ROI, or return on investment, measures the profit earned on an investment after all costs of the investment are deducted. ROI for real estate is simply a measurement of the return on an investment property.

Your real estate ROI is a critical metric that every real estate investor should know and compute regularly, yet many fail to do a real estate ROI calculation when determining whether to purchase, or continue to hold, an investment property.

Here are five key things to consider when doing a real estate ROI calculation, all extremely important and useful when evaluating whether or not it is prudent to buy, or hold, a piece of investment real estate:

1. Income generation

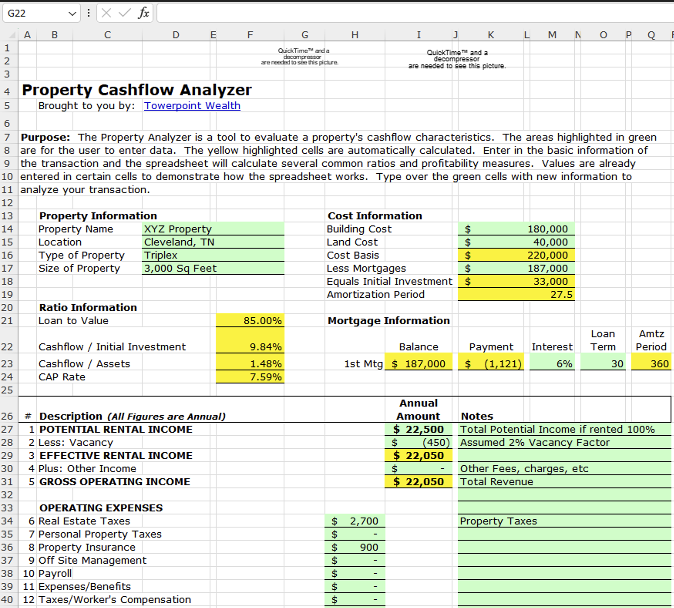

Real estate investments almost always generate income through rental properties, such as residential apartments, commercial spaces, or vacation rentals. The ROI for real estate in this case is calculated by dividing the net income (“top line” rental income minus expenses like maintenance, taxes, insurance, and vacancy rates) by the initial investment. A higher real estate ROI indicates better income generation potential and increased profitability.

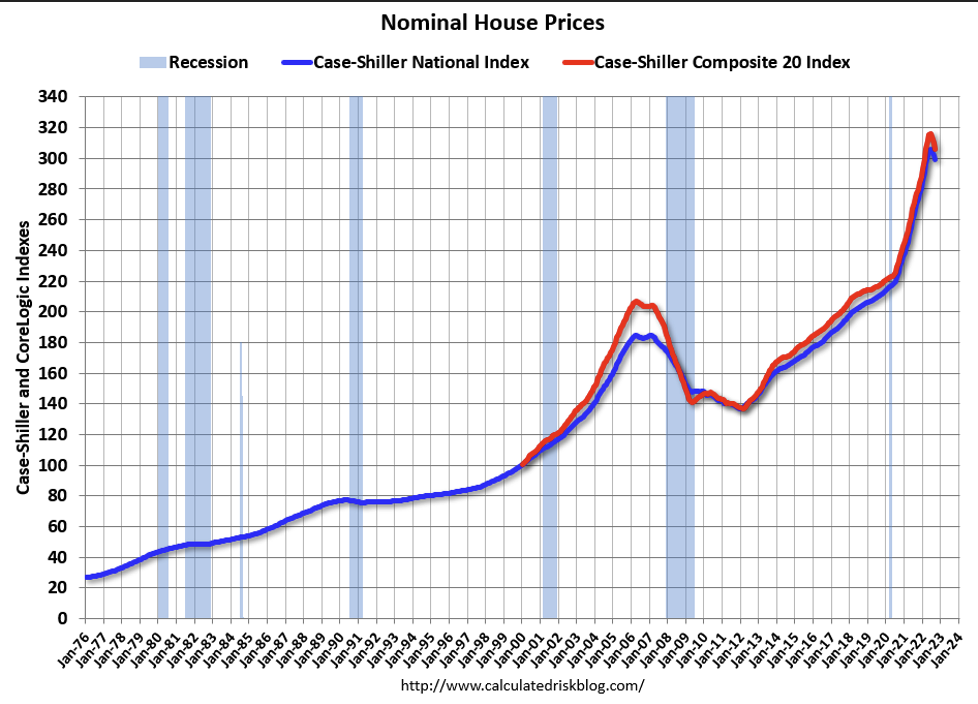

2. Appreciation

Real estate values have historically appreciated over time, allowing investors to benefit from capital appreciation. A real estate ROI calculation should take into account the increase in property value when determining returns. To calculate real estate ROI based on appreciation, subtract the initial investment cost from the final sale price of the property and divide it by the initial investment. A higher ROI signifies a significant appreciation in the property's value.

