How the Change in Current Federal Interest Rates Could Affect YOU?

The impact of interest rates on stocks is significant!

Interest rate cuts can signal a shift in the financial and economic landscape. For investors, this change in the direction of interest rates on stocks can either be considered a cause for concern or an opportunity for significant wealth-building.

Interest rates play a crucial role in the economy, guiding everything from consumer spending and borrowing to corporate profits. When interest rate cuts occur, borrowing costs drop with them, and companies have access to “cheaper money.”. This can correlate to higher stock valuations, but also opens the door to potential risks, such as inflated asset bubbles or increased market volatility.

On Wednesday, Jerome Powell, the 16th chair of the U.S. Federal Reserve (or, “The Fed”), announced on behalf of the Federal Open Market Committee (FOMC) its first interest rate cut in four years (since COVID), reducing its benchmark “Fed Funds Rate” a half point, from a 23-year high of 5.50% to 5.00%.

This cut in the current federal interest rates — also known as the Fed rate — represented a significant economic milestone in the central bank's most aggressive inflation-fighting campaign since the 1980s, and for Americans struggling with rising living costs over the past two years. It also raises many questions for investors.

What is the impact of interest rates on stocks?

What stocks might perform better with lower interest rates?

Should I stay the course, or pull my money out of the stock market and invest elsewhere?

Whether you're a seasoned investor, or just starting to build your portfolio, understanding the effect of interest rates on stocks will help you make informed decisions, stay ahead of the curve, and avoid making costly reactionary decisions.

In this newsletter, we will answer your questions about how a lower Fed Funds interest rate can affect YOU as an investor, and we’ll discuss some strategies to help you navigate this ever-changing environment.

Key Takeways

- The FOMC has gained “greater confidence” that inflation is moving steadily toward its 2.0% inflation target.

- Expectations for 50 bps (1/2 point) of further cuts before this year is through, likely 25 bps (1/4 point) at each of their two remaining meetings.

- For 2025 & 2026, the Fed anticipates 100 bps (1 point) & 50 bps of cuts respectively.

- The money supply remains the most important indicator on the path forward. How M2 growth progresses from here will dictate if the Fed has room for further rate cuts or sees a re-acceleration of inflation as was seen when the Fed declared a premature victory on inflation back in the 1970’s. If M2 growth remains modest, both inflation and economic growth will slow, but the Fed will have room to continue cuts.

- Interest rates and stock prices tend to have an inverse relationship, with higher interest rates making it more expensive for businesses to borrow capital and expand.

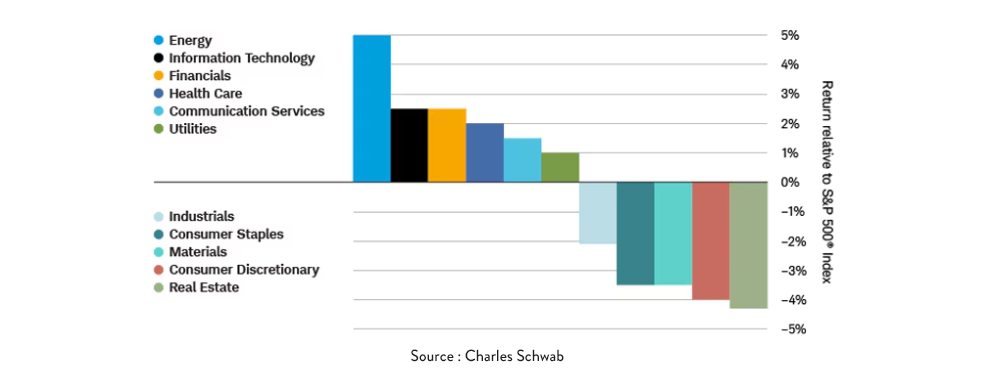

- Different sectors experience different effects from interest rate changes.

- It is imperative to be disciplined in following your long-term financial and investment plan and strategy, and work with a trusted fiduciary financial advisor before adjusting your portfolio positions or asset allocation.

What is the Impact of Interest Rates on Stocks?

Before we understand how interest rate cuts can alter your investment strategy, let’s take a look at the impact of interest rates on stocks as a whole. Understanding interest rates in investing is crucial for making informed decisions about your portfolio.

