As our clocks struck midnight this past Saturday, advancing from 2022 into 2023, many investors were eager to turn the page on what was a grinding, unsettled, and very difficult year in the financial markets. The only good news that can be taken from the 2022 investor experience? Fortunately, past performance is no guarantee of future results!

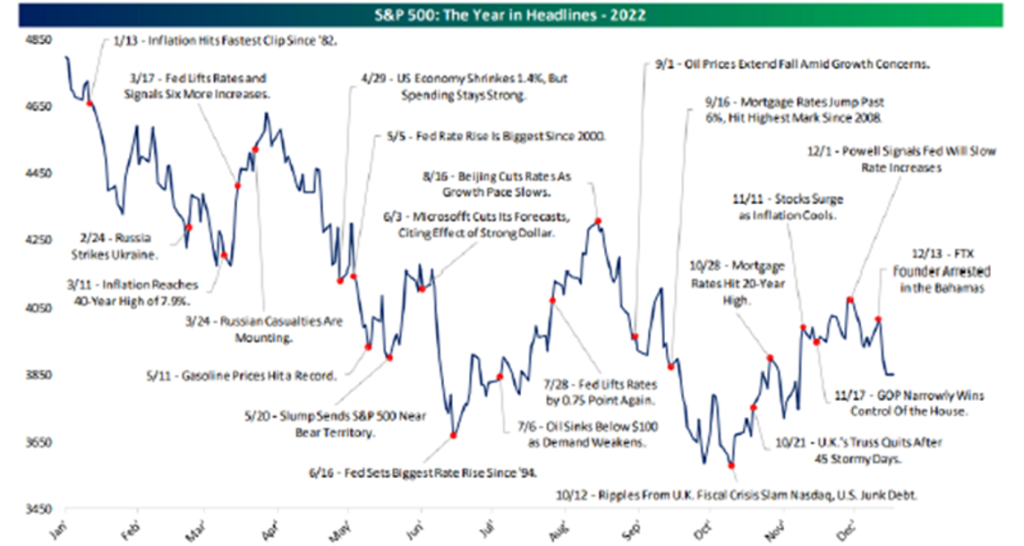

- Stocks, as represented by the S&P 500, finished 2022 down just shy of -20%:

- Bonds, typically the “Steady Eddies” of a properly diversified portfolio, did not fare much better, with 2022 being one of the worst years for bond returns in h The US Federal Reserve raised (“tightened”) its target short-term interest rate seven times to fight inflation, from 0.25% to 4.50%, representing an unprecedented pace of increases in such a short period of time for the 109-year-old central bank.

This interest rate tightening led to historically poor returns for bonds in 2022. Long-term US Treasuries were down -31.2%, and the Bloomberg US Aggregate Bond Index (the Agg), a broad measure of the overall bond market, had its worst year on record, down -13%.

Except for those holding cash, or commodities or energy stocks, 2022 was an awful year for the capital markets, one that virtually all of us would like to forget. This has caused many investors to ask – with 2022 as bad as it was, will 2023 be similar?

