Updated November 2024.

Restricted Stock Units (RSUs) can be a significant component of an employee’s compensation package. But what is an RSU package? Do you have an RSU strategy? How are RSUS taxed? When are restricted stock units taxed? How should you consider RSUs taxation? What are stock options, and why do employers offer RSUs vs stock options? How do you plan most effectively when your RSUs vest? What does net worth mean in regards to an RSU selling strategy?

The 411 on Restricted Stock Units (RSU) tackles these questions and more.

What is an RSU? | Restricted Stock Units, RSUs and Stock Options

What is an RSU?- Learn what is a Restricted Stock Unit?

RSU vs Stock Options - What are stock options? How Are RSUs Different Than Vested Stock Options?

What Is the Taxation of Restricted Stock Units? - Learn about taxation of RSUs

RSU Strategy - What Are the Risks of Holding RSUs?

How Can I Most Effectively Plan - How Can I Most Effectively Plan for Restricted Stock Units, RSUs?

What is an RSU?

RSUs, also commonly known as restricted stock units, or restricted stock shares, are a form of stock based compensation whereby an employee receives rights to shares of stock in a company that are subject to certain restrictions. These units do not represent actual ownership or equity interest in the company and as such hold no dividend or voting rights. (1) However, once the restriction is lifted, the units are converted to actual company shares and an employee owns the shares outright (same as traditional stock ownership). Learn more about RSU tax selling strategy.

The lifting of restriction on the units is generally based on a vesting schedule. Most vesting schedules will fall into one of two categories:

- Time-based: based on the period of employment. Common time-based vesting schedules are between three to five years and are either pro-rata or “cliff” based. For a “cliff” based schedule, all shares vest fully at the end of the schedule.

- Performance-based: based on the company achieving a performance goal. Common performance-based vesting schedules are based on a company achieving a particular stock price or a return on equity, or earnings per share.

* There is a hybrid-approach between time-based and performance-based known as time-accelerated. Vesting is on a time-based schedule but may be accelerated by the company achieving a performance-based goal.

RSUs vs stock options | How Are RSUs Different Than Vested Stock Options?

When most people think of stock based compensation, vested stock options, or the right to buy a company’s stock at some future date at a price established now (the strike price), are typically what first comes to mind. (2)

Historically, vested stock options have been the most popular form of stock based compensation. And up until 2004, stock options merited favorable accounting treatment as a company could avoid recognizing compensation expense by issuing the options.

In 2004, this loophole was eliminated and subsequently RSUs/restricted stock shares, aka units, emerged as the preferred form of equity compensation.

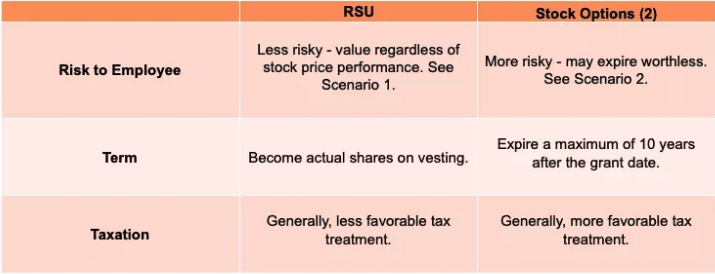

RSUs and stock options have some notable differences:

Restricted stock units are a little easier to understand compared to stock options. The employer grants a set of RSUs, which vest periodically over a period of time. This is an incentive for an employee to stay at the company longer. As they vest, income taxes on those shares are withheld. In other words, you pay income taxes on the restricted stock unit shares as they vest. There may be exceptions to this; you might be able to defer income taxes if the company offers a 409(a) which allows you to defer receipt or ownership of these RSUs to a later period of time, something that might be attractive to high income earners.

Two scenarios illustrate RSUs vs stock options:

Scenario 1: An employee is granted 1000 RSUs when the market price of the company’s stock is $10. When the RSUs vest, the stock price has fallen to $8. The shares are still worth $8,000 to the employee.

Scenario 2: An employee is granted 1000 stock options with a strike price of $10. During the window to exercise these vested options, the market price of the stock is always below $10. These options will expire worthless to the employee.

*There are many other forms of nontraditional compensation, such as Stock Appreciation Rights (SARs), Phantom Stock, and Profit Interests. None of these are as widely used as RSU and Stock Options and are not a focus here.

What Is the Taxation of Restricted Stock Units?

RSUs taxation is based upon delivery of the shares, and taxes must be paid upon vesting (i.e., when the restriction has been lifted).

The shares’ fair market value is included in an employee’s taxable income as compensation at the time of delivery. The taxation of restricted stock units is identical to normal wage income and as such, is included on an employee’s W-2. (3)

The shares are subject to federal and employment tax (Social Security and Medicare) and state and local tax as well.

Companies provide employees with either one uniform withholding method or several options to pay the taxes on their restricted stock units. They may offer:

- Net-settlement: a company “holds back” shares to cover RSU taxes and then the company pays the tax from its own cash reserve. This is the most common practice.

- Pay cash: an employee receives all shares and covers the RSU taxes out of their own pocket. This is a riskier strategy than net-settlement, as it results simultaneously in a more concentrated equity allocation and lower cash balance (less money to pay the taxes).

- Sell to cover: an employee sells the shares needed to cover the income tax burden on their own. This method provides no real advantage over net-settlement and places the additional burden of selling the shares on the employee.

When an employee ultimately sells their vested shares, hopefully based on their well-constructed RSU selling strategy, they will pay capital gains tax on any appreciation over the market price of the shares on the vesting date. The sales proceeds will be taxed at the more favorable long-term capital gains rate if the shares are held longer than one year after vesting. (4)

Taxation of Restricted Stock Units Example:

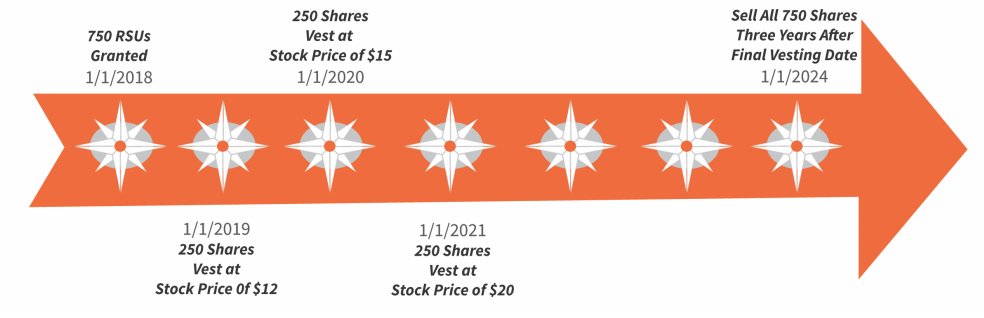

Here’s an example of an RSU selling strategy: An employee is granted 750 RSUs on January 1, 2018. The market price of the stock at the time of grant is $10 and the RSUs vest pro-rata over three years:

Taxation of Restricted Stock Units : RSU strategy and RSU taxed

Each increment is taxable on its vesting date as ordinary income. The total ordinary income paid over the three years is $11,500.

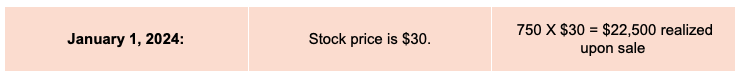

The employee then sells all 750 shares of stock three years after the last shares vest.

The employee held each share of his RSU stock options for more than one year, so the gain is treated as long-term. The employee’s long-term capital gain is $11,000 ($22,500 less $11,500) to be reported on Schedule D of their U.S. individual tax return.

Ordinary income tax rates are usually paid on the fair market value of the stock at the time of vesting. Whether you eventually sell RSU stock units or hold them, is, however, not likely to impact your up-front tax bill at the time of vesting.

RSU Strategy | What Are the Risks of Holding RSUs?

Utilized correctly, restricted stock units/restricted stock shares can be a wonderful complement to a traditional compensation package and can contribute substantially to an employee’s net worth. (5) This can be, however, a double-edged sword.

The overlying risk is that an employee can have too much of their net worth concentrated in one individual stock and one individual company.

Let’s explore a scenario:

Jim has a net worth of $200,000, not including 2,000 shares of RSUs with his employer, Snap Inc. On January 1, 2019, 100% of Jim’s 2,000 RSUs vest at $50 per share.

Great news! Jim’s net worth, on paper, has now increased by $100,000 overnight. Jim’s overall net worth is now $300,000.

Jim decides to keep all his shares in Snap Inc. with the belief the stock price will continue to go up.

He also sees his colleagues choosing to hold most of their shares, and fears that if Snap Inc.’s price soars, he will have missed out and his colleagues will all become wealthier than him.

On July 1, 2019, Snap Inc. releases a weak earnings report and the share price drops to $20. Jim’s net worth is now $240,000, down 20% from January 1.

Even worse, Jim paid taxes at his ordinary rate on the original share value of $100,000 when the shares are now only worth $40,000.

And finally, because Jim has a significant portion of his net worth in the company he works for, he faces an additional and potentially catastrophic risk. What if Snap Inc. runs into serious financial struggles and he loses his job? Not only will Jim’s net worth plunge from further declines in Snap Inc.’s share price, he also will now have lost his primary source of income.

You may see Jim as foolish, but his predicament is a common one. We often see employees dealing with the hesitation to sell the shares for reasons that can be more emotional than rational.

It might be a helpful RSU strategy to think of vested RSUs as cash available for investing: If you would take that cash and buy company stock, then keep the RSUs where they are. However, if you had this cash and would put it into a more diversified investment vehicle, then sell and move it.

How Can I Most Effectively Plan for Restricted Stock Units, RSUs?

We recommend you discuss how to effectively plan for RSU shares with your financial advisor to ensure a decision is not made in a vacuum, but rather in the broader spectrum of your entire financial picture. Of course, we encourage collaboration with your tax advisor to determine the optimal strategy from a tax perspective as well.

In reality, when RSUs vest, you may be better off by immediately (or over a short-term schedule) selling a sizeable portion of the vested units and using the proceeds to add to or build a diversified investment portfolio.

Regardless, before you make any decisions, it can be helpful to explore the following questions:

- How much of your overall wealth is tied up in RSUs?

- Is your company growing quickly or slowly?

- What is your current tax situation? Is it better to wait more than one year after the shares vest to sell them to receive the more favorable long-term capital gains tax treatment?

- How long do you plan to be with the company?

- What is your tolerance for risk?

- If the market value of the stock was instead received in the form of a cash bonus, how much of this would you invest in the company stock?

How can we help with your RSU and stock options?

While we at Towerpoint Wealth continue to believe in the importance of a diversified portfolio, we also understand every individual situation is unique, what growing net worth means to each individual is different, and understand emotions can play a significant albeit oftentimes problematic role in making sound financial decisions. This is especially the case for RSUs. If you would like to speak further about what is an RSU vs stock options, or need an RSU strategy (or have questions about any nontraditional compensation for that matter), I encourage you to call, 916-405-9166, or email Steve Pitchford (Certified Financial Planner) email spitchford@towerpointwealth.com.

Learn more about Maximize stock compensation and What are RSUs?

Visit Towerpoint Wealth's YouTube Channel

Visit our library of financial guides and checklists.

(1) While RSUs hold no automatic dividend rights, companies may choose to issue dividend equivalents. For example, when a company pays cash dividends to common stock holders, RSUs can be credited dividends for the same amount. These credits may ultimately be used to pay the taxes due when RSUs vest or can simply be paid out in cash.

(2) RSU strategy - Stock Options can either be Incentive Stock Options (ISOs) or Nonqualified Stock Options (NQOs). They are treated differently for tax purposes.

(3) When received, dividend equivalents are subject to the same tax rules as RSUs.

(4) Important to note that the shares must be held more than one year for long-term capital gains treatment. If sold exactly one year from the vesting date, they will be taxed at the higher short-term capital gains.

(5) Net worth means the total value of all of an individual’s assets less their liabilities.

Towerpoint Wealth, LLC is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Towerpoint Wealth, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Towerpoint Wealth, LLC unless a client service agreement is in place.