While many of us were “stuck” in our offices tied to our computer screens last week, three of Towerpoint Wealth’s finest were in Surf City USA, soaking in not only the sun, but also the speakers, content, education, and networking of the world’s largest wealth management festival, Future Proof 2023.

Akin to South By Southwest, Future Proof 2023 was a true departure from the “traditional” wealth management conferences we have previously participated in. For starters, Future Proof was held not in a stogy indoor hotel ballroom, but instead on The Boardwalk, a special ½ mile stretch of outdoor promenade, constructed specifically for the festival and directly next to Huntington Beach. With almost 3,000 attendees and more than 200 (!) world-class guest speakers, it was truly an enormous wealth management event – arguably an extravaganza – as the vision, creativity, and scale of the festival were unlike anything any of us at Towerpoint Wealth had ever experienced.

The energy and excitement of the festival were palpable from beginning to end, as our President, Joseph Eschleman, our Partner, Wealth Advisor, Jonathan LaTurner, and our Director of Research and Analytics, Nathan Billigmeier rubbed shoulders with the entire wealth management ecosystem during an arduous but invigorating four days.

Future Proof 2023

What exactly made the Future Proof 2023 “next level?” To quote Josh Brown, CEO of Ritholtz Wealth Management, who, along with Advisor Circle, co-created the wealth management festival, now in its second year:

“There’s something about the outdoor, beachfront setting that makes Future Proof different. I learned more – and shared more – at Future Proof… than at any other conference ever. This year’s event is going to be ridiculous. The agenda is incredible, the music is amazing, and the audience is shaping up to be a who’s who of this industry.”

Michael Kitces, co-founder of CY Planning Network and Chief Financial Planning Nerd for Kitces.com, suggested that the overall spirit of the festival was to “explore all aspects of the future of wealth,” seeking to “connect people, purpose, and ideas through the lens of wealth, technology, culture, and impact.”

Future Proof 2023 was an immersive journey into the ever-evolving wealth management universe, intended to ignite innovative conversations, and think outside of our normal Towerpoint Wealth perspectives. The festival centered around three key themes, all directly shaping the future of wealth management:

- Alternative Investments

As alternative investments grow both in size and complexity, there’s an increasing need to sharpen our understanding. You know the drill: with great power (or, in this case, assets) comes great responsibility (or need for education). Future Proof industry expert speakers broke down this seemingly convoluted topic and transformed it into a growth opportunity through actionable insights and cutting-edge strategies. - Artificial Intelligence

Have you wondered what AI means for the larger economy, what implications it has for wealth management, or even on your regular day-to-day life? You’re not alone – these were some of the top-trending Google searches in 2023. The Future Proof conference took a deep dive into the world of AI, demystifying its complexities and spotlighting its profound potential. - Macro Outlook

A number of Future Proof 2023 speakers discussed the impact of the Fed’s actions, the weakening dollar, and the overall outlook for the global economy. It’s not just about predicting the future – it’s about how you are positioned to thrive in it.

Curious about some of the content that Joseph, Nathan, and Jonathan soaked in? Below you will find a curated summary of the festival highlights, as well as some of the events, breakout sessions, podcasts, and presentations that our TPW family participated in!

Sunday, September 10

1 minute video recap:

- The Biggest Financial Decision Your Family Will Ever Make, with NYT Bestselling Author Ron Lieber & Ann Garcia

An exciting and thought-provoking Q&A session with Ron Lieber, Your Money columnist in the New York Times and author of The Price You Pay for College, and Ann Garcia, author of How to Pay for College. This session delved into the rising cost of education in the United States, and explored the factors driving these costs, the relationship between education expenses and career opportunities, and the actions that can be taken to tackle this complex issue.

- Baby Equity: Restoring Capitalism Through Inclusivity at Birth, with Josh Brown, CEO, Ritholtz Wealth Management, and Brad Gerstner, founder and CEO, Altimeter Capital

Click the link above to hear about their plan to seed 3.8 million newborns with a $1,000 stock account at birth, as a direct means to help all “new” Americans have a foundation to build their personal net worth!

Monday, September 11

1 minute video recap:

- Morningstar’s The Long View Podcast, with Christine Benz, Director of Personal Finance and Retirement Planning, and Jeff Ptak, Chief Ratings Officer, Morningstar, and guest Nizar Tarhuni, VP of Institutional Research, PitchBook

In a live podcast recording attended by Joseph, Nathan, and Jonathan, Benz and Ptak interviewed Tarhuni on key trends in the market and the implications they have for the evolving investor that advisors aspire to serve.

Based on PitchBook’s independent analysis, Nizar’s advice to advisors is, “if you want meaningful results from adding an alternatives sleeve to your clients’ allocation, you can’t just dip your toe in. You have to be ready to commit for an extended period of time, over multiple vintages, with significant capital capacity in order to access quality managers and achieve your return and diversification objectives."

