Please click below for a special one minute holiday message from all of us at Towerpoint Wealth!

While we’re wishing for peace, and working to help you coordinate all of your financial affairs during this holiday season, US lawmakers are currently considering major tax reform—again. Put differently, we can’t help wondering about the Secure Act 2.0 status.

The massive $1.7 trillion year-end omnibus spending bill could be voted on in the coming days, funding our government through September of 2023. Putting the sheer size of this legislation in physical perspective (and love him or hate him), here is a Tweet from Senator Rand Paul (R-KY) standing next to a photo of the 4,155 page bill:

Putting aside the very real possibility that the legislation could add another $500 billion to the $31 trillion US national debt, what is of particular interest to our clients, and therefore to us, is the Secure Act 2.0 status, a major component of this omnibus spending bill.

Secure 2.0 is bipartisan retirement savings legislation that is part of the sweeping $1.7 trillion omnibus spending bill, and is a package of proposed tax reforms and changes to help Americans save and invest more for retirement.

Why do we care at Towerpoint Wealth about the Secure Act 2.0 status? Put simply, we believe that any changes in law that help Americans save and invest for retirement are positive changes!

While there are more than 100 provisions in the Secure 2.0, here are six important highlights regarding how the Secure Act 2.0 may help and benefit YOU, if passed:

1. Increased age for retirement plan required minimum distributions (RMDs)

Currently, you must begin taking RMDs from your retirement accounts at age 72. Secure 2.0 would increase this RMD age to 73 as of January 1 of 2023, and to 75 over the next ten years.

2. Bigger “catch up” contribution limits for people ages 60 to 63

Currently, you can put an extra $6,500 annually into your 401(k) once you hit age 50. Secure 2.0 would increase that limit to $10,000 (or 50% more than the regular catch up amount) starting in 2025 for retirement plan savers ages 60 to 63.

3. Emergency savings accounts

One provision of Secure 2.0 would let employees withdraw up to $1,000/year from retirement accounts for emergency expenses without having to pay the typical 10% federal tax penalty for pre age-59 ½ withdrawals.

Companies could also let workers set up an emergency savings account through automatic payroll deductions, up to $2,500/year.

Contributions to this account would be treated like a Roth account – they'd be after-tax contributions and their growth would be tax free. This could create a Roth-type account for employees to save in their retirement accounts to meet emergency expenses in the future. Leftover money would stay in the account year-to-year and could be rolled over to a Roth IRA in the future.

4. Matching contributions for student debt payments

Beginning in 2024, student loan payments would count as retirement contributions in workplace retirement plans such as 401(k), 403(b), 457(b), and SIMPLE-IRA accounts, and would qualify student debtors for a matching company contribution into their retirement account while paying their student loans.

5. Saver’s Match

Workers with incomes up to $71,000 will receive a matching contribution from the government when they save inside of an IRA and/or workplace retirement plan.

In its current form, the Saver’s Credit allows individuals to receive up to 50 percent of their retirement savings contribution (capped at $2,000), in the form of a nonrefundable tax credit. Put differently, they receive the money back, up to $1,000, if they owe at least that much in taxes. If they don’t owe any taxes, they don’t receive the benefit.

However, starting in 2027, instead of the nonrefundable tax credit (paid in cash as part of a tax refund), taxpayers will receive a federal matching contribution that must be deposited into their IRA or retirement plan.

6. Broadening uses for “unspent” tax-free 529 college savings money

Tax and penalty-free rollovers of up to $35,000 from 529 college savings accounts to Roth IRAs would be allowed, as long as the 529 has been open for at least 15 years.

Like those big holiday meals, this new legislation sure is a lot to digest.

To be clear, the $1.7 trillion omnibus spending bill is very controversial, and may or may not be passed by Congress. However, if it does pass, President Biden is expected to sign it into law, making the Secure Act 2.0 status no longer a question, but reality.

Have questions or concerns? Message us to share them, and let us know you’re interested in learning more.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients save and invest for retirement while minimizing taxes.

What do falling off a bike, the movie Elf, baking calzone, BB guns and broken windows, homemade chocolate pie, why Santa Claus doesn’t “do” Mexico, and a 110 lb. rottweiler have in common? Click the thumbnail image below to find out!

We hope you get a kick out of our video, where the one consistent theme amongst everyone at TPW was spending time with family.

Don’t forget to have a good laugh at the TPW grinch at the 2:42 mark, and most importantly, we hope that you have a peaceful, warm, and joyous holiday season.

Here are some of our top trending moments at Towerpoint you might have missed on our social platforms.

Click the images below!

What else is happening with the Towerpoint Wealth family?

We were all very fortunate to spend some quality fun time together earlier this month, connecting for our 2022 Towerpoint Wealth holiday party!

Surrounded by our close friends and family, we gave thanks for another year of blessings and good fortune as we enjoyed an evening toasting our clients and our TPW family.

A special thank you to the wonderful team at Mulvaney’s B&L for the amazing food and great service, and to Patrick Mulvaney for his cameo appearance!

As you and your family continue with your holiday festivities, we want to express our gratitude for your confidence and trust in our planning, counsel, discipline, and service, and wish everyone a prosperous 2023 as well!

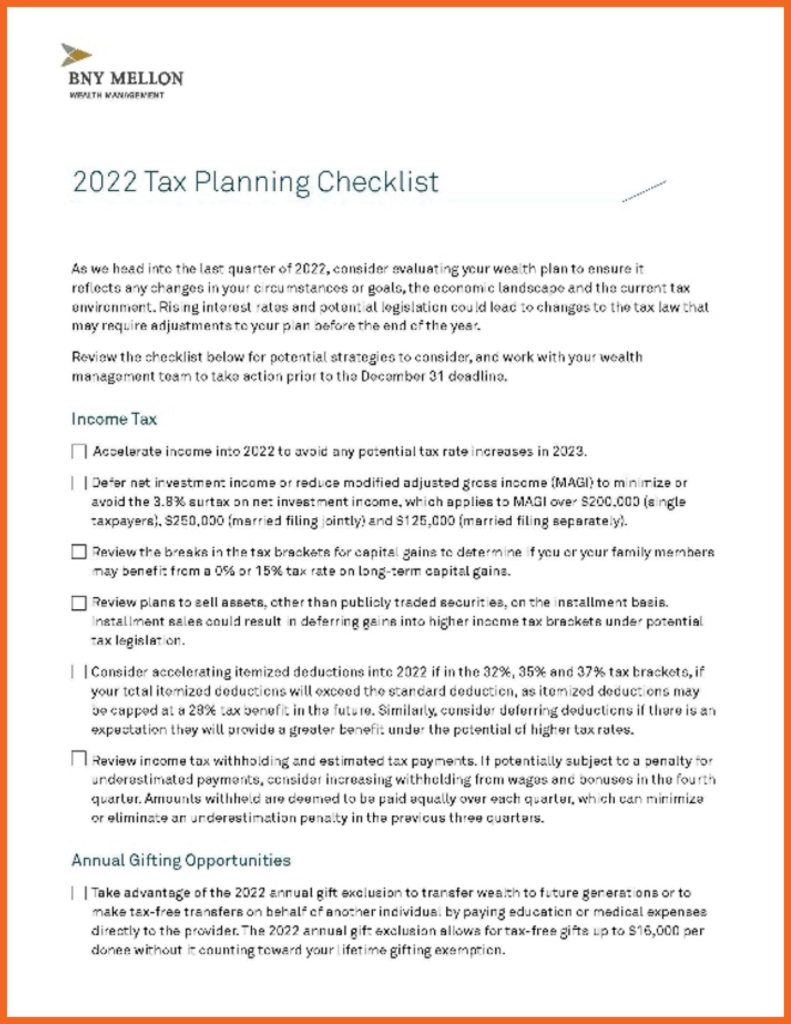

As 2023 quickly approaches, it is essential that your overall financial, investment, and retirement plan and strategy is evaluated for year-end tax saving and tax minimization opportunities. Personal income tax situations constantly change, and we believe that tax law changes in 2023 are inevitable – two baseline reasons that highlight the importance of proactive tax planning prior to December 31.

The 2022 Tax Planning Checklist found below, courtesy of our friends at BNY Mellon, does an excellent job of outlining potential tax minimization strategies to consider. Get on it before the ball drops in Times Square, and be sure you have done everything you can to reduce your obligation to Uncle Sam this year!

Have more questions? Contact us or click below to message our Director of Tax and Financial Planning, Steve Pitchford, to request a complimentary analysis.

Have you proactively considered end of year strategies to REDUCE your 2022 income taxes?

Useful and interesting content we’ve read over the past two weeks:

1. The Quiet Disappearance of the Safe Deposit Box

the Hustle – 12.2.2022

Once revered as the safest way to store physical valuables, safe deposit boxes are now being phased out by major banks. The move is already starting to backfire.

2. Surging Retail Theft Could Force WalMart to Close Stores and Raise Prices, CEO Doug McMillon Warns

NY Post – 12.7.2022

A gesture towards closing stores is part of a retail industry effort to highlight dollar increases in “shrinkage” or inventory lost to thieves, although national data suggests shrinkage has not risen as a percentage of revenue in recent years.

