Investing vs speculating | The US Federal Reserve (“the Fed”) has a target inflation rate of 2%. However, inflation is running wild right now, at a 9.1% annualized rate!

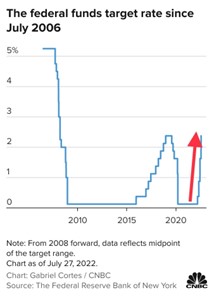

And Jerome Powell, the Chairman of the Fed, is not fooling around – using the Fed’s most potent weapon to douse the flames of this inflationary “fire” – increasing the short-term Fed Funds interest rate, which is the rate that banks and other depository institutions charge each other to borrow or lend excess reserves, usually on an overnight basis.

And, after hiking short-term rates by a quarter point in March, half point in May, and three-quarter point in June, the Fed on Wednesday unanimously voted to again raise rates, for a fourth time this year, by another three-quarter point! This took the Fed’s target rate from a range of 0% - 0.25% at the beginning of the year to 2.25% - 2.50% as of today.

These back-to-back 0.75% (or 75 basis point) interest rate hikes were very aggressive, as the Fed hadn’t increased rates by a combined 1.5% in consecutive meetings since the 1980’s. Additionally, Fed officials have said by the end of 2022 they expect the benchmark rate to hit a range of 3.25% to 3.50%, the highest level since 2008, in an effort to be unflinching in its battle against the most intense bout of inflation in 40 years.

In a vacuum, none of this can be classified as positive economic news. However, the S&P 500 rallied 102.56 points (+2.62%), and the Nasdaq rallied 469.85 points (+4.06%) on Wednesday, seemingly flying in the face of these aggressive interest rate increases and a slowing US economy. This begs the question – WHY?

The simple answer: It’s all about managing expectation.

The Fed’s fourth 0.75% interest rate increase shouldn’t have come as a surprise to anyone, and was actually considered relatively good news (!) for the following reasons:

1. Powell said that today’s current 2.25% - 2.50% Fed Funds rate is at the “Neutral Rate” (neither restrictive nor accommodative to US economic growth).

➢ This is a relatively positive signal, and the first indication of what the Fed Chair believes to be the neutral rate.

2. Powell said it is reasonable to assume the Fed needs to get to a “moderately restrictive” interest rate level by the end of 2022, or 3.25% - 3.50%.

➢ This is a very positive signal, as hearing Powell actually state his expectation that rates will settle at or below 3.5% by the end of 2022 was a welcome RELIEF for markets.

3. There was underlying trepidation that the Fed would go well beyond an interest rate of 3.5% to get inflation under control.

➢ For now, Powell’s indication that he doesn’t seem interested in going beyond this point is another RELIEF for markets, and helps investors to manage expectation.

➢ Powell was quoted as saying “We’re trying to do just the right amount. We are not [emphasis added] trying to have a recession.”

Phew, another RELIEF. The markets responded well to hearing that Powell is mindful about sending the US economy into a complete tailspin in order to get inflation under control, and that his preference is to avoid doing so.

4. Powell said that he “does not believe we are currently in a recession,” and referenced the strength of the labor markets.

➢ Expectations for a market rebound or recovery would be extremely muted if Powell instead suggested that he believed the US economy was in worse shape.

Wednesday’s “relief rally” is a clear example that oftentimes bad news “prices” into the market early, and it takes just a hint of an expectation of acceptable (or better), news to manage expectation and relieve any remaining selling pressure.

Anticipating and analyzing the market’s reaction to any economic news always carries a certain amount of nuance. At Towerpoint Wealth, we believe the market trades based not on what is currently happening in the economy, but instead what is expected to be happening three, six, or even twelve months (or more) in the future. Put differently, as the great Wayne Gretzky said:

Important point of clarification: By now virtually all of our Trending Todayay readers know that here at Towerpoint Wealth we are strict adherents to maintaining and following a disciplined and coordinated longer-term wealth-building and wealth-protection plan and philosophy, and espouse the investing ideals of Warren Buffett, Sir John Templeton, and Peter Lynch. While today’s newsletter focused on the shorter-term vicissitudes and relationship of the economy and the stock market, most of our clients do not (or should not) get too excited, nor too worried, about shorter-term market fluctuations, either upwards or downwards.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients build and protect their net worth.

The entire Towerpoint Wealth team came out last week on Community Volunteer Day to lend a hand to the American River Parkway Foundation program to clean up trash along Sacramento’s urban gem. Spanning 23 miles and covering 4,800 acres, the Parkway is a mecca for outdoor enthusiasts and those looking to refresh themselves.

In 2021, more than 200 fires burned over 15% of the Parkway. The Parkway in Peril program created by the Foundation aims to mitigate fire risk by cleaning up trash, as volunteers (like us!) play an essential role in the conservation of the Parkway.

The TPW team hauled out approximately 1,400 lbs. of old bicycles, couches, and what felt like a ton of plastic waste in sweltering temperatures. Click the thumbnail below to watch a fun two-minute video of all of us hard at work helping preserve this Sacramento treasure!

http://www.parc-auburn.org/This past Sunday, our President, Joseph Eschleman, CIMA®, ran the 10.5 mile Blood, Sweat, and Beers trail run in the American River Canyon in beautiful Auburn, CA a with friend of the firm, John Palombi.

Nice work, Joe and John – looks like you earned that post-race SacYard IPA!

What else is happening with the Towerpoint Wealth family?

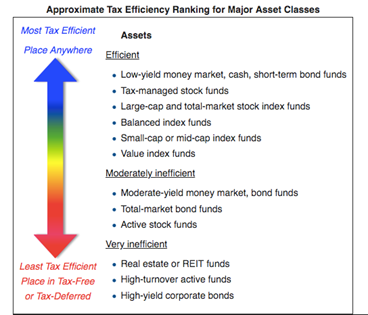

Did you know that the type of account you invest in is almost as important as the investment itself?

Generally speaking, it is not advantageous to implement your portfolio asset allocation plan uniformly across each of the accounts you own, but instead to be mindful of owning, or “locating,” the more tax-inefficient components of your overall diversification inside of your tax free (Roth IRA, Roth 401K) and tax deferred (Traditional IRA, Traditional 401K) accounts. A tax-inefficient investment is one that pays a significant amount of interest income (taxed at higher, ordinary income rates), or has a high turnover ratio and is more likely to incur capital gains, distributed out to investors who are responsible for paying taxes on them.

It is usually more advantageous to locate the more tax-efficient components of your diversification inside of “regular” taxable accounts (ones that issue a 1099 every year). Tax-efficient investments pay little in dividends and/or interest, and typically also minimize capital gains distributions.

While implementing an appropriate asset location strategy oftentimes entails as much art as science, when done properly it can add up to 0.75% to an investor’s average net, after-tax annual return, according to Vanguard.

Curious about how Towerpoint Wealth is directly collaborating with our clients’ CPAs to do proactive tax planning?

Useful and interesting content we read the past two weeks:

1. The US is Sweltering – The Heat Wave of 1936 Was Far Deadlier – The Washington Post – 7.20.2022

The U.S. and much of the world are currently baking in a brutal heat wave. But in much of the central United States, summer of 1936 was even hotter. However, 1936 had such a frozen start to the year that the idea of a heat wave would have seemed like wishful thinking!

2. Kamala Harris is Stuck – The NY Times – 7.25.2022

Vice President Kamala Harris, who was a first-term senator from California before entering the White House, hasn’t been given the immersive experiences or sustained, high-profile tasks that would deepen and broaden her expertise in ways Americans could see and appreciate.

If other presidents have formed substantive partnerships in office with their VPs and made efforts to deepen their experience, President Biden and Ms. Harris have been unable or uninterested in bringing about a similar transformation. From the outside, there’s little evidence that the Biden White House feels urgency to enhance the role and preparedness of the person who might inherit the presidency at any moment.

3. Mark Zuckerberg Has a Plan to Rescue Meta, But Can He Convince His Employees? – The Verge – 7.26.2022

As Meta’s growth slows, Mark Zuckerberg is pushing even harder. Will his employees melt under the pressure? The company he founded 18 years ago is facing existential threats on multiple fronts, and Zuckerberg sees that fixing his company’s culture is critical to surviving the tough times ahead.

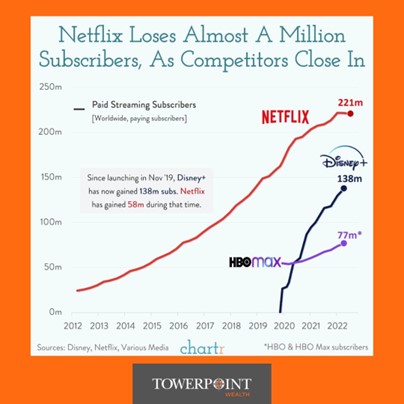

Netflix shed nearly 1 million subscribers, according to its second quarter earnings report.

NFLX shares are down almost 63% for the year (as compared with the S&P 500’s 17% dip), a slump that has wiped out roughly $70 billion of the content streamer’s market capitalization.

The question is: Are you still Netflixing and chilling?

Let us know – Do you still chill out with Netflix?

Holding and intelligently divesting cash during a market rough patch has both pros and cons, and evaluating these risk/return tradeoffs are even more challenging with rampant inflation just another issue to consider.

With confidence low and inflation high, our President, Joseph Eschleman, CIMA®, shared his perspective with Investors Business Daily reporter Kathleen Doler on where to “stash your cash” right now.

Click the thumbnail image below to read Doler’s article.

Have additional questions about how to position yourself and your portfolio to better protect against and possibly even profit from inflation?

A longer-term upward trajectory is much more important than what is indicated by daily metrics. It can be very easy to get caught up in the minutiae of shorter-term outcomes, yet the importance of maintaining focus on your longer-term overall progression cannot be overstated.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph, Jonathan, Steve, Lori, Nathan, Michelle, and Luis

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity.

We will happily donate $10 to it!