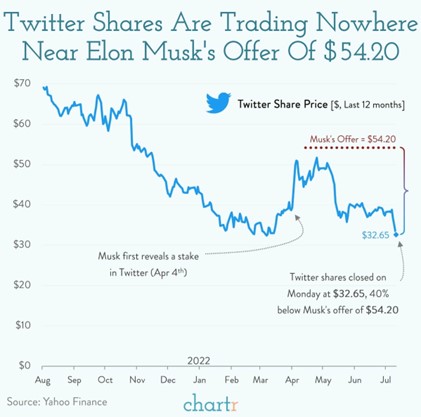

The Twitter Musk “saga” has certainly been an interesting and increasingly outlandish one. On one hand, Musk said that Twitter rebuffed his efforts to obtain information and details surrounding fake users and accounts (aka bots, or automated accounts that can do the same things as human beings), alleging that the company is not as valuable, and is not as profitable, as their current official 400MM user count suggests. Twitter’s stock has plummeted on the news that the world’s richest person intends to revoke his offer of $54.20 per Twitter share.

On the other hand, Twitter says they have “played ball,” have continued to act in good faith, and have justified not sharing the information with Musk by saying that it was worried he would build a competing platform after abandoning the acquisition. Additionally, with Twitter fully intending to call the bluff on Musk’s “billionaire vanity project,” and with Twitter stock now trading in the mid 30’s, a $54.20/share takeover offer is way too sweet to let Musk walk away!

Semi-ironically (considering that Twitter never wanted to be acquired in the first place), Twitter filed a much-anticipated lawsuit earlier this week to force Elon Musk to close his acquisition of the company. With the lawsuit set to begin in mid-September, what happens next with Twitter Musk is anyone’s guess, but for some, it will be must-see TV (and must-see Tweeting, as evidenced by the clickable image below).

How could this Twitter Musk soap opera end? Here are eight ways it could happen.

Perhaps more importantly, why does this Twitter Musk stuff even matter and why should you care? Five important considerations may answer that question:

1. Free speech – Musk said in his news release announcing his purchase that “Free speech is the bedrock of a functioning democracy, and Twitter is the digital town square where matters vital to the future of humanity are debated.”

2. Advertising – Many are concerned that advertisers would be less willing to spend advertising dollars on Twitter if Musk removes content moderation to further promote free speech. Additionally, advertisers could move to other platforms like YouTube, TikTok, or other online channels.

3. Donald Trump – Would or wouldn’t Musk let Trump back? Few people if any did a better job of dominating the “media ecosystem” via Twitter than Donald Trump prior to his ban in early 2021. Love him or hate him, Musk said at an April, 2022 TED conference that he prefers timeouts for “offending” Twitter users, and would be very cautious with permanent bans. It seems difficult not to argue that nothing would stoke the Twitter Musk soap opera more than a Trump reinstatement…

4. Tesla – Would acquiring Twitter put too much on Musk’s plate? Musk is planning on using TSLA stock as collateral for a loan to finance the takeover. Do Tesla shareholders really want to see Twitter stock added to the Tesla portfolio, and have their visionary CEO shoulder even more responsibility?

5. Current Twitter users – Alternative social media platforms (WeChat, Facebook, YouTube, Truth Social, WhatsApp, Snapchat, and Instagram come to mind) abound in today’s digital ecosystem. Additionally, would Twitter be nearly as viable if its largest users (Barack Obama, Justin Bieber, Katy Perry, Rihanna, Cristiano Ronaldo, Taylor Swift, Lady Gaga, and Elon Musk himself) decided to close their account and move to another platform?

Twitter continues to be an extremely popular communication and information dissemination platform, and we certainly expect this saga to carry on for quite some time. Being humble about our ability to consistently and accurately predict the future, our preference at Towerpoint Wealth is to simply sit back with some popcorn and watch these important and entertaining twists and turns of the Twitter Musk soap opera as they unfold.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients build and protect their net worth.

The Towerpoint Wealth crew was well represented at the American Century Celebrity Championship last weekend, as our Director of Research and Analytics, Nathan Billigmeier, his wife Jessica, our President, Joseph Eschleman, his son Henry, and our Partner, Wealth Advisor, Jonathan LaTurner, and his wife, Katie McDonald, all “crashed” Edgewood Tahoe Golf Course in South Lake Tahoe, NV!

A lineup of more than 80 athletes and celebrities, including Steph Curry, Justin Timberlake, Charles Barkley, Jerry Rice, Patrick Mahomes II, and Nick Jonas, competed in the three-day tournament, won for a third time by former Dallas Cowboys quarterback Tony Romo on the second hole of an exciting playoff!

(aka The Flyin’ Hawaiian) pose for a selfie!

Earlier this month our new Marketing Specialist, Luis Barrera, visited Morelia, Mexico to spend some family time with his cousin (and designer, TV host, and businesswoman), Rossana Salgado, at her wedding to Jose Luis Higuera.

What else is happening with the Towerpoint Wealth family?

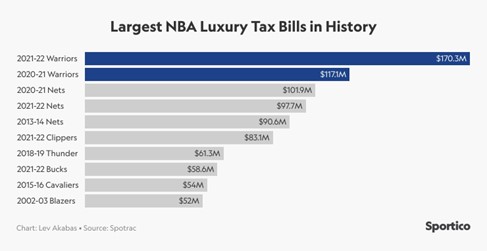

While having little if any effect on your personal income tax return or liability, the recent $346 million spending spree by the Golden State Warriors has placed the 2021-2022 NBA Champs knee-deep into the NBA luxury tax, an incremental tax meant to control team spending and penalize owners who go over the NBA salary cap.

Understanding the Warriors have been anything but shy about spending money in order to maintain the roster that has helped them win four NBA titles since 2014-15, their spending on player salaries, while legal, has not sat very well with many NBA owners, and was a hot topic at the recent NBA owners’ meeting in Las Vegas.

Steph Curry earns close to $50 million/year. Klay Thompson, Andrew Wiggins, and Draymond Green combine for almost another $100 million in salary. Star center Kevon Looney just signed a new three-year, $25.5 million contract, and up-and-coming star Jordan Poole expects to earn a contract extension upwards of $100 million.

Is all of this fair? Well, it’s legal. But click the thumbnail below for an excellent commentary on why this is such an important issue, and what the league may, or may not, do about it:

Curious about how Towerpoint Wealth is interfacing with our clients’ CPAs to do proactive and collaborative tax planning?

Useful and interesting content we read the past two weeks:

1. We Don’t Have a Microwave Democracy – com (Myron Clifton) – 7.6.2022

Democracy isn’t made in a microwave. Democracy takes time. Democracy requires an investment in process. And Democracy requires sharing across generations to sustain progress and pass along lessons that should not be forgotten.

Every vote is your most important vote. You will not always get your way, but you significantly increase your chances of improving our nation and perfecting our democracy when you exercise your inherited civic duty.

If you want your way there’s only one way to get it: Vote and vote every time you have the opportunity to and ensure future Americans have more and better rights, laws, and government.

2. Pension Funds Plunge Into Riskier Bets – Just As Markets Are Struggling – The Wall Street Journal – 6.26.2022

US public pension funds don’t have nearly enough money to pay for all their obligations to future retirees. A growing number are adopting a risky solution: Using leverage and investing borrowed money in an effort to earn higher returns and close big funding gaps.

As both stock and bond markets struggle, it’s a precarious gamble.

3. How Justice Amy Coney Barrett is Wielding Enormous Influence on the Supreme Court – USA Today – 7.13.2022

After a term in which the court’s conservative majority overturned Roe v. Wade, set a tougher standard for assessing gun regulations, and redrew the line separating church and state, Americans are debating whether the court is putting forth an honest effort (even if one you ultimately don’t agree with) to determine what the Constitution and precedent requires, or if it is purely results-driven and designed to impose the policy preferences of the majority.

This discussion inevitably leads back to Barrett herself – and her influence on the nation’s highest court.

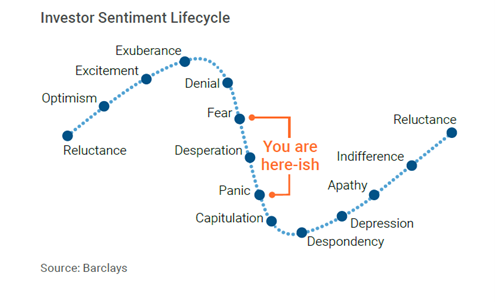

In order to successfully achieve their longer-term financial and investment goals, it is essential that investors make rational, informed, and unemotional decisions – easier said than done sometimes!

As human beings, we fall victim to the emotional roller-coaster of a typical market and economic cycle, with the investor sentiment lifecycle delineated below.

Let us know where you currently find yourself falling within the above chart!

Our President, Joseph Eschleman, CIMA®, dove into a number of specific opportunities and valuable money-saving tips to navigate today’s inflationary environment with Sacramento Bee reporter Hanh Truong, in her recent article: “Should You Keep Cash On Hand as Inflation Rises? California Adviser Gives Money-Saving Tips.”

As inflation continues to be a challenge for virtually all in the Sacramento area, many residents harbor significant concerns that today’s prices on the rise will persist for some time.

Click the thumbnail image below to read Truong’s article, as Eschleman contributes specific strategies for possible relief and protection from this rampant inflation.

Have additional questions about how to position yourself and your portfolio to better protect against and possibly even profit from inflation?

Today’s rampant inflation continues to be a central economic issue of interest and concern, as June’s Consumer Price Index (CPI) reading of +9.1% was the highest on record since November of 1981.

Today’s post-COVID increased consumer demand and spending, coupled with trillions of dollars of recent government COVID stimulus, and today’s continued supply chain constraints, equal a perfect recipe for inflation. And while fighting inflation is now a central goal of our government, successfully doing so can be a challenge.

As the 24/7 news cycle churns, twists, and turns, a number of trending and notable events have occurred over the past few weeks:

- Texas state residents are asked to conserve energy amid predictions for record-high temperatures, and are warned of potential rolling blackouts.

- California Governor Gavin Newsom visits the White House for a series of meetings centering on abortion, climate change, and gun control.

- The euro reached parity with the dollar for the first time in twenty years.

- The Washburn Fire threatens the Mariposa Grove of Giant Sequoias in Yosemite, but the ancient trees are being protected by sprinklers!

- Lockeford, a small San Joaquin County town just east of Lodi, will be the guinea pig for Amazon drone delivery.

- WHO chief urges ‘bring back face masks’ as COVID pandemic ‘nowhere near over’.

- North Carolina is #1, California ranks #29 in CNBC’s annual ‘America’s Top States for Business in 2022’.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph, Jonathan, Steve, Lori, Nathan, Michelle, and Luis

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity.

We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on Twitter