3. Thousands Wait at US-Mexico Border, Awaiting Ruling on Title 42 Asylum Limits

Associated Press – 12.21.2022

Migrants along the U.S. border with Mexico crowded into shelters Wednesday as they waited for the Supreme Court to rule on whether and when to lift pandemic-era restrictions that have prevented many from seeking asylum.

The limits on border crossings had been set to expire Wednesday before conservative-leaning states sought the top court’s help to keep them in place. The Biden administration asked the court to lift the restrictions, but not before Christmas.

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

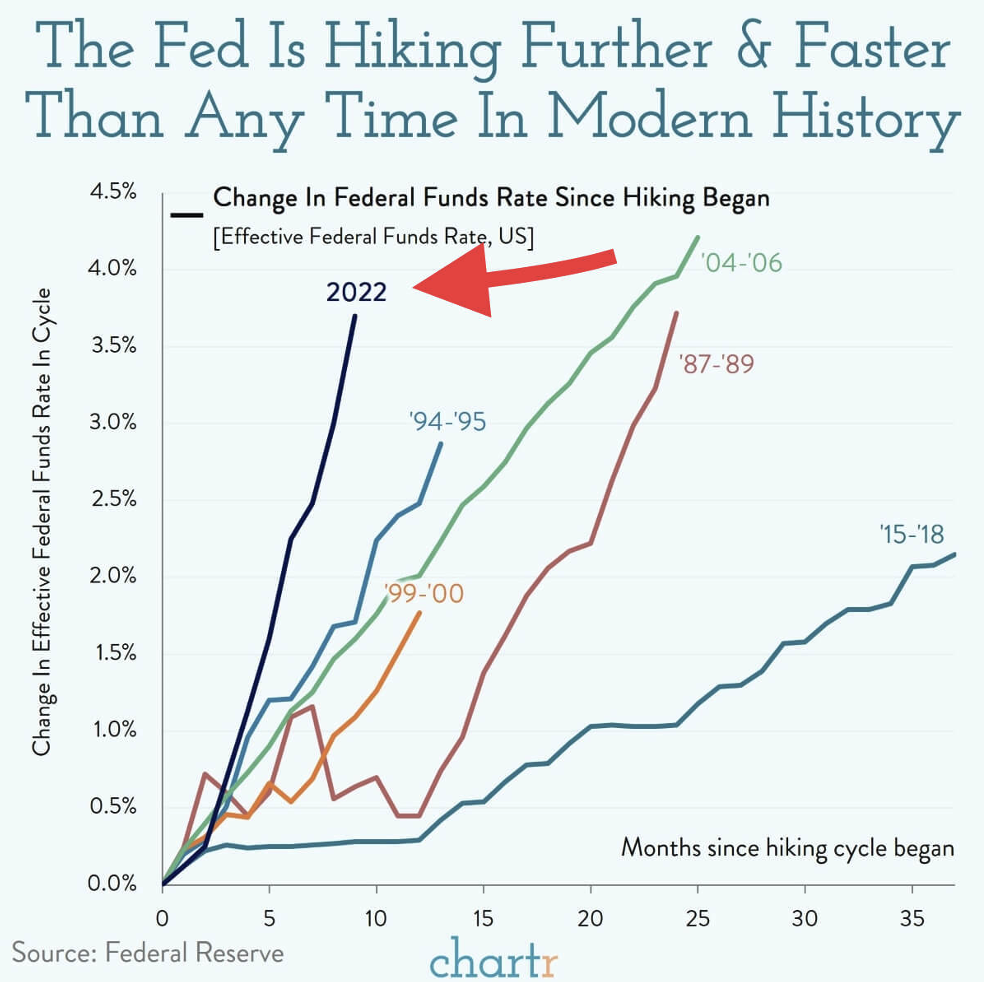

We all know that the US government (in this case, the US Federal Reserve) is aggressively increasing interest rates to combat the rampant inflation we have experienced throughout 2022, but this fast, and this quickly?

For borrowers, this is bad news. However, for savers and lenders (if you own bonds, or have a savings or money market account, this means you!), this is good news, as it generally means more money and interest income in your pocket.

Click here to send us a message

If you speak with someone who is concerned or

unsettled about their investments or advisor, we welcome talking with them.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

- Joseph Eschleman, Jonathan, Steve, Lori, Nathan, Michelle, and Luis

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity.

We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on YouTube

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on X

Click HERE to follow TPW Podcast : A Wealth of Knowledge