Right now, there are many people saying to themselves “What’s the point?” when thinking about investing during inflation. Does the below photo conjure up familiar feelings right now when checking your accounts?

There is no question that today’s market, economic, and political environment is scary, volatile, disconcerting, and our favorite adjective to use, unsettling. Saving and investing during inflation seems to hold no basis in logic, and can feel like throwing good money after bad. And no matter how old you are, there are at least five things going on right now that are affecting how you are thinking about what to do (or not do) with your money, including:

- The dawn of “crypto winter” this summer.

- The official arrival of a bear market (a 20% decline from its peak) for stocks.

- Soaring gas prices that are closing in on a $5/gallon national average, and rampant overall inflation.

- Skyrocketing interest rates, making it much more expensive to borrowing money.

- A quickly cooling and slowing real estate and housing market.

Add to this consumer prices rising more than they have in the past 40 years, and these events start to sound like reasons to run. Investing during inflation is emotionally difficult, but extremely important! Don’t use these events as excuses or rationalizations to withdraw, unless you have a magic crystal ball that will accurately predict these two important things.

1. When, exactly, to get out of the stock market, before it assumedly drops more, and

2. When, exactly, to get back in to the stock market, when circumstances are even scarier and prices are lower than they are today

We’ve seen people get #1 right, or #2 right, but rarely does anyone consistently and accurately get both right.

What to do to ensure we are investing during inflation, and not turning our backs?

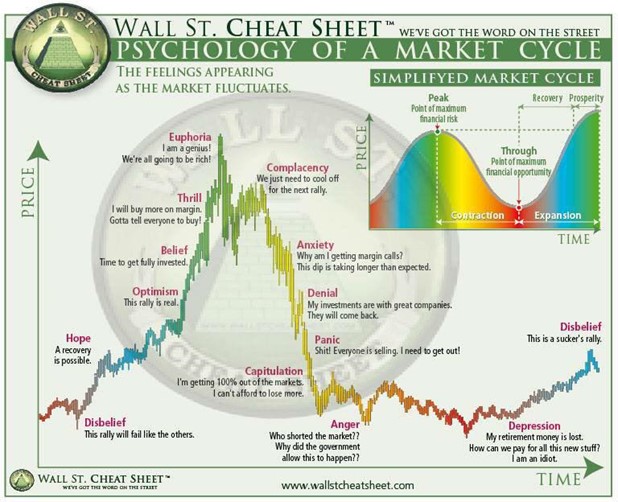

1. Recognize this is an emotional time, and give yourself space – it’s normal to feel worried, desperate, fearful, anxious, and even angry.

We are human beings, and we are hard-wired to be emotional. However, at Towerpoint Wealth, we understand that allowing emotions to dictate financial decision-making is the most common and problematic mistake made by many investors. And we also understand that it is immensely detrimental to growing and protecting one’s net worth and assets.

As investors (and humans), we all harbor cognitive biases, and having the fortitude to recognize and not give into our biases is essential.

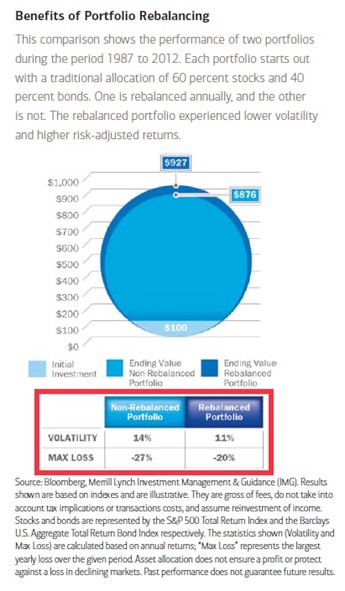

2. Be humble about your ability to predict the future, and disciplined in systematically rebalancing your portfolio.

Trying to sell right at the top, and buy right at the bottom, is an exercise in futility, and is an expectation that no reasonable investor should harbor. We believe the sooner you recognize that accurately predicting the future is something human beings are not very good at, the better off you will be.