3. Cash flow

Positive cash flow occurs when your rental income exceeds your property expenses and mortgage payments, and is an essential component of ROI for real estate. Positive cash flow allows investors to recoup their initial investment while still generating income, while negative cash flow can reduce real estate ROI, as it means the investment is not generating enough income to cover all expenses.

4. Leverage and financing

Real estate investments often involve leveraging (borrowing) money through mortgages or loans. This allows investors to maximize their returns by using other people's money. The ROI for real estate calculation considers both the initial investment and the costs associated with financing. However, it's important to assess the risks associated with leverage, such as interest rates, market fluctuations, and debt service coverage ratios.

5. Time horizon

The time frame in which an investment is held can significantly impact your real estate ROI calculation. Real estate investments are generally considered long-term, and ROI for real estate calculations should reflect this perspective. Over time, real estate investments can experience fluctuations in income and value. It's crucial to consider the overall return over the holding period rather than shorter-term variations.

Click the image below for an excellent and downloadable template spreadsheet to use when doing an initial real estate ROI calculation.

Real estate ROI is a comprehensive tool for investors to gauge the profitability of their real estate investments. By considering factors such as income generation, property appreciation, cash flow, leverage, and the investment's time horizon, individuals can make informed decisions and assess the potential risks and rewards associated with real estate investments. However, it is important to remember that real estate markets can be dynamic and subject to various economic and market conditions. Therefore, thorough due diligence, proper risk assessment, and ongoing monitoring are essential for optimizing a real estate ROI calculation.

By leveraging the power of ROI for real estate, investors can navigate the complexities of the real estate market and strive to maximize their returns while building a robust and diversified investment portfolio.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients save and invest for retirement while minimizing taxes.

Last Thursday the entire Towerpoint Wealth team headed to Oakland for a teambuilding event, watching the A's take on the Yankees at the Oakland Coliseum. While the home team did not bring home the ‘W,’ the TPW team enjoyed a full day of ballpark activities and each other's company.

Congrats to the Yankees on their victory, making both Nathan and Michelle very happy!

Click HERE to message us with any questions or concerns you may have about your retirement right now.

Click the images below to get caught up on some of our most recent trending moments at Towerpoint Wealth you might have missed!

The Sacramento Housing Market is Heating Up!

Right now, the Sacramento housing market is experiencing a scarcity of available homes. This lack of supply, coupled with inflation and higher interest rates, is making it more expensive for borrowers to obtain loans. As a result, many homeowners with low mortgage interest rates are hesitant to sell and move. Concurrently, our limited housing supply has led to increased demand, providing support to home prices, even with money being more “expensive” now.

Put differently, our real estate market here in Sacramento continues to be both a challenging one, and an unusual one, to unpack and understand.

Despite these challenges, the Sacramento housing market is still better than some might perceive. Click the image below and enjoy taking a few minutes to watch a recent discussion our President, Joseph Eschleman, shared with ABC10 news anchor Lora Painter, as the two shine light into some of the more recent developments in the greater Sacramento real estate market, and the impact they’re having on homeowners, renters, and investors like you.

Click HERE to browse TPW’s library of other wealth-building and wealth-protecting educational videos.

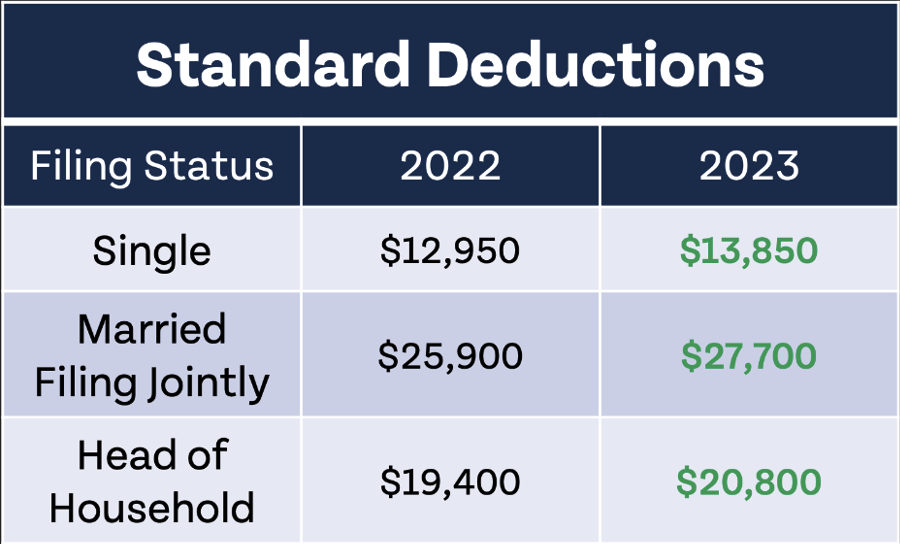

The (Higher) Standard Deduction

Taxpayers often get frustrated when they are unable to itemize their taxes due to the higher standard deduction. Itemizing allows individuals to list and deduct specific expenses, such as mortgage interest, property taxes, medical expenses, and charitable donations. It gives them a sense of control and the opportunity to potentially reduce their taxable income. However, with the introduction of a higher standard deduction, many taxpayers find that their itemized deductions no longer exceed the standard deduction threshold, making it less advantageous to go through the itemization process.

Realistically, a higher standard deduction has many advantages and can be beneficial for many taxpayers. It simplifies the tax filing process by eliminating the need to gather and itemize numerous expenses, which can be time-consuming and complicated. Additionally, a higher standard deduction increases the threshold at which itemizing becomes advantageous, allowing more taxpayers to benefit from a reduced tax liability.

Overall, a higher standard deduction promotes fairness, simplifies the tax system, and provides a broader reach of tax benefits to a larger population.

Click the image below to view our 2023 Tax Reference Guide, and download an excellent resource intended to help you stay on top of and organized with your tax planning this year!

Have questions or concerns about filing your 2022 tax return?

We welcome connecting with you and are happy to help. Click the banner below to message Steve Pitchford, Steve Pitchford, Certified Financial Planner.

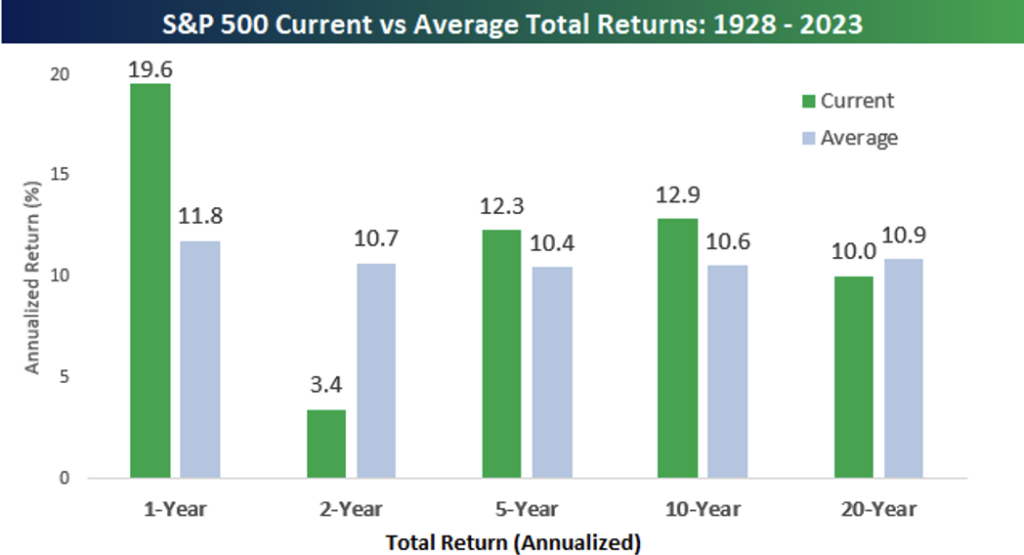

While the shorter-term returns of the stock market over the last year have handily exceeded the long-term average (see 1-Year column below), performance over the last two years has been equally extreme in terms of underperformance.

Quoting Bespoke Investment Group (thank you to them for the chart as well):

“As easy as it is to say the market has gotten ahead of itself, it is just as easy to look over a different time period and say that it has fallen behind. It all depends on your timeframe.”

In light of how unsettled the economy and markets are, are you concerned or worried about

the bonds in your portfolio, and/or the overall level of risk you are taking in your portfolio? Message us to discuss your circumstances.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to contact us at any time, or call or email us (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Worried about whether you have enough set aside to retire? Check out our “Retiring with 2 Million Dollars” guide to learn five specific steps you can take immediately to work to grow your net worth!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast