The markets, politics, and economy are uncontrollable and unpredictable. However, income taxes and investing costs, while unpleasant for sure, are omnipresent and forever.

As you work to build and protect your net worth, investing costs, fees, and expenses are virtually unavoidable. And owning investments inevitably means you will be subject to income tax obligations as well. The bad news? These two “necessary evils” are inevitable and unavoidable when working to grow and protect your net worth. The good news? With intelligent and proactive planning, we DO have some control over reducing and minimizing both!

Be it taxes or investment costs, it’s not what you make but what you keep. Let’s take a closer look at both necessary evils, and what can be done to reduce and minimize each of them.

Necessary Evil 1 - Taxes

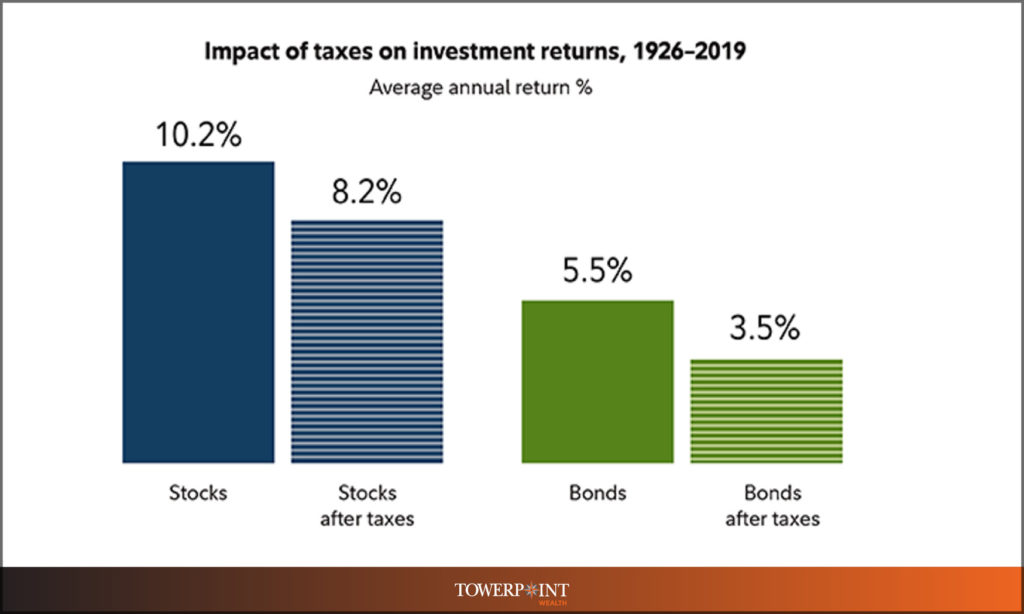

Are income taxes dragging you down, ruining the “gas mileage” of your portfolio, and bringing down its real return? While financial and investment decisions should never be primarily driven by taxes, evaluating opportunities to reduce and minimize the income tax drag of your portfolio should always be top of mind.

Things to consider:

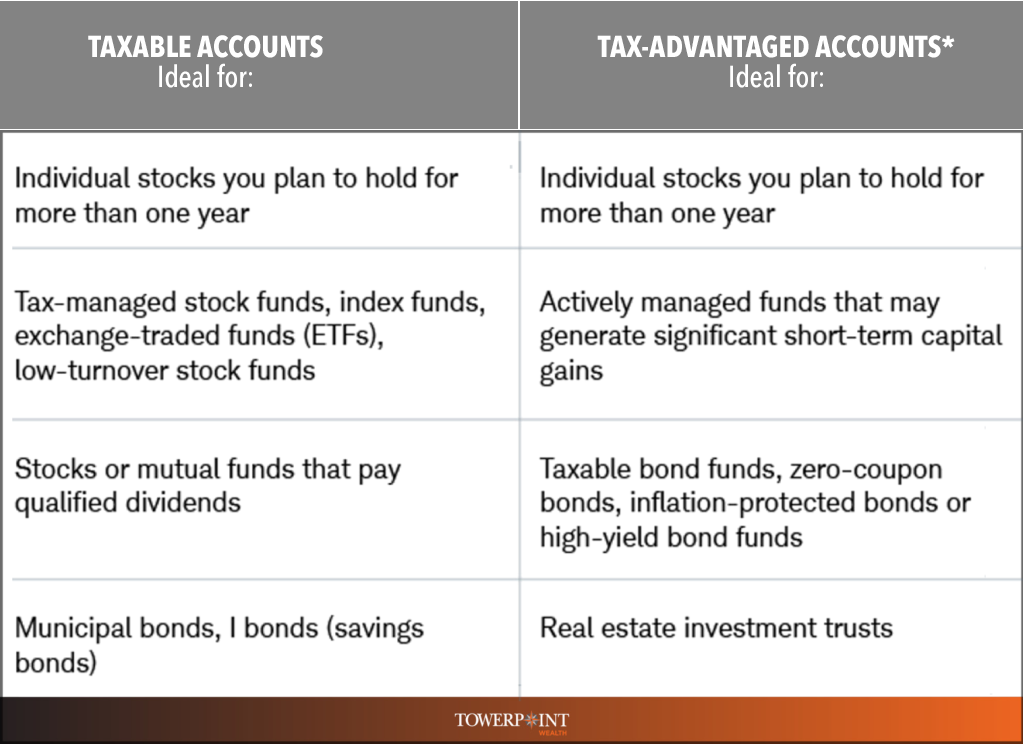

1. The location of your investments matters: If you have a “regular” taxable account and also a tax-deferred retirement account, understanding which account to hold which of your investments in makes a huge difference. Knowing how to leverage, and what to hold, inside of IRA and 401(k) accounts can have a significant influence on your net, after-tax returns.

2. When to buy and sell your investments matters: Tax-loss harvesting and the strategic realization of capital gains can make a huge difference when reducing the overall tax drag of your portfolio.

3. Which accounts to trade in matters: Should you buy and sell in your tax-deferred IRA or 401(k) account, or would it be better to take advantage of the long-term capital gain and/or return of principal opportunities that a “regular” taxable account offers?

4. The type of investments and funds you own also matters: Certain funds trade less and have lower turnover, tending to be inherently more tax efficient, as compared to funds that do a lot of active buying and selling, which can generate unwanted income and capital gain distributions.

5. Which accounts you make withdrawals from matters: When taking money from your portfolio, being mindful of the type of account you decide to draw from matters, as does your personal income tax bracket at the time these withdrawals occur.

Necessary Evil 2 – Investment Costs

Four out of 10 investors don’t know how much they are paying in fees and investment costs, according to a study by Consumer Reports. And one of the easiest ways to bolster your returns and to better grow and protect your net worth is through expense, fee, and cost reductions.

Things to consider:

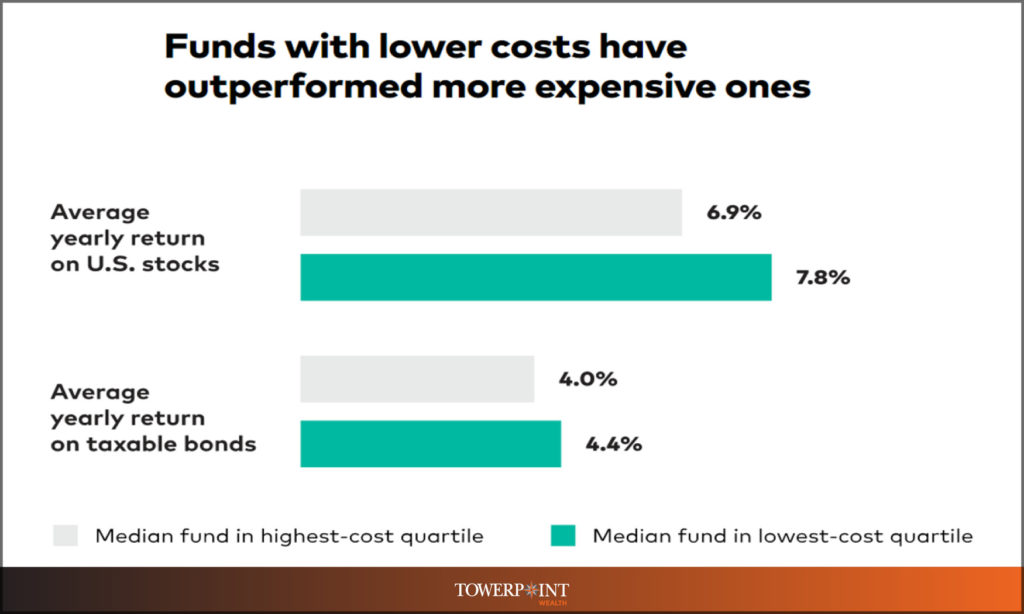

1. Consider low-cost index funds and ETFs over actively-managed funds. While you don’t receive a bill in the mail to physically write a check to pay the internal costs and expenses of your diversified investment funds (these are paid directly out its returns), it is essential to be aware of, and work to reduce, this necessary evil.

2. Reduce/eliminate account custodial fees and trading commissions/costs. Use a custodian or brokerage firm that doesn’t charge for these things. This is simple, and an absolute no-brainer. Towerpoint Wealth has partnered with Charles Schwab as our custodian, and our clients do not pay any account custodial fees, nor any stock/ETF trading commissions.

3. Do not pay a “load” when investing in a mutual fund. A “load” is another word for commission. Don’t pay them, and instead seek out no-load and institutional funds, and financial advisors who recommend them.

4. Pay attention to hidden fees within your company-sponsored retirement plan. Ask to see the summary plan description, also known as the plan document. If your menu of investment choices is a limited selection of high-expense/high-fee funds, ask your plan administrator why, and what lower-cost options are available to you.

Reducing and minimizing investment costs and income taxes is a significant responsibility of properly managing, protecting, and growing your net worth. There is no question that the drag created by these two necessary evils reduces the overall “gas mileage” of your portfolio, but fortunately, you do have direct control over the application and implementation of the above-mentioned strategies. As Warren Buffett said:

Have questions or concerns? Let’s talk.

Message us to schedule a no-strings-attached initial conversation.

Click the Wealth Management Philosophy thumbnail image below to learn more about exactly how we help our clients build and protect their net worth

Keeping our professional saw sharp! Click to read more

After two years of having to host the conference virtually, the 2022 Charles Schwab IMPACT conference, aka the “World Series of Investment Conferences,” was back in full effect in Denver, CO this month.

Among the more than 5,000 invite-only attendees were our Director of Research and Analytics, Nathan Billigmeier, our Director of Tax and Financial Planning, Steve Pitchford, and our Partner, Wealth Advisor, Jonathan LaTurner.

From live keynote presentations from some of the biggest names in business, finance, wealth management, and politics, to intimate and interactive breakout sessions throughout the three-day event, the conference is a one-of-a-kind and fully-immersive experience for attendees.

Here are some of our top trending moments at Towerpoint you might have missed on our social platforms.

Click the images below!

What else is happening with the Towerpoint Wealth family?

Are you aware of your ability to align your investment portfolio with your personal values?

Watch an interesting and insightful conversation between our President, Joseph F. Eschleman, CIMA®, and Jay Lipman, co-founder at Ethic Investments, a global leader in ESG investing who helps empower wealth advisors and investors to create sustainable and socially-responsible portfolios.

Joseph and Jay specifically touch on:

- What is ESG, sustainable, and responsible investing?

- Why demand for ESG, sustainable, and responsible investing has exploded over just the past 18 months.

- Why returns and growth no longer need to be sacrificed when utilizing and implementing an ESG and sustainable investment philosophy.

- Why utilizing a customized separately managed account (SMA) is a much more effective way to develop and implement a inclusionary and exclusionary ESG-focused portfolio, as opposed to an ESG ETF or open-end mutual fund.

- How the pandemic and COVID-19 accelerated the growth and focus on ESG investing.

- What the future of ESG, sustainable, and responsible investing looks like.

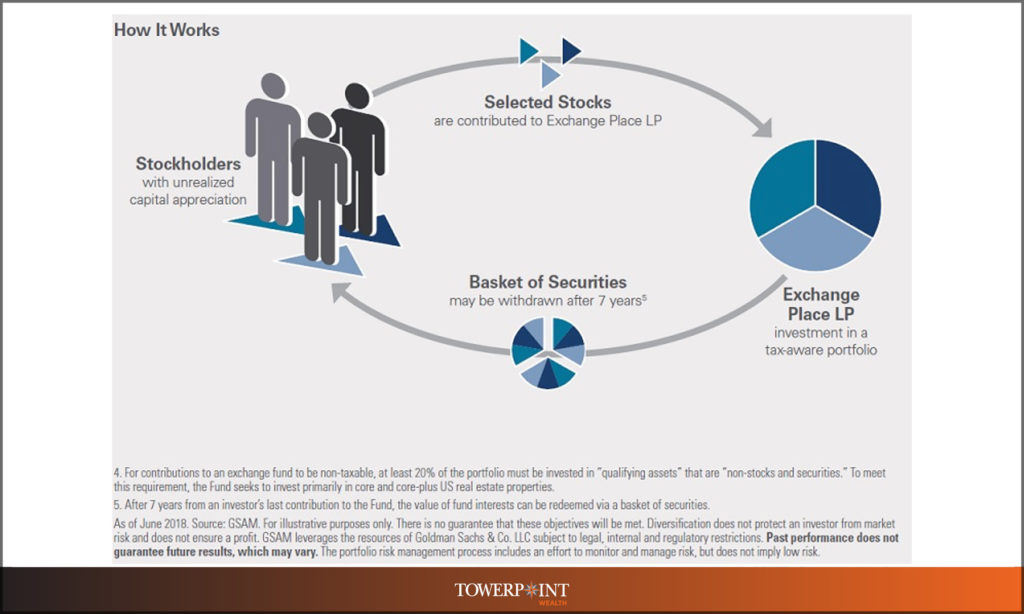

Have you heard of an exchange fund? Are you aware of how an exchange fund can help you diversify your holdings and defer capital-gains taxes?

Exchange funds, also known as swap funds, pool large amounts of concentrated shareholders of different companies into a single investment pool, allowing large shareholders of a single stock to exchange this concentrated stock holding into a share in the pool’s more diversified portfolio.

Each exchange fund investor receives a share of partnership units commensurate with their contribution. The fund then employs its strategy, and usually after seven years, you have the option to redeem your units. When you do, you typically receive a pro-rata share of some or all of the stocks in a fund’s portfolio, depending on the policy of the individual fund. Or, you can continue to stay invested in the partnership on a tax-deferred basis.

Have more questions? Contact us or click below to message our Director of Tax and Financial Planning, Steve Pitchford, to request a complimentary analysis.

Have you considered specific 4Q, 2022 tax-planning and tax-reduction opportunities, before December 31 comes and goes?

Useful and interesting content we’ve read over the past two weeks:

1. Republican Infighting Roils Congress As Midterms Fallout Continues

Washington Post – 11.15.2022

Republicans in both chambers of Congress mounted challenges to their leaders Tuesday as disappointment over their lackluster performance in the midterm elections manifested in infighting and instability at the Capitol.

2. CNN, ABC News Cuts: TV News’ Belt-Tightening Era Begins

Hollywood Reporter – 11.16.2022

As CNN, ABC News, and others grapple with an advertising downturn and lower linear (non-streaming) viewership, the new mandate is to trim costs and find savings however they can while staffers weather the storm.

3. Yankees Ready to Pay Top Dollar to Keep Aaron Judge

NY Post – 11.15.2022

Hal Steinbrenner sounds prepared to do what it takes to keep Aaron Judge a Yankee – to a point. The Yankees’ managing general partner said Tuesday he told Judge he wants him to stay in the Bronx and indicated money won’t prevent that from happening.

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

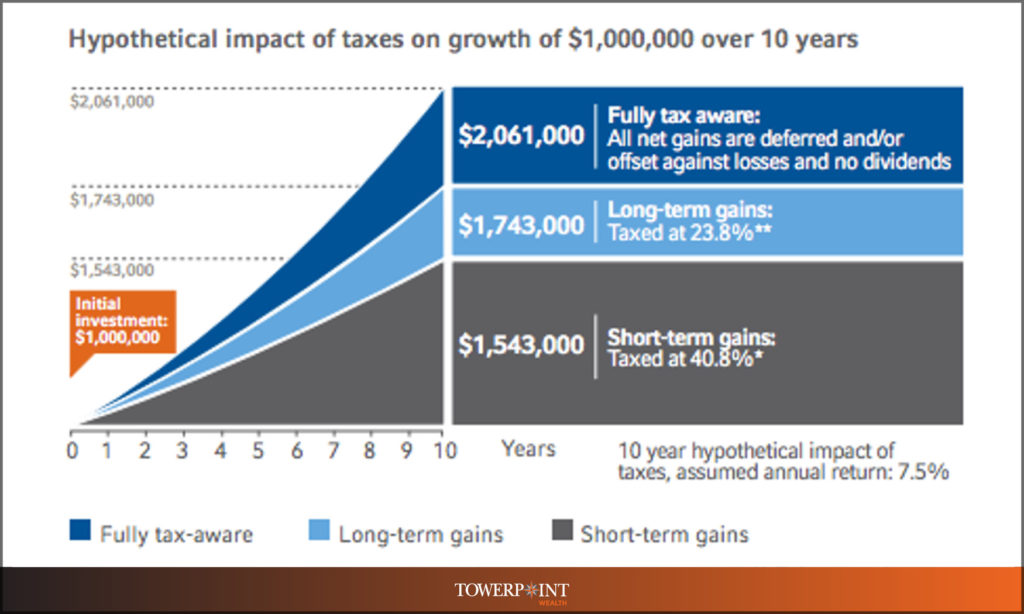

The below chart reflects the material range of possible outcomes, depending on whether or not a tax-smart approach was taken. Whether investing for short-term or long-term gains, a failure to follow a tax-sensitive strategy can significantly impact your financial security.

Broken record: Let us help you keep as much of your growth and returns as possible.

If you speak with someone who is concerned or unsettled about their investments or advisor, we welcome talking with them.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Joseph Eschleman, Jonathan, Steve, Lori, Nathan, Michelle, and Luis

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity.

We will happily donate $10 to it!

Click HERE to follow TPW on LinkedIn

Click HERE to follow TPW on Facebook

Click HERE to follow TPW on Twitter