Instead of repeatedly flailing with attempts to time the market and accurately predict the future, have a plan to systematically rebalance your portfolio (we advise semi-annually). This forces you to sell high and buy low, add to areas that are undervalued, and reduce areas that are overvalued. The chart below provides empirical evidence of the benefits of rebalancing.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients build and protect their net worth.

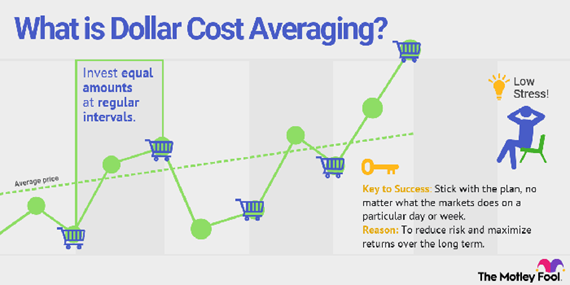

3. If you are working, be disciplined in dollar-cost averaging (DCAing) funds into your portfolio and nest egg while the markets are temporarily weak.

Investing during inflation does not have to be any more complicated or sophisticated than investing during more “normal” times, and this certainly includes being systematic in investing during inflation.

It is important to understand that the key to dollar-cost averaging is NOT timing the market, a concept that can be difficult to internalize! The emotional temptation to terminate a DCA program becomes greater when the value of your accounts are declining, as it feels like you are throwing good money after bad, as we mentioned previously. However, the opposite is actually true, as you are adding more capital to your portfolio when prices are low, therefore building a stronger overall base to your nest egg – it just doesn’t feel very good at the time!

You can also consider value averaging if you and/or your advisor have the time and the expertise.

4. If you are retired, be mindful about where in your portfolio you are withdrawing funds from while the markets are temporarily weak.

Having a plan to derive sustainable retirement income, during both good economic environments and bad, is essential. Follow a systematic retirement income plan like this basic example:

- Establish a cash and emergency fund (your “feeder” fund) that holds enough cash to cover approximately two years of general lifestyle expenses

- Regularly backfill your feeder fund with investment income from your investment accounts, i.e. interest and dividends, as well as guaranteed pension and Social Security income

- Backfill your feeder fund by selling investments that have appreciated when the financial markets are doing well; pause and avoid selling investments at a loss when the markets are temporarily weak and in decline

Would you like to discuss specific ideas on where to invest your money during an inflationary environment?

What's Happening at TPW?

Today we are excited to welcome Luis Barrera to the Towerpoint Wealth family as our new Marketing Specialist.

We look forward to having Luis apply his marketing skills and experience to help Towerpoint Wealth connect in new ways with new and existing clients.

Click the photo below to learn more about Luis and his background, and be sure to ask him about his two Australian Shepherds, Bella and Blue, in reaching out to him with a warm “welcome aboard!”

A big congratulations to our Director of Research and Analytics, Nathan Billigmeier, for earning his Certificate in Blockchain and Digital Assets from the Digital Assets Council of Financial Professionals just last week!

What else is happening with the Towerpoint Wealth family?

TPW Taxes - 2022

While the IRS has historically provided significant tax breaks to real estate investors, the 2017 Tax Cuts and Jobs Act created another avenue of advantage for these investors through the creation of the Opportunity Zone program. By investing in an Opportunity Zone (OZ) through an investment vehicle called a Qualified Opportunity Fund (QOF), investors are provided with a unique opportunity to potentially defer, reduce, and eliminate capital gains taxes!

Click the image below to open and review a well-assembled white paper we recently published on the specifics of Opportunity Zones and Qualified Opportunity Funds, the tax advantages of investing in Qualified Opportunity Funds, as well as other considerations for an investor contemplating a QOF.

Curious if you might benefit from an OZ or a QOF in 2022?

TPW News You Can Use

Useful and interesting content we read the past two weeks:

1. The Markets and Households Lose Faith that the Fed Can Handle Inflation – The Washington Post – 6.14.2022

The Federal Reserve’s missteps in waiting too long to tackle the greatest run-up in prices in four decades has shaken trust across the markets and the American public that it is up to the task of curbing inflation.

2. For Families Deeply Divided, A Summer of Hot Buttons Begins – AP News – 6.16.2022

For families fractured along red house-blue house lines, summer’s slate of reunions, trips and weddings poses another exhausting round of tension at a time of heavy fatigue. Pandemic restrictions have melted away but gun control, the fight for reproductive rights, the Jan. 6 insurrection hearings, who’s to blame for soaring inflation and a range of other issues continue to simmer.

For families fractured along red house-blue house lines, summer’s slate of reunions, trips and weddings poses another exhausting round of tension at a time of heavy fatigue. Pandemic restrictions have melted away but gun control, the fight for reproductive rights, the Jan. 6 insurrection hearings, who’s to blame for soaring inflation and a range of other issues continue to simmer.

3. From Great Resignation to Forced Resignation – Tech Companies Shift to Layoffs After a Huge Ramp Up in Hiring – Marketwatch – 6.15.2022

Thousands of layoffs in the tech sector, compounded by hiring freezes and a slowdown in hiring, highlight the abrupt shift in fortunes over the past several months as a result of rampant inflation, fear of stagflation and recession, supply-chain interruptions, the war in Ukraine, an ailing stock market and other red-alert economic factors.

Chart / Infographics of the Week

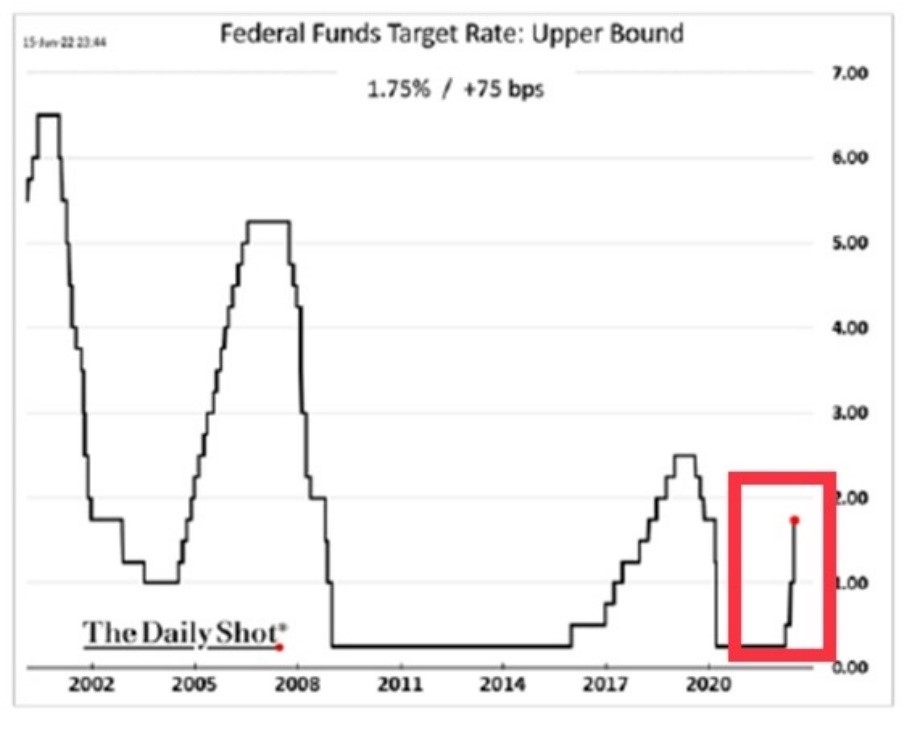

The Fed raised rates 75 basis points (3/4 of a point) on Wednesday. This is the biggest rate hike since 1994!

One of the main reasons for the Fed’s hike was the massive increase in consumer inflation projections in the next year.

Why should you should care?

TPW Educational Video : Are You Really a Long Term Investor?

An essential, yet frankly sometimes annoying, question to ask in today's current difficult market environment:

✅ Are you *really* a long-term investor?

Click the thumbnail below to learn what you may be doing wrong

Quote of the Week

An excellent quote below from author, entrepreneur, and photographer James Clear. Famous for his #1 NY Times best seller Atomic Habits, Clear focuses on habits, decision-making, and continuous improvement in his work.

Trending Today

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

– Joseph, Jonathan, Steve, Lori, Nathan, and Michelle

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity.

We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on Twitter