The stock market has been a friend to investors in recent years, just as Brutus was a friend (for a time) to Caesar. However, most of us know the end of that ancient tale: Caesar ignored the soothsayer’s dark and gloomy warning, “beware the ides of March,” ultimately to his peril, as Brutus stabbed him in the back.

Seeing that we are only three days removed from 2022’s Ides of March, should today’s investors be concerned that their portfolio this year may suffer a similar outcome as Caesar, especially understanding the recent spate of “doom and gloom” economic, geo-political, and market forecasts?

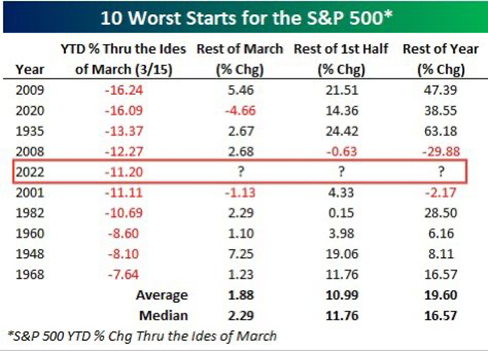

Through the Ides of March (March 15), the S&P 500 was down more than 11% year-to-date, marking the fifth worststart to the year ever.

However, then came Tuesday’s, Wednesday’s, and yesterday’s swift and major rebound.

Historically, and as evidenced by the “10 Worst Starts for the S&P 500*” chart found above, comparably

1) The remainder of March

2) The remainder of the first half of the year

3) The remainder of the entire year

How closely are you regularly following financial news stories? Do you feel that 2022 will, or will not, follow this bounceback trend?

Towerpoint Wealth’s wealth-building and wealth-protection philosophy leads us to rarely be led by feelings, get worried or excited by daily market movements (please see the below Chart/Infographic of the Week). And despite historical trends, we have no soothsayer. However, considering the deluge of troubling and worrisome news we have been overburdened with recently, it is important not to get overwhelmed, but instead to be aware and not lose perspective. While history rarely repeats itself exactly, it is certainly rhyming so far this March.

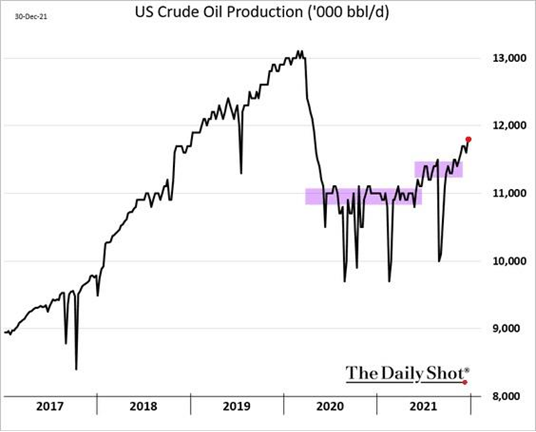

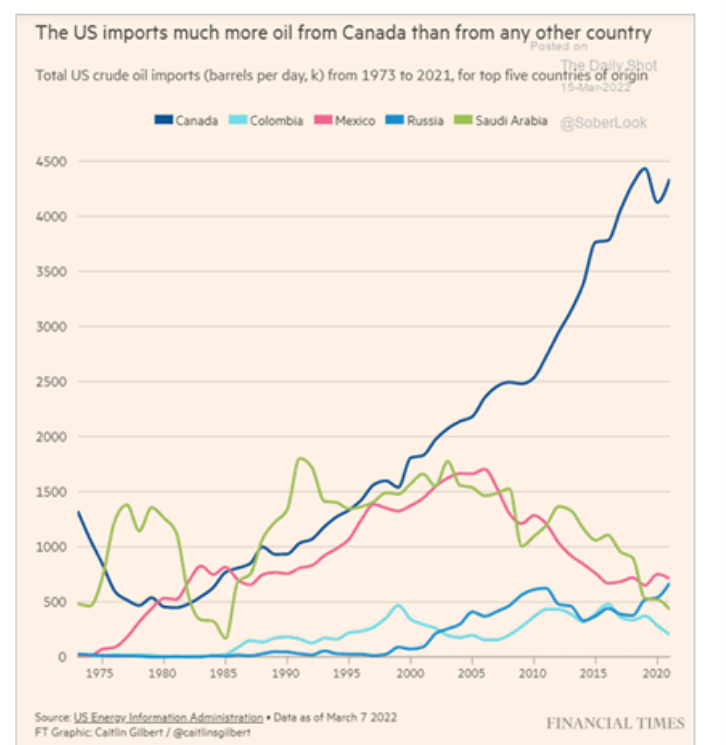

Of course, we would be remiss if we did not also briefly touch upon the price of oil, and concurrently, the price at the pump of a gallon of gasoline. While it is evident that supply disruptions will continue to persist, we feel there is a high probability of a “settling out” of oil and gasoline prices. In fact, it’s already underway.

US oil production is increasing again

The price of oil is down ~ 25% from its recent early March highs

The U.S. imports WAY more oil from Canada than from any other country

What is happening at TPW?

Cheers and a BIG thank you to two excellent Towerpoint Wealth clients, Steve and Toni Shaffer!

Steve and Toni gave a very apropos t-shirt to our craft beer-loving President, Joseph F. Eschleman, CIMA®, after their financial and wealth planning meeting last week with Joseph and our Director of Research and Analytics, Steve Pitchford.

Helping out and giving back to our local community has always been a central core value here at TPW.

We were humbled and privileged to assemble, and then distribute, 100+ bagged lunches, hot coffee, and hand warmers to Sacramento’s homeless community late last month at the Cathedral of the Blessed Sacrament here in downtown Sacramento.

A big thank you to Marilynn Fairgood (again!), and the Brown Bag Lunch program she is in charge of, for helping us coordinate our volunteering efforts.

TPW in the Media

Speaking of financial news stories, our President was recently featured in the February 25 edition of Financial Advisor IQ, a highly regarded wealth management industry publication, discussing what clients need to know about Russia’s invasion of Ukraine, the impact these developments may have on investments, and how clients can and potentially should respond.

Click the thumbnail image below to read Joseph’s insightful comments and perspective in greater detail.

TPW Taxes - 2022 - Financial News Stories

As the April 18, 2022 “Tax Day” personal filing deadline draws closer, we have seen an unsurprising uptick in tax-related questions, CPA inquiries, and service-related needs. And in the interests of making your life a little easier as you gather your information and prepare to file, we continue to stand ready to help you (and your CPA)!

Additionally, click on any of the six thumbnail images below for resources, tax tips, commonly asked tax-related questions, and other information. Enjoy!

Chart/Infographic of the Week

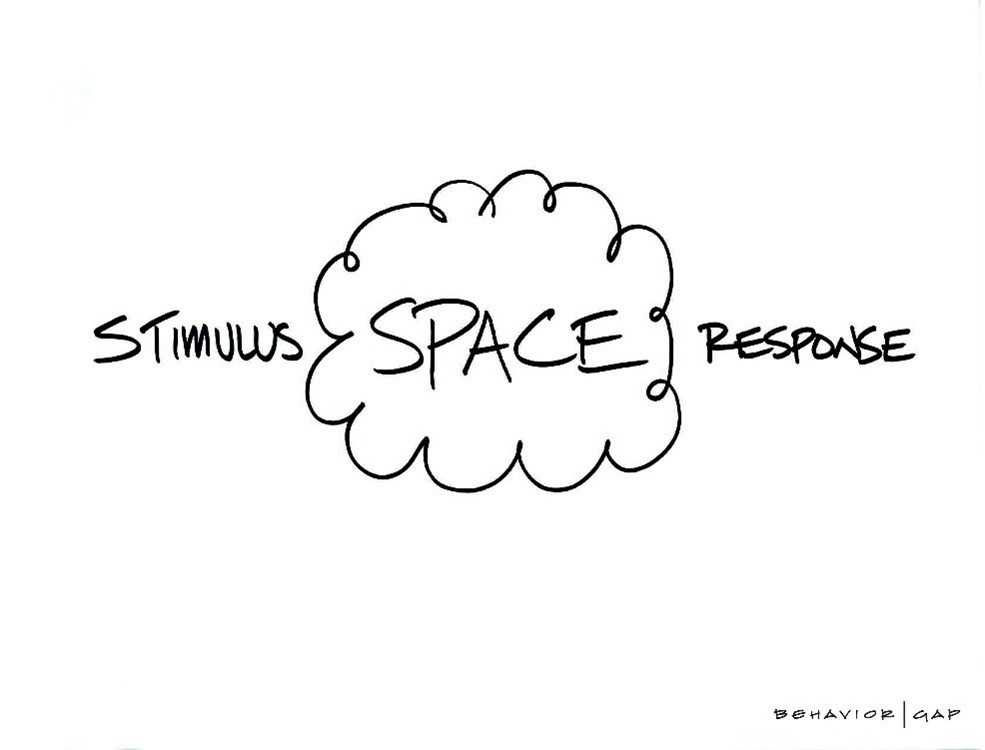

Understanding we can all be influenced by today’s in-your-face, 24/7 news cycle, we believe it is extremely important to put some SPACE between these events, and any response that they may (or perhaps more likely, may *not*) merit.

Quote of the Week

Once again, Warren Buffett nails it. While nobody is perfectly comfortable with volatility and temporary market and portfolio declines, we believe it is important to both expect and embrace volatility throughout your career as an investor.

Trending Today

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph, Jonathan, Steve, Lori, Nathan, and Michelle