“Everybody’s doing something. We’ll do nothing!”

- George Costanza, “The Pitch”, Seinfeld, Season 4, Episode 3

Holding cash in your investment portfolio, aka not investing it, is akin to “doing nothing.” Historical arguments against holding cash in an investment portfolio cite that it is boring and unproductive to do so, and an extremely defensive position to take.

However, considering the afflictions facing today’s financial markets, could holding cash be just what the doctor ordered?

Depending on your unique financial plan and investment strategy — and the current and expected state of the economy and financial markets — doing nothing could be a sound strategy or a foolish one that, in the long term, will be detrimental to the health of your nest egg.

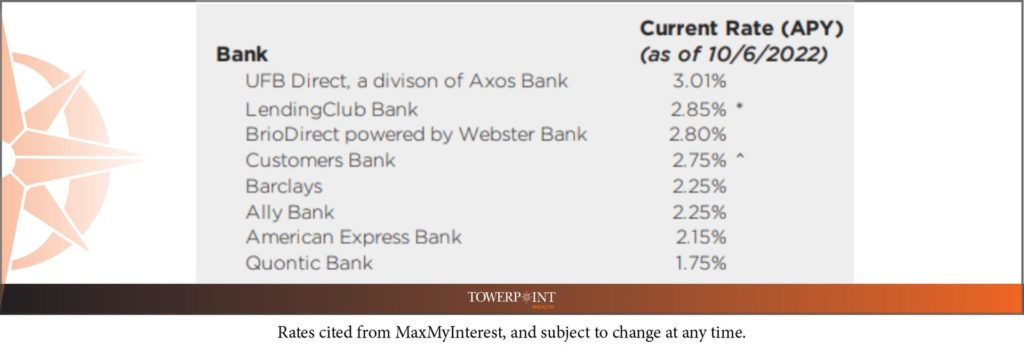

It was only a little more than three years ago when we wrote about the possibility of banks paying negative interest rates on savings and money market accounts. Today, the economic and market environment is certainly quite different:

Arguments have historically been made that holding cash in an investment portfolio is boring, unproductive, and extremely defensive.

At Towerpoint Wealth, we have always believed that having a small allocation to cash – and cash’s cousin, cash alternatives – within a properly diversified portfolio is appropriate, for three main reasons:

- Holding cash provides stability and insulation to a portfolio during times of market weakness.

- Maintaining a small allocation to cash protects an investor against having to sell other investments at an inopportune time if an unexpected withdrawal need arises.

- Cash acts as “dry powder” during a time of market weakness, giving investors the ability to buy low when prices are temporarily low, without having to sell other securities in their portfolio.

And now that interest rates have quickly moved up in 2022, and are expected to increase even further before the year is out, holding cash balances that are relatively larger is not as unproductive as it was even a few years ago.

Do you currently have cash in a checking account, savings account, money market account, or as part of your investment portfolio? Is it too much? Not enough? Is it working as productively as it can be for you?

Let’s talk – message us to schedule a no-strings-attached initial conversation.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients build and protect their net worth

Here are some of our top trending moments at Towerpoint you might have missed on our social platforms.

Click the images below!

What else is happening with the Towerpoint Wealth family?

Are you really a long term investor?

Or do you say you are, but sometimes tempted to behave more like a trader or a gambler, and fail to apply long term investment strategies to your portfolio?

Watch our President, Joseph F. Eschleman, CIMA®, discuss exactly what it takes to truly act and behave like a long term investor, and what specific long term investing strategies and philosophies need to be developed and internalized to be a successful long term investor.

Watch our educational video on YouTube!

There is never a bad time for tax planning – especially right now!

- The October 15 deadline for 2021 income tax returns on extension is right around the corner.

- The December 31 deadline for many 2021 tax planning opportunities is also right around the corner.

We encourage you to click below for an excellent two-page guide that summarizes the current "lay of the land" regarding 2021 tax rules and deadlines, and remember, the lower your tax bill, the lower the drag on your overall investment portfolio

Have you considered specific 4Q, 2022 tax-planning and tax-reduction opportunities, before December 31 comes and goes?

Useful and interesting content we’ve read over the past two weeks:

| 1. For Pelosi and McCarthy, A Toxic Relationship Worsens As Elections Approach NY Times – 10.5.2022 The hostility between the speaker and the man in line to succeed her should Republicans win control of the House has only intensified as the decisive moment nears. |  |

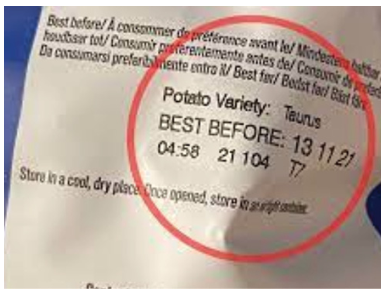

| 2. Keep It or Toss It? ‘Best Before’ Labels Cause Confusion Associated Press – 10.4.2022 As awareness grows around the world about the problem of food waste, one culprit in particular is drawing scrutiny: “best before” labels. |  |

| 3. US National Debt Tops $31 Trillion For First Time The Miami Herald – October 5, 2022 America’s total national debt surpassed $31 trillion for the first time on October 3, according to newly released Treasury Department data. Though the debt had been growing steadily in recent years, the rate of growth increased substantially throughout the pandemic. |  |

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

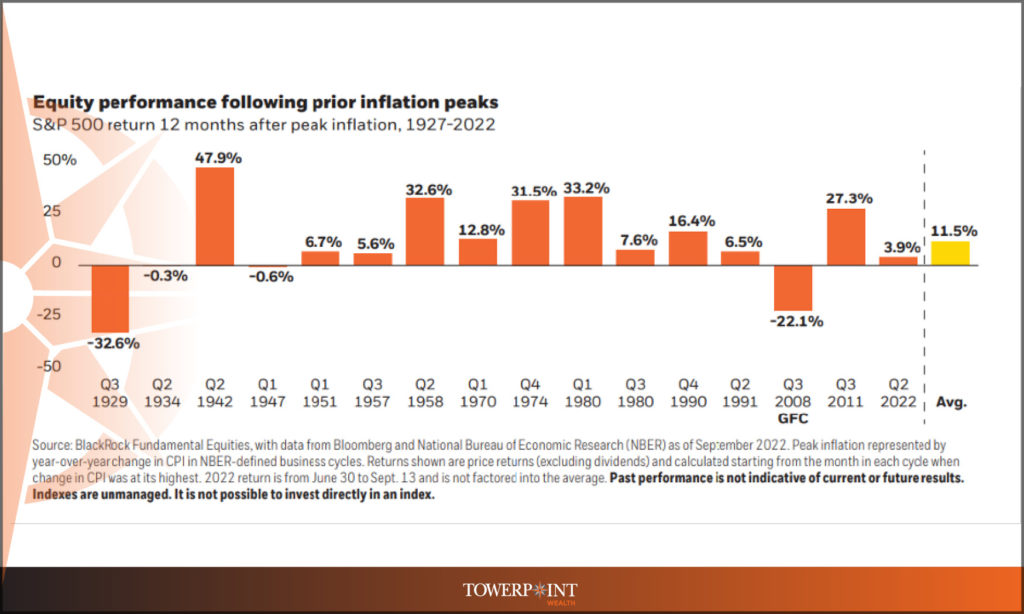

Have we reached peak inflation?

The stock market has historically rallied after inflation peaks (as measured by the CPI).

Since 1927, the average return for the S&P 500 in the 12 months following a peak in CPI was +11.5%.

Was June’s CPI figure of +9.1% the peak inflation rate for this current inflationary cycle? Let’s hope so.

Concerned about the upcoming midterm elections? At Towerpoint Wealth, we can help you - let’s talk about it!

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

While the global 24/7 news cycle churns, twists, and turns, here are a number of fun, local trending events of note:

- These 33 restaurants just opened around Sacramento. Check out new dim sum, burgers, and more. (open in private/incognito mode)

- The Sacramento Turn Verein is hosting its 53rd Annual Oktoberfest!

- The Aftershock Festival continues, with Papa Roach and My Chemical Romance on Saturday, and Shinedown and Muse on Sunday.

- 2nd Saturday Art Walk in Natomas is Saturday, October 8.

- The 4-0 Sac State Hornets put their undefeated record on the line vs. Northern Colorado on Saturday, October 8 at 6:00PM.

- Rock With You – a Michael Jackson Tribute, at Swabbies on the River, Saturday, October 8.

- The Sacramento Natural Foods Co-Op’s 2022 Harvest Festival is this Saturday, October 8, from 1-5PM, on the top floor of the 28th & S Street parking garage!

- The Sacramento Greek Festival is back (!), from October 7th – 9th.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Joseph Eschleman, Jonathan, Steve, Lori, Nathan, Michelle, and Luis

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity.

We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on Twitter