Picture this: It's a brisk Monday morning, and as you groggily shuffle to the kitchen for your daily caffeine fix, a friendly voice chimes in from your countertop speaker, "Good morning! Your cappuccino is already brewing, and your schedule is all set. Don’t forget your jacket and umbrella, it’s 46 degrees out and rain is expected this afternoon. It's going to be a great day!"

No, it's not your roommate trying to brighten your day; it's your trusty AI-powered virtual assistant, making your daily routine not just manageable but downright delightful. In a world where artificial intelligence (AI) is seamlessly woven into our daily lives (whether we’re aware of it or not), the question isn't whether we can do something with AI; it's more likely to be, "I can do THAT with artificial intelligence?" Welcome to the future where AI isn't just a buzzword; it's your everyday companion, your digital sidekick, and your key to a smoother, smarter, and more enjoyable daily routine.

Click the image below to read an excellent report on AI from Tech Republic.

We’ve been receiving a regular stream of questions from our clients and colleagues about AI. So if you’ve ever wondered about how AI brings “magic” to your daily life, and where the AI user experience can make your life easier and more convenient, then read on!

As we seek to answer the “I can do THAT with artificial intelligence?” question, dive into the world of the AI user experience, and identify the myriad of ways that artificial intelligence is making our daily routines smoother, smarter, and dare we say it, a lot more fun!

What sets the AI user experience apart from regular ole' user experience (UX)? Imagine traditional UX as the friendly server at your favorite restaurant who knows your “usual.” They remember the go-to meal you typically like to order, talk with you about your family, bring you your favorite dessert, and make your dining experience a lot more pleasant. Now, think of the AI user experience as that server, but with a twist—they not only remember your usual, but also anticipate when you might want to try something new, and they bring it to you with a smile. In a nutshell, the AI UX is not just about personalization, but also about prediction and unparalleled convenience. Here are some specific examples of how we are, or can be, incorporating the AI user experience in our daily lives.

The AI-Powered Virtual Assistant

Let's kick things off with our trusty AI companions: virtual assistants! Siri, Alexa, Google Assistant—these “folks” have become an integral part of our daily lives. They're like the BFFs who help us navigate the digital world effortlessly.

Take, for instance, the moment you groggily wake up and wonder about the weather. Instead of fumbling for your phone, you simply ask, "Hey Siri, what's the weather today?" Voilà! You've got your daily weather report served on a digital platter. From setting task reminders and keeping shopping lists, to controlling smart home automation and making personal media recommendations, AI-powered virtual assistants make life more convenient and time-efficient, one voice command at a time.

Predictive AI: Making Life Easier

One of AI's superpowers is its ability to predict your needs before you even realize them. Have you ever noticed how your smartphone suggests the next word you're about to type? It's not just reading your mind—it's AI in action! Predictive text saves you time and makes messaging a breeze.

But predictive AI goes beyond text. It's the reason your smart thermostat adjusts the temperature before you even get home or why your favorite ride-sharing app seems to know exactly where you're headed. It's like having a personal assistant who's always one step ahead.

Chatbots and Conversational AI

Remember the last time you had a question about a product or needed assistance with an online purchase? Chances are, you interacted with a chatbot, and while sometimes annoying, they can actually be surprisingly helpful! Chatbots are like the friendly customer support agents who never take a coffee break.

Whether it's answering FAQs, troubleshooting tech issues, or even helping you place an order, chatbots are the unsung heroes of the online world. They're available 24/7 and always ready to assist you.

Healthcare and Wellness: AI as a Health Assistant

AI isn't just about making life more convenient; it's also a health buddy. It's there to help you stay fit, monitor your health, and even detect potential issues before they become major concerns.

Think about wearable devices that track your heart rate and sleep patterns. They're not just counting steps; they're using AI to provide insights into your overall well-being. And let's not forget the AI-powered diagnostic tools that assist doctors in making quicker and more accurate diagnoses. AI isn't replacing healthcare professionals; it's enhancing their capabilities, making sure you receive top-notch care.

Creativity and Content Generation

Here's where things get really interesting! AI has started getting creative, and the results are nothing less than mind-blowing. From generating art to composing music and even writing articles, AI is proving that it can wear the writer’s and artist's hat (or should we say, code?)!

Imagine an AI-generated artwork that looks like it was painted by a master artist, or a song that sounds like it was composed by your favorite musician. AI isn't just mimicking; it's creating something entirely new and exciting.

Ethical Considerations in AI User Experience

Of course, we can't talk about AI without addressing the elephant in the room—ethics. With great power comes great responsibility, and AI is no exception. Artificial intelligence can sometimes exhibit bias, invade privacy, or even make questionable decisions. It's crucial that we develop AI responsibly, ensuring fairness, transparency, and accountability. After all, we want AI to be our trusty sidekick, not our supervillain!

The Future of AI User Experience

Imagine AI that understands not just what you say but also how you feel. It can detect your mood and offer comforting words when you're down or share in your excitement during celebrations. The future holds AI that's not just intelligent but emotional as well.

We're also looking at AI that enhances collaboration between humans and machines. Picture a world where AI isn't just a tool but a true partner in creativity and problem-solving. It's a future where AI amplifies human potential rather than replacing it.

As we wrap up this AI adventure, one thing is clear: AI isn't just a tech buzzword anymore. It's your daily companion, your personal assistant, your creative muse, and so much more. Whether it's simplifying tasks, offering recommendations, or adding a touch of magic to your daily life, AI is here to stay, and it's making our world a more exciting place.

So, the next time you find yourself wondering, "I can do THAT with artificial intelligence?" just remember – it's only the beginning. AI is on a journey of endless possibilities, and we're all along for the ride!

How has AI improved your daily life? Have any AI-powered experiences surprised you lately? Please reply to us, and share your thoughts and stories – we’d love to hear from you!

Click the thumbnail image below to watch a fun video recap below of our 2023 Client Appreciation Gala held at the SMUD Museum of Science and Curiosity, as our “Out of This World” event was a blast!

We can’t thank our incredible clients, friends, colleagues, and industry partners enough for joining us. Your presence transformed this event into a true success! At Towerpoint Wealth, we recognize that our journey is intertwined with your triumphs. Your unwavering trust and confidence drive our shared success story. The joy of your company, the shared celebrations – it all meant the world to us. Here’s to the ongoing collaboration, respect, and trust that define our exceptional partnership.

Thank you for making this evening unforgettable! A very special thank you to SMUD MOSAC for the hospitality, Sergio Serrano for the great music, Ginger Elizabeth Chocolates for the TPW-branded chocolate, and our friends at Mulvaney’s B&L for the delicious bites!

Click the images below to get caught up on some of our most recent trending moments at Towerpoint Wealth you might have missed!

Look at T-bill rates today compared to bank CD best rates, and also consider that T-bill interest is state tax free, and it becomes easier to understand why owning a Treasury bill trumps owning a certificate of deposit, all else being equal.

Click the thumbnail image below to watch a brand-new educational video we produced that dives into this important T-bill vs. CD distinction in greater detail!

4Q, 2023 Tax Planning

Now that we’re officially into October, doing some proactive fourth quarter tax planning is essential for individuals and businesses to optimize (read: minimize) their tax liability for the current tax year. Here are some tax planning ideas to consider for the fourth quarter:

For Individuals

- Maximize Retirement Account Contributions: Contribute the maximum allowable amount to your retirement accounts such as 401(k)s, IRAs, or self-employed retirement plans like SEP-IRAs or Solo 401(k)s. These contributions can directly reduce your taxable income.

- Harvest Investment Losses: Review your investment portfolio for assets that have declined in value compared to when you originally purchased them, and consider selling them to offset current-year (and possibly future-year) capital gains. Capital losses can reduce your overall tax liability.

- Charitable Giving: Make charitable contributions before year-end to qualify for potential deductions. Consider donating appreciated assets, like stocks, to maximize tax benefits.

- Health Savings Accounts (HSAs): If you are eligible for an HSA, consider making contributions before the end of the year to reduce taxable income. Ensure you are within the annual contribution limits.

- Flexible Spending Accounts (FSAs): Spend down your FSA funds before they expire. These pre-tax dollars can be used for qualified medical expenses.

- Review Tax Withholding: Check your tax withholding to ensure it aligns with your tax liability. Adjust your withholding if necessary to avoid underpayment penalties or overpayments.

- Consider Gifting: Take advantage of the annual gift tax exclusion by making gifts to family members or loved ones. Consult with a tax professional for strategies related to larger gifts or estate planning.

For Businesses

- Capital Expenditures: Consider making necessary business equipment purchases before year-end to take advantage of Section 179 expensing and bonus depreciation deductions.

- Review Employee Benefits: Ensure that your business is providing tax-efficient employee benefits, such as retirement plans, health savings accounts, and flexible spending accounts.

- Estimated Tax Payments: Calculate and make any necessary estimated tax payments for your business to avoid underpayment penalties.

- Inventory Management: Review your inventory and consider strategies to reduce it before year-end to lower your taxable income.

- Charitable Contributions: Businesses can also make tax-deductible charitable contributions. Ensure you keep proper records and documentation.

- Depreciation Strategy: Consider adjusting your depreciation strategy to maximize deductions or take advantage of any changes in tax laws.

Whether as an individual or as a business, remember to consult with a proactive tax professional! Every person and business is unique, and consulting with a tax professional or accountant to develop a comprehensive tax plan tailored to your specific situation is essential, time well-spent, and yet oftentimes overlooked.

Additionally, remember that tax laws can change, so staying up-to-date and working with a qualified tax advisor is crucial for effective tax planning. These ideas provide a starting point for your fourth quarter tax planning, but your specific circumstances may warrant different strategies.

Click the image below to complete our short form and download Towerpoint Wealth’s 2023 Tax Reference Guide, an excellent resource and tax “cheat sheet” that was designed to help you take advantage of the many tax deductions and opportunities there are to help shave to help shave money off of your tax bill!

Whether as an individual or as a business, remember to consult with a proactive tax professional! Every person and business is unique, and consulting with a tax professional or accountant to develop a comprehensive tax plan tailored to your specific situation is essential, time well-spent, and yet oftentimes overlooked.

Additionally, remember that tax laws can change, so staying up-to-date and working with a qualified tax advisor is crucial for effective tax planning. These ideas provide a starting point for your fourth quarter tax planning, but your specific circumstances may warrant different strategies.

Have questions or concerns about filing your 2022 tax return?

Would you like to review an old tax return for missed opportunities?

Click the banner below to message Steve Pitchford, Steve Pitchford, Certified Financial Planner.

Failures teach people lessons that are often more valuable than their successes.

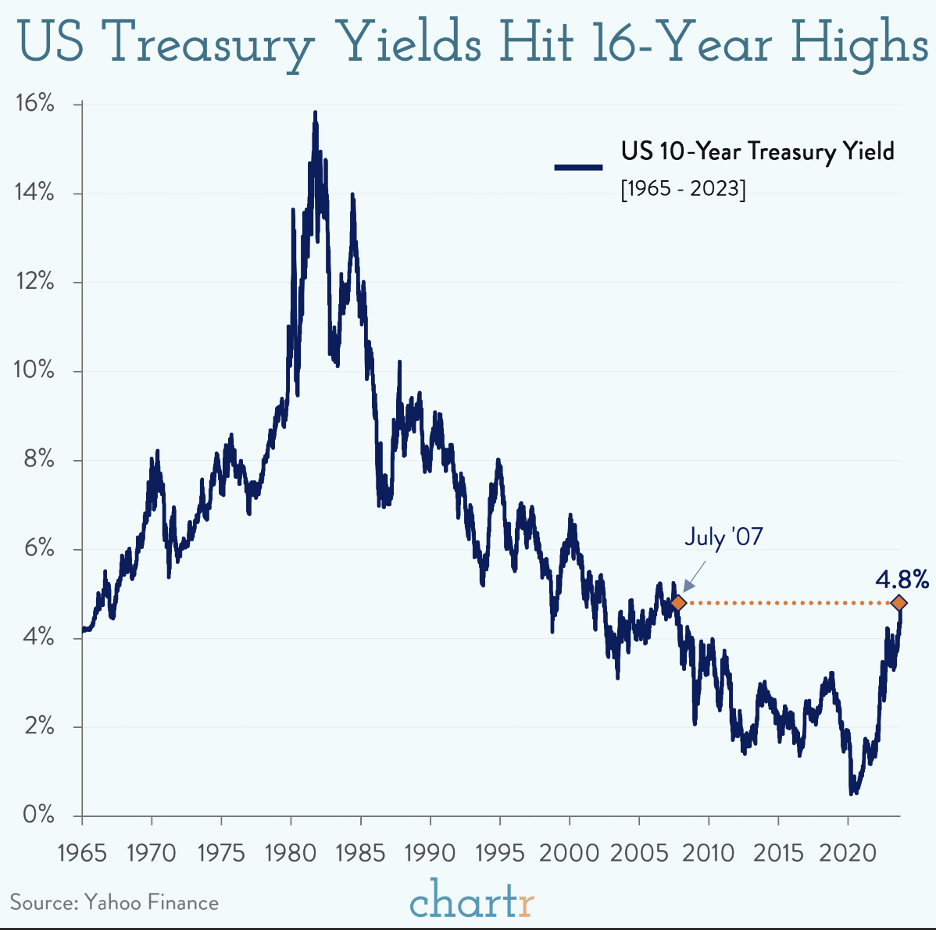

US 10-year Treasury yields (read: interest rates), a key measure of the interest cost for future government borrowing, as well as consumer borrowing such as mortgages, have shot up to their highest levels in 16 years! The benchmark yield leaped on Tuesday, surpassing 4.8%, driven by the latest jobs report from the US Labor Department. The survey revealed a surge in job openings, raising the expectation that the Federal Reserve will have to maintain an interest rate regime of “higher for longer.”

The move spooked investors, with the S&P 500 Index dropping 1.4% on Tuesday, and the tech-heavy NASDAQ shedding nearly 2%.

Apart from hurting your stock portfolio, treasury yields that shoot up and stay up are a big deal for the government’s ability to borrow more debt. Borrowing a few extra billion, or trillion, with a promise to pay it back in 10 years will now come with a 4.8% interest rate for Uncle Sam — while only 3 years ago, the rate was just 0.8%.

Thanks to Chartr for the graph and commentary!

In light of how unsettled the economy and markets are, are you concerned or worried about the bonds in your portfolio, and/or the overall level of risk you are taking in your portfolio? Message us to discuss your circumstances.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to contact us at any time, or call or email us (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast