By: Steve Pitchford, CPA, CFP®, Director of Tax and Financial Planning

Dreading a Required Minimum Distribution, or RMD, from a retirement account? No doubt, it’s because of T-A-X-E-S.

RMDs can be an unwanted by-product of contributing to and investing in retirement accounts such as 401(k)s, IRAs, 403(b)s, etc. And there are impactful and proactive tax planning strategies that can materially lessen the tax sting of an RMD.

What is a Required Minimum Distributions, RMD?

Why are Investors Subject to RMDs?

How are RMDs Calculated?

Form 5329

How to Effectively Plan to Decrease RMD Taxes

What are RMDs, and how should an individual plan for them within the context of a tax-efficient retirement strategy? Read on to learn more about RMDs, and specifically, three actionable RMD strategies worth evaluating reduce taxes on RMDs withdrawals.

What is a Required Minimum Distributions, RMD?

The Internal Revenue Service (IRS) requires that individuals begin taking annual distributions (read: withdrawals) from pre-tax qualified retirement accounts[1] when they reach age 73. These withdrawals are referred to as required minimum distributions (RMDs).

RMDs from pre-tax qualified retirement accounts are subject to ordinary income tax rates in the year in which they are taken.

Examples of pre-tax qualified retirement accounts include:

- Regular/Traditional IRAs

- SEP IRAs

- SIMPLE IRAs

- 401(k) plans[2]

- 403(b) plans

- 457(b) plans

- Profit sharing plans

- Other defined contributions plans

- Inherited IRAs (subject to special rules, see page six)

- Annuities, but only when held within another qualified retirement plan

Generally, Roth IRAs are the only type of qualified retirement plan not subject to RMDs. Withdrawals from Roth IRAs are tax-free, and the IRS does not mandate distributions from these accounts, as no tax revenue is generated when taking a Roth distribution.

Why are Investors Subject to RMDs?

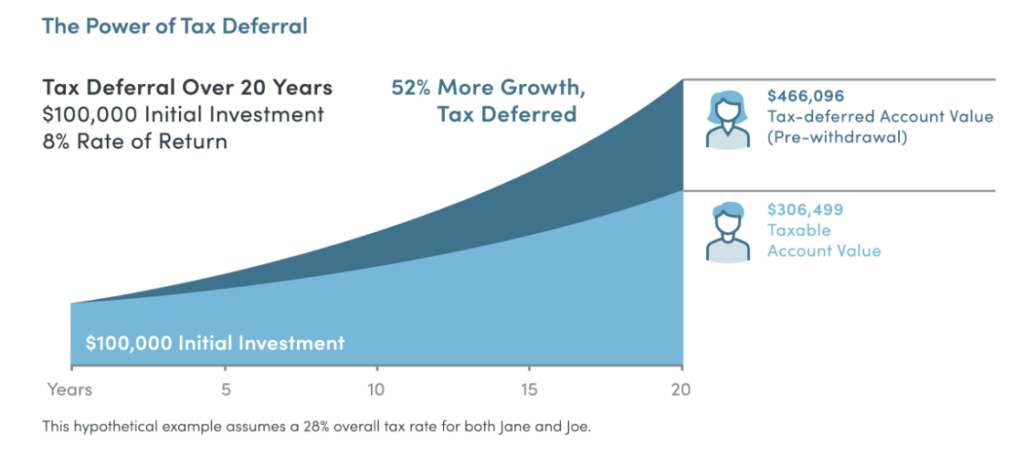

Pre-tax contributions to a qualified retirement account provide two important and major tax advantages:

- A dollar-for-dollar reduction in taxable income (read: an income tax deduction) for the contribution in the year it was made

- Investment earnings (interest, dividends, and capital gains) are not taxed until withdrawn from the plan[3]. The power of tax-deferred compounding is tremendous, FYI:

If RMDs did not exist and an individual had sufficient supplemental financial means[4] to meet their retirement spending goals and objectives, they would probably avoid distributions from a pre-tax qualified retirement plan in the interests of avoiding paying the concurrent ordinary income taxes on those distributions. Requiring these distributions ensures that the government will not lose out on valuable tax revenue, on top of the lost tax revenue from the upfront tax deduction and tax-deferred growth that retirement accounts already provide.

How are RMDs Calculated?

For most individuals, the annual RMD calculation is as follows:

- The individual determines the account balance as of December 31 of the year before the RMD is to be taken.[5]

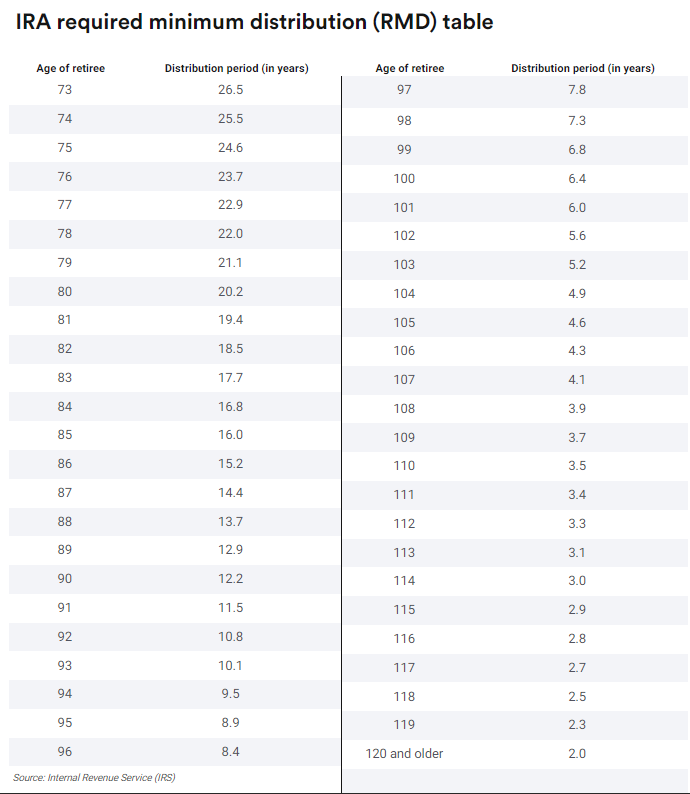

- The account owner determines his or her “life expectancy factor” using the life expectancy tables published by the IRS.

- The account balance is divided by the life expectancy factor to determine that year’s RMD.

The life expectancy table used for most individuals is the following:

*Individuals should speak with their financial advisor or tax professional to ensure that they are not subject to a different life expectancy factor, as exceptions to the above table do exist.

Investment custodians such as Charles Schwab, Fidelity, and Vanguard typically calculate RMDs on behalf of the retirement account owner. However, it is the responsibility of the owner to ensure the RMD is satisfied before year-end.[6]

Towerpoint Tip:

Withholding taxes directly from qualified retirement plan distributions is generally the most convenient way to pay the RMD taxes. However, using after-tax dollars instead to pay estimated tax payments to cover the RMD taxes may be a more tax-efficient approach.

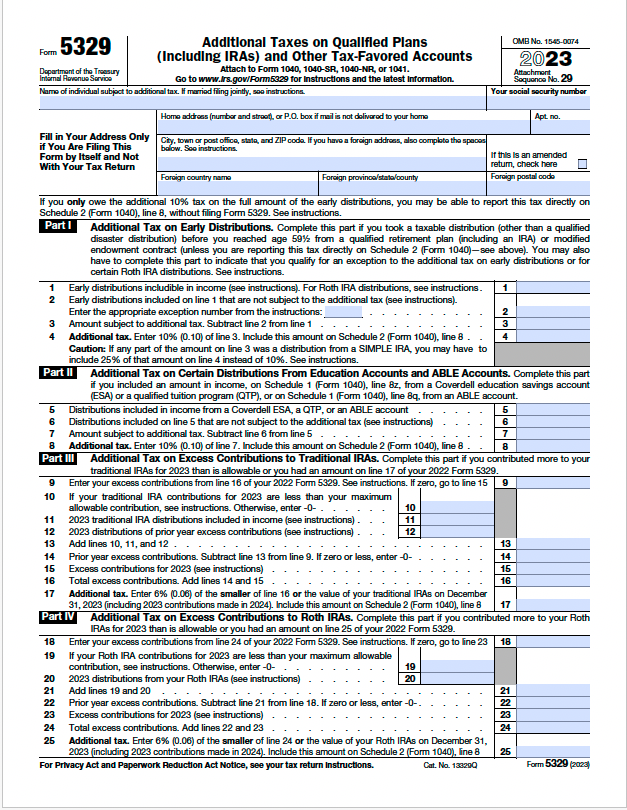

Form 5329 | What If an Investor Misses Taking Some or All of Their RMD?

If a retirement account owner who is subject to an RMD misses taking it by December 31, the penalty is steep: 50% of the RMD shortfall.

If this happens to occur, the individual should immediately: Form 532

- Take corrective action and distribute the shortfall from their qualified retirement account as quickly as possible.

- File a Tax Form 5329.

- Attach a letter to the Form 5329 explaining the steps taken to correct this and why it was missed in the first place. While there is no formal guidance from the IRS regarding an error that would qualify for the penalty to be waived, three common positions taken are a change in address resulting in not getting the RMD notification, a death in the family, or an illness.

How to Effectively Plan to Decrease RMD Taxes

There are three strategies that we regularly employ for our Towerpoint Wealth clients to mitigate RMD taxes.

Strategy One: Accelerate IRA Withdrawals

Subject to certain exceptions, age 59 ½ is the first year in which an individual is able to take a distribution from a qualified retirement plan without being subject to a 10% early withdrawal tax penalty.

Consequently, the window of time between age 59 ½ and age 73 becomes an important one for proactive RMD tax planning. By strategically taking distributions from pre-tax qualified retirement accounts between these ages, an individual may be able to lessen theiroverall lifetime tax liability by reducing future RMDs (and the risk that RMDs may push them into a higher tax bracket) by reducing the retirement account balance.

This strategy becomes particularly opportune for an individual who has retired before age 73, as it often affords the individual the ability to take these taxable distributions in a uniquely low income (and lower income tax) period of time.

At Towerpoint Wealth, we utilize BNA Income Tax Planner, a robust piece of tax planning software, to evaluate these types of tax planning opportunities, helping our clients optimize this decision-making process.

Towerpoint Tip:

Don’t forget Social Security! Leveraging distributions taken from qualified retirement accounts to serve as a retirement income “bridge” is an important consideration when strategically planning how and when to receive Social Security benefits. Oftentimes, it is advisable to take distributions from qualified retirement accounts to meet retirement spending goals and objectives and delay filing for Social Security benefits until age 68, 69, or even 70.

Why? Each year Social Security benefits are deferred, starting at the first eligible filing year of age 62, until age 70, the monthly benefit amount increases by a guaranteed 8%!

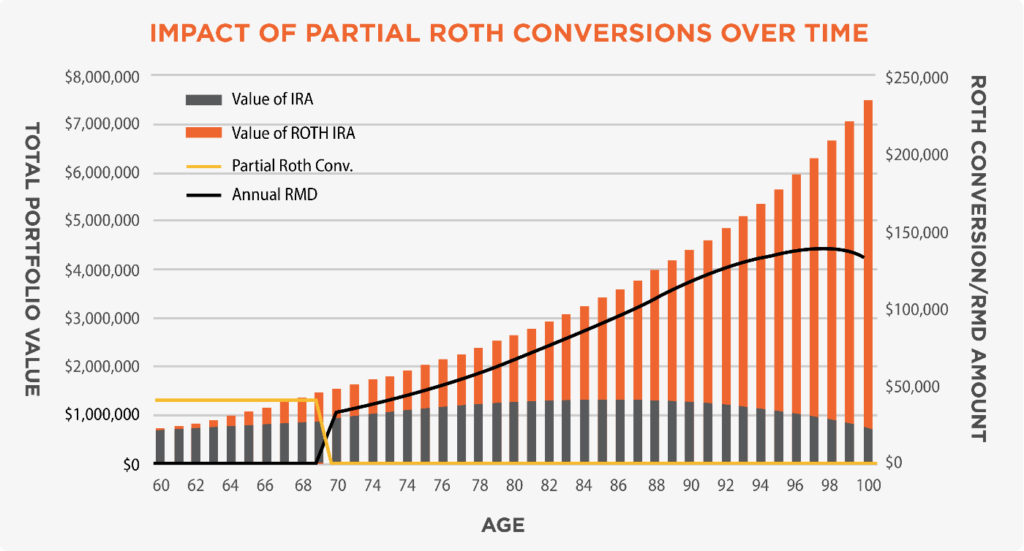

Strategy Two: Execute a Roth Conversion

A Roth conversion is a retirement and tax planning strategy whereby an individual transfers, or “converts,” some or all of their pre-tax qualified retirement plan assets from a Traditional IRA into a tax-free Roth IRA.

While ordinary income taxes are owed on any amounts of tax-deferred contributions and earnings that are converted, a Roth conversion, when utilized properly, is a powerful tax planning strategy to reduce a future IRA RMD, as Roth assets are not subject to RMDs. Further, Roth conversions 1) maximize the tax-free growth within a taxpayer’s investment portfolio, 2) provide a hedge against possible future tax-rate increases (as Roth retirement accounts are tax-free), and 3) leave a greater tax-free financial legacy to heirs.

For both strategies #1 and #2: Consider executing these strategies for the older spouse first, as this individual will be subject to an IRA RMD earlier. For this same reason, it is often advisable to contribute to the younger spouse’s pre-tax qualified retirement plan first.

Towerpoint Tip:

At Towerpoint Wealth, pairing a Roth conversion with the "frontloading" of a Donor-Advised Fund (DAF) has been a powerful tax planning strategy, allowing our clients to convert additional assets “over” to tax-free Roth assets at lower tax rates, while also allowing taxpayers who would not ordinarily itemize deductions to "hurdle" the standard deduction. This ensures that they receive at least a partial tax deduction for their charitable contribution to a DAF.

Strategy Three: Use the IRA RMD to Make Qualified Charitable Distributions

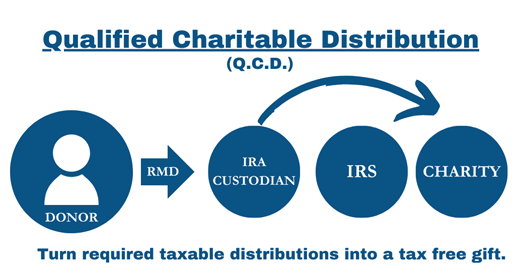

When an individual becomes subject to an IRA RMD, in lieu of having the IRA distributions go to them, they may consider facilitating a direct transfer from their IRA to one, or more, 501(c)3 charitable organizations (up to $105K annually). This is known as a Qualified Charitable Distribution (QCD).

As long as these distributions are made directly to the charity, they 1) satisfy the RMD and 2) are excluded from taxable income.

This strategy, when executed property, results in a dollar-for-dollar income reduction compared to a “normal” RMD.

What Is an Inherited IRA, and Are They Subject to RMDs?

An Inherited IRA, also commonly known as a Beneficiary IRA, is a qualified retirement account that is opened on behalf of the beneficiary(ies) of the original owner’s qualified retirement account after the death of this owner. While the rules surrounding RMDs for Inherited IRAs can be complicated, Inherited IRAs are subject to mandatory distribution schedules.

For most individuals, the RMD on Inherited IRAs is levied as follows:

RMD on Inherited IRA for an owner who passed before December 31, 2019

Subject to a life expectancy table similar to those for regular RMDs. These RMDs begin the year following the death of the owner.

RMD on Inherited IRA for an owner who passed after December 31, 2019

Subject to the “10-Year Rule” where all funds need to be distributed ten years after the year of the owner’s death. How and when funds are distributed within this ten-year time horizon is up to the owner of the Inherited IRA.

Towerpoint Tip:

The “10-Year Rule” is making Inherited IRA tax planning more important than ever. Although the flexibility of how and when to withdraw funds within this period may be helpful, the window of distribution is more compressed (for most individuals) compared to the “old” rules.

Individuals should consider a Roth conversion if they are concerned about their inheritors paying taxes on future distributions. While Inherited Roth IRAs are subject to the same RMD rules as Inherited IRAs, the distributions are tax-free. A Roth conversion, within this context, is an estate planning strategy to transfer tax liability to the original account owner and away from the future inheritor(s).

How Can We Help?

Towerpoint Wealth’s certified financial planners serve as legal fiduciaries to our clients near Roseville, Rocklin, Granite Bay, Folsom, Gold River, El Dorado Hills, East Sacramento, Curtis Park, Land Park, Elk Grove, and Rancho Murietta. At Towerpoint Wealth, we are a fiduciary to you, and embrace the legal obligation we have to work 100% in your best interests. We are here to serve you and will work with you to formulate a comprehensive and tax-efficient retirement strategy.

Are you searching “certified financial planner near me?” You’ve found Sacramento independent financial planner Joseph Eschleman, as well as certified financial planner Steve Pitchford, CPA, CFP®, and our entire independent wealth management team.

We serve clients primarily in the Northern California region. Glad you’re here! Please contact us with any questions you have about our wealth management process.

[1] A retirement plan that provides tax advantages relative to nonqualified plans. Most employer-sponsored plans are qualified retirement plans.

[2] Less than 5% owners can defer RMDs until they leave the company or retire.

[3] Taxable investment accounts, such as a brokerage account or trust account, are subject to taxes based on annual earnings. Investors receive a Form 1099 each year showing the income to be reported on tax returns.

[4] Pension income, Social Security benefits, taxable investment assets, etc.

[5] For example, a 2021 RMD is calculated using the account balance as of December 31, 2020.

[6] RMDs may be taken all at once or throughout the year.

Written by : Steven Pitchford, Sacramento Certified Public Accountant, CPA®, Sacramento Certified Financial Planner, CFP®