Today’s housing market – it feels to us like we are at a true inflection point right now, and perhaps not a good one.

Clients and colleagues are frequently asking: “Is the housing market in a bubble?” And they are hearing conflicting words from economists:

“Housing starts have historically been unresponsive to changes in mortgage rates in a supply-constrained environment, likely because homebuilders are able to continue building with little fear that homes will sit vacant after completion.” - Ronnie Walker, Goldman Sachs economist

vs.

“We expect the combination of surging mortgage rates and record-high home prices to cause more homebuyers to drop out of the market." - Daryl Fairweather, Redfin chief economist

Can we expect to see housing prices go down with overall economic growth remaining strong? The housing market does seem to be struggling a bit under the weight of higher interest rates, consistent with Fairweather’s statement above. Don’t let anyone tell you that interest rates don’t matter – they do! The cost of money (read: the interest rate you are charged to borrow) is extremely important, and directly correlated to the overall long-term growth of the housing market!

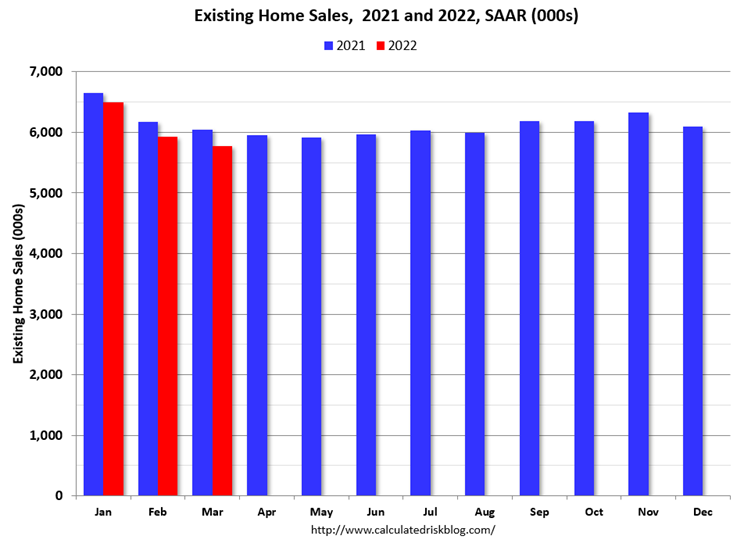

While still hot, the housing sector seems to be just a touch cooler today when compared to the 2021 market, when over 70% of home listings saw a bidding war!

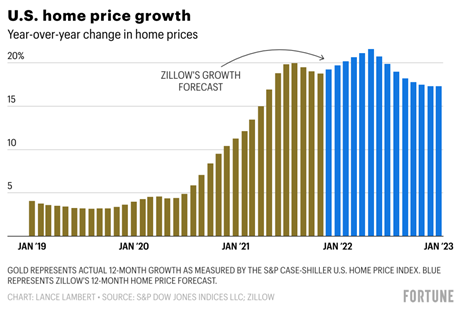

We argue how can it not be, understanding US home prices soared by a seemingly unsustainable 18.8% (!) last year.

But housing prices going down? Current “expert” opinion on what happens next is quite varied, and while we are admitted skeptics of expert predictions due to their consistently poor overall track record, the current dichotomy is extreme.

On one hand, housing “bulls” say:

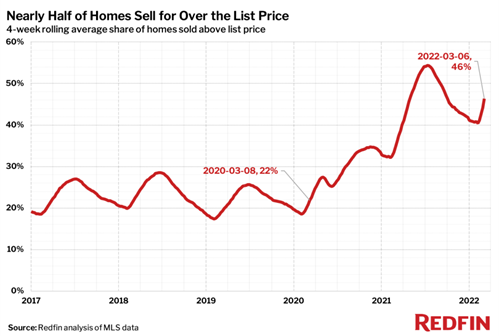

- Demand remains strong, with many properties still consistently selling for above asking price.

According to a new report from Redfin, some 5,897 homes nationwide sold for at least $100,000 over (!) asking price at the beginning of 2022, up from 2,241 compared to the same period in 2021.

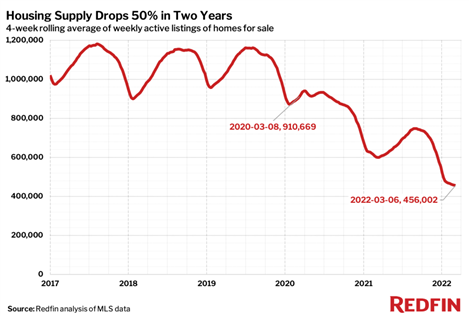

- There’s no inventory!

Among the 327 housing markets tracked by Zillow, 254 have inventory levels that are down by more than 30%between December 2019 and December 2021. In another 54 housing markets (Miami and Ft. Collins, CO being two), housing inventory is down by over 50% from pre-pandemic levels!

- Buyer urgency has increased.

As interest rates rise, people may push to buy sooner rather than later, anticipating and getting ahead of further rate increases. This could be creating additional temporary demand.

On the other hand, housing “bears” say:

- We have a "hawkish" Fed. The housing sector is vulnerable to the risk of the Fed orchestrating a “hard landing” with its interest rate hikes, possibly leading to a recession.

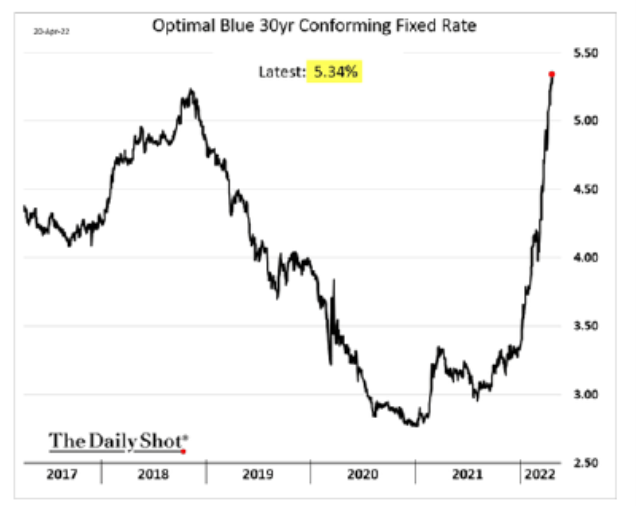

- Yields/interest rates on 30-year mortgages are surging.

Just last month, the average 30-year mortgage rate was 4.2%. NOW, it is north of 5.3%, the highest it has been since 2009!

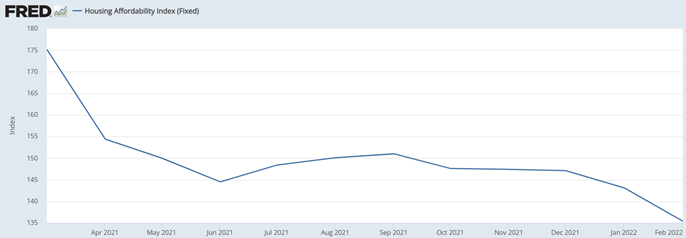

- Affordability is horrible.

The combination of surging mortgage rates and rapidly increasing home prices translates into even more difficulty for aspiring homebuyers, and many Americans are being priced out of safe and affordable housing.

- The SPDR® S&P® Homebuilders exchange traded fund (XHB) is out of favor, down nearly 25% year-to-date

XHB seeks to provide exposure to the homebuilders segment of the S&P Total Market Index, which comprises the following sub-industries: Home Building, Building Products, Home Furnishings, Home Improvement Retail, Home Furnishing Retail, and Household Appliances.

Interest-rate sensitive areas of the economy and stock market, like XHB, are portending pain, and less-than-attractive profits, in the housing market.

At Towerpoint Wealth, we do believe we are at an inflection point right now, and that home appreciation may soon begin to slow. However, appreciation that is slowing is still appreciation, and is clearly much better than no growth or, even worse, negative growth.

Put differently, we fully agree with Citi analyst Steve Zaccone’s take:

TPW in the Media

Described as “a human wellbeing and flourishing podcast,” LifeBlood is released daily and features a myriad of different professionals and subject matter experts. Produced and hosted from Scottsdale, AZ by George Grombacher, Lifeblood featured our President, Joseph Eschleman, earlier this week.

Click the thumbnail below hear what Joe had to say about leading by example, focusing on process and on things you can control, and about his membership, along with Tim Cook, Oprah, and Michelle Obama, in the 4AM club!

What is happening at TPW?

Flanked by two beautiful young ladies and outstanding Christian Brothers' freshmen, our President, Joe Eschleman, was not interviewing for upcoming summer internship positions, but instead chauffeuring his daughter Josephine, and her good friend Bailey, to and from the Crocker Art Museum last week, with a TPW pit-stop mixed in!

Arches National Park, the world’s largest concentration of natural sandstone arches, is the latest vacation destination for our adversome Director of Tax and Financial Planning, Steve Pitchford!

Nice work, Steve – your affinity for Mother Nature and goal to see all 63 amazing US national parks is ambitious and wonderful, and we are all jealous of your getaway and amazing photos!

What else is happening with the Towerpoint Wealth family? Follow us on Instagram to find out!

TPW Taxes 2022

With the passing of the 2021 income tax filing deadline on Monday (hooray!), myths abound about ways to get information about tax refunds and how to speed one up.

As of the week ending April 1, the IRS said it has sent out more than 63 million refunds worth over $204 billion! The average refund is $3,226.

Click the image below to read an excellent article from ThinkAdvisor that discusses seven common myths about income tax refunds.

TPW News You Can Use

Useful and interesting content we read the past two weeks:

1. We’re Trader Joe’s Workers, and There are Some Items You Should Never Buy – NY Post – 4.19.2022

Four unnamed workers revealed a list of products that shoppers shouldn’t buy, as well as seasonal items shoppers shouldn’t miss out on, when visiting their local Trader Joe’s store this spring.

2. All Hope Isn’t Lost for Democrats in November – The Hill – 4.5.2022

“We got a story to tell; just got to tell it,” former President Obama replied to a question about Democrats’ chances in the 2022 midterms as he left a news conference with President Biden. I watched the moment on live TV and immediately thought, “Easy for you to say.”

3. A LePen Upset Would Be as Big a Shock to Markets as Brexit – Yahoo! Finance – 4.20.2022

All the polls show French President Emmanuel Macron is likely to win a second term Sunday. But from Citigroup Inc. to asset manager Amundi SA, the warnings are piling up that markets are underestimating the risk of a surprise.

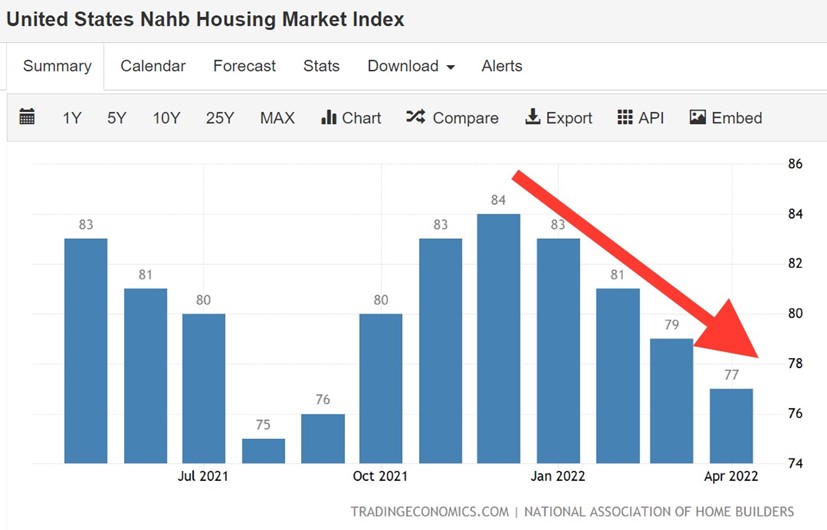

Chart/Infographic of the Week

The National Association of Home Builders (NAHB) Housing Market Index (HMI) in the US fell in April for a *fourth* consecutive month, to reach its lowest point since September of last year. See our commentary above for some of the possible reasons why, as well as NAHB’s Chief Economist Robert Dietz’s quote below:

The housing market faces an inflection point as an unexpectedly quick rise in interest rates, rising home prices, and escalating material costs have significantly decreased housing affordability conditions, particularly in the crucial entry-level market.

Quote of the Week

Saving money and investing money are two completely different philosophies, and require two completely different mindsets, as the excellent wealth-building and wealth-protection illustration below demonstrates!

Responsible Investing

Happy Earth Day 2022! Did you know you can align your portfolio with your *personal values*? Yes, you can!

Click the thumbnail below, or visit our responsible investing page to learn more.

Trending Today

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph, Jonathan, Steve, Lori, Nathan, and Michelle