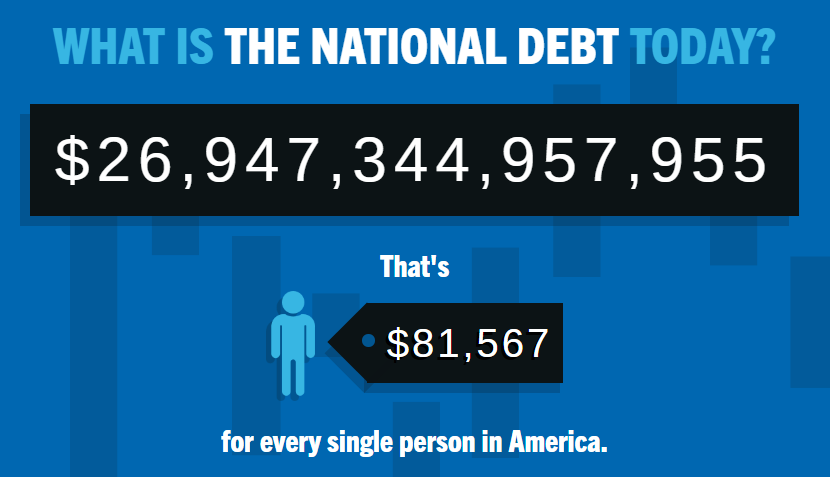

$27 trillion. That is where the United States' current debt load currently stands as of 10:40 a.m. today:

The budget deficit is expected to be $3.3 trillion just for 2020, as the Federal government seeks to provide stimulus to our economy in the face of the COVID-19 crisis. This has added $2 trillion to our national debt, on which in most months we are spending more than $1 billion a day just in interest.

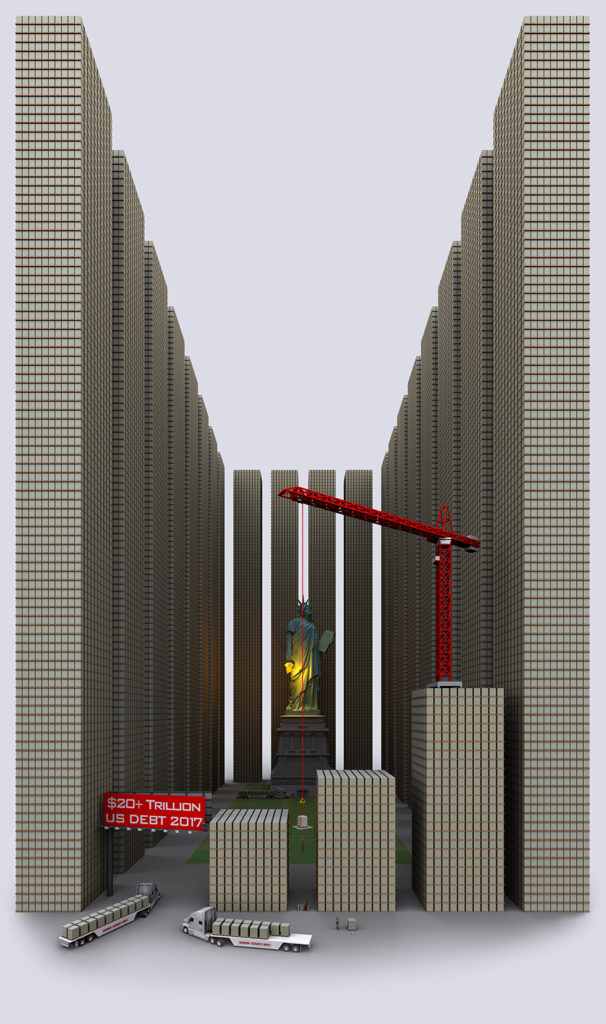

For perspective, here is a sobering infographic (yes, that is a football field in front of the Statue of Liberty) depicting what $20 trillion looks like. Each pallet, or "brick," represents $100 million:

Infographic courtesy of www.demoncracy.info

Unless there is some new economic or societal model that none of us are aware of, our country's debt will almost assuredly never be paid back. Politicians love promising us the world, and when the cash is not there to keep their promises, our government borrows money. Paying back this debt would require making extremely difficult decisions, and concurrently, losing votes. It is much easier to avoid this problem, kick the can down the road, and borrow from our children's future than responsibly address it.

The politicians' solution? Inflate our way out of the problem. The path of least resistance is to manufacture (read: print more) money to pay the debt back. By doing so, we are able to meet and satisfy our debt obligations (at least on paper). However, what this means is the holders of U.S. debt will receive back less than they loan in real dollars, as the purchasing power of a dollar declines as inflation occurs.

Most economists agree with and are untroubled by such massive amounts of borrowing, understanding our economy is currently in peril. The national debt was barely a concern when we passed the CARES Act, a cornerstone $2.2 trillion coronavirus economic stimulus bill, almost unanimously in March.

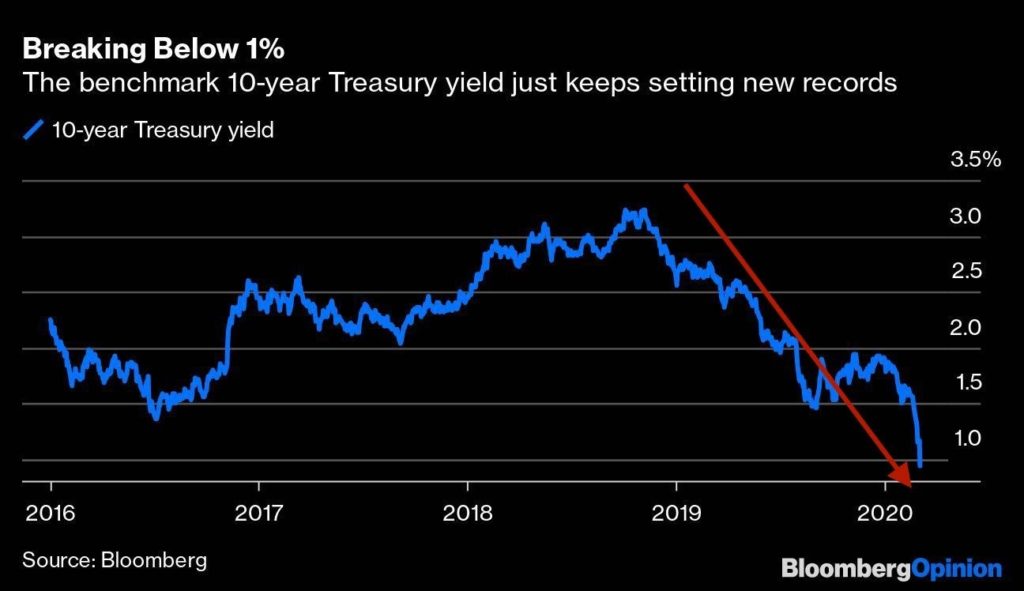

The two major concerns about carrying such a major debt load (higher interest rates and higher inflation) have not yet come to pass, as interest rates are extremely low and inflation remains quite muted. And because of that, our government is able to focus on providing the above-mentioned stimulus to combat the COVID-19 pandemic, and not have our national debt constrain our response. Seeing that we have been "forced" to borrow aggressively, at least we have been able to do so quite cheaply!

Make no mistake about it, questions remain about what the actual impact of this aggressive borrowing and economic stimulus will be. At Towerpoint Wealth, we believe the politics will eventually have to switch towards reining in the deficit. As this occurs, expect potentially massive implications for government spending, focused in areas like pension and medical spending, especially as our economy and our citizens age.

However, while we do feel there may be a transition to and an increased focus on debt reduction here in the United States at some point, the way we see it for the foreseeable future:

- The U.S. economic engine will remain a powerful one

- The urgency of the COVID-19 crisis will continue to underscore the demand for "safe haven" assets like U.S. Treasurys

- The U.S. dollar will remain the world's reserve currency

- The U.S. Federal Reserve will continue to print vast amounts of money to buy our debt

- Once business start to reopen and growth returns to more "normal" levels, tax revenues will increase substantially.

What’s Happening at TPW?

It was great to have a Towerpoint Wealth quorum downtown yesterday, with everyone looking good and dressed nicely to boot!

She said yes!

Our Partner, Wealth Manager, Jonathan LaTurner, *finally* popped the question to his long-time partner, Katie McDonald, while at Carmel by the Sea this past weekend.

A huge congratulations to both Jon and Katie, we can't wait for your wedding!

TPW Service Highlight – Concentrated Stock Management

Have you amassed personal wealth through equity-based compensation, the inheritance of a large single-stock position, or from receiving stock as part of the sale of a closely-held business? Does this stock represent more than 10 or 15% of your overall portfolio? Do you recognize and are you concerned about the risk that this position may represent to your overall net worth? If the stock has appreciated, are you worried about the potential income and capital gains tax consequences of selling it?

We are experts in helping our clients manage and mitigate the risk and tax consequences of owning a concentrated stock position - click HERE or scroll to the bottom of this newsletter to download the white paper we recently published on this very important issue.

Graph of the Week

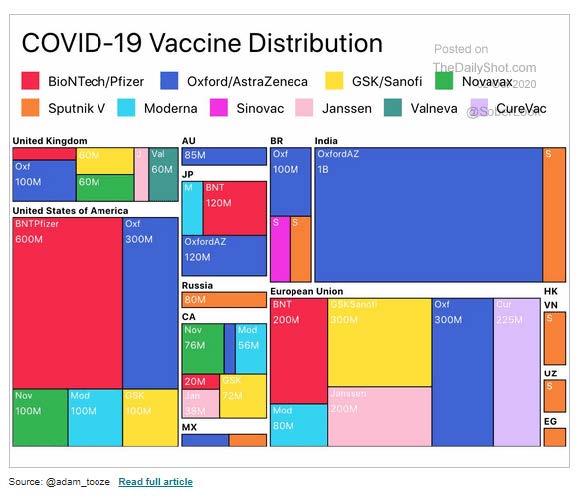

Researchers around the world are working around the clock to find a vaccine against COVID-19. In addition to a number of individual companies, the pandemic has created a number of unprecedented public/private partnerships in search of promising vaccine candidates:

- BioNTech / Pfizer

- Oxford / AstraZeneca

- GSK / Sanofi

- Novavax

- Gamaleya Research Institute of Epidemiology and Microbiology

- Moderna

- Sinovac

- Janssen

- Valneva

- CureVac

Below you will find a chart that outlines these current major partnerships and companies, as well as geographic distribution of the anticipated vaccine.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely complicated place, and we are here to help you properly plan for and make sense of it.

- Nathan, Raquel, Steve, Joseph, Lori, Jonathan, and Matt