The relationship between interest rates and the stock market has been closely studied — when the Fed announces a change in interest rates, the market usually responds. Because of this link, the Fed has historically used interest rate cuts or hikes to either bolster or manage the growth of the economy and, some may argue, the financial markets.

Stock Prices

Interest rates and stock prices typically have an inverse relationship. The higher interest rates are, the more expensive it is for businesses to borrow money, hindering their ability to finance new projects, expansions, or acquisitions. Higher interest rates also make it more difficult for consumers to borrow money, and can generally result in lower consumer spending, possibly leading to lower corporate revenues and weaker earnings.

Conversely, when the Fed enacts an interest rate cut, borrowing becomes cheaper, encouraging businesses and consumers to invest and spend. This can lead to higher corporate earnings and a greater demand for goods and services, which can boost stock prices. Investors generally see lower interest rates as a positive sign for the stock market, as companies benefit from more affordable credit, which can drive profitability and stock performance.

Investor Behavior

Federal interest rates also have a direct influence on investor behavior. In a lower-rate environment, fixed-income investments like bonds offer lower yields, prompting many investors to shift their focus to equities.

Stocks tend to become more attractive compared to bonds when interest rates are lower because the income that bonds pay may not keep pace with inflation, especially when interest rates are below inflation rates, thus driving more demand for stocks and pushing prices higher.

Sectoral Impact

The impact of interest rates on stocks varies across different sectors and industries. Some are more sensitive to interest rate changes than others.

For example, the financial sector, particularly banks, benefits from rising rates because they can charge higher interest on loans, improving their profit margins. As a result, bank stocks often perform well when the Fed raises rates.

In contrast, industries that are heavily reliant on borrowing, such as real estate and utilities, may face some challenges when rates rise. Higher borrowing costs increase expenses for companies in these sectors, which can, in turn, hurt profitability and lead to weaker stock performance.

Think of growth-oriented sectors like technology that can benefit from interest rate cuts. These companies typically have high valuations based on future earnings, and when rates rise, the present-day value of those future earnings diminishes. This can lead to declines in tech stocks as the Fed signals rate hikes.

