Following the deep wounds created by the still-fresh memory of the Global Financial Crisis (GFC) of 2007-2008, many are wondering if another bailout for banks is as regulators attempt to stave off a banking crisis that has spread across global markets.

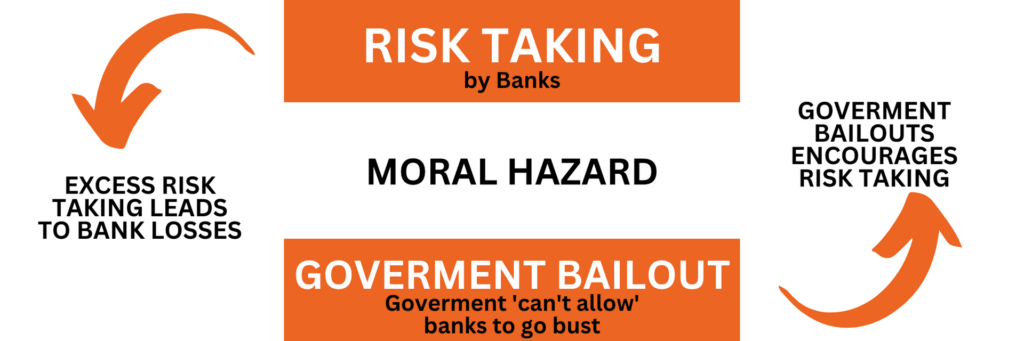

This is leading people to rightly wonder: Has this created a moral hazard? Moral hazard is when you knowingly take a risk in the expectation that if it goes wrong, others will bear the consequences. While there are assuredly similarities, and depending on what your definition of a bailout for banks is, today’s banking crisis is much different than the circumstances that led to the GFC. One of the primary differences: depositors at Silicon Valley Bank, Silvergate Bank, and Signature Bank, rather than the three banks themselves, were rescued.

Amongst a continued whirlwind of debate and discourse about all of these issues, at Towerpoint Wealth we believe there are three central key points for discussion.

- What FDIC insured means.

- What constitutes a bailout?

- Does what’s happening now constitute another bailout for banks?

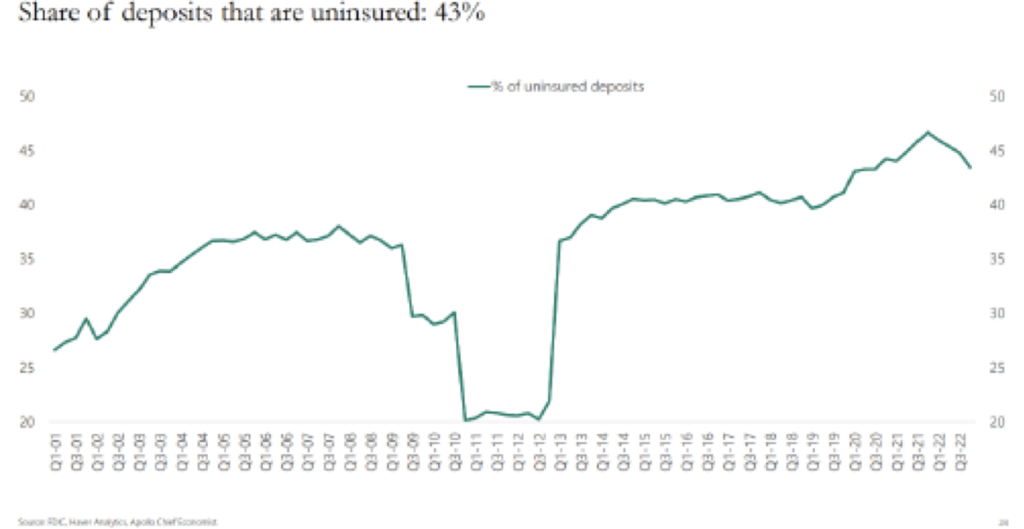

Most agree that an emergency government rescue of the individuals and companies who held deposits at Silicon Valley Bank (SVB) and Signature Bank was needed, as many SVB and Signature clients held funds at the bank in excess of the $250,000 FDIC insurance maximum, and a total wipeout of these depositors’ funds would have almost assuredly led to contagion in the financial system and a massive run on banks throughout the country. That is, everyone would want to withdraw their cash at the same time.

At Silvergate Bank, depositors did not need a government rescue, as the bank went through a voluntary liquidation, and the bank was able to sell its assets and investments and return all deposited money to its customers.

Let’s explore these three important points:

- What FDIC insured means.

It used to be a simple question with a simple answer. Per the FDIC’s website:

FDIC deposit insurance protects bank customers in the event that an FDIC-insured depository institution fails. Bank customers don’t need to purchase deposit insurance; it is automatic for any deposit account opened at an FDIC-insured bank. Deposits are insured up to at least $250,000 per depositor, per FDIC-insured bank.

However, over the past two weeks, the goalposts have changed regarding this $250,000 deposit insurance cap. Officials at the US Treasury are studying ways to guarantee all bank deposits, especially if these problems in the banking system create a domino effect.

- What constitutes a bailout?

Quoting author and equities analyst Barry Ritholtz, a bailout is:

“When an individual or company, through their own behavior and risk management, suffers a disastrous loss — but is then somehow made fully (or even partially) whole, and they do not have to suffer the impact of their own decision-making.”

Sounds very similar to moral hazard, doesn’t it?

The concept that you are responsible for the results of your own handiwork is so old, it’s biblical:

The US government has facilitated bailouts for banks and other institutions for more than 200 years, beginning with the Panic of 1792, and more recently, with the Troubled Assets Relief Program (TARP) that authorized the US Treasury to purchase up to $700 billion of toxic assets from banks and other companies teetering on the brink of insolvency. Bank of America, Citigroup, Fannie Mae, Freddie Mac, Bear Stearns, and AIG received both direct and indirect Federal intervention and economic assistance. In other words, a bailout for banks.

Bailouts for banks and other institutions are primarily criticized for a number of reasons: taxpayers can suffer losses, they may not work or take too long to be effective, they create moral hazard, they are perceived as political in nature, and they are rushed and may not work as intended.

Privatized gains and socialized losses anger virtually all of us, as that is not how capitalism is supposed to work. Is that what is happening today?

- Does this constitute another bailout for banks?

Are Silicon Valley Bank and Signature Bank depositors getting all their money back through FDIC insurance, even if they had more than the guaranteed $250,000 in deposits, the same thing as a bailout for banks?

People are questioning what FDIC insured means primarily because while authorities don't yet see full, limitless FDIC coverage as necessary, they are clearly worried that if another regional bank becomes insolvent, there will be a run on deposits. Without unlimited FDIC insurance, this would almost assuredly send significant additional capital (billions of dollars!) to the largest banks in the world, known as systemically important banks, or SIBs. In other words, away from small and mid-size banking institutions.

As businessman and investor Kevin O’Leary said to Yahoo Finance earlier this week (emphasis added):

This was not a 2008 Lehman Brothers situation. These are just idiot bankers with an incompetent board. It’s that simple.

…we’re sitting in a horrible moral place today, where every single account in every single bank, regardless of who is running it, is guaranteed by the taxpayer. I’m not happy with the outcome. I can do anything I want as a bank manager, I can swing for the fences… but I can take inordinate risk to move that stock price (up), and never worry about what I do with the depositors’ money. Does that sound like a good idea to you?

While support for a motion to guarantee all bank deposits is growing, there is a strong chorus of those who are firmly against a universal Federal guarantee of all bank deposits. A two-day Reuters/Ipsos poll found 84% of respondents – including strong majorities of Republicans and Democrats – think taxpayers should not foot the bill when problems are caused by bank mismanagement.

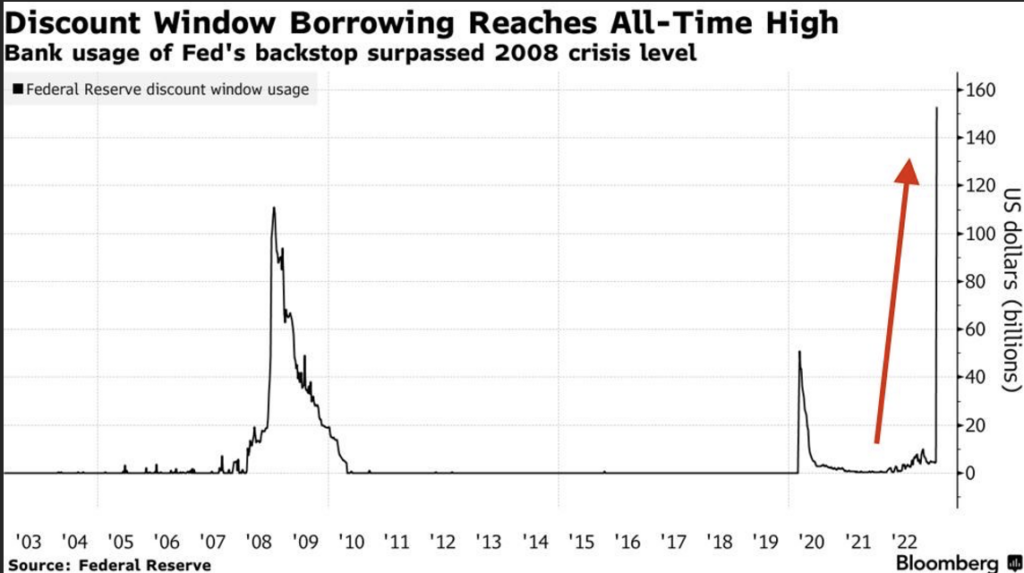

Additionally, the government is already handing out money to banks in the form of a new lending program launched this month, the Bank Term Funding Program (BTFP), complementing the discount window, both of which allow banks to borrow money from the Fed to meet cash shortages and function as a safety valve to relieve pressure in the financial markets.

U.S. banks have borrowed a combined $164.8 billion from these two backstop facilities, which has eclipsed the money that was borrowed during the 2008/2009 financial crisis.

The effects of this bank borrowing will be wide-ranging, including real estate loans, corporate loans, personal loans, mortgages, credit card interest rates, the U.S. Prime Rate, and every other type of lending that you can consider.

Does all of this constitute a bailout for banks, or is it simply essential support for our US banking system? Send us a note and let us know what you think!

Click the thumbnail image below if you are interested in learning more about the details of what happened at Silicon Valley Bank.

What’s Next?

Investors, depositors, and market participants are all hopeful that the game of “whack-a-mole” but with a similar feel, will end soon. Considerations about the overall health of the economy persist. While moves by Treasury Secretary Janet Yellen and Fed Chair Jerome Powell will hopefully limit contagion in the banking industry, economic activity will almost certainly be slowed by tightening standards and greater scrutiny and regulation of lenders, and rising interest rates from the Fed firmly tip the odds in favor of a recession.

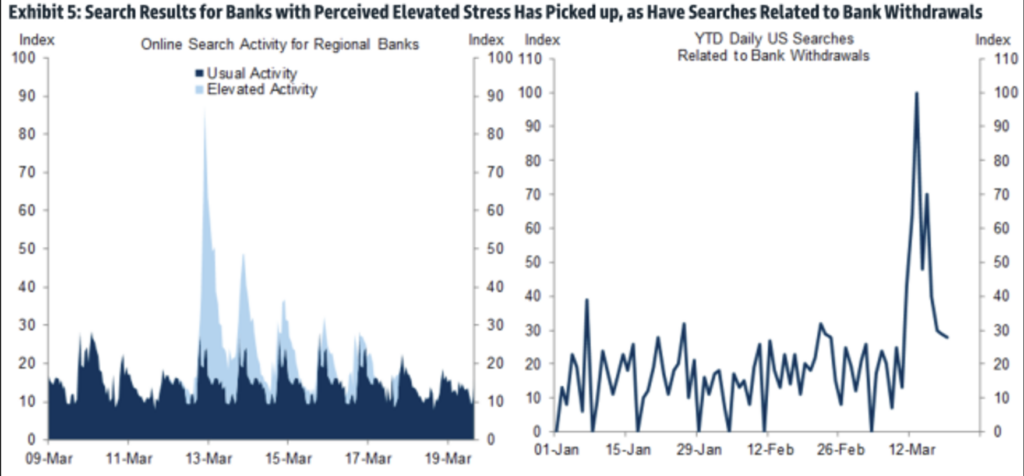

For now, it seems as though consumers are comfortable with the current state of things; at least people aren’t searching Google to find information on bank withdrawals today as often as they were just a week ago.'

Secretary Yellen has also promised to intervene and provide further support for banks if needed, helping consumer fear abate further.

Veteran banking analyst Dick Bove said “…if you go back in history, you know that time before the Federal Reserve was formed, that’s what was done to preserve stability in the banking industry.”

He also said that he believes the banking crisis is finished. At Towerpoint Wealth, we believe the more important question is – do you?

Crises will always be a part of life and will always occur, and this latest one is by no means a reason to hit the panic button. Prudent and successful longer-term investors will recognize this period as simply another entry on their wealth-building and wealth-protecting resume (earning another investment “stripe,” if you will), and just another part of our schizophrenic business cycle.

“This too shall pass” is a quote attributed to both King Solomon and Abraham Lincoln, and an excellent reminder to be humble during good times and resolute during periods of uncertainty and fear. Markets will go up, and they will go down, all of which is out of our control – what matters is how you respond to these challenges (read: opportunities), which just so happens to be in our control. We will persevere as we always do, as we remind our Towerpoint Wealth clients and friends that having a disciplined investment approach and a properly-diversified portfolio will always remain essential, independent of our external environment.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients save and invest for retirement while minimizing taxes.

Are you a real estate investor?

Would you like to learn how to reduce and minimize the income taxes you pay on your real estate portfolio?

Please join us on March 28 at the Kick’n Mule, as our Associate Wealth Advisor, Megan Miller and Joseph Eschleman, as they join The West Sacramento Real Estate Investor Meetup group to talk about how to better manage the tax liability of your real estate investing!

The event is free to attend. Click the thumbnail image below to learn more about the upcoming event!

Here are some of our top trending moments at Towerpoint you might have missed on our social platforms.

Click the images below!

What else is happening with the Towerpoint Wealth family?

Will my investments and assets at Schwab be OK?

Recent news about three large regional bank failures – Silicon Valley Bank, Signature Bank, and Silvergate Bank – has been concerning and unsettling to say the least. Here at Towerpoint Wealth, we have recently had a few clients ask us about how the fallout may affect our primary custodian that we have partnered with to hold and custody our client assets – Charles Schwab.

While no financial institution has completely escaped the consequences of this crisis, we are confident that Schwab is fundamentally different in many ways from those banks in the news. Our confidence in Schwab is underpinned by Schwab’s:

- Conservative balance sheet.

- Strong liquidity position.

- Diversified base of more than 34 million account holders.

Click the thumbnail below to watch a recent CNBC interview of Walt Bettinger, Charles Schwab’s CEO, as he discusses these recent events, and why he (and we) believe that Schwab remains a safe port during this temporary storm

The August Rule

Is this the IRS rule that feels too good to be true?

The “Augusta Rule” is the nickname for Section 280A(g) of the IRS tax code. It allows business owners to rent their personal residence to their business for up to 14 days per year, making the rental income tax-free and allowing the business to write off the expense.

To benefit from the Section 280A deduction, schedule legitimate business meetings at your home, ensuring they do not exceed 14 days and are not for entertainment purposes.

Be sure to charge fair market rent, document the meetings by taking corporate minutes, and submit them to the IRS to protect the deduction!

Are you searching “certified financial planner near me”? You’ve found Sacramento wealth advisor Steve Pitchford, CPA, CFP® and the Towerpoint Wealth Sacramento financial advisor team.

We serve clients primarily in the Northern California region. Glad you’re here! Please contact us with any questions you have about our wealth management services.

Useful and interesting content we’ve read over the past two weeks:

California Lawmakers Call For an Audit of Spending on Homelessness

KCRA3 – 3.21.2023

The state spends billions of dollars each year trying to address the homeless crisis, but is it working? There is a new bipartisan effort among California lawmakers to try to find out.

The Incredible Tantrum Venture Capitalists Threw Over Silicon Valley Bank

Slate – 3.13.2023

If the technological innovation coming out of Silicon Valley is as important as venture capitalists insist, the past few days suggest they haven’t been very responsible stewards of it.

The collapse of Silicon Valley Bank may have resulted from a perfect storm of ugly events. But it was also emblematic of a startup ecosystem and venture-capital apparatus that are too unstable, too risky, and too unmoored from reality to be left in charge of something as important as the direction of our technological development

The Biggest Lie the Rich Ever Told? That Money Can’t Buy You Happiness

The Guardian – 3.14.2023

News just in: Money does buy you happiness. Duh, you might say. Anyone could have told you that; it’s hardly a Nobel-prize winning insight. Well, actually, it kinda is: In 2010, Daniel Kahneman, a Nobel prize-winning economist and psychologist, came out with the theory that there was a monetary “happiness plateau”. Once you hit an annual household income of $75,000, earning more money didn’t make you any happier.

In 2021, the happiness researcher Matthew Killingsworth released a dissenting study, showing that happiness increased with income and there wasn’t evidence of a plateau. Now the pair have teamed up in a process known as “adversarial collaboration” and released a new study finding that they were both sort of right, but Killingsworth was more right: for most people, earning more money makes you happier.

Since the 1970s, over 90 banks in the United States with $1 billion or more in assets have failed.

The Yahoo Finance list below is based on assets at the time of failure of banks insured by the FDIC.

If you want to feel confident in your retirement planning decisions, reach out to us and schedule a 20-minute “Ask Anything” call - we are confident it will be time well spent!

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

At Towerpoint Wealth, we help you remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement. If you are worried about how the 2024 election could affect your financial future, we welcome talking further with you about your personal situation.

Worried about whether you have enough set aside to retire? Check out our “Retiring with 2 Million Dollars” guide to learn five specific steps you can take immediately to work to grow your net worth!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast