Managing Capital Gains Distributions from Mutual Funds and ETFs

As the end of the year approaches, many investors may find themselves surprised by an unwelcome addition to their year-end taxes: year-end capital gains distributions from mutual funds and certain ETFs.

These distributions, typically caused by fund managers selling securities within the fund throughout the calendar year, can create significant tax liabilities — even if you didn’t sell a single share of any of your investments. For investors in taxable accounts, this can feel like paying taxes on gains you didn’t directly benefit from, and can erode your net returns and decelerate your financial goals.

Understanding the impact of year-end taxes and capital gains distributions is essential for managing your tax burden and preserving as much of your portfolio’s value as possible. By being proactive and taking advantage of tax-efficient strategies, you can stay ahead of these unwanted surprises, and keep more of your hard-earned money invested for longer-term growth.

This is why a core wealth-building and wealth-protection philosophy here at Towerpoint Wealth emphasizes tax efficiency as a cornerstone of portfolio management. Tax-efficient investing isn’t just about minimizing taxes — it’s about strategically maximizing the longer-term potential of your wealth.

In this article, we’ll explore the challenges of year-end taxes and capital gains distributions, and provide actionable strategies to help you mitigate their impact. Let’s dive into how you can turn this tax hurdle into an opportunity to boost your investment outcomes.

Key Takeaways

- Year-end capital gains distributions from mutual funds and some ETFs can create unexpected tax liabilities for investors, even if they didn’t actively sell their shares.

- These distributions are taxed as either short-term capital gains (ordinary income rates) or long-term capital gains (usually lower than ordinary income rates).

- Mutual funds are more prone to capital gain distributions than ETFs due to structural differences in how they manage redemptions and internal trading.

- To reduce the impact of these taxes, investors can:

- Time investments carefully, avoiding purchases just before year-end distributions.

- Prioritize tax-advantaged accounts for holding mutual funds that trade more frequently.

- Generally, utilize ETFs in lieu of “regular” open-end mutual funds.

- Choose tax-efficient investments.

- Use tax-loss harvesting to offset capital gains and reduce taxable income. - Regular portfolio reviews and proactive communication with a financial advisor can help you stay ahead of potential tax issues.

What Are Year-End Capital Gains Distributions?

Let’s start by discussing what year-end capital gains distributions are and how they affect your portfolio.

Year-end capital gains distributions are a common, but often misunderstood, part of investing in mutual funds and certain ETFs. They result from fund managers selling securities within the fund to rebalance the portfolio, manage risks, or fulfill investor redemptions. By law, the gains from these sales are passed along to shareholders as taxable distributions, even if you didn’t sell any of your shares in the fund.

For many investors, this creates a confusing and frustrating tax situation; though you may not have sold a single share, you’re still responsible for paying taxes on the fund’s realized gains. These distributions typically happen in the fourth quarter of the year, leading to an unwelcome surprise when next year’s tax season rolls around.

Mutual Funds vs. ETFs: Why Are Mutual Funds More Affected?

Mutual funds are more prone to year-end capital gains distributions than ETFs due to differences in their structure. When mutual fund investors redeem their shares, fund managers often need to sell securities within the fund to raise cash to meet the redemption. This creates taxable gains, which legally are required to be distributed proportionally to all investors in the fund.

On the other hand, ETFs use an “in-kind” redemption process that involves exchanging securities with market makers, instead of selling them directly. This process minimizes the taxable gains that are passed on to ETF shareholders, making ETFs generally more tax-efficient.

However, it’s important to note that certain ETFs can still distribute capital gains under specific circumstances, particularly those that trade less liquid or complex securities.

Why Year-End Capital Gains Distributions Matter

Year-end distributions can have a significant impact on your financial situation, especially if you hold mutual funds in a non-retirement “taxable” account. These distributions are reported on your 1099, and are taxed as either short-term or long-term capital gains, depending on how long the fund held the securities before selling them.

For investors, this creates two main issues:

- Unexpected Tax Bills: If you’re not anticipating a distribution, it can upend your financial plans, forcing you to pay taxes you didn’t account for.

- Reduced Returns: Taxes on distributions eat into your investment gains, reducing your portfolio’s net overall performance.

This problem is worsened for those who invest in a mutual fund late in the year. Even if you’ve only held the fund for a few weeks, you could still be on the hook for the entire year’s distribution. That’s why understanding a fund’s distribution schedule and structure is crucial when investing.

Year-end capital gains distributions are more than just a tax nuisance — they can erode your portfolio’s overall efficiency over time. However, by knowing how they work and why they happen, you can take steps toward mitigating their impact and aligning your investments with your long-term financial goals.

How Capital Gains Distributions Impact Investors

Year-end capital gains distributions may seem like a routine part of investing, but they can have significant implications for both your portfolio’s performance and your year-end taxes and tax bill. For many investors, the effects of these distributions can feel out of their control, which is why understanding the potential impact is crucial for making informed decisions about how and where you invest.

The Tax Consequences of Capital Gains Distributions

As mentioned, when mutual funds or ETFs distribute capital gains, they are taxed as either short-term capital gains, which are taxed at your ordinary income rate, or long-term capital gains, which are taxed at lower rates depending on your income level.

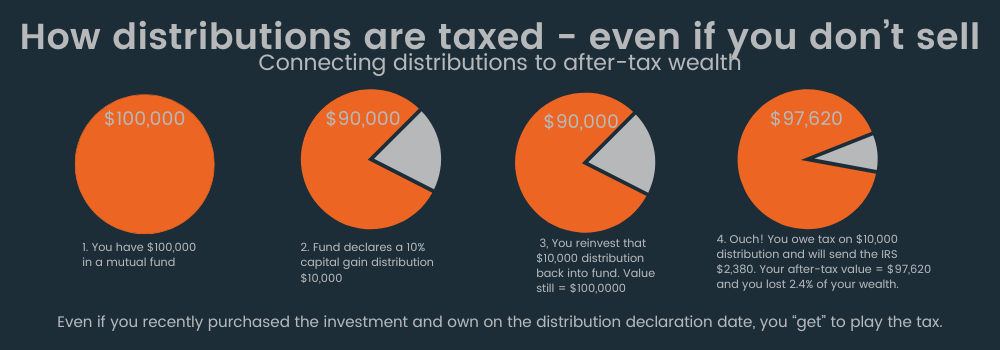

Regardless of the type, these taxes can quickly add up and reduce the overall value of your investments. For example, if a mutual fund distributes $10,000 in capital gains and you’re in a 20% long-term capital gains tax bracket, you owe $2,000 in taxes, even if you didn’t sell any shares.

This tax liability is particularly burdensome for investors who hold mutual funds in taxable accounts. While tax-advantaged accounts like IRAs or 401(k)s shield you from immediate taxes, distributions in taxable accounts directly impact your finances today.

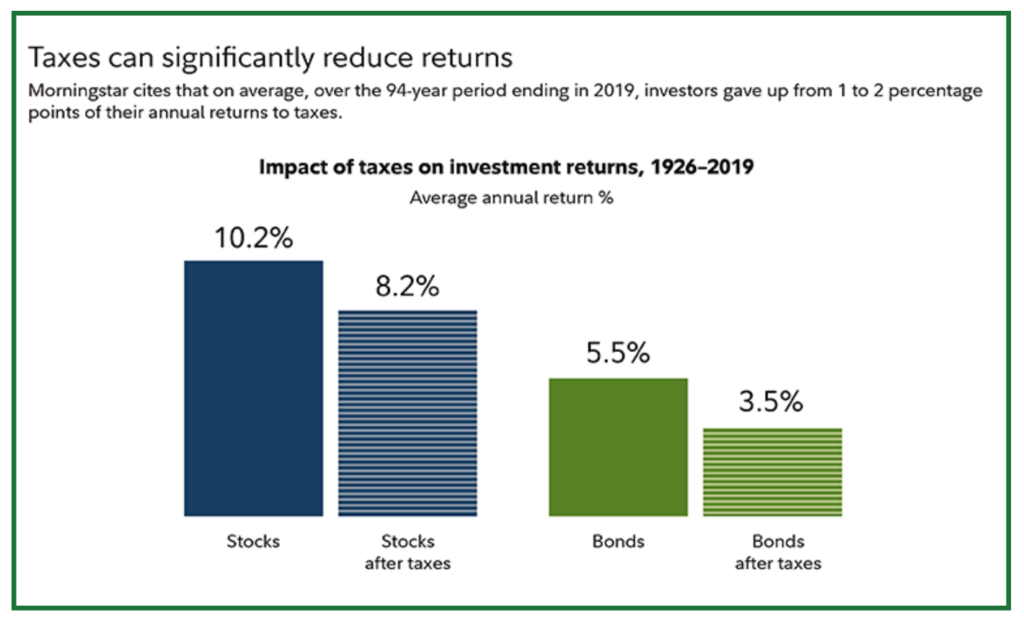

Erosion of Returns Over Time

Year-end capital gains distributions don’t just result in a one-time tax hit — they can have a lasting effect on your portfolio’s growth. Taxes paid on distributions reduce the amount of money you have available to reinvest, which limits the power of compounding over time.

Let’s consider two investors: one who consistently reinvests distributions without tax implications (in a tax-advantaged account) and another who pays taxes on distributions in a taxable account. Over decades, the investor in the tax-advantaged account will likely see significantly higher growth because their funds remain fully invested.

Unexpected Timing and Financial Strain

One of the most frustrating aspects of year-end capital gains distributions is their timing. Investors who buy into a mutual fund late in the year may still be responsible for the entire year’s gains. This means you could owe taxes on profits realized by the fund before you even invested.

If you purchase shares in a mutual fund on December 1, and the fund makes a large distribution on December 15. Even though you’ve held the fund for less than a month, you’ll owe taxes on your portion of the distribution, which could significantly impact your expected returns.

Why It Matters

The financial and emotional toll of capital gains distributions can be substantial. Unexpected tax bills and reduced returns can affect your overall financial plans, forcing you to adjust your budget or sell assets to cover the tax burden — and creating a significant amount of stress in the meantime. This is why proactive planning and strategic portfolio management are critical for minimizing these impacts.

Strategies to Manage and Prevent Capital Gains Tax Complications

While year-end capital gains distributions can create unexpected tax liabilities, there are strategies you can implement to mitigate or even prevent their impact. By taking a proactive approach to your investments, you can minimize taxes and keep more of your money working toward your financial goals.

Time Your Investments Carefully

One of the simplest ways to avoid unexpected capital gains taxes is to be mindful of when you invest in mutual funds. Before purchasing shares, especially late in the year, check the fund’s distribution schedule. Buying into a mutual fund just before it makes a distribution could result in an immediate tax bill on gains you didn’t benefit from.

To avoid this, you can review the fund’s website or contact the fund company to find out when distributions are expected. You can then delay your purchase until after the distribution if you’re investing in a taxable account. This strategy ensures you’re not inadvertently inheriting an unexpected tax liability when making new investments.

Make the Most of Tax-Advantaged Accounts

Placing mutual funds in tax-advantaged accounts like IRAs, 401(k)s, or Health Savings Accounts (HSAs) can help shield you from immediate taxes on capital gains distributions. Because these accounts defer or eliminate taxes on growth, they are an excellent choice for holding investments that are prone to taxable events.

For example, a Traditional IRA allows you to defer taxes on distributions until you withdraw the funds in retirement. A Roth IRA, on the other hand, allows your investments to grow tax-free, meaning you won’t owe taxes on distributions or withdrawals (as long as certain conditions are met).

By prioritizing tax-advantaged accounts for funds that frequently distribute capital gains, you can reduce your overall tax liability and maximize your portfolio’s growth potential.

Choose Tax-Efficient Investments

Not all funds are created equal when it comes to tax efficiency. Certain types of funds, like index funds and some ETFs, tend to generate fewer taxable events than actively managed mutual funds.

Index funds, for example, track a market index and require less trading, which results in fewer realized capital gains. Exchange-traded funds (ETFs), on the other hand, are designed with a unique structure that minimizes taxable events, making them an ideal choice for taxable accounts.

Another option to consider is tax-managed funds. These funds are specifically designed to minimize taxable distributions by implementing strategies like loss harvesting and low-turnover trading.

Take Advantage of Tax-Loss Harvesting

Tax-loss harvesting can be an effective strategy for reducing taxable gains by using losses from underperforming investments to offset them. This works by selling investments that have declined in value to combat the capital gains from distributions or other profitable sales.

For example, if a mutual fund distributes $5,000 in capital gains, you could sell a stock or another investment with a $5,000 loss to eliminate the taxable income. If your losses exceed your gains, you can offset up to $3,000 of ordinary income annually, with any additional losses carried forward to future tax years.

By proactively managing your portfolio throughout the year, tax-loss harvesting can help you minimize your tax burden and support your overall financial plan.

Work With a Financial Advisor

Navigating the complexities of capital gains distributions and tax-efficient investing can be overwhelming, especially as year-end deadlines approach. A financial advisor can help by providing personalized guidance tailored to your unique financial situation, goals, and preferences.

Advisors can help you identify funds that are prone to distributions and recommend alternatives. They can also help you optimize your portfolio by placing the right assets in the right accounts and using tax-loss harvesting strategies to minimize your tax liability.

At Towerpoint Wealth, we make decisions with the understanding that minimizing taxes is a crucial part of helping our clients achieve their long-term financial goals, which is why tax efficiency is a focus for all of our investment strategies.

By working with a financial advisor to optimize your investments for tax considerations, you can work to get the most out of your assets and preserve your nest egg for long-term growth.

Proactive Communication and Planning

Our last, but critical strategy for managing capital gains tax complications is proactive communication and planning. By regularly reviewing your portfolio and staying informed about upcoming distributions, you can make more strategic decisions about your investments and avoid costly surprises.

Closely monitoring the funds in your portfolio can help you to stay aware of your upcoming tax liabilities. Many mutual funds and ETFs provide distribution estimates in the fourth quarter, which can give you a clear picture of potential tax liabilities.

Reviewing these estimates with your financial advisor or on your own can help you determine how they might impact your overall tax situation and act accordingly. If a fund is planning a significant distribution, you may want to take action, such as selling your shares before the distribution in a taxable account, to avoid inheriting a tax liability.

It’s also important to think ahead about your overall financial goals. Do you need liquidity in the near future? Are you planning to rebalance your portfolio or make new investments before the end of the year? By aligning these objectives with your tax strategy, you can make more efficient decisions that support your broader financial plan. Keeping open communication with your advisor and planning your objectives beforehand is key in mitigating unnecessary tax complications.

Final Thoughts

As we have discussed, year-end capital gains distributions can pose a significant challenge for investors, creating unexpected tax liabilities and reducing the portfolio’s overall returns. However, with the right strategies — such as careful timing, using tax-advantaged accounts, opting for tax-efficient investments, and implementing strategies like tax-loss harvesting — you can take control of your tax situation and minimize the impact of these distributions.

Proactive planning and regular portfolio reviews are essential to ensuring your investments remain aligned with your financial goals. At Towerpoint Wealth, we focus on tax efficiency as a cornerstone of our investment approach, helping our clients maximize their wealth and keep more of their returns working toward their future.

If you want to learn how we can help you build a tax-efficient portfolio that supports your long-term goals, we welcome speaking with you.

By staying informed and working with experienced professionals, you can turn the stress of year-end capital gains distributions into an opportunity to strengthen your financial plan and feel confident in your future.

Joseph Eschleman, CIMA®

President

Jonathan W. LaTurner

Partner, Wealth Advisor

Steve Pitchford, CPA, CFP®

Director of Tax and Financial Planning

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

Isabelle Orozco

Office Coordinator

Connect with Towerpoint Wealth, your Sacramento Financial Advisor, on any of these platforms, and send us a message to share your preferred charity.

We will happily donate $10 to it!

Follow TPW on LinkedIn

Follow TPW on YouTube

Follow TPW on Facebook

Follow TPW on Instagram

Follow TPW on X

Follow TPW Podcast