Michael Douglas won critical acclaim and the 1988 Academy Award for Best Actor in a Leading Role for playing him in Oliver Stone’s Wall Street. And whether you love or despise the notorious Gordon Gekko, the ambitious, manipulative, charismatic, and cold-blooded character became an icon in popular culture, representing the archetype of the ruthless and GREEDY corporate villain.

Seeing how despicable he is, is it possible that Gekko on some level may actually be correct? We can confidently state that it sure doesn’t feel right, or virtuous, or moral, to say that greed is good, so how is is possible that it actually might be?

“Of course, none of us are greedy. It’s only the other fellow who’s greedy.”

Below is a thoughtful, provocative, and intellectual two minute conversation between the great economist, Milton Friedman, and the great American media personality, Phil Donahue, discussing the drawbacks and merits of greed. Donahue’s questions are excellent, and agree or disagree with Friedan’s perspective, the dialogue challenges the conventional viewpoint that greed is bad.

The clip has some excellent Friedman quotes:

- “Tell me, is there some society you know that doesn’t run on greed? Do you think Russia doesn’t run on greed? Do you think China doesn’t run on greed?”

- “The world runs on individuals pursuing their separate interests.”

- “In the only cases in which the masses have escaped from the kind of grinding poverty you’re talking about, the only cases in recorded history, are where they have had capitalism and largely free trade.”

- “Is it true that political self-interest is nobler somehow than economic self-interest?”

- “And just tell me: Where in the world do you find these angels who are going to organize society for us?”

- “There is no alternative way so far discovered of improving the lot of people than the productivity of free enterprise.”

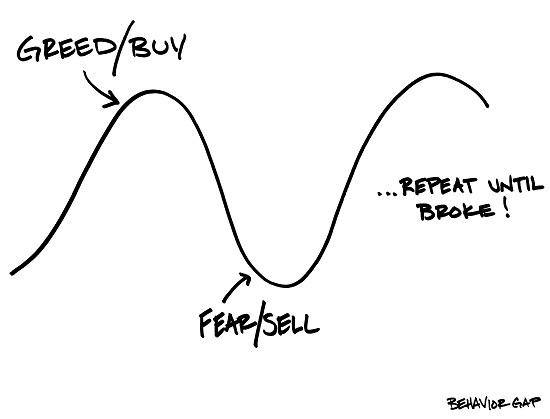

We believe that Friedman is a giant in the world of economics because he does not just work within theories in a vacuum sitting in some office, but instead directly accounts for human nature and behavior. Warren Buffett holds very similar views about human behavior and investor sentiment:

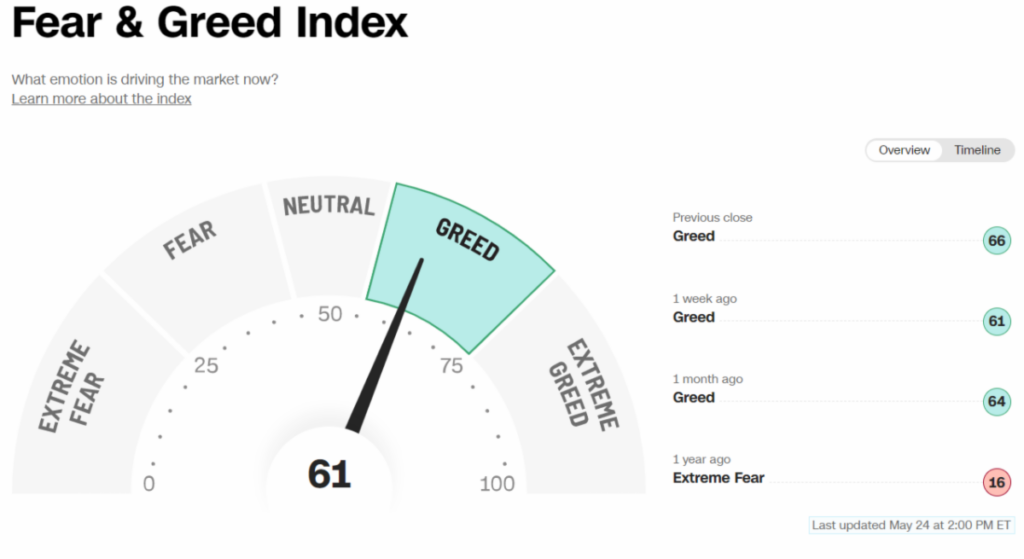

Greed (and its counterpart, fear) is so widely recognized as an influencing factor in the financial and investment markets that CNN created an index for it:

Everybody has an incentive to maximize their lot in life. And certainly while unchecked greed can lead to unethical behavior and harm others, a certain level of ambition…greed…can be a powerful motivator for individuals to work harder, take risks, and push beyond their comfort zones. It fuels a desire for personal advancement and success, inspiring individuals to set ambitious goals and make determined efforts to achieve them. This drive and motivation can lead to personal growth, innovation, and the accomplishment of remarkable feats.

Greed, when harnessed within the framework of a competitive market, can stimulate economic growth and foster innovation. Entrepreneurs driven by a desire for wealth and success often start businesses and develop new products, services, and technologies to satisfy market demand and to improve society as a whole. This entrepreneurial spirit can create job opportunities, drive technological advancements, and enhance overall productivity, benefiting society as a whole.

Fully recognizing the importance of striking a balance between ambition (dare we say greed), and ethical considerations, and that the pursuit of wealth aligns with integrity and social responsibility, at Towerpoint Wealth we also fully understand Gordon Gekko’s point, and work to recognize, capitalize on, and leverage how greed, as a natural human emotion, can oftentimes create opportunities for our clients as we help them develop and execute on a disciplined plan to build and protect their wealth.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients save and invest for retirement while minimizing taxes.

Big TPW news!

Last weekend our Director of Tax and Financial Planning, Steve Pitchford, tied the knot to his beautiful fiancée, Katie.

The couple had an exquisite wedding at Rancho Roble Vineyards, surrounded by friends, family, and of course the whole TPW family!

Join us in wishing the newlyweds a very happy and prosperous life together! Congratulations Steve and Katie!

|  |

Thinking about getting married? Currently a newlywed?

Click HERE to message us with any questions or concerns you may have

about your new financial circumstances.

Click the images below to get caught up on some of our most recent trending moments at Towerpoint Wealth you might have missed!

Is crypto worth investing in?

Did you see Joseph Eschleman, CIMA® on ABC10 last week??!!

Lora Painter interviewed our President about “The Truth about Crypto” and how it can be considered as a potentially complementary part of a properly diversified investment portfolio.

Thanks for having us back ABC10 – we love informing viewers about money and spreading the “financial gospel.” Click the video above and learn more about crypto currency.

Click HERE to browse TPW’s library of other wealth-building and wealth-protecting educational videos.

One of our favorite wealth-building and wealth-protecting quotes of all time, from legendary investing great Peter Lynch.

Pooled Income Fund

A pooled income fund (PIF) is a type of charitable giving vehicle that allows donors to make contributions to a common fund, which is then invested by the fund manager. The income generated from the investments is distributed to the individual donor(s) based on their share of the fund. Pooled income funds are often established by nonprofit organizations, such as universities or foundations, to provide a structured and efficient way for individuals to support charitable causes, but are oftentimes established by “regular” retail investors as well.

One of the key benefits of pooled income funds is the ability to receive income for life. When donors contribute to a pooled income fund, they typically receive a regular income stream from the fund's investments for the remainder of their lives. This can be particularly advantageous for individuals who want to support charitable organizations while also ensuring a steady income during retirement.

Additionally, donors may receive a charitable income tax deduction for their contributions to the pooled income fund, which can provide additional tax and economic benefits.

Overall, pooled income funds offer a unique opportunity for individuals to combine their philanthropic goals with financial planning. By contributing to a common fund and receiving income for life, donors can make a lasting impact on charitable causes while also enjoying the financial security of regular lifetime income.

We encourage you to click the image below to learn more, and to contact us to discuss whether considering a pooled income fund would be a worthwhile tool to utilize within your current wealth management plan.

Have questions or concerns about filing your 2022 tax return?

We welcome connecting with you and are happy to help. Click the banner below to message Steve Pitchford, Steve Pitchford, Director of Tax and Financial Planning.

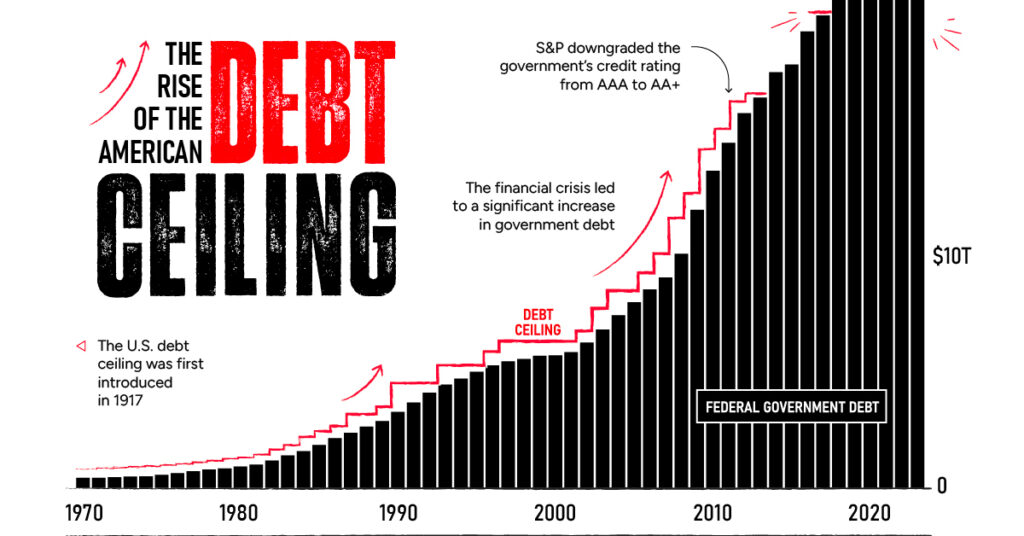

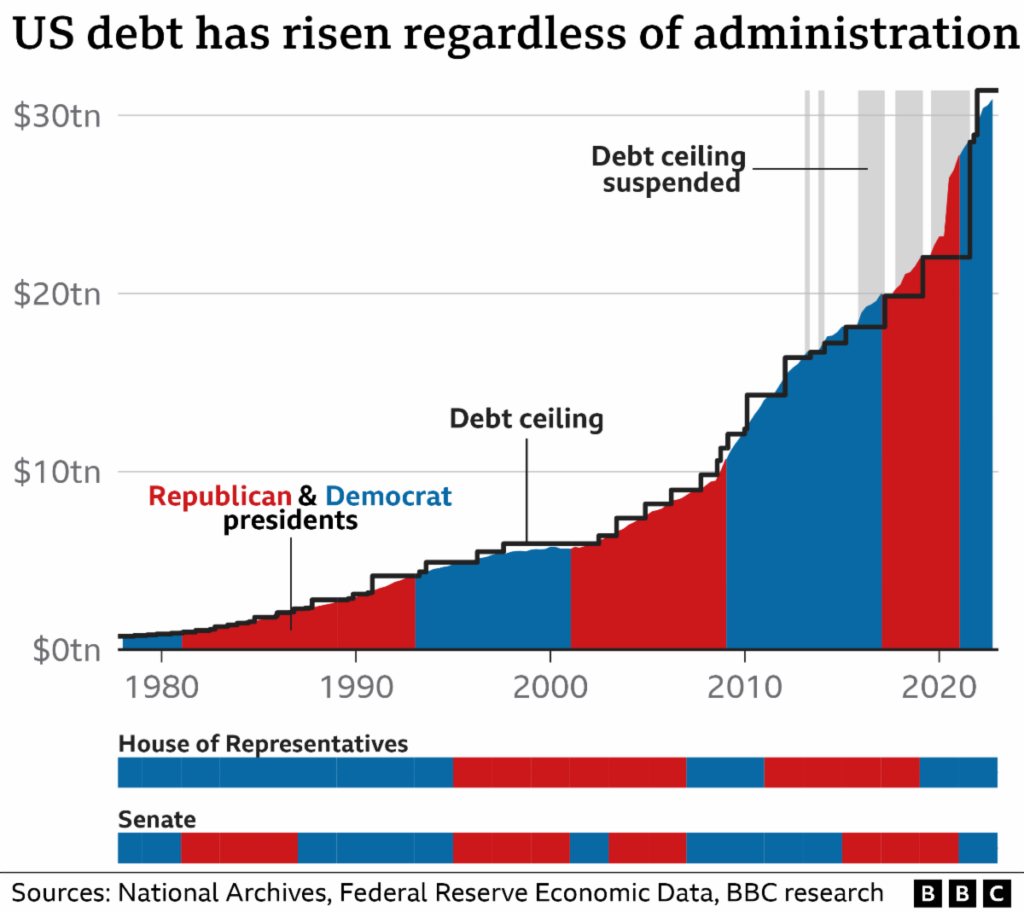

The debt ceiling

While we remain confident that a debt ceiling deal will be reached, how (un)sustainable is the overall level of our borrowing as a country?

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to contact us at any time, or call or email us (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

If you want to feel confident in your retirement planning decisions, reach out to us and schedule a 20-minute “Ask Anything” call - we are confident it will be time well spent!

At Towerpoint Wealth, we help you remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement. If you are worried about how the 2024 election could affect your financial future, we welcome talking further with you about your personal situation.

Worried about whether you have enough set aside to retire? Check out our “Retiring with 2 Million Dollars” guide to learn five specific steps you can take immediately to work to grow your net worth!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X