In the realm of investing, where opportunities crackle and fortunes are forged, there exists an incandescent area known as FIRE investing. FIRE is an acronym for Financial Independence, Retire Early, and as the flames of financial independence burn brightly, FIRE investing embraces the goal of a self-sufficient life, early retirement (many FIRE investing adherents target a retirement in their late 30s or 40s), and liberation from the shackles of traditional employment.

Embracing a philosophy of intentional living, sacrifice, disciplined saving, and strategic investment to fuel the flames of wealth accumulation and financial independence, FIRE investing maintains a fervent focus on frugality and aggressively saving money. FIRE followers focus on living well below their means so they can save and invest large portions of their income, all in the interests of achieving an early retirement and complete financial independence.

Think you have the discipline, tenacity, desire, and guts to become a FIRE investing disciple? The first rule is to calculate your FIRE number, and then practice the four key tenets.

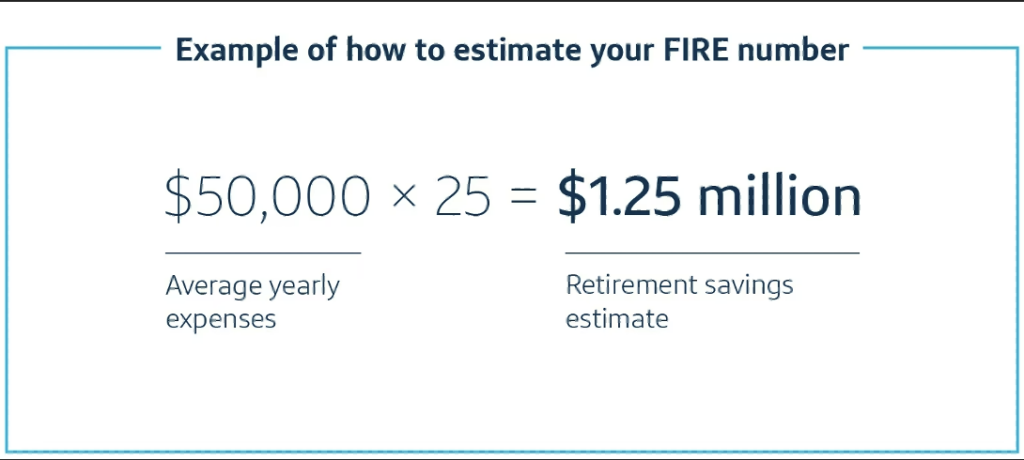

Computing your FIRE number is akin to figuring out the approximate amount of money you need to reach financial independence. While this is a very subjective analysis with many variables to account for, the very general rule of thumb is to multiply your anticipated annual expenses by 25.

This FIRE number equation is simply an estimate, it does not account for inflation, increased medical expenses, pensions and Social Security, real estate equity, anticipated inheritances, and a myriad of other variables. But it’s a starting point, and once you have determined it, you can then begin practicing the four key tenants of FIRE investing:

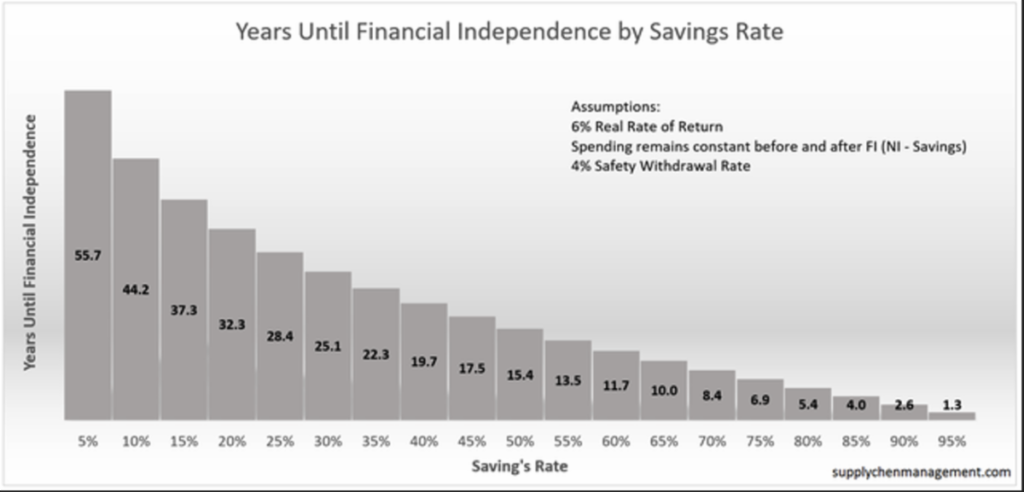

1. Aggressive savings – between 40% to 70% of your annual income!

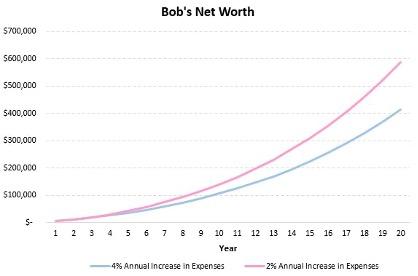

FIRE practitioners aim to maximize savings by adopting a frugal lifestyle and by tracking and minimizing expenses (see tenant four below). They usually create a disciplined budget and look to increase their earned income by asking for a raise, finding a higher-paying job, or adopting a side-hustle, all in the interests of increasing their capability to save, and accelerate the growth of their portfolio and net worth.

2. Strategic investing

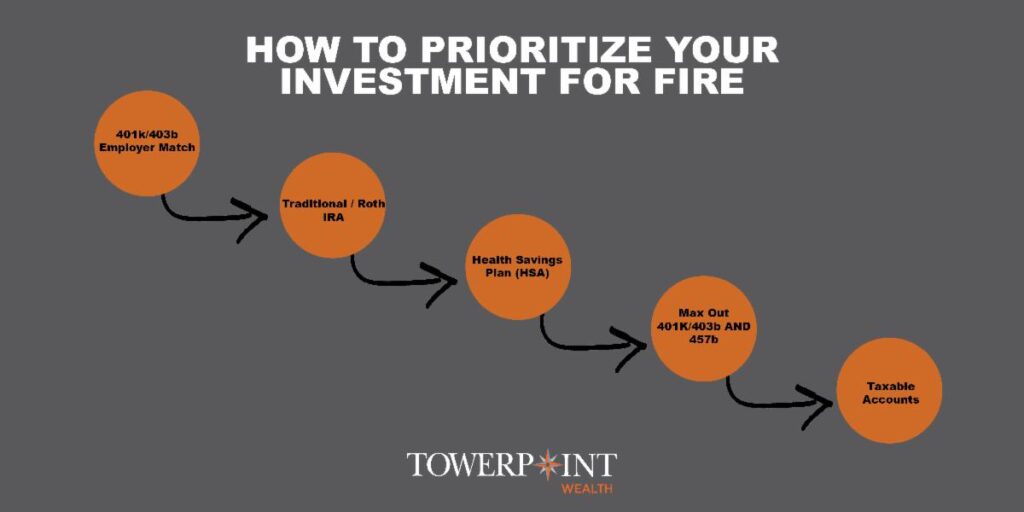

FIRE investors recognize the power of strategic investing to generate wealth over the long term. They diversify their investment portfolio across different asset classes, such as stocks, bonds, real estate, and possibly alternative investments. By following a disciplined investment approach and taking advantage of compounding returns, they aim to maximize their investment growth and income generation and compounding.

The proper prioritization of saving and investing is also important for FIRE investors, as taking advantage of free money (via various employer matching programs) and tax-advantaged accounts are central doctrines not to be mismanaged.

3. Sustainable withdrawal rate

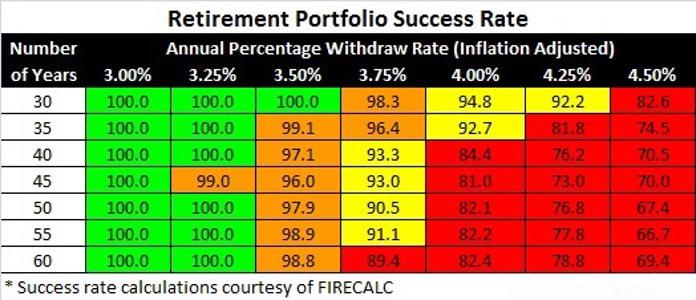

Once financial independence is achieved, maintaining it is just as important. Developing a sustainable withdrawal rate from your portfolio plays a crucial role in FIRE investing, serving as a guiding principle for supporting a desired lifestyle after retiring early. A general rule of thumb for how much you can sustainably take from your portfolio once retired is around 3-4% of your investment portfolio annually.

This rate is meant to strike a balance between meeting ongoing retirement and lifestyle expenses, while preserving the long-term viability of your investments. By adhering to a conservative withdrawal rate, FIRE investors aim to ensure that their funds last throughout their retirement years. This requires diligent monitoring of expenses, and the flexibility to allow for adjustments to the withdrawal rate as necessary, considering factors such as investment performance, inflation, and potential unforeseen expenses. By carefully managing their withdrawal rate, FIRE investors can confidently pursue their early retirement dreams while maintaining financial independence and the freedom to enjoy a fulfilling post-career life.

4. Lifestyle optimization / economic discipline

Also known simply as “living below your means,” lifestyle optimization is a pivotal aspect of FIRE investing, and focuses on the strict minimization of discretionary expenses. Personal fulfillment is defined quite differently by each of us, as accelerating your journey towards financial independence comes with the tradeoff of a frugal lifestyle and mindset. Making a long-term commitment to nurturing a sense of contentment and forgoing excessive consumerism may sound good in theory, but can be challenging in practice.

While achieving financial independence early is the central goal of FIRE investing, the FIRE lifestyle is certainly not for everyone. Making the strict sacrifices needed to retire early can be quite difficult, as the lifestyle trade-offs of a reduced budget, downsized housing, and foregone luxury and comfort items are not palatable for many individuals. However, for those who have the fortitude and the discipline, FIRE investing can be rewarding and extremely empowering, as it is impossible to put a price tag on the peace associated with financial independence!

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients save and invest for retirement while minimizing taxes.

Our Associate Wealth Advisor, Megan Miller, EA, and Director of Tax and Financial Planning, Steve Pitchford, CPA, CFP®, worked hard together earlier this week collaborating on a client’s customized financial plan.

We are fortunate to have an on-staff CPA, CFP®, and EA, and both Steve and Megan have had a huge impact on the level and sophistication of the planning and wealth management work we regularly do with clients.

Our clients and our firm are lucky to have both of you, Steve and Megan!

Click the images below to get caught up on some of our most recent trending moments at Towerpoint Wealth you might have missed!

Crypto making a comeback!

Despite economic uncertainty and a regulatory crackdown on some crypto exchanges, bitcoin prices have nearly doubled since last December, and have risen ~ 20% just this week, with the price eclipsing $30,000 for the first time since mid-April.

At Towerpoint Wealth, we recognize that digital assets like bitcoin and Ethereum will continue to exhibit short-term volatility as a new asset class.

We also continue to believe that the entrance of major Wall Street institutions into the digital assets market indicates a significant shift in the financial landscape. In particular, Bitcoin's acceptance as a mainstream asset class offers investors a diversification opportunity, while its unique properties position it as a potential digital gold.

Click below to watch a recent educational video we produced about digital assets and cryptocurrencies, and learn why we believe that crypto is here to stay, and not going away

Click HERE to browse TPW’s library of other wealth-building and wealth-protecting educational videos.

Organizing Your Financial Records

Many people struggle every time they open their mail or email. “Is this important? Do I need this? Should I keep it? Should I throw it away?”

When it comes to managing your financial records, it's crucial to strike a balance between keeping necessary documents and disposing of those that are no longer needed. Certain financial records such as tax returns, W-2 forms, and supporting tax documentation should be retained for a specified period to comply with legal requirements and for personal reference.

It is advisable to shred any discarded documents that contain personal or sensitive information to protect against identity theft. Ultimately, maintaining an organized system for financial record-keeping ensures that you retain the necessary documents while minimizing clutter and unnecessary storage.

Click the image below or view our new Wealth Management Resources webpage, and download an excellent resource from MFS that should help you stay organized and purge with confidence!

Have questions or concerns about filing your 2022 tax return?

We welcome connecting with you and are happy to help. Click the banner below to message Steve Pitchford, Steve Pitchford, Certified Financial Planner.

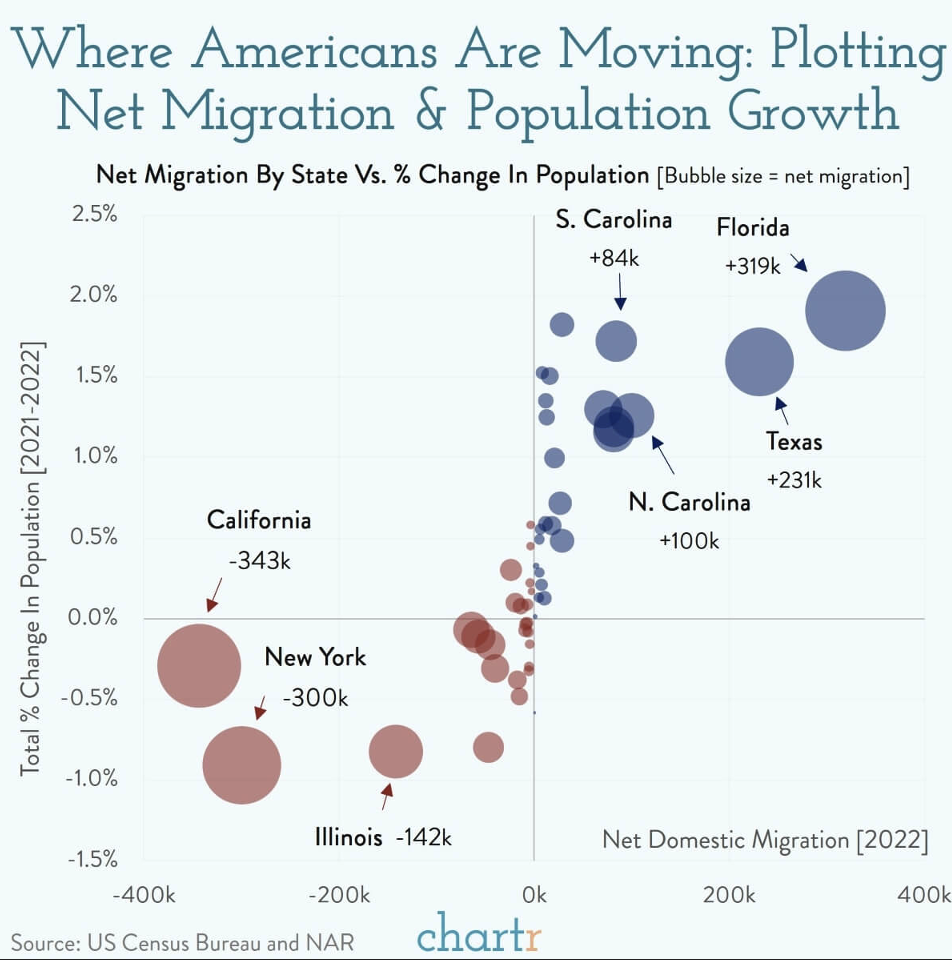

Where are Americans moving to?

Internal migration within the United States has been a significant phenomenon that has shaped the country's demographic and economic landscape. Often driven by factors such as job opportunities, politics, lifestyle preferences, cost of living, and family considerations, migration has been a constant feature of American society.

Individuals and families frequently relocate from one state to another in search of better employment prospects, improved living conditions, or a change in environment. For instance, people may move from rural areas to urban centers in search of employment in industries such as technology, finance, or entertainment, or from urban centers to rural areas due to a desire for a quieter and more peaceful lifestyle away from the hustle and bustle of urban areas, the allure of a closer connection to nature, more affordable housing, and the opportunity to enjoy outdoor activities such as gardening, hiking, or farming.

Surprisingly, while the pandemic did not disrupt the decline in the rate of people moving, Chartr’s graph below highlights the fact that those who do decide to pack up and switch states contribute to regional variations in population density, cultural diversity, and economic activity, as people gravitate toward areas that align with their aspirations and needs.

In light of how unsettled the economy and markets are, are you concerned or worried about

the bonds in your portfolio, and/or the overall level of risk you are taking in your portfolio? Message us to discuss your circumstances.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to contact us at any time, or call or email us (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Worried about whether you have enough set aside to retire? Check out our “Retiring with 2 Million Dollars” guide to learn five specific steps you can take immediately to work to grow your net worth!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast