“I’ve got a will, I’m in good shape.”

“I know why estate planning is important – I’ll get around to it soon.”

Have you been putting off your estate planning? Why not make 2023 the year you get your estate in order?

The thought of planning around your incapacity or death can oftentimes feel like too much to contemplate, and thinking about the meaning of intimidating legal jargon can quickly lead to distraction and procrastination. However, while rarely at the top of a “to-do” list, most investors recognize the importance of proper estate planning, even if deferring or flat-out avoiding the creation of a thoughtful and customized estate plan is a huge error we see made time and time again.

Having an estate plan is not just for those who are wealthy or who are in their later years, as there is an abundance of reasons why estate planning is important. And as you will see below, estate planning is more than just having a collection of documents that specify how you want your assets distributed upon incapacity or death.

It is important to have a foundational understanding and working knowledge about fundamental estate planning documents. Want to bone up? The 411 on Estate Planning read our financial guide.

If you have any assets to leave behind, and people important to you, then read on – here are six reasons why estate planning is important!

1. To protect your children.

If you die, or become incapacitated, would you prefer to have a probate court appoint a legal guardian for your children and other dependents, or would you prefer to dictate who takes care of them? Clearly a rhetorical question.

Without an estate plan, the court will be making these decisions. And if a minor child has no surviving family members, and a third party such as a family friend does not step up, the child could end up in foster care.

2. To protect YOU.

What happens if you are incapable or unable to manage your own legal or financial affairs? Unless you have a durable power of attorney (one component of a well-assembled estate plan) the probate courts will get involved. This is time consuming, expensive, and tedious. Can you be certain about the court’s capacity to truly act in your best interests?

Additionally, having a healthcare proxy grants someone permission to make healthcare decisions for you if you are incapable of making them for yourself. Don’t have one? Fingers crossed that someone the probate court appoints, or a random hospital staffer who is unfamiliar with you and your wishes, may be in charge of you and your health. Also known as a living will, it is extremely important to have an updated one in place.

3. To protect against overpaying taxes.

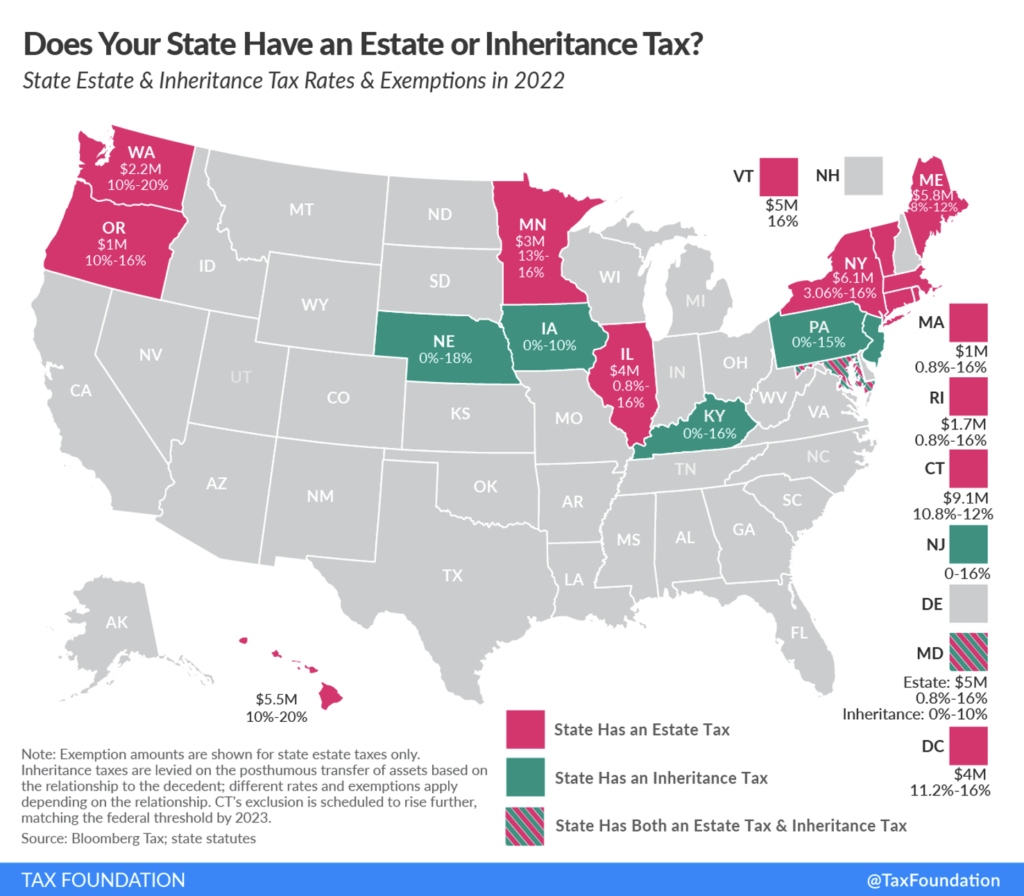

While estate planning is oftentimes associated with the wealthy because of federal estate taxes, there is a much lower economic bar to being subject to state estate and inheritance taxes, depending on the state you live in.

The current federal estate tax exemption for 2023 is $12.92 million per individual. This is the amount you can pass on at your death and be exempt from federal estate and gift taxes. If you are a married couple, you can pass almost $26 million in assets tax free.

However, this exemption will revert back to $5 million (adjusted for inflation) per individual in 2026, and more people will be subject to it.

Additionally, while California surprisingly does not, 12 states (and the District of Columbia) do impose a state estate tax, and six states impose an inheritance tax, usually with much lower financial thresholds than the federal levels mentioned above. Massachusetts and Oregon tax estates valued at more than $1 million, and in Nebraska, heirs may pay inheritance tax on anything over $10,000 (depending on their relationship to the decedent).

4. To avoid probate and protect against wasting time and money.

Probate is the court-supervised legal process of authenticating, validating, and administrating your will (if there is one), assessing the value of your assets, paying off debts, and then distributing the remainder to whom the probate court deems to be your rightful heirs.

Sound complicated and tedious? Probate usually is, costing your family and loved ones time, stress, and money. However, the good news is that it is avoidable! Simply create a revocable trust and retitle your assets into its name during your lifetime, and any asset titled in the trust is a “probate-free” asset.

Click the image below to watch our educational video

5. To restrict your assets from and protect against the bad decisions of other family members.

Owning and holding assets in the name of your revocable trust is a good safety measure for not only you, but for your family as well. Establishing clauses on when and at what age beneficiaries may receive your assets is a powerful tool, as is dictating who will act as the trustee.

Additionally, with a well-assembled estate plan, you have the ability to ensure that your assets go to your children or grandchildren rather than to a spouse’s new partner or other family members, cutting out unwanted inheritors.

6. To protect your privacy.

Probate is public, and if your will goes to it, it becomes public record. Unless you don’t mind everyone knowing about your financial position, information, beneficiaries, and intent, you want to do everything to avoid it!

These six reasons for ensuring that you have a comprehensive and documented estate plan and strategy should eliminate any question of why estate planning is important. People always think they have enough time left for planning like this, until they don’t.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients save and invest for retirement while minimizing taxes.

We wrote about the many wealth-building opportunities and retirement planning considerations created with the passage of the brand-new Secure Act 2.0 in our December 23, 2022 Trending Today newsletter, which was very well-received by our clients, colleagues, and friends.

Understanding this interest and demand, we created a CliffsNotes version of what we feel to be the major and most important provisions of Secure Act 2.0.

Here are some of our top trending moments at Towerpoint you might have missed on our social platforms.

Click the images below!

What else is happening with the Towerpoint Wealth family?

Tax season is right around the corner. And with it will come the inevitable onslaught of forms, schedules, and statements. The centerpiece in this tax paperwork deluge are your 1099s.

