You’ve probably noticed, the Sacramento housing market is falling asleep!

Understanding that real estate is an important part of the net worth of virtually all of our clients, and whether you are in the market to buy, sell, or just hold real estate, a combination of metrics right now has people in Sacramento almost expecting real estate prices to drop. This is certainly a different, weaker market than what it was seven short months ago.

In our own April 22, 2022 Trending Today newsletter, Will Homeowners Frown with Housing Prices Going Down?, we wrote of legitimate reasons for housing “bulls” to say that the “pandemic housing boom” had room to run. There was:

- Virtually no inventory!

- Demand remained strong.

- Buyer urgency remained high.

We also mentioned what the housing and real estate “bears” were warning us about – a hawkish US Federal Reserve, surging interest rates on 30-year mortgages, horrible affordability, and homebuilder stocks that were completely out-of-favor.

Yes, things are different now.

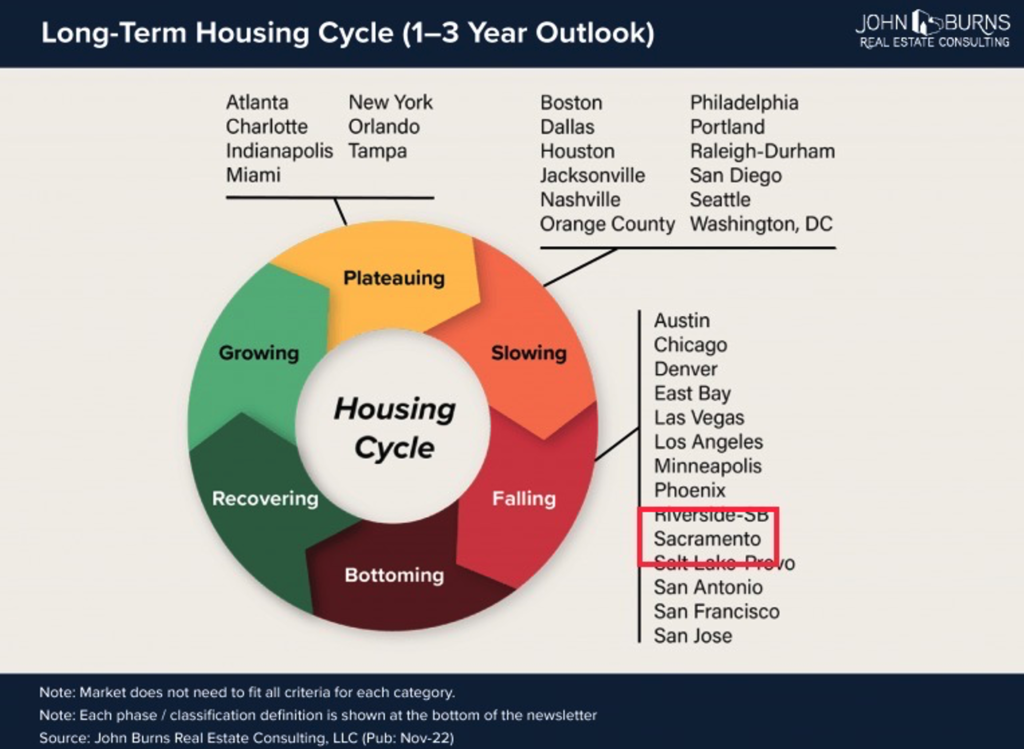

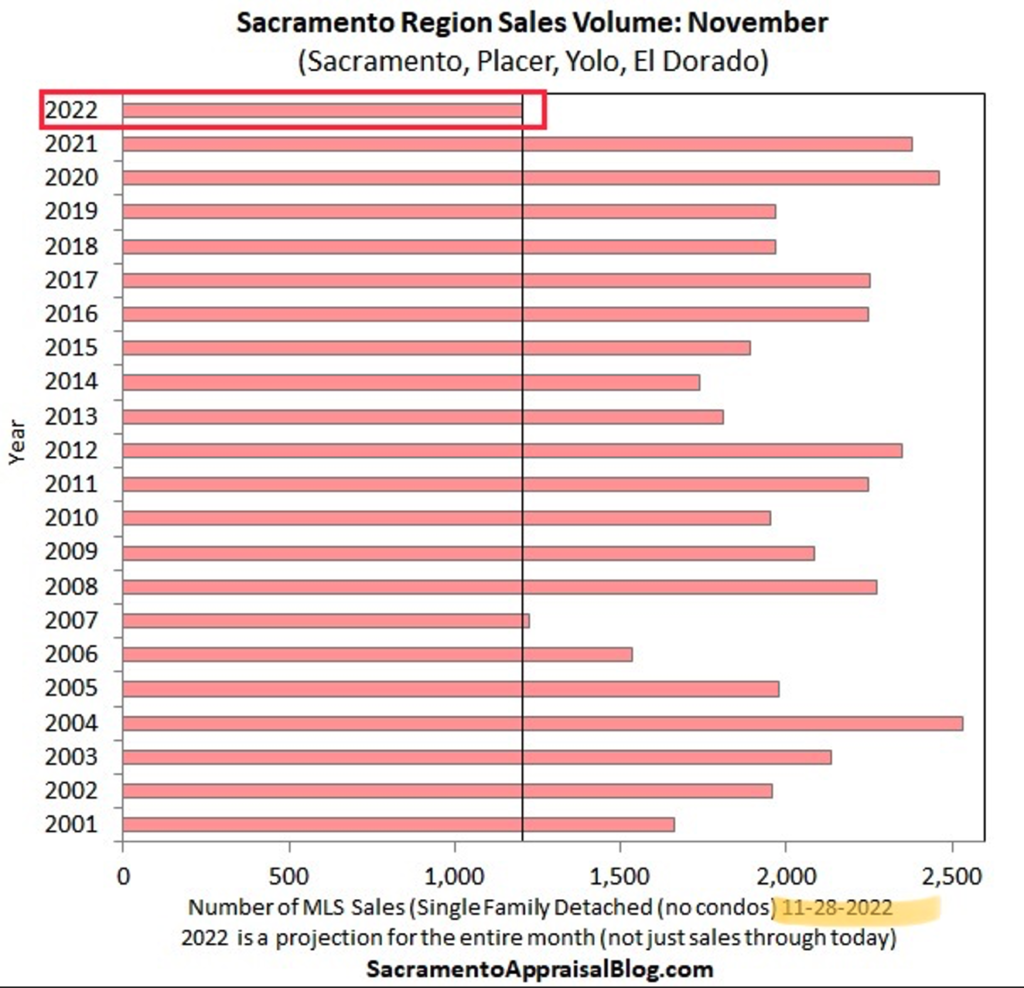

Sacramento home prices are declining, and interest rates are much higher. Both sales volume and sales prices are down. Will these declining prices continue? Is there a bottom yet to come in this housing cycle, as the image below would indicate?

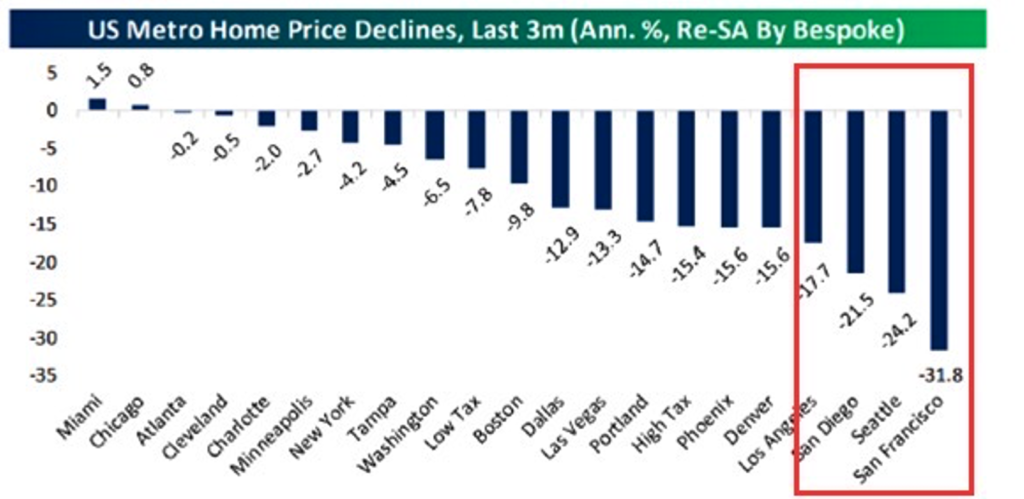

This weakness is not just here in Sacramento, it is occurring throughout the Western US and virtually the entire country:

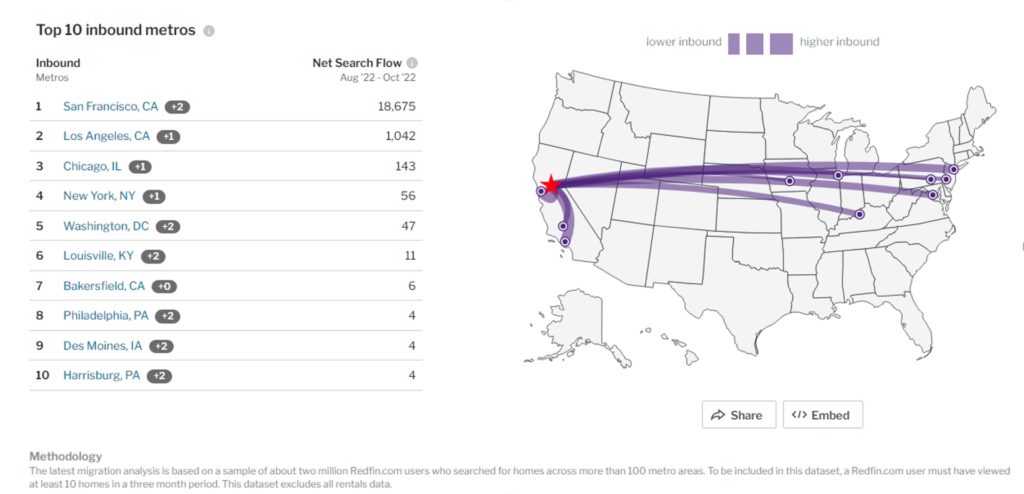

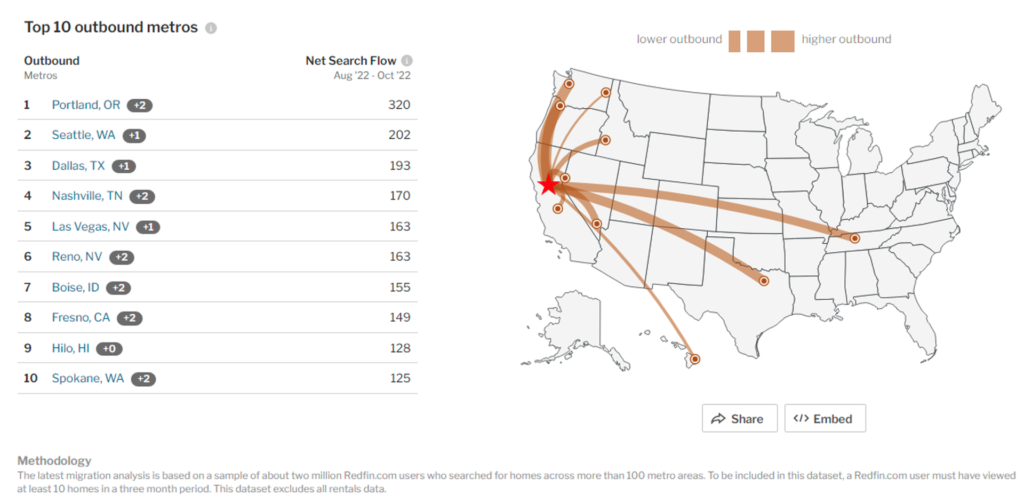

Migration is one factor that is not causing real estate prices to drop here in Sacramento, as we are still much more of an inbound destination, which provides some support for the value of Sacramento housing:

While nice to see, this migration data has not mitigated a slowdown in sales here in Sacramento, as November real estate sales were the worst in two decades for the Sacramento region, down close to 50% from last year’s November sales number.

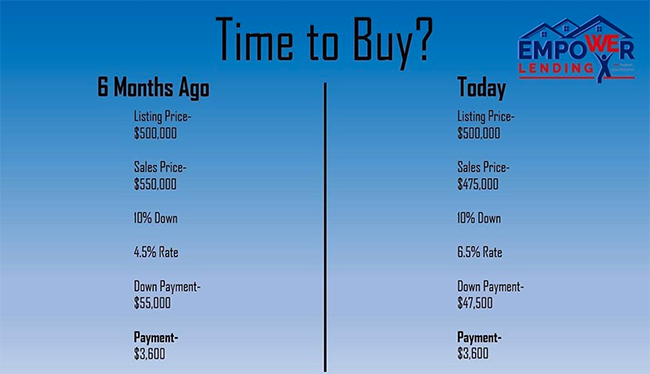

In light of much of this bearish news about Sacramento housing, let’s keep some perspective – since a combination of reasons have caused real estate prices to drop, the market is much more attractive and affordable now if you are a buyer!

If you are looking for more perspective and perhaps a forecast of what to expect for 2023, this timely Realtor.com article has a lot to say!

Have questions or concerns? Message us to share them, and let us know you’re interested in learning more.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients build and protect their net worth

Our President, Joseph Eschleman, recently conducted an extremely productive financial, investment, and retirement comprehensive review meeting with two excellent and long-time TPW clients, Dan and Sue Britts.

Dan, Sue, it was great to see and connect with both of you – LOVE your big smiles, and glad to hear how enjoyable your recent trip to Ville de Sanary-sur-Mer was!!

Here are some of our top trending moments at Towerpoint you might have missed on our social platforms.

Click the images below!

What else is happening with the Towerpoint Wealth family?

Is a recession around the corner? Quite possibly...

Are you worried your portfolio will suffer further declines? Just about everyone is...

Do you wonder: How can I better protect my investments from the pain a US recession might bring?

Have you considered: Are there ways to take advantage of a recession if and when one occurs?

Well, we have some answers for you!

Click the image below to watch our newly-published educational video, "The Top 5 Ways to Recession-Proof Your Portfolio."

Required Minimum Distributions

Dreading a Required Minimum Distribution, or RMD, from a retirement account? No doubt, it’s because of T-A-X-E-S.

While RMDs can be an unwanted by-product of contributing to and investing in retirement accounts such as 401(k)s, IRAs, 403(b)s, etc., there are impactful and proactive tax planning strategies that can materially lessen the tax sting of an RMD.

What are RMDs, and how should an individual plan for them within the context of a tax-efficient retirement strategy? Click below to learn more about RMDs, and specifically, three actionable RMD strategies worth evaluating to better keep Uncle Sam at bay.

Have you considered how to plan around taking your 2022 RMDs? Click below to message Steve!

Useful and interesting content we’ve read over the past two weeks:

1. #NeverTesla – Elon Musks’s Twitter is Full of People Swearing off Tesla

Bloomberg – 11.29.2022

The belligerent and erratic performance in his new role as “chief Twit” has raised Elon Musk’s already stratospheric public profile to new heights. If Twitter is a global town square, Musk has transitioned overnight from one of its loudest orators to equal parts mayor and sheriff, with the potential to irritate far beyond the echo chamber of his 118 million followers. For owners and potential buyers of Tesla cars, it has become all but impossible to find neutral ground on the controversies that surround Musk.

2. Tiger Woods Concedes He’s Almost Done Playing Golf, Unloads on LIV’s Greg Norman

Yahoo Sports – 11.29.2022

Tiger Woods' playing days are almost done. But his influence on the game will clearly continue long after he's holed his last putt.

Woods spoke Tuesday morning in advance of the Hero World Challenge, his own tiny-field tournament in the Bahamas, and as has become the norm at this event, he was unusually open and forthright, both about his own game and the state of the sport in general.

3. Crypto Creep Claims No Fraud!

CNBC – 11.30.2022

Former FTX CEO Sam Bankman-Fried, in possibly the understatement of 2022, said Wednesday, “I’ve had a bad month.”

The former billionaire added that he “didn’t do a good job” at upholding his responsibilities to regulators, customers and investors in a hotly anticipated conversation with CNBC’s Andrew Ross Sorkin at the DealBook Summit.

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

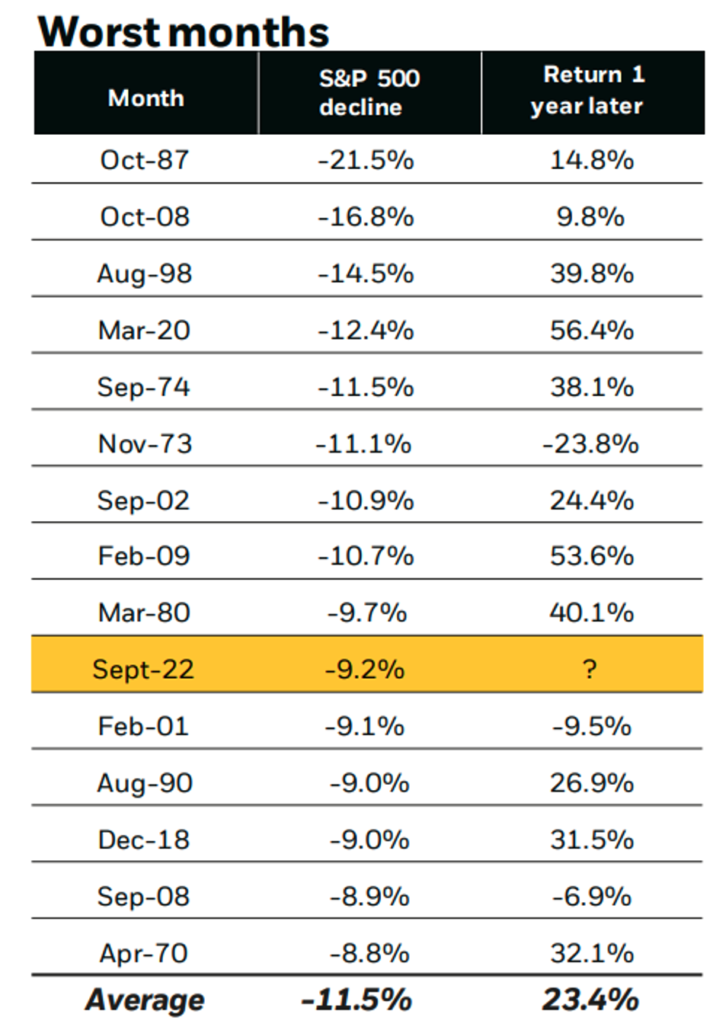

September, 2022 was one of the worst months in the stock market, as represented by the S&P 500, since 1950.

The good news? In looking back at the worst 15 individual months for the S&P 500, stocks have historically rebounded, with 1-year forward returns averaging more than +23%.

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

While the global 24/7 news cycle churns, twists, and turns, here are a number of fun, local trending events of note:

- November 25 – January 1 – Enchant Sacramento – Sutter Health Park

- November 18 – January 2 - Imaginarium – Light Up the Night – Cal Expo Center

- December 4 – Chicago Bulls vs. Sacramento Kings, December 4, Golden1 Center

- December 7 – Adam Sandler, LIVE – Golden1 Center

- December 10, 11 – The Nutcracker with Live Orchestra – SAFE Credit Union Performing Arts Center

- December 11 – Kevin Hart: Reality Check Tour - Golden1 Center

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Joseph Eschleman, Jonathan, Steve, Lori, Nathan, Michelle, and Luis

We enjoy social media, and are actively growing our online community!