- Using Generative AI to Create Unique Experiences That Clients Crave, with Christine Simone, President, Caribou

Artificial intelligence (AI) has revolutionized the way businesses engage with their clients by enabling the creation of unique and tailored experiences. Through advanced machine learning algorithms, AI can analyze vast amounts of data, from customer preferences to past interactions, to gain valuable insights. This data-driven approach allows companies to personalize their products and services, predicting and meeting individual needs and desires. Whether it's recommending personalized content, optimizing user interfaces, or providing real-time assistance, AI empowers organizations to build deeper, more meaningful relationships with their clients. By harnessing the power of AI, businesses can offer seamless, one-of-a-kind experiences that leave a lasting impression and foster loyalty in an increasingly competitive market.

- Driving Growth with Direct Indexing: Insights From 3 Industry Giants, moderated by Ian Wenik, editor, CityWire, Ben Hammer. Head of Client Development – Vanguard Personal Indexing, Vanguard, Brandon Haas, Head of Direct Indexing and Model Portfolios, S&P Dow Jones Indices, and Ari Rosenbaum, Principal, Director of Private Wealth Solutions, Canvas Custom Indexing

Direct indexing is a modern investment strategy that allows investors to build customized portfolios of individual stocks or securities to closely mimic the performance of a particular index, such as the S&P 500, while also offering greater flexibility and tax efficiency compared to traditional index funds or exchange-traded funds (ETFs). With direct indexing, investors can select and own the individual components of an index directly, rather than investing in a fund that holds those components. This approach offers advantages like the ability to optimize for tax efficiency by managing capital gains, harvesting tax losses, and incorporating environmental, social, and governance (ESG) criteria into the portfolio. Direct indexing has gained popularity as technology and platforms have made it more accessible, allowing investors to tailor their investments to align with their specific financial goals and preferences.

Tuesday, September 12

1 minute video recap:

- Powerhouse Perspectives – Scott Wapner, anchor and reporter, CNBC, and Jeffrey Gundlach, CEO, Doubline Capital

Jeffrey Gundlach is a prominent American investor and financial expert known for his expertise in fixed income investments and his role as the founder and CEO of DoubleLine Capital, a leading investment management firm. Gundlach has gained renown for his astute market insights, particularly in the realm of bonds and interest rates. He has often been referred to as the "Bond King" in the media. Gundlach's investment strategies and predictions are closely followed by investors and financial professionals alike, and he has received numerous accolades for his contributions to the field of finance. His ability to navigate complex financial markets and provide valuable investment perspectives has solidified his reputation as a significant figure in the world of asset management.

- Powerhouse Perspectives: U.S. – China Relations, with Former U.S. Ambassador David Adelman, Managing Director & General Counsel, Kraneshares

U.S.-China relations have long been characterized by a complex interplay of cooperation, competition, and occasional tension. As the world's two largest economies and major global players, their relationship carries significant weight in shaping the geopolitical landscape. Over the years, both nations have collaborated on issues like trade, climate change, and regional stability, but they have also grappled with disagreements over human rights, intellectual property, and territorial disputes. David Adelman did an excellent job of discussing how the evolving dynamics of this crucial bilateral relationship continues to influence not only the Asia-Pacific region but also global politics, economics, and security, making it a focal point for international diplomacy and strategic maneuvering.

Wednesday, September 13

½ day final day!

- Case Study: Revolutionary Cash Management for High Net Worth Clients, with Rob Burgess, technology reporter, Wealth Management magazine, Ben Cruikshank, President, Flourish Cash, Brett Orvieto, Managing Director, Senior Wealth Advisor, Dakota Wealth Management, and Lindsay Brock, Wealth Advisor, Stearns Financial Group.

Many studies have tried to determine whether active management of equities can generate outsized returns relative to a stock market index. But what about cash? Can a more active approach to managing bank accounts generate higher returns? Active cash management oftentimes can deliver real ‘alpha’ on cash. For investors holding cash, cash management programs like Flourish Cash can offer clients higher interest rates, broader FDIC coverage, and streamlined account opening. Cash is no longer boring, and advisors need to ensure that their clients cash is maximized!

Joseph’s, Jonathan’s, and Nathan’s heads are still spinning with all of the information and insight from the festival, and our Towerpoint Wealth team cannot wait to roll up our sleeves and apply what was learned towards helping you better build and protect your wealth, and better helping you properly coordinate all of your financial affairs.

Click the Wealth Management Philosophy thumbnail image below to learn more about how we help our clients grow and protect their net worth.

Earlier this week our President, Joseph Eschleman, connected with two excellent TPW clients, Jeff and Sabrina Murphy, at Fieldwork Brewing in downtown Sacramento for a strategy session on what it might take for Jeff and Sabrina to open a new brewery or taphouse!

Seems logical that the three of them felt that drawing inspiration for a new brewery should only be done while imbibing a little at one of the best breweries in Northern California!

Click the images below to get caught up on some of our most recent trending moments at Towerpoint Wealth you might have missed!

Click below to watch a short and fun “mashup” video of Joseph, Jonathan, and Nathan’s experience at the Future Proof 2023 wealth management festival!