What exactly is a Form 1099, why can they be so frustrating to process, and importantly, how do you manage the problem of receiving a late, amended one? Click below to read our white paper and find out!

Click below to begin a dialogue with Steve Pitchford, Director of Tax and Financial Planning.

Useful and interesting content we’ve read over the past two weeks:

Your Stuff is Actually Worse Now

Vox – 1.4.2023

Consumer goods have faced a dip in comparative quality. All manner of things we wear, plus kitchen appliances, personal tech devices, and construction tools, are among the objects that have been stunted by a concerted effort to simultaneously expedite the rate of production while making it more difficult to easily repair what we already own, experts say.

How an Alaskan ‘Puppy Bus’ Went Viral

NPR – 1.24.2023

Mo Thompson never planned to be a dog walker — and she definitely didn't plan to go viral on TikTok. But recently, her videos of the pups she walks have racked up millions of views, especially the ones showcasing how she picks them up: the puppy bus.

"They're getting on the bus and they get in their seat, and the Internet just lost it," she said. "50 million views. That was wild."

The Fiscal Arsonists

Noahpinion – 1.22.2023

I regret to inform you that once again, people are playing weird political games with the U.S. fiscal system.

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

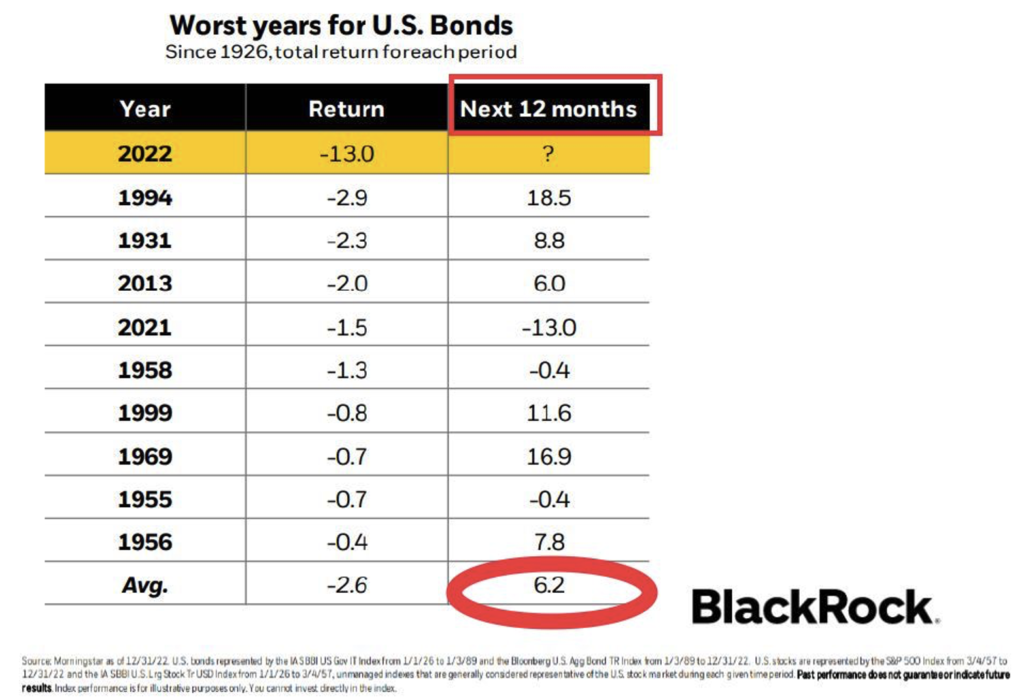

Understanding that 2022 was the worst year ever for bonds, BlackRock’s chart below gives us optimism that 2023 will be better.

At Towerpoint Wealth, we help you remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement. If you are worried about how the 2024 election could affect your financial future, we welcome talking further with you about your personal situation.

Worried about whether you have enough set aside to retire? Check out our “Retiring with 2 Million Dollars” guide to learn five specific steps you can take immediately to work to grow your net worth!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X