When taking a closer look at T-bill rates today versus bank CD best rates, it becomes easier to see why owning a Treasury bill trumps owning a certificate of deposit, all else being equal. In support of this opinion, the Washington Post published a recent Alexis Leondis’ opinion piece about bank CDs that did not mince words:

However, CDs issued by virtually every bank in the United States carry FDIC insurance protection, which is backed by the full faith and credit of the United States government – a safeguard against loss that is a strong magnet for conservative and risk-averse investors. Attracting the attention (some might say “affection”) of those seeking safety, the FDIC is happy to prominently feature its feel-good, government-supported guarantee directly on its website.

However, as Alexis Leondis was quick to point out in her opinion piece, there is a lot more to the story that investors need to be aware of!

Understanding that careful consideration of their respective features is essential, Treasury bills (T-bills), short-term government bonds issued by the US Department of the Treasury, almost always carry virtually all of the benefits of CDs (time deposits offered by banks), with a number of additional features and economic benefits.

T-bills often emerge as the superior choice due to factors such as their exceptional liquidity, safety backed by an unlimited federal government guarantee, potential for better interest rates (consider T-bill rates today), and significant tax benefits. Let’s take a closer look at these four specific (and compelling!) reasons why owning a Treasury bill may be more advantageous than owning a certificate of deposit.

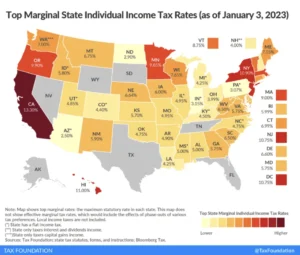

1. Tax benefits

Owning and investing in T-bills offers clear-cut tax benefits in comparison to CDs. The interest income from T-bills, while still taxable at the federal level, is exempt from state and local taxes, presenting a notable advantage for investors residing in states with moderate to high state and local income taxes.

This state and local tax exemption enhances the after-tax yield of T-bills, and helps to contribute to more efficient returns on investment (ROI). Conversely, the interest paid by CDs is fully taxable at the federal, state, and local level, potentially reducing net returns for investors. The tax-favored treatment of T-bill interest enhances their appeal as a tax-efficient investment, particularly for those seeking to optimize their returns while minimizing tax liabilities.

2. Liquidity and flexibility

Treasury bills are renowned for their exceptional liquidity in the financial markets, are easily bought and sold, and offer distinct liquidity advantages over CDs. As short-term bonds issued by the US Treasury, these instruments are actively traded in the secondary markets, enabling investors the ability to easily buy or sell them (if need be) at prevailing market prices, even before their maturity. This dynamic secondary market presence provides a high degree of liquidity, enabling investors to swiftly convert T-bills into cash without incurring significant transaction costs. On the other hand, while CDs offer some liquidity, they often come with significant penalties for early withdrawals, which can discourage investors from accessing their funds before the CD matures.

3. Safety and risk

Treasury bills hold a distinct advantage over certificates of deposit when considering safety and risk. T-bills are issued by the US Department of Treasury, and are backed by the full faith and credit of the US government without limits. This government guarantee makes T-bills virtually risk-free, as the likelihood of default is exceedingly low. This level of security provides investors with a safe haven for their capital, particularly during uncertain economic times.

Conversely, while CDs offered by banks also carry a degree of safety, they are subject to the credit risk of the issuing bank. Although many CDs are insured by the FDIC, these insurance limits are relatively low ($250,000 per depositor, per FDIC-insured bank, per ownership category), especially when compared to the limit-free US government insurance that T-bills provide. Additionally, if an investor owns a CD issued by a bank that fails, an investor would then have to go through the FDIC Proof of Claim process. Having the express and unlimited backing of the US government for T-bills provides a strong extra layer of assurance, making them a preferred choice for risk-averse investors seeking a reliable and secure investment option.

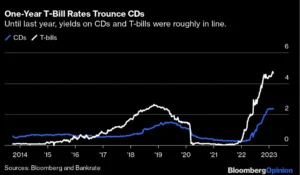

4. Market interest rates

T-bill yields are often as competitive, and oftentimes more competitive, than the interest rates offered on CDs with comparable maturities, especially during periods of economic uncertainty or when interest rates are low. T-bill rates today haven’t been this high since 2001!

T-bills frequently offer yields that are competitive with or even surpass the interest rates provided by CDs. This advantageous rate positioning stems from T-bills being issued by the U.S. government, effectively eliminating default risk and allowing investors to earn a return commensurate with the market’s risk-free rate.

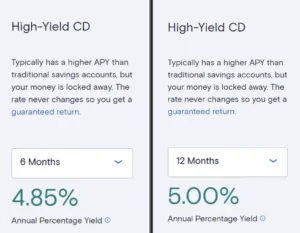

Here are the current bank CD best rates from Marcus, a leading online bank, for six and twelve-month CDs (as of 8.30.2023):

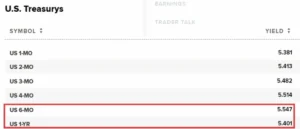

Versus T-bill rates today as listed on CNBC’s website (as of 8.30.2023):

When it comes to safe-harbor investments, don’t let the slick marketing of your local bank, or even the FDIC, influence your objective decision on how and where to invest your conservative money. T-bills offer an array of advantages over CDs, positioning them as the superior choice, especially for investors looking for security, liquidity, competitive returns, and tax benefits!

You’re Invited! Towerpoint Wealth’s 2023 Client Appreciation Gala

We’re thrilled to invite you to our big upcoming annual client appreciation gala! This is our way of saying “Thank You” for your incredible partnership, trust, and confidence in us. Without you, Towerpoint Wealth would not exist, and our mutual success wouldn’t be possible.

So it’s time to roll out the red carpet and raise a toast to you!

Mark your calendar for an unforgettable evening of gratitude, camaraderie, and festivities at our upcoming Out of This World client appreciation gala at MOSAC, Sacramento’s newest museum of science and curiosity!