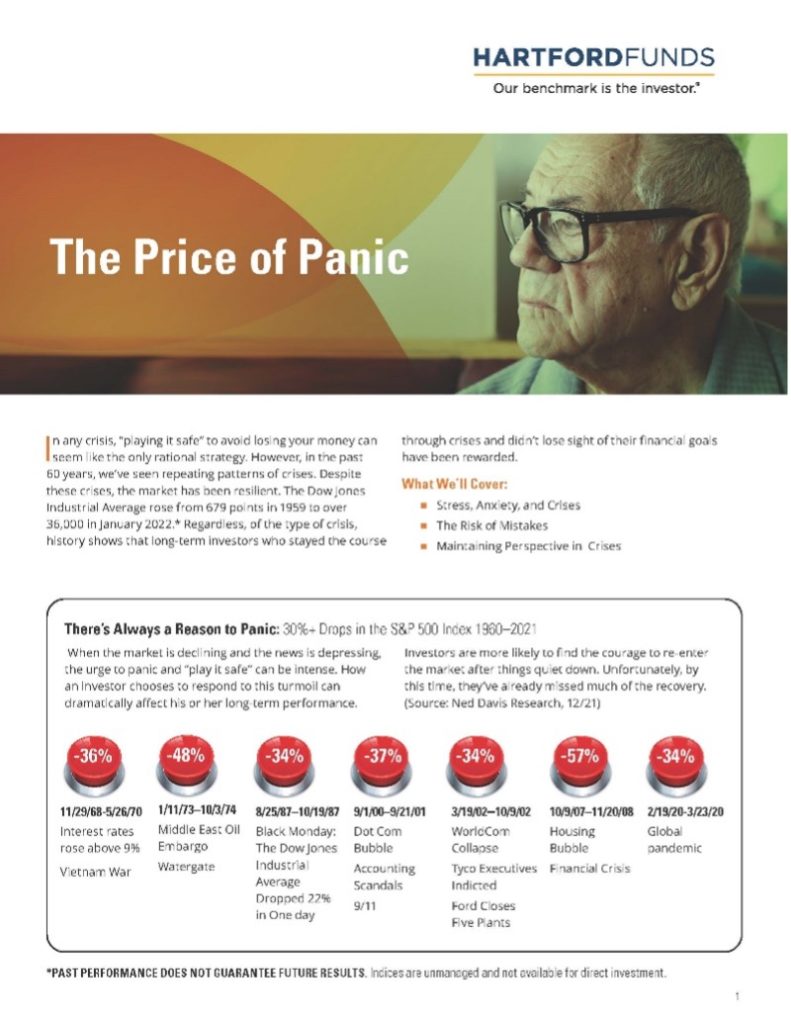

Below we will explore how recency bias can lead to poor and irrational financial and investment decision-making, oftentimes because investors FORGET that past performance is no guarantee of future results!

As we exit 2022, what were the major headlines for the year that drove this volatility?

Here at Towerpoint Wealth (TPW), we believe what’s past is prologue, and in light of the difficult year that investors had to endure in 2022, we are certain that many will exhibit recency bias when thinking about the future of their investments, portfolio, and overall status of their personal net worth.

We also believe that doing so is a mistake.

Is it reasonable to believe that 2022’s poor market performance repeats itself in 2023? We believe no. Does having recency bias oftentimes lead to short-sighted and poor financial planning and investment decision making? We believe yes. And while historical patterns are important, and will always shape how investors feel about the future of their portfolios and investments, our core TPW wealth management philosophy leads us to counsel and work with our clients to be disciplined, to remain level-headed, to have a plan, and to objectively execute on it.

The common investment disclaimer rings particularly true to us here at Towerpoint Wealth as we move into 2023: Past performance is no guarantee of future results.

Put more succinctly: We strongly encourage you to not fall prey to recency bias!

Lastly, there will always be the temptation to deviate from your plan, to not be disciplined, and to capitulate and sell to “stop the bleeding.” Much more often than not, these choices are strongly influenced by recency bias, and considered at the worst possible time – when prices are temporarily low. If you notice yourself feeling this way right now, we encourage you to reach out to us, and/or click the report found below.

Here’s to a productive and hopefully profitable 2023. We can’t wait to see what the new year has in store for all of us!

Have questions or concerns? Message us to share them,

and let us know you’re interested in learning more.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients save and invest for retirement while minimizing taxes.

Our TPW family continues to grow as we prepare for an exciting new year in 2023!

Just three short weeks ago, we happily welcomed our new Associate Wealth Advisor, Megan M. Miller, EA, to the firm.

We feel extremely fortunate to have this experienced, caring, talented, highly ethical, engaged, and organized professional joining the Towerpoint Wealth team, and encourage you to click the image below (and also hit that thumbs up button on YouTube!) to find out more about Megan. Hint – she’s awesome!

Here are some of our top trending moments at Towerpoint you might have missed on our social platforms.

Click the images below!

What else is happening with the Towerpoint Wealth family?

He is one of the most successful investors in the world for a reason - Warren Buffett is the epitome of value and disciplined investing!

Click the image above to watch an excellent video reel of Warren, riffing on his optimism about America, the importance of buying low (and also when people are scared), and why trying to predict the future is futile. A few excerpts:

“I bought stocks after 9/11.” | “I bought stocks in 1987 after the big crash and the fall.” | “The country’s not going to go away.” | “The country will grow in value over time.” | “Now… who gets it is another question!” | “It’s a terrible mistake to buy or sell stocks based on what you think business are going to do next month, even next year.”

Are you self-employed? Looking for opportunities to lower your taxable income while building personal net worth?

Traditional employees with W-2 income usually have an omnipresent income tax deduction available to them: Making traditional, pre-tax 401(k), 457, or 403(b) contributions.

Conversely, if you are self-employed, you are not an employee, and will not have a company-sponsored retirement plan to contribute to. However, all is certainly not lost if you are a sole proprietor, as there are a number of powerful self-employed retirement plan options available to you to reduce your taxable income while growing your portfolio and nest egg, arguably better than the traditional retirement plans offered to W-2 employees!

Click the image below to better understand the differences, advantages, and disadvantages of “crawling” via a

1.) SIMPLE-IRA, “walking” via a

2.) SEP-IRA, “running” via a

3.) OnePersonK or Solo 401(k), and “flying” via a

4.) personal defined benefit plan (DBP), as each type of account offers self-employed individuals a tremendous opportunity to save money on taxes and build wealth.

Are you self-employed, and would like to learn more about strategies still available to you to REDUCE your 2022 income taxes? Click below to begin a dialogue with Steve Pitchford, Director of Tax and Financial Planning.

Have more questions? Contact us or click below to message our Director of Tax and Financial Planning, Steve Pitchford, to request a complimentary analysis.

1. How SpaceX’s Starlink terminals first arrived in Ukraine

Quartz – 12.22.2022

Weeks before Russia invaded Ukraine, the US began scrambling to find satellite communications equipment that could keep the Ukrainian government connected to the rest of the world, new documents reveal.

Those efforts resulted in thousands of satellite-antenna terminals that connect to SpaceX’s Starlink broadband internet network being sent to Ukraine. They have proven vital to Ukraine’s war effort, but became a source of controversy for both SpaceX and the US over the service’s cost, and who is paying for it.

2. Lawmakers Say McCarthy Speaker Fight Portends Debt Ceiling Crisis

The Hill – 1.6.2023

The messy, drawn-out battle over electing the next Speaker is raising the danger of a debt limit crisis later this year, lawmakers in both parties warn.

Conservative rebels in the House are demanding that the next Speaker, whether it’s Rep. Kevin McCarthy (R-Calif.) or someone else, make a stand against passing a clean debt limit increase, which would set up a major fight with Senate Democrats and President Biden.

3. Freudenschaude (Freudenfreude)

Barry Ritholz, The Big Picture – 1.2.2023

As the new year begins, perhaps we would all be better off if we engaged in less Schadenfreude and more Freudenfreude. Let’s stop taking delight in other people’s misfortunes, and recognize that there but for the grace of God go I. Let’s recognize how rare and fragile success is, and revel in it – even if that means there is no increase in our bank accounts, our follower numbers, or our status among the neighbors.

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

For this edition of Trending Today, it’s not a chart, but a graphic.

“For success, attitude is equally important as ability.”

- Walter Scott

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

At Towerpoint Wealth, we help you remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement. If you are worried about how the 2024 election could affect your financial future, we welcome talking further with you about your personal situation.

Worried about whether you have enough set aside to retire? Check out our “Retiring with 2 Million Dollars” guide to learn five specific steps you can take immediately to work to grow your net worth!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X