If you have been paying attention to finance and politics over the past two years, you are probably aware that ESG (environmental, social, governance) investing has found itself in the political crosshairs, with debates intensifying over its impact on corporate governance and economic performance. Policymakers and stakeholders are scrutinizing the balance between ethical considerations and financial returns, making ESG a hot-button issue in the investment world.

While profitability will always be paramount, and crucial for growth and building shareholder value, higher profitability also can provide the financial resources needed for companies to invest in ESG initiatives. Balancing profit with environmental, social, and governance goals can drive long-term value and positive societal impact. These same concepts oftentimes also apply to individual investors.

Programs like Johnson & Johnson’s renewable energy commitment, or Pfizer’s Global Health Innovation Grants program, along with countless others, result from corporations investing in socially responsible initiatives, recognizing their responsibility is to not only be profitable but also to take action to make the world a better place.

Socially responsible investors (also known as ESG investors) have also recognized the importance of using their resources to create a positive impact on the world. Environmental, social, and governance (ESG) investing allows investors to consider factors outside of traditional financial metrics when making their investment decisions. These metrics include carbon emissions and pollution, human rights, employee diversity, executive pay, political contributions, and so on.

Some believe that ESG investors enjoy a dual benefit: contributing to creating a global impact with their assets and investments and reaping the financial and investment benefits of making informed ESG decisions that can boost their portfolios.

By focusing on investments that prioritize environmental responsibility, social conscientiousness, and strong governance, some investors believe they can mitigate risks that come with regulatory penalties, environmental degradation, and social unrest.

In this article, we are going to discuss ESG investing, specifically examining five key trends in ESG investing that socially responsible investors should be aware of when making investment decisions with their advisors.

The Risks and Opportunities of Artificial Intelligence

Artificial intelligence (AI) has taken the world by storm in recent years. It has transformed the way we communicate, work, learn, and make decisions. Developments in AI have provided society with more access to information and improved data-processing capabilities… and its effects continue to be COLOSSAL.

AI has enabled society to automate, innovate, and overcome barriers more effectively than ever before; however, this progress also brings increased risk and uncertainty. Regulators have faced challenges in keeping pace with the complexity and rapid advancements of AI, leading to privacy concerns, significant political pressure, and public scrutiny of its developers.

Though AI has struggled from a regulatory perspective, from an ESG investing standpoint it has enhanced the ability to analyze and interpret data relating to ESG criteria. With an increased focus on creating a positive impact through using ESG criteria, it’s equally important to focus on the validity of the data being reported.

Using AI, leaders can use algorithms that validate and enhance the quality of the data being reported to ensure that companies are effectively meeting their ESG-responsible initiatives. AI tools also allow companies to monitor and report their ESG criteria to shareholders more efficiently and cost-effectively.

How does this affect you as an investor?

With more accurate and timely data, you, as an investor, can better understand the steps that companies in your portfolio are taking to be socially and environmentally responsible. Artificial intelligence allows investors to process and assess ESG data from companies to formulate more intelligent investment decisions.

As an investor, however, you also must recognize that while AI plays an increasingly significant role in making investment decisions based on ESG metrics, it isn't always entirely reliable or transparent. Regulations are fighting to keep pace with technological advancements, making assessing the accuracy of the information provided by AI challenging.

AI poses both opportunities and risks for ESG investing, so it will be worth it for investors to keep a close eye on these ever-changing developments in the technology, and how it can be properly leveraged when making ESG-specific investment decisions.

Regulatory Changes on ESG Transparency

Regulatory changes have a profound influence on market direction and the shape of future trends. When it comes to ESG investing, regulations in recent years have appeared to lean toward holding companies accountable for their ESG reporting to allow for better transparency to shareholders.

In March 2024, the SEC adopted new rules to enhance and standardize climate-related disclosures. In their related press release, the SEC states that this new rule is in response to the demand from investors for more comparable, consistent, and reliable information about the financial effects of climate-related risks on businesses’ operations.

This is excellent news for YOU as an investor.

Improved transparency arms investors with more accurate and understandable financial information about climate-related risks, which allows you to make more informed investment decisions. This improved transparency affords you (and your financial advisor) the ability to better assess the potential impacts of climate change on your portfolio, allowing for more strategic and sustainable investment choices.

This increased accountability from businesses ensures that they are more diligently reporting and managing their environmental impact, fostering a fairer and more transparent investment environment. The adoption of this rule not only benefits investors by providing them with reliable data, but also encourages businesses to adopt more sustainable practices, contributing to the overall integrity of the market.

Green Finance is Growing!

Green finance is an increasingly popular phenomenon in finance that refers to businesses allocating capital to prioritize environmental sustainability and supporting efforts to mitigate climate change. This includes investments in renewable energy, sustainable agricultural practices, and other environmentally-sound practices.

The goal of green finance is to channel capital towards projects and businesses that have a positive environmental impact, thereby promoting a transition to a more sustainable economy.

Green financing has experienced a significant surge of interest and traction in 2024. This trend is accompanied by a growing recognition of the need to address climate change and increased awareness among investors about the environmental impact of their financial decisions.

Green finance has its own set of financial products such as green bonds, green loans, green mortgages, green banks, etc. These green financial products are designed to finance projects that deliver environmental benefits such as renewable energy, energy efficiency, and pollution prevention.

Green bonds are a particularly popular green financial product. Green bonds are issued to fund projects that have a positive impact on the environment, with increased interest from municipalities and major corporations alike, and can be used for projects like renewable energy installations, energy efficiency improvements, sustainable waste management, and conservation initiatives.

These bonds are particularly appealing because they allow investors to achieve their financial goals and receive a return on their investment, all while supporting projects that support ESG objectives. The transparency that comes with green bonds, thanks to the rigorous reporting and third-party verification of environmental impact, makes them a more attractive option for ESG investors.

Climate Risk as a Financial Metric

When you think of financial metrics, you probably think of things like operating margins, return on equity, earnings per share… typical profitability measurement tools. However, in recent years, there’s a new metric that has been accelerating for environmentally and socially responsible investors – climate risk.

Financial institutions, CEOs, and investment decision-makers have been progressively considering climate-related risks as financial metrics when making investment decisions, following the previously discussed regulatory and technological developments in ESG investing.

This change highlights the increasing awareness of how climate-related risks—such as severe weather, rising sea levels, and evolving regulations—can affect financial performance and long-term sustainability. More and more investors believe that climate change can pose material risks to their portfolios, so it’s no wonder that 2024 has seen a growing trend of quantifying and analyzing these risks for stakeholders.

The growing focus on climate risk as a financial metric is also shaping investor preferences and market dynamics. ESG investors are increasingly prioritizing assets from companies that demonstrate strong climate risk management practices and align with sustainability goals, driving demand for green and sustainable investments and influencing businesses’ behaviors.

ESG investors believe that climate change can disrupt supply chains, damage physical assets, and alter market dynamics, which in turn affects the profitability and stability of investments. By factoring in climate risk, ESG investors can make more informed decisions and work to safeguard their portfolios.

Biodiversity and Natural Capital

Another key trend for ESG investors in 2024 is the focus on biodiversity. Biodiversity is a term for the diversity of life on Earth and how living things interact with each other and their environment. For environmentally-conscious investors, preserving biodiversity and natural capital are fundamental objectives of long-term sustainability in their portfolios.

The variety of life forms on Earth, including plants, animals, fungi, and microorganisms, contributes to ecosystem services that are crucial for survival. These services include pollination of crops, purification of air and water, regulation of climate, and decomposition of waste. Without biodiversity, these natural processes could be disrupted, leading to negative impacts on food security, clean water availability, and overall human well-being.

The increasing recognition of biodiversity's role in maintaining ecological balance and supporting economic stability has led ESG investors to incorporate biodiversity considerations into their investment strategies.

A potent incentive for ESG investors is the preservation of natural capital, which includes things like air, geology, soil, living organisms, etc. Think of natural capital as the assets that are derived organically from the earth. These resources are paramount for the financial sustainability of businesses, as it’s estimated that over half of the world’s GDP is moderately or highly dependent on these natural resources.

It’s because of the gravity of biodiversity’s role in the ecological balance that ESG investors care now, more than ever, about the sustainability of the companies they invest in. Given these financial and environmental considerations, ESG-focused investors are now factoring in biodiversity when assessing investment risks, selecting new opportunities, and evaluating a corporation's performance and values.

Key Takeaways on ESG Investing Trends

With these environmental, social, and governance factors affecting the way that ESG investors view the long-term sustainability of investment opportunities, it’s important to stay aware of these factors and how they adapt over time.

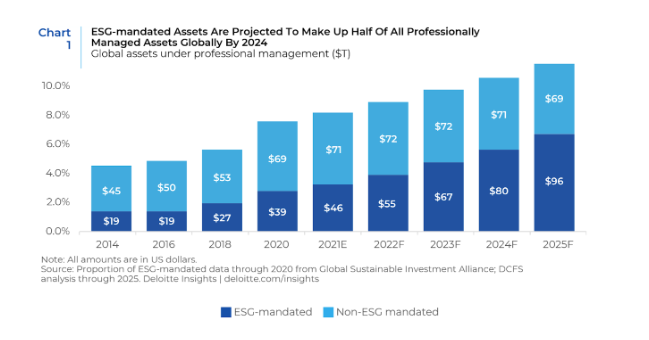

Recent trends indicate that the market is becoming increasingly aware of ESG factors when making investment decisions, considering corporate values and missions, and allocating resources.

Does this mean you should drastically reallocate your assets to reflect more ESG-conscious options? Maybe!

As an investor, your portfolio is based on your unique values, risk tolerance, and preferences that you establish with your financial advisor. Your unique personal and financial circumstances should always be primary when making important decisions about the future of your portfolio, and any crucial decisions should be made with a trusted professional.

ESG investing may or may not be important to you, and that is certainly OK, but either way, having a customized and comprehensive plan to properly coordinate all of your financial affairs applies to all investors.

At Towerpoint Wealth, we support our clients who keep ESG impact top of mind. From considering sustainable investment funds to charitable giving and philanthropic planning, we welcome supporting you if you want to align your investment decisions with your personal values.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to contact us at any time, or call or email us (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity. We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on YouTube

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Instagram

Click HERE to follow TPW on X

Click HERE to follow TPW Podcast : A Wealth of Knowledge