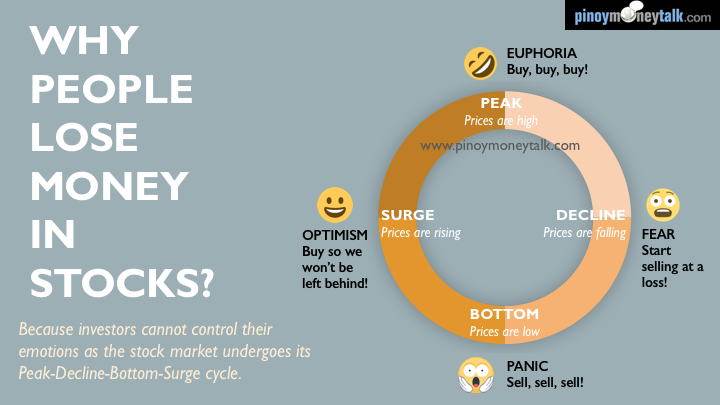

Wealth doesn't come from managing money. Almost without fail, wealth comes from managing the emotions behind the money.

Unquestionably, emotions hold an important (even essential) place in everyday life, and evolution has hard-wired them into our brain. As human beings, we get angry and fearful, we get joyful and sad, and we also can become greedy. Each of these emotions is innate and universal, and all are designed to ensure we demonstrate behavior with a high "survival value."

However, emotions can both connect and disconnect us, and what produces this high survival value in normal settings can quickly become our enemy when managing money and wealth.

In today's 24/7 news cycle, rational and considerate thought can often take a back seat to immediate judging and reactionary decision-making. When dealing with our finances, it can be extremely difficult to consistently make objective financial decisions, especially when we are innately wired to be fearful and greedy.

Recognizing our emotional financial weakness is important, as is working to overcome it. The word "disciplined" is one we oftentimes use when describing the planning and work we do with our clients at Towerpoint Wealth, and as many industry veterans will tell you, both "regular" retail investors and bigger institutional investors too often deviate from a well thought out plan. Instead, they oftentimes fall prey to making decisions based on "gut feeling," or said differently, based on their inherent emotional biases.

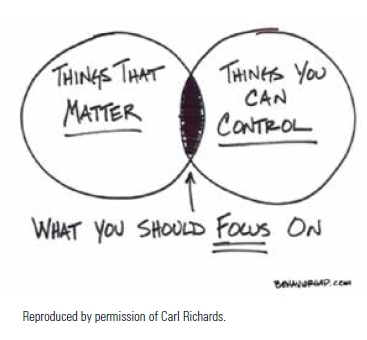

We know our clients at Towerpoint Wealth expect both professional stewardship and behavioral coaching from us as we act as their legal fiduciary. The importance of having a defined process when establishing a comprehensive wealth management methodology and plan, and then having the discipline to consistently follow it (most often during times of euphoria and panic), will have a huge influence over an investor's longer-term success in building and protecting net worth. Concurrently, this strongly enhances one's financial security and peace-of-mind, a virtually universal goal of investors. Helping to take emotions out of our financial planning and decision-making is essential. At Towerpoint Wealth, our goal with each of our clients is to recognize what is important, understand what we can control, and then focus our time, planning, and resources accordingly.

Put simply, we have your back.

TPW CLIENT UPDATE - Schwab Account Security Enhancement

In the ever-evolving environment of cybercrime, we continue to be vigilant when it comes to client data. That means investing in technology designed to protect our clients, while at the same time training our team to also be highly attentive.

Cybersecurity will always be one of our top priorities, and we recommend you take action right now to improve the protection of your accounts held at our custodian, Charles Schwab, by doing the following:

- Initiate two-step ("multi-factor") verification. Enhanced authentication adds a layer of security to your Schwab login IDs and passwords. You can sign up for this security enhancement by logging in at schwab.com/Securitycenter and selecting 'Manage Two-step Verification'

- Review the Protecting Your Identity, Data, and Assetspresentation found below

Towerpoint Wealth - First Annual Retreat A Hit!

The Towerpoint Wealth family enjoyed bonding at our first annual TPW Retreat last Friday and Saturday morning. We had breakfast together at Awful Annie's in Auburn. We hiked the Donner Summit Abandoned Railroad train tunnels together. We convened at Steve Pitchford's cabin to discuss the current and future state of affairs at Towerpoint Wealth together. We enjoyed dinner at Cottonwood Restaurant in Truckee together, and breakfast together the next morning, prepared by our own partner and wealth advisor, Jonathan LaTurner.

Operative word - together! It was truly a fun, productive, and memorable 24 hours, and we all look forward to the second annual TPW Retreat next year.

Click HERE to see a few additional photos!

Trending Today

In addition to TPW family bonding, a number of trending and notable events occurred over the past two weeks:

- 16-year-old activist Greta Thunberg leads largest climate protest in history

- Thousands attend mostly peaceful Area 51 events in Nevada desert

- Antonio Brown released by the New England Patriots after rape and sexual assault accusations

- 2019 Emmys

- Cokie Roberts, legendary journalist and one of NPR's "founding mothers," dead at 75

- Demi Moore releases Inside Out, a controversial tell-all memoir

- UN General Assembly 2019

- A whistleblower's complaint about President Trump's communications with Ukraine is declassified, setting off major controversy and formal impeachment proceedings

Lastly, please take three or four minutes to review the curated content found below, highlighted by:

- President Joseph Eschleman attended the Amplifying Your Value workshop, learning best practices for articulating and communicating the value we bring to our clients and preferred network partners, and how we are differentiating ourselves, adding value to our clients lives, and continually enhancing our suite of wealth management services and client service objectives.

- An interesting article discussing why the current level of U.S. Federal debt may not be as problematic as is commonly believed.

- The Hopper app, which helps you save up to 40% by using advanced data science to predict the future of airfare and hotel prices.

As always, we encourage you to reach out to us (info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely complicated place. We are here for you, and look forward to connecting with, helping, and being a direct, fully independent, and objective expert financial resource for you.