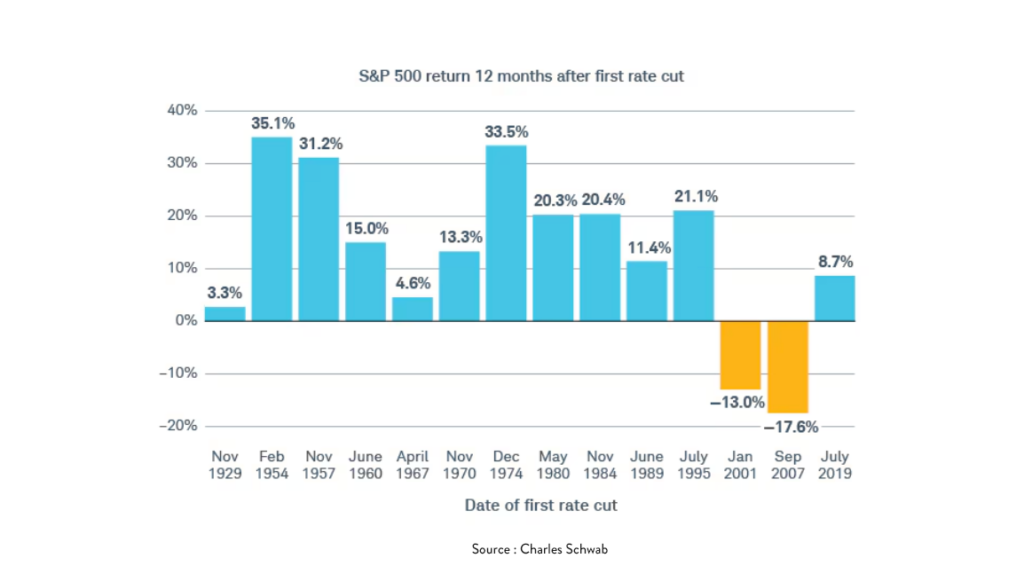

Historical Results

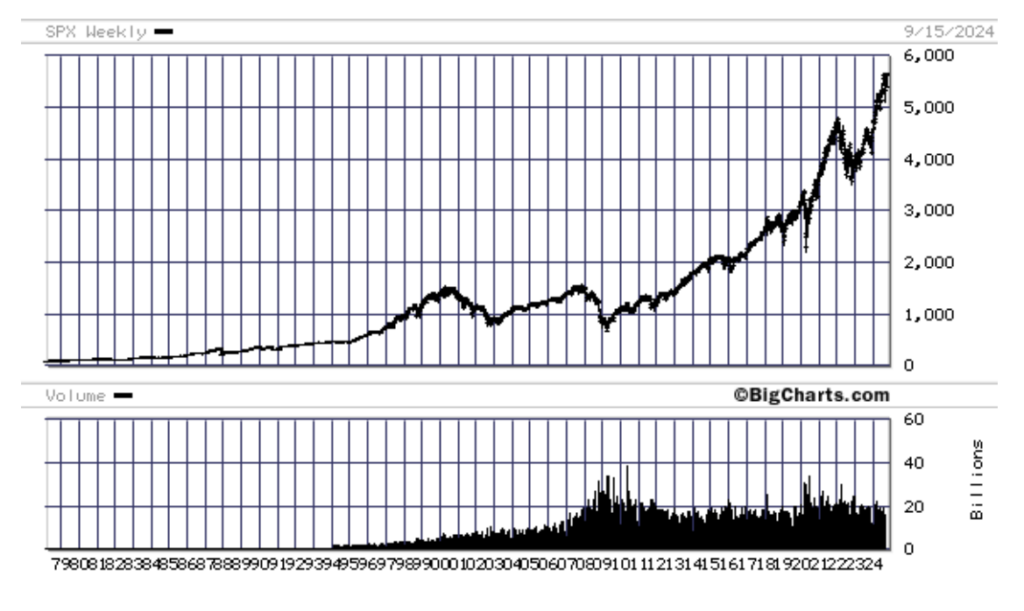

The stock market has historically responded positively to federal interest rate cuts, especially when the economy is stable or improving. When the Fed cuts rates, it signals that it is taking measures to support economic growth, which investors often interpret as a bullish sign for stocks.

However, not all rate cuts lead to positive stock market performance. If the Fed cuts rates due to concerns about a weakening economy, the market may view this as a signal of trouble ahead, which can dampen investor confidence. Rate cuts in the face of an economic downturn — such as during the 2008 financial crisis or the COVID-19 pandemic — can lead to market volatility or declines, as investors grapple with broader economic uncertainties.

This is why it’s so critical to look at the “why” behind rate cuts. While they may appear to be a positive sign at first glance, the underlying economic factors that lead to the Fed rate cuts tell much more of the story.

What Should You Do if Interest Rates Drop?

Short answer: there is no “correct” answer.

When the Fed cuts interest rates, it often stirs feelings of anxiety or excitement among investors. You may feel tempted to make more immediate tactical decisions — like selling off certain assets or shifting portfolios entirely — in response to lower interest rates. However, knee-jerk reactions to Fed rate cuts can often lead to more harm than good.

Rather than making impulsive moves, investors must understand and consider the bigger picture and approach their decisions with a longer-term strategy in mind. Here are some key principles investors should keep in mind when navigating a potential interest rate cut:

Avoid Reacting Too Quickly or Aggressively

The first and perhaps most important piece of advice is to avoid a knee-jerk reaction. A Fed rate cut can spark a flood of speculation and commentary from the media, leading to volatile market movements. While making immediate adjustments to your portfolio may be tempting, a more measured approach tends to be prudent in the long run.

Historically, stock market reactions to rate cuts have been mixed. Sometimes the market rallies, while other times it might face a period of turbulence. These fluctuations are normal, but if you react too quickly, you risk locking in losses or missing out on gains that may occur once the market stabilizes.

Predicting the shorter-term movements of the stock market is next to impossible to do, and we encourage you to be humble about this fact.

Odds are, you’re investing for your longer-term goals and objectives. By being disciplined in following your longer-term strategy, you are more likely to weather shorter-term volatility and benefit from the general upward trend of the stock market over time.

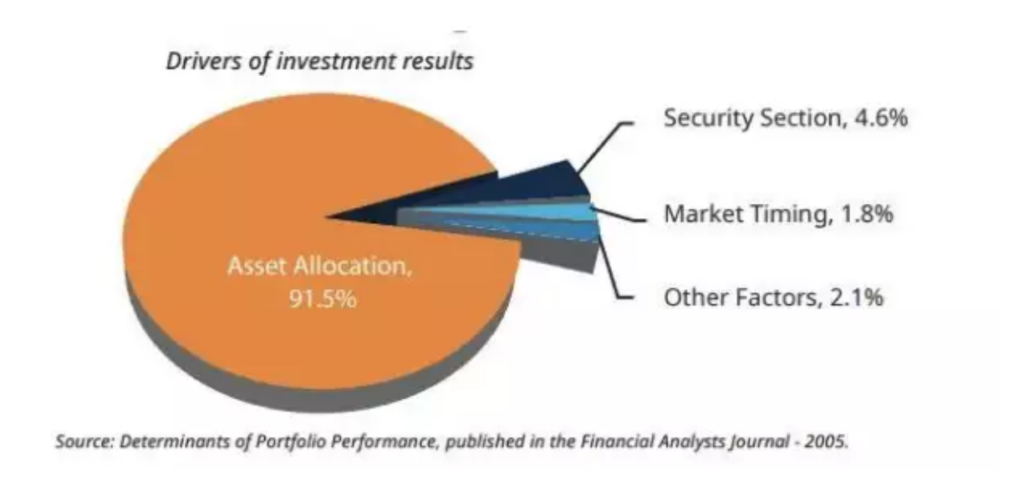

Focus on Asset Allocation

Instead of drastically changing individual stock or investment positions, it's smarter to revisit your overall asset allocation and diversification. Asset allocation is the distribution of your investments across different asset classes like stocks, bonds, alternatives, and cash, and it is one of the most important factors in determining your long-term returns.

In a low-interest-rate environment following a Fed cut, certain asset classes may perform better than others. For example, stocks may look more attractive relative to bonds, which offer lower yields in a rate-cut scenario. However, this doesn't mean you should completely shift out of bonds or other safer assets. Bonds, even with lower yields, can provide diversification and help cushion your portfolio during periods of stock market volatility.

A balanced portfolio that includes a mix of equities, bonds, and possibly alternative assets like real estate or commodities can help you mitigate risk while still capturing potential upside.

If you’ve already established a long-term asset allocation plan, now is the time to ensure that it still aligns with your financial goals and risk tolerance, rather than making impulsive shifts based on short-term events like a rate cut.

Don’t have a custom asset allocation plan yet? Schedule a 20-minute “Ask Anything” call to discuss how we can help you create a customized strategy tailored to your long-term goals!

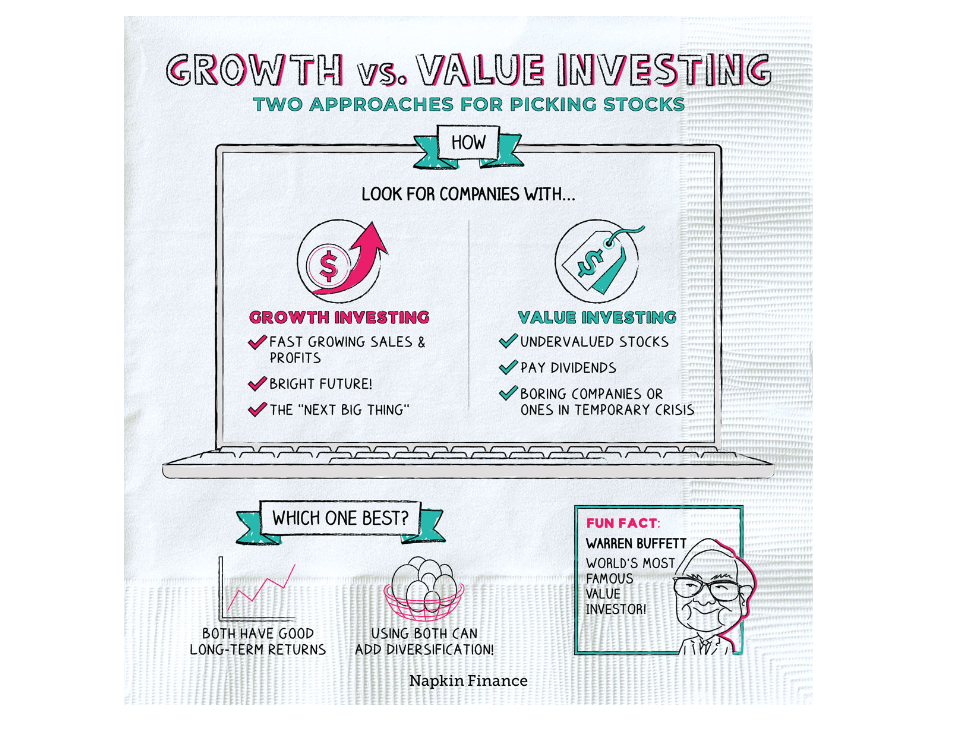

Assess Growth vs. Value

When interest rate cuts occur, certain sectors and types of stocks may outperform others. As we’ve discussed, growth stocks — typically companies that are expanding rapidly and reinvesting profits to fuel further growth — often benefit in lower-rate environments. Lower borrowing costs allow these companies to finance their expansion more easily, and the discount rate applied to their future earnings decreases, boosting present-day valuations.

On the other hand, value stocks, which are generally more established companies trading at lower price-to-earnings ratios, may not respond as positively to rate cuts. This doesn’t mean, however, that value stocks should be discarded. There are times when value stocks can outperform even in a low-rate environment, particularly if economic conditions improve and lead to rising corporate earnings.

As an investor, you should consider maintaining a diversified portfolio that includes both growth and value stocks. Trying to time the market by switching entirely to growth or value stocks based on rate movements is notoriously difficult and can lead to missed opportunities.

Instead, ensure that your portfolio reflects your long-term investment goals while allowing room for both growth and value-based assets.

Keep an Eye on Inflation

A Fed interest rate cut may also affect inflation, especially if the economy is already showing signs of overheating. While lower interest rates can stimulate economic growth, they can also lead to rising inflation if demand outpaces supply. Inflation erodes purchasing power, which can have a detrimental effect on fixed-income investments and the value of certain stocks.

If you are worried about protecting your portfolio from potential inflationary pressures, consider adding inflation-hedging assets like Treasury Inflation-Protected Securities (TIPS), commodities, or real estate. These assets tend to perform well when inflation is rising, helping to offset the negative effects on other parts of your portfolio.

Keep in mind, however, that inflationary pressures following a rate cut are not guaranteed. It's important to monitor economic indicators and adjust accordingly, rather than making sweeping changes in anticipation of inflation that may not even materialize.

Don’t Lose Sight of the Big Picture

One of the most important things for investors to remember is that the impact of interest rates on stocks, and Fed interest rate cuts, are just one piece of the broader economic puzzle.

While lower rates can stimulate the economy and affect stock prices, they are not the sole determinant of market performance. Factors like corporate earnings, global economic trends, and geopolitical risks can all have a significant impact on the stock market.

For instance, a rate cut may boost stock prices in the short term, but if corporate earnings are declining or geopolitical tensions are escalating, the stock market could still face headwinds. As an investor, you must look beyond the headlines and focus on the bigger picture. Maintain a diversified portfolio, avoid making emotional decisions, and keep your long-term financial goals in mind.

Final Thoughts

Subsequent to Wednesday’s Federal Reserve interest rate cut, understanding how these rate cuts affect the stock market and why the Fed adjusts these rates is essential for investors.

While an interest rate cut can create opportunities, it’s important to recognize that the stock market’s reaction is not always straightforward. Interest rate cuts can stimulate economic growth and boost stock prices, but they are also a response to broader economic challenges. These complexities mean that relying on a single metric — such as the Fed’s decision on rates — is not enough to guide sound investment decisions.

Navigating a potential interest rate cut involves more than simply reacting to headlines. The key takeaway for you, as an investor, is to avoid making knee-jerk portfolio changes based on shorter-term market fluctuations. Instead, focus on maintaining a well-diversified portfolio that aligns with your longer-term goals. By staying disciplined with your financial plan, you can position yourself to benefit from potential opportunities while mitigating risk.

If you aren’t feeling confident in your financial plan and its ability to withstand economic conditions, we urge you to meet with a trusted financial advisor to monitor and adjust (if necessary) your financial plan.

At Towerpoint Wealth, we are committed to helping you remove the hassle of coordinating all of your financial affairs, so you can live a happier life and enjoy retirement.

If you are concerned about how interest rate cuts may affect your portfolio, we encourage you to schedule an initial 20-minute “Ask Anything” discovery call with us!

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast