For a myriad of reasons, 2020 has been both a surreal and unreal year, and the growth in the value of residential real estate is illustrative of that. According to USA Today and the National Association of Realtors (NAR), despite the hard economic times caused by the COVID-19 pandemic, home prices rose in the first quarter of 2020 in 96% of U.S. metro markets. A few of the local Sacramento-area agents we work with have commented that "this [real estate] market is even hotter and crazier than it was at its peak in 2006."

The environment 14 years ago was very different - during the U.S. housing bubble, real estate prices were artificially inflated due to speculative fervor, lax lending standards, and arguably negligent regulations. But when we fast forward to 2020, we find four reasons for this red hot market:

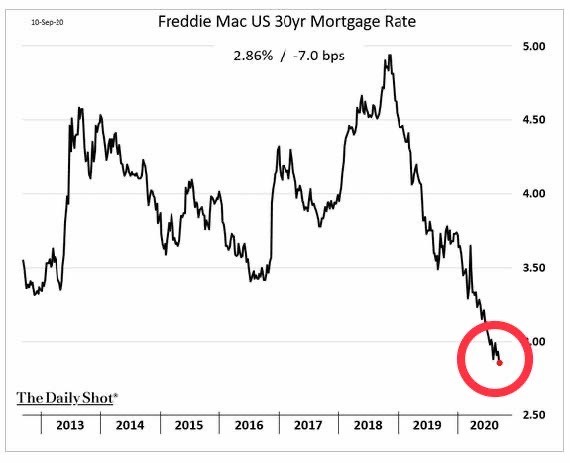

Historically LOW interest rates. Money is extremely "cheap" right now, as interest rates on mortgages continue to hit record lows.

Cheap money is analogous to low interest rates, meaning it doesn't "cost" much to borrow. Mortgage rate cuts have given house hunters ~ 25% more buying power in less than two years, and that does not appear to be ending soon. The less it costs to borrow, the more a buyer may be inclined to do so when buying a home. Alternatively, the less it costs to borrow, the lower the homebuyer's monthly mortgage payment. Adding this all up provides major stimulus to and demand for buying real estate.

Urban exodus. Just a few years ago, demand for city living was high, and people were piling into major metropolitan areas throughout the United States; now, the opposite is happening, and they are filing out in favor of suburban life.

Rent decreases are accelerating, as seven of the top ten priciest rental markets saw apartment prices drop 5% over the same time last year. Cultural and social opportunities that often draw people to metropolitan areas have largely shut down due to coronavirus. The perceived health concerns associated with public transportation and dense city living, high city taxes, the safety concerns and stress caused by demonstrations devolving into riots and other increases in crime, the desire for more space, and the ability to work remotely have all created a huge outflux from the cities, and concurrently, an influx of cash that has pushed up real estate prices in the 'burbs.

Telecommuting / virtual working. Before COVID-19, only about 5% of workers did their jobs remotely. That figure has jumped to nearly half. Google, Twitter, and Facebook have led Silicon Valley in announcing plans to let, or even require, employees to work from home, at least for the next year, if not indefinitely. New York-based financial giants J.P. Morgan and Morgan Stanley have offered their employees a similar option. Telecommuting is no longer a trend, it is a full-blown movement. And that has allowed, or better put, freed people to live where they desire, and not feel geographically-tethered to their job location.

Inventory shortage. There is an imbalance. There are more buyers than sellers. Postponed purchases from March and April due to home-buying restrictions have created intense demand. Families are looking to upgrade, and, understanding we are all spending more time in our homes that before, people simply want more space. There was a nationwide industry shortage even before the pandemic hit, and the COVID-19 crisis has only exacerbated the problem. U.S. home values grew to $256,663 in August, an 0.7% increase from July, the largest increase since 2013, and inventory is 29.4% lower than a year ago! Builders are racing to catch up with demand, and rising prices should encourage more potential sellers to come off of the sidelines and list. But until those things occur, the shortage of inventory will continue to tilt the housing market in favor of sellers. Economics 101: When demand outstrips supply, prices go up.

How long this lasts remains to be seen. At Towerpoint Wealth, we believe that things will only begin to change in the real estate market when the uncertainty surrounding the job market, economy, and COVID-19 epidemic begin to subside.

What’s Happening at TPW?

The TPW crew enjoyed a "robust" teambuilding potluck earlier this week, highlighted by grass fed tri-tip marinated in "The Sauce for All Seasons," Pearson's Premium!

Our Partner, Wealth Manager, Jonathan LaTurner, our Director of Research and Analytics, Nathan Billigmeier, our new Wealth Advisor, Matt Regan, and our Director of Tax and Financial Planning, Steve Pitchford, enjoyed an early morning TPW team-building golf outing at William Land Golf Course!

TPW Service Highlight – Roth IRA conversions

While 2020 will rightfully be remembered for the challenging and unprecedented COVID-19 battle we have all been impacted by, at Towerpoint Wealth, we have continued to proactively work with clients to identify economic opportunities presented by the coronavirus crisis. Specifically, we have identified a "silver economic lining" tax planning strategy this year, one that is designed to take advantage of today's low income tax rates, which we feel are temporary, while at the same time leave our clients better positioned for tomorrow's higher income tax rates, which we feel are inevitable.

Below you will find 2020: The Perfect Year for a Roth Conversion, our newly-published white paper that discusses what a "Roth conversion" is, who may benefit from a Roth conversion, why 2020 is a potentially great year to do a Roth conversion, and how to utilize important tax planning tools to evaluate this opportunity.

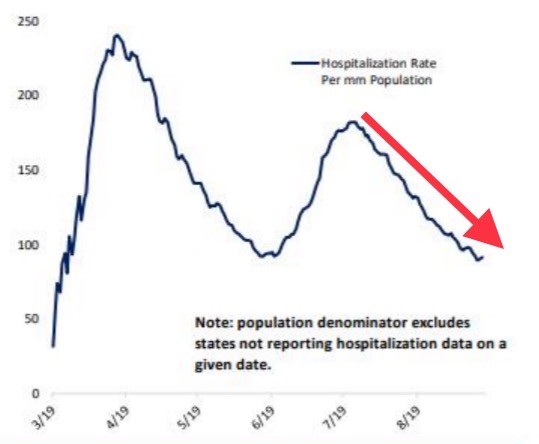

Graph of the Week

While we obviously need to continue to remain disciplined, and understanding there is still more work to be done, the United States COVID-19 hospitalization numbers below, from Bespoke Investment Group, are encouraging. Less than one person per 10,000 population (or less than 100 people per 1MM population) is currently hospitalized with coronavirus.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely complicated place, and we are here to help you properly plan for and make sense of it.

- Nathan, Raquel, Steve, Joseph, Lori, Jonathan, and Matt