Charitable Remainder Trusts (CRTs)

Charitable remainder trusts (CRTs) are a powerful financial planning tool that provide both philanthropic benefits and significant tax advantages. These trusts allow individuals to transfer assets, typically appreciated securities or real estate, to a trust while retaining an income stream for themselves or their beneficiaries for a specified period, often for life. One of the most attractive tax benefits of CRTs is the immediate charitable income tax deduction. When the assets are transferred to the trust, donors can typically claim a deduction for the present value of the charitable remainder interest. This deduction can help reduce the donor's taxable income in the year of the gift, potentially lowering their overall tax liability.

Another substantial tax benefit of CRTs is the avoidance of capital gains taxes. Since CRTs are tax-exempt entities, they can sell donated assets without incurring capital gains taxes. This is particularly advantageous when the assets have appreciated significantly over time, as it allows donors to avoid a substantial tax hit that they would face if they sold the assets directly. By avoiding capital gains taxes, donors can reinvest the full proceeds from the sale, potentially leading to greater income for themselves or their beneficiaries. Additionally, CRTs can provide estate tax benefits by removing the donated assets from the donor's taxable estate, potentially reducing the estate tax liability upon their passing. In essence, charitable remainder trusts offer a dual benefit of supporting a favorite charitable cause while optimizing the donor's financial situation through favorable tax treatment.

Click the image below to download an excellent resource from Vanguard, summarizing the major charitable giving tools we regularly utilize at Towerpoint Wealth.

Have questions or concerns about filing your 2022 tax return?

Would you like to review an old tax return for missed opportunities?

Click the banner below to message Steve Pitchford, Steve Pitchford, Certified Financial Planner.

The Federal Reserve Board (“the Fed”) kept interest rates unchanged at its Wednesday meeting.

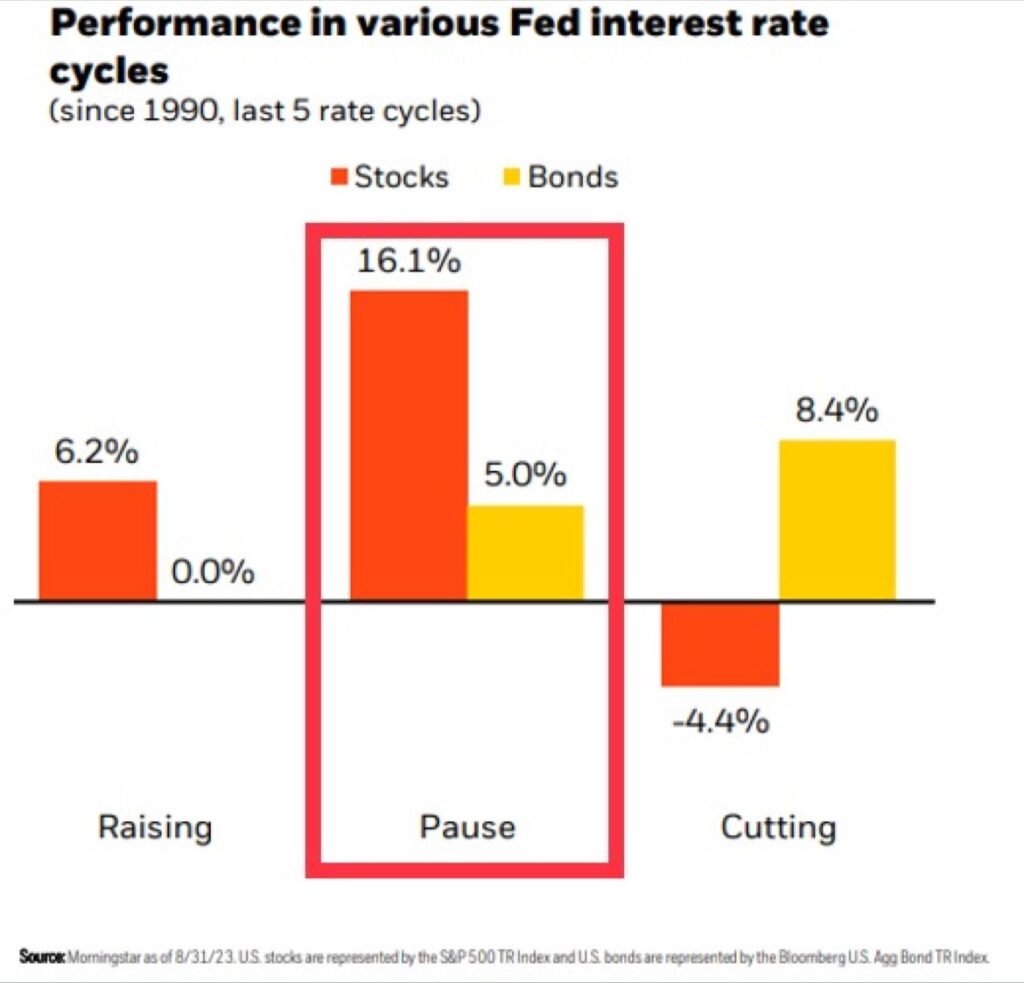

The chart below from Morningstar highlights that a Fed “pause” has historically been bullish (positive) for equities over the past five rate cycles dating back to 1990.

Meanwhile, Fed interest rate cuts are historically bullish for bonds as well.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to contact us at any time, or call or email us (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast