What’s the deal with the debt ceiling in America, and is it important for investors?

A dramatically accelerated timeline for lawmakers to negotiate was established on Monday, as Treasury Secretary Janet Yellen said that the debt ceiling in America could be reached as early as June 1 if President Biden and Congress do not come to an agreement to raise or suspend it. Put differently, the US could run out of money to pay its bills, and default on its debt, if this contentious political and economic issue is not solved soon. Here we go again…

We’ve been here before regarding the debt ceiling in America. Congress on the brink of another deadlock. Debate raging between Democrats and Republicans. Concerned citizens. Grandstanding politicians. Worried investors. And here at Towerpoint Wealth, while we feel the end result is obvious (the limit will be increased), there will be no shortage of brinksmanship as both parties do their song and dance, yet ultimately heed the advice Ms. Yellen offered in her May 1 letter to Congress:

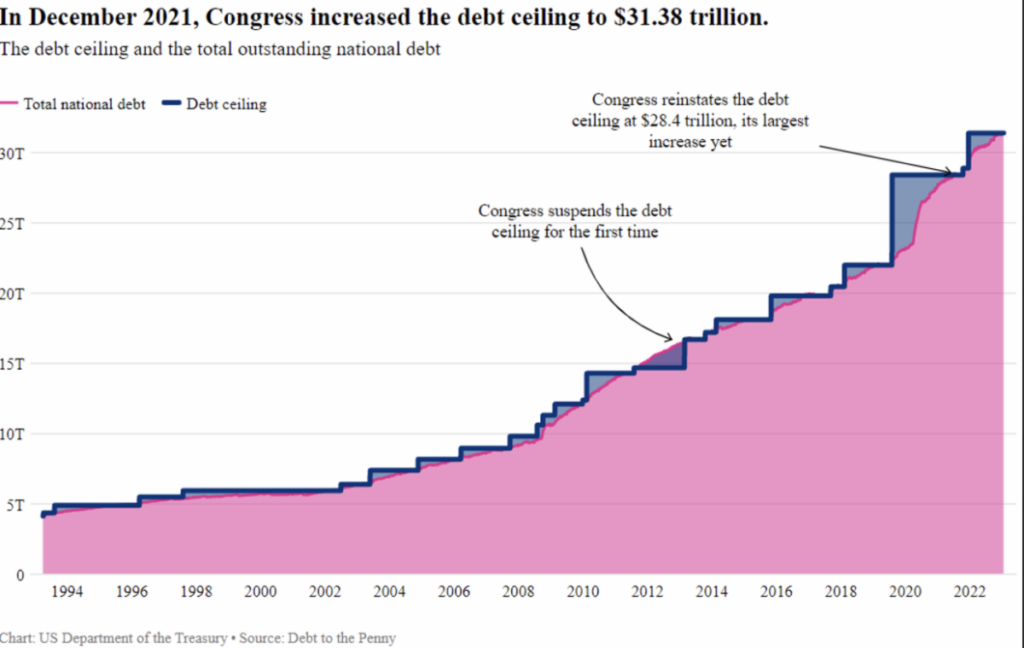

The last time this issue came to the forefront was December of 2021, when Congress ended up increasing the debt ceiling in America to $31.38 trillion.

Since 1960, politicians have moved to raise, extend, or revise the definition of the debt ceiling in America 78 times - including three just in the last six months. The debt limit was first introduced in 1917, as a way to give the government flexibility to raise money during the First World War. In theory it gives Congress a way to check in on spending. But fights over the ceiling have become increasingly fractious, as political polarization increases and US debt has skyrocketed, roughly doubling in a decade. When the debt ceiling is reached, the government must either cut spending or raise taxes to reduce the deficit. This is often a difficult and unpopular choice, and it can lead to government shutdowns and economic instability.

The debt ceiling in America has often been a source of political conflict – in 2011, for example, the debt ceiling debate led to a downgrade in the US credit rating and a period of economic uncertainty. One of the main arguments against raising the debt ceiling is that it encourages government spending and makes it easier for politicians to avoid making tough choices about budget cuts and tax increases. Some politicians argue that the debt ceiling should be lowered or eliminated altogether to force the government to live within its means. However, many economists and financial experts warn that defaulting on the national debt would have catastrophic consequences for the US and global economy, including a possible recession or depression.

Overall, the debt ceiling crisis is a complex issue that requires a delicate balance between fiscal responsibility and economic stability. While the government must be held accountable for its spending, it is important to avoid defaulting on the national debt and to work towards a sustainable financial future for the country.

What can YOU do as an investor as the debt ceiling in America becomes a more acute and pressing issue? Be disciplined, have a plan, remain objective, and keep two things in mind:

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients save and invest for retirement while minimizing taxes.

Last Friday, our Marketing Specialist, Luis Barrera, represented Towerpoint Wealth at the California Future Business Leaders of America (FBLA) state conference at the SAFE Credit Union Convention Center.

Luis connected with high school students from all over the state, who were eager to learn about what a wealth management firm is all about, and how we help our clients properly coordinate all of their financial affairs. Thank you to FBLA for having us!

Click HERE to message us with any questions or concerns you may have about your retirement right now.

Click the images below to get caught up on some of our most recent trending moments at Towerpoint Wealth you might have missed!

As seen on TV!

Our President, Joseph F. Eschleman, CIMA®, was the go-to financial expert on ABC10 News’ March 20 feature story.

A guest on ABC10’s Dollars and Sense segment, Joseph explained the four different taxes people need to be aware of when they inherit money through an estate, revocable trust, or will: estate taxes, gift taxes, inheritance taxes, and income taxes.

“Nine times out of 10, when you inherit money – be it from a friend, be it from a family member, doesn’t matter – the act of…inheriting it is not taxable to the beneficiary,” said Eschleman.

There’s more, of course, to the story. Click on the video below to watch Joseph in the ABC10 video, or reach out to us here at Towerpoint Wealth to discuss any questions you have related to your estate planning, estate taxes, or income taxes.

Click HERE to browse TPW’s library of other wealth-building and wealth-protecting educational videos.

One of our favorite wealth-building and wealth-protecting quotes of all time,

from legendary investing great Peter Lynch.

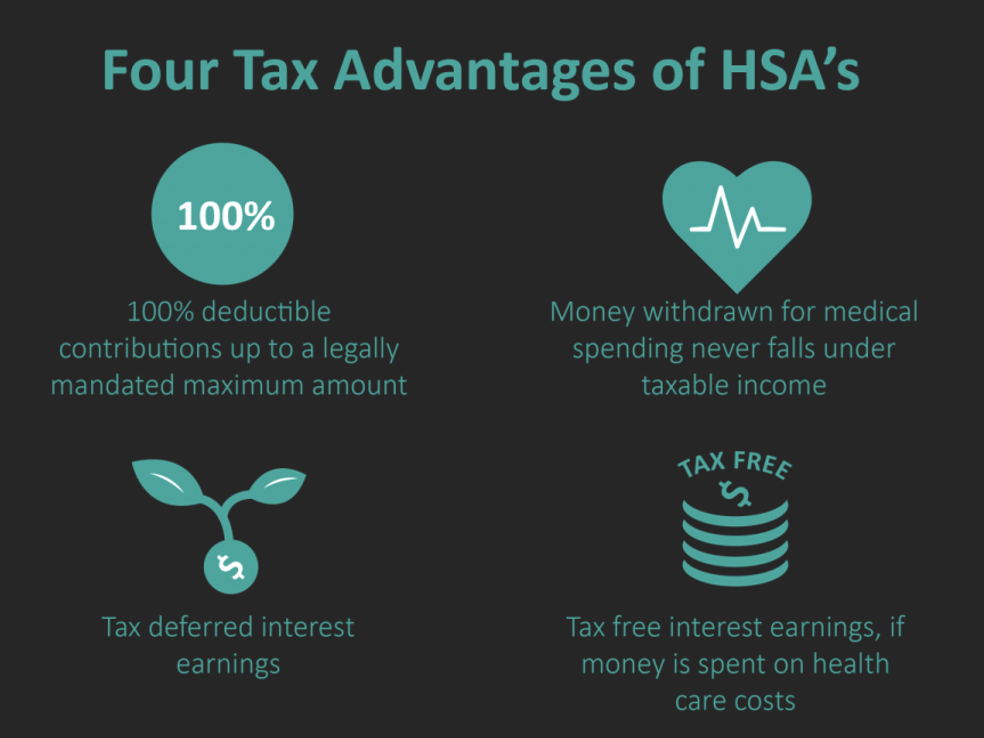

Health Savings Accounts (HSAs) are tax-advantaged savings accounts that allow individuals who qualify for a high-deductible health plan (HDHP) to save and invest money for qualified medical expenses. One of the key benefits of an HSA is that contributions made to the account are tax-deductible, which can lower your taxable income and reduce the amount of taxes you owe. Additionally, any interest or investment earnings on the account are tax-free, which means you can grow your HSA without having to worry about paying taxes on the earnings. Furthermore, withdrawals from the account that are used for qualified medical expenses are also tax-free, which allows you to use your savings to pay for healthcare expenses without having to pay taxes on the money you withdraw.

Another significant tax benefit of HSAs is that the account can be used as a long-term savings vehicle for retirement. Once you reach the age of 65, you can withdraw money from your HSA for any reason, not just medical expenses, without penalty. However, if you withdraw money for non-medical expenses, you will have to pay income tax on the amount withdrawn. Their overall tax treatment makes HSAs an attractive option for individuals who want to save money for healthcare expenses in the short-term, while also planning for their long-term retirement needs.

Have questions or concerns about filing your 2022 tax return?

We welcome connecting with you and are happy to help. Click the banner below to message Steve Pitchford, Steve Pitchford, Director of Tax and Financial Planning.

1. TV’s Streaming Bubble Has Burst, a Writers Strike Looms, and “Everybody Is Freaking Out”

Vanity Fair – 5.1.2023

“People are just desperate,” says David H. Steinberg, a writer and showrunner. “I’ve been doing this for over 20 years, and I’ve never been in a situation where people are like, ‘Oh, no one’s buying anything right now.’ We just can’t sell.”

2. The Glorious Return of a Humble Car Feature

Slate.com – 4.26.2023

The touch screen pullback is the result of consumer backlash, not the enactment of overdue regulations or an awakening of corporate responsibility. Many drivers want buttons, not screens, and they’ve given carmakers an earful about it. Auto executives have long brushed aside safety concerns about their complex displays—and all signs suggest they would have happily kept doing so. But their customers are revolting, which has forced them to pay attention.

3. With Playoff Knicks Hot, Madison Square Garden ‘Flooded with Requests From Celebrities’

NY Post – 5.3.2023

It’s once again the most coveted ticket in town.

On Tuesday night, Madison Square Garden’s Celebrity Row was overflowing with A-listers cheering on a hot Knicks squad, who defeated the Miami Heat in Game 2 of the Knicks second-round playoff series.

“The team has been flooded with requests from celebrities, with some saying they will fly in from out of town if they can get tickets,” a source close to MSG told The Post. “There’s way too many asks to address.”

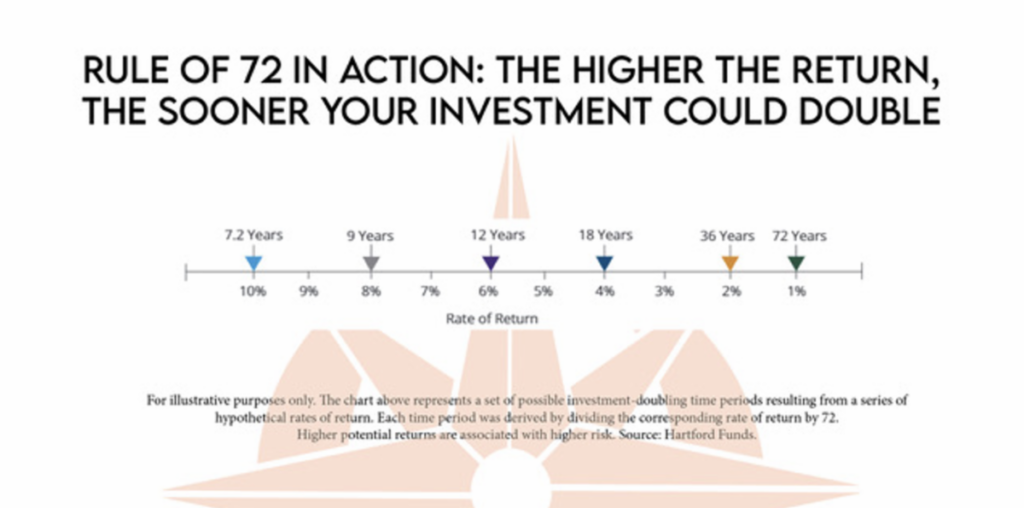

How long will it take until I double my money?

The Rule of 72 is a simple mathematical concept that helps individuals estimate how long it will take for their investments to double in value. To use the rule of 72, divide the number 72 by the annual rate of return (ROR) you expect to earn on your investment.

The result? An approximation of the number of years it will take for your investment to double in value. For example, if you expect to earn a 6% annual return on your investment, dividing 72 by 6 gives you 12 years. This means that it would take approximately 12 years for your investment to double in value at a 6% annual return. The rule of 72 is a helpful tool for investors to quickly estimate the potential growth of their investments and make informed financial decisions.

If you want to feel confident in your retirement planning decisions, reach out to us and schedule a 20-minute “Ask Anything” call - we are confident it will be time well spent!

At Towerpoint Wealth, we help you remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement. If you are worried about how the 2024 election could affect your financial future, we welcome talking further with you about your personal situation.

Worried about whether you have enough set aside to retire? Check out our “Retiring with 2 Million Dollars” guide to learn five specific steps you can take immediately to work to grow your net worth!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast