Buying, selling, and owning individual stocks can be fun for many reasons. Doing so can also be dangerous, and fraught with peril. All of this begs the question – do you want your investing to be dangerous and fun?

Buying, selling, and owning individual stocks can also feel akin to riding a roller coaster – thrilling highs, gut wrenching lows, and big emotional swings. Some might call it investing, others, gambling. What do we believe at Towerpoint Wealth about this important and oftentimes polarizing issue?

Do you believe that successfully picking individual stocks is based on skill, experience, research, guts, and guile? Or do you believe that luck may play a bigger role than many are willing to admit?

The Peril of Buying and Selling Individual Stocks

Even today, with everything we know about the importance of diversification, disciplined money management, and investment risk management, buying, selling, owning, and trading individual stocks is oftentimes still glorified.

There are the bragging rights, the illusion of control, and the emotional rush of picking a winner, watching it climb, and feeling smart.

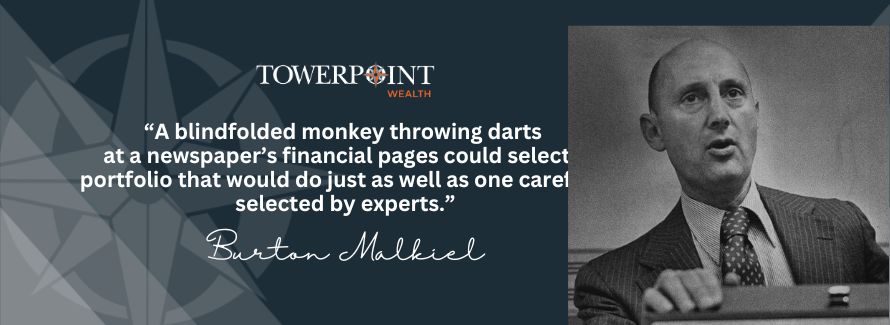

However, buying and selling individual stocks is also perilous. It can be difficult to discount Burton Malkiel’s random walk hypothesis (the theory that stock prices move randomly), especially when animals have shown a history of doing better at picking individual stocks than their “expert” human counterparts!

- A house cat named Orlando did a better job of picking stocks than a team of professional money managers in 2012.

- A chimpanzee in Russia outperformed 94% of the country’s investments funds in 2009.

- In 2009, lab rats taught to trade in foreign-exchange and commodity futures markets outperformed some of the world’s leading fund managers.

Additionally, in his classic 1973 book, A Random Walk Down Wall Street, Malkiel states:

While the examples cited above may not have perfectly adhered to the scientific method and are meant to be somewhat of a tongue-in-cheek illustration to suggest that successfully buying and selling stocks is extremely difficult, Malkiel’s quote and random walk hypothesis does support our belief that intelligently selecting, holding, and selling individual stocks is a perilous endeavor. Here are four reasons why:

Volatility and Market Whiplash

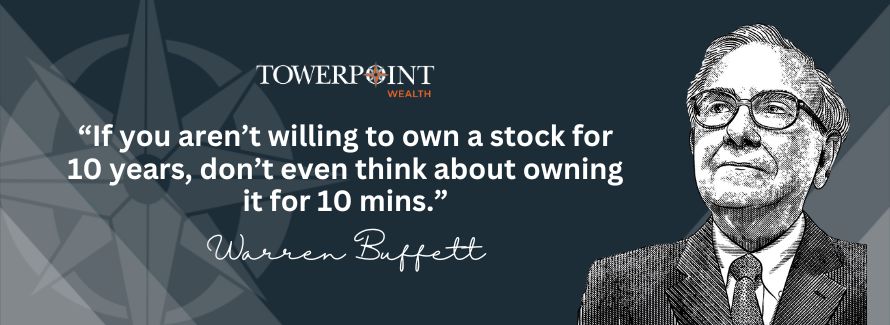

Stock prices are susceptible to fluctuations influenced by a myriad of different variables and factors, most of which are completely unpredictable. Like a bull in a rodeo, the price of an individual stock can move in sudden, bizarre, and outright delusionary directions, and stock prices can swing wildly in short periods.

Not surprisingly, one of our favorite Warren Buffett quotes here at Towerpoint Wealth sums this concept:

Market sentiment is fickle to say the least, as positive news can quickly catapult a stock to new highs, while negative developments can send it plummeting with equal force. Economic indicators, such as interest rate changes or employment figures, act as unseen currents beneath the market's surface, influencing the price of an individual stock in ways that even seasoned investors may find challenging to predict. The result is a landscape where calm seas can quickly transform into stormy waters, putting the stability of individual stock portfolios to the test.

Company-Specific Catstrophes and Lack of Diversification

Ever heard the phrase "putting all your eggs in one basket"? With individual stock ownership, that basket is your chosen company. If it falters – be it a scandal, management mishap, earnings miss, or a product flop – your eggs (read: investments) could end up scrambled. Vulnerabilities in a company’s business model are exposed quickly, and changes in the competitive landscape and regulatory environment make owning individual stocks quite challenging. And a single negative event, whether it be a company-specific issue or a broader market or economic shock, can have a disproportionately severe impact when holding specific individual stocks.

Many investors do not have a plan when they add individual stocks to their portfolio, and instead do so for the wrong reasons: they heard a good story, read an interesting article, received a tip from a smart friend, or were given a “recommendation” from a broker. As Joel Greenblatt said:

Emotional Turmoil

Individual stocks can turn you into an emotional yo-yo. The emotional turmoil is not merely a byproduct, but instead an integral part of the individual stock ownership experience. The psychological seesaw involves navigating the peaks of euphoria when your stocks are flourishing, and enduring the valleys of despair during market and price downturns. It is important to internalize and remind yourself:

Staying the course may sound easy, but doing so amid this emotional turbulence requires nerves of steel and a disciplined mindset to avoid succumbing to impulsive decisions driven by fear or exuberance. When buying, selling, and owning individual stocks, emotional fortitude is as crucial as financial acumen. These investors are navigating unpredictable terrain where sentiment can be as influential as market fundamentals.

Warren Buffett, an often-cited expert in more than a few of our earlier Trending Today newsletters, does an excellent job of highlighting one of the main emotional reasons people like buying and owning individual stocks:

Buying Is Fun, Selling Is Not – What’s Your Exit Strategy?

A great company doesn’t mean a great stock. You have to buy the stocks of great companies, but at the right price. Good luck doing so consistently! Additionally, you have to know when to get out. Having an exit strategy is essential, and oftentimes completely overlooked by inexperienced individual stock investors.

Buying individual stocks is exciting, and laced with the optimism of potential gains. However, breaking up is a different story, as emotions can quicky get involved – you don’t want to hold onto a sinking ship, hoping for a miraculous rebound, while ignoring the lifeboats passing by.

Selling also requires admitting you might have been wrong, and humility isn't everyone's strong suit. Timing the exit is difficult, akin to attempting to catch a falling knife, and the market doesn't care about your feelings – it operates on its own schedule.

Warren Buffett says, “A stock doesn’t know that you own it.”

Exiting individual stocks is way more difficult than buying them, and demands a level of discipline that buying often conveniently overlooks.

So do you still want to invest in individual stocks? While potentially rewarding, this is not for the faint-hearted, and it comes with a multitude of risks. And while the allure and thrill of owning individual stocks is undeniable, doing so can oftentimes also be reckless. Are you investing for fun and pleasure, or to intelligently build, grow, and protect your net worth? This is an important distinction, oftentimes correlated with why investors consider owning individual stocks.

Would you like to discuss your own situation further with us, or learn more about our wealth management philosophy and how we help clients build and protect their wealth? We encourage you to schedule an initial 20-minute discovery call with us, as we welcome learning more about you and your unique circumstances.

Towerpoint Wealth Tours Salesforce Building in SF

The world of wealth management is complex and nuanced, as is the technology needed to effectively run a wealth management firm. Fortunately for us and for our clients, we utilize Salesforce as our operational backbone, helping us efficiently and intelligently manage virtually every area of our company as we strive for exceptional client satisfaction and service.

Just last week, our Joseph Eschleman, and Partner, Wealth Advisor, Jonathan LaTurner, visited Dodge Williams at the Salesforce Tower in San Francisco. Understanding the pace of change and innovation in the artificial intelligence and CRM industries, it is essential that we ensure that our partnership is sound and that our Salesforce instance is operating crisply.

Not just a repository for data, Salesforce is truly the “invisible hand” behind the TPW operation, and we are happy to leverage it in amplifying our ability to understand, anticipate, and exceed our clients’ needs and expectations.

What is happening with the Towerpoint Wealth family? Click the banner below to find out!

Understanding the world of investing and wealth-building is filled with opportunity, not only for growth but also for errors, at Towerpoint Wealth we believe our role is to raise awareness and help our clients and friends avoid investing mistakes as they work to build and grow their net worth and move toward a more prosperous financial future.

To that end, we’ve created a special four-part educational video series, focusing on 20 of the most common investing mistakes to watch out for, as identified by the CFA Institute.

Are you aware of, or even making, any of these common investing mistakes?

Find out more – click the thumbnail image below to begin watching our special educational videos!

We are hopeful you will enjoy these educational videos, and encourage you to share this valuable information / share the video links with any colleagues or friends who would benefit from watching them.

CLICK HERE or the thumbnail image below for an excellent resource from Vanguard, discussing Roth IRA conversions. Is an end-of-year 2023 Roth IRA conversion right for you? After you’ve assessed your current and future income tax brackets, the below guide should help you better understand your options.

Have questions about your upcoming 2023 tax return?

Would you like to review an old tax return for missed opportunities?

Click the banner below to message Steve Pitchford, Steve Pitchford, Certified Financial Planner.

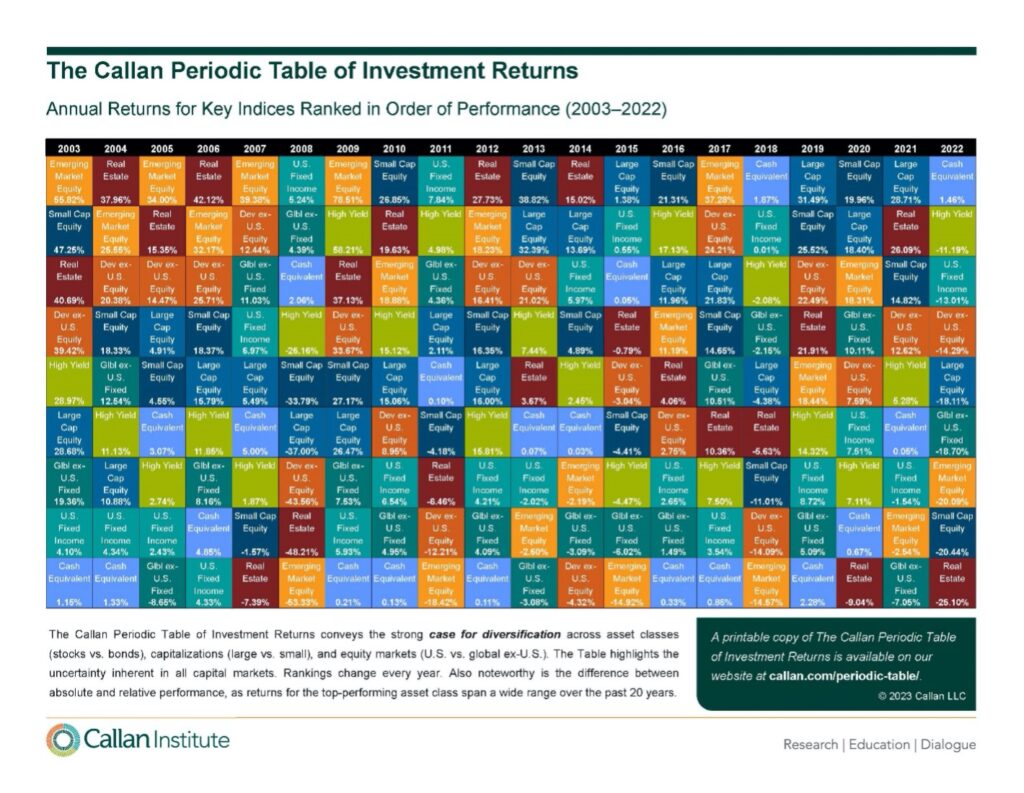

The Callan Periodic Table of Investment Returns

The Callan Periodic Table of Investment Returns conveys the strong case for diversification across asset classes (stocks vs. bonds vs. cash), market capitalizations (large vs. small), and global equity markets (U.S. vs. global ex-U.S.).

The Table highlights the uncertainty and change in popularity inherent in all areas of investing. Rankings change every year. Also noteworthy is the difference between absolute and relative performance, as returns for the top-performing asset class span a wide range over the past 20 years.

In light of how unsettled the economy and markets are, are you concerned or worried about the bonds in your portfolio, and/or the overall level of risk you are taking in your portfolio? Message us to discuss your circumstances.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to contact us at any time, or call or email us (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast