It’s that time – the 2024 tax season is upon us!

As we embark on the 2024 tax season, many individuals and businesses are gearing up to tackle their financial obligations and maximize their tax benefits. With the ever-evolving landscape of tax laws and regulations, it's essential to address the top 2024 tax season questions to both ensure compliance and optimize financial outcomes. From understanding filing statuses and deductions to navigating changes in tax brackets and credits, getting answers to these important questions can empower taxpayers to make informed decisions and minimize their tax burden. Let's delve into the top tax season questions for 2024 and provide insightful answers to better guide YOU through this oftentimes painstaking and complex annual tax labyrinth.

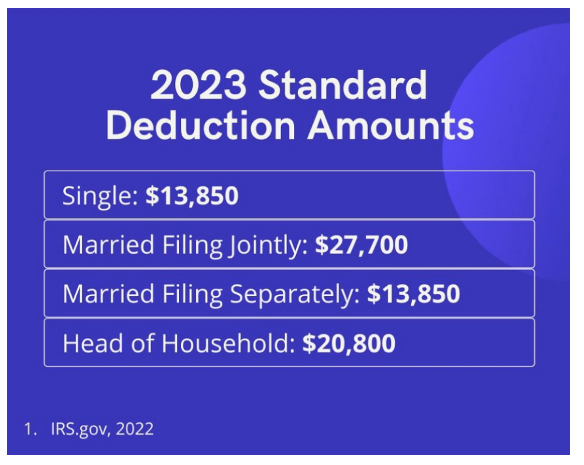

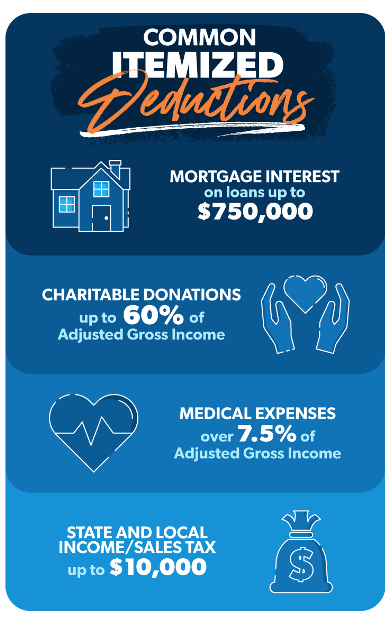

Should I itemize or take the standard deduction?

When completing your tax return, you have the option to decrease your taxable income by either opting for the standard deduction or itemizing deductions.

The standard deduction is a fixed amount determined by your filing status, while itemized deductions comprise expenses incurred in the previous year that can reduce your taxable income. Examples of itemized deductions, as outlined on the IRS website, include mortgage interest, real estate taxes, property taxes, disaster losses, state and local income or sales taxes, charitable donations, and certain medical and dental expenses.

Typically, individuals with higher incomes and substantial deductible expenses from the previous year may benefit from itemizing deductions rather than taking the standard deduction. For instance, owning rental property offers tax-deductible advantages that might surpass what one would receive through the standard deduction.

What is the best tax season software I should use?

Tax season software refers to specialized computer programs designed to assist individuals and businesses in preparing and filing their taxes with government authorities. These software applications streamline the often complex and time-consuming process of tax preparation by providing users with intuitive interfaces, step-by-step guidance, and automated calculations. Tax season software typically offers features such as importing financial data from various sources, identifying eligible deductions and credits, and generating accurate tax forms based on the user's input.

Moreover, tax season software often includes error-checking functionalities to help users identify and correct any mistakes before submitting their returns, reducing the risk of audits or penalties. Additionally, some software solutions offer electronic filing options, allowing users to submit their tax returns directly to tax authorities online, further expediting the process. Overall, tax season software serves as a valuable tool for individuals and businesses alike, helping them navigate the complexities of tax laws and regulations while maximizing their tax savings and ensuring compliance with legal requirements.

Earlier this year, CNBC Select meticulously assessed 12 tax season software options, scrutinizing them across various criteria such as pricing, user interface, expert tax support, and Better Business Bureau rating. Their recommended tax season software choices:

- Best for user experience: Intuit TurboTax

- Best for DIY filing: H&R Block

- Best free tax season software: Cash App Taxes (formerly Credit Karma Tax)

- Best affordable tax season software: TaxSlayer

- Best for accuracy guarantee: TaxAct

What happens if I miss the April 15 tax deadline for the 2024 tax season?

Missing the April 15 tax deadline can have various consequences depending on individual circumstances. Primarily, failing to file your taxes by the deadline typically results in penalties and interest accruing on any unpaid taxes owed. The penalty for late filing is usually a percentage of the unpaid taxes, increasing over time the longer the return remains outstanding. Additionally, interest compounds daily on any unpaid tax balance until it's fully paid. These penalties and interest charges can significantly increase the total amount owed to the IRS, making it crucial to file your taxes as soon as possible, even if you can't pay the full amount owed.

Furthermore, missing the tax deadline may also lead to missed opportunities for tax refunds. If you are owed a refund but fail to file your return on time, you risk delaying the receipt of your refund. The IRS typically has a statute of limitations on claiming refunds, and filing after the deadline could result in forfeiting any refund you might be entitled to. Therefore, it's essential to file your taxes promptly, even if you're unable to meet the deadline, to avoid penalties, interest, and potential loss of refunds.

If you anticipate not being able to meet the April 15 tax deadline, you have the option to request an extension from the IRS. This extension grants you additional time to file your tax return, typically extending the deadline by six months to October 15. However, it's crucial to note that an extension to file does not grant an extension to pay any taxes owed. Therefore, if you expect to owe taxes, it's essential to estimate and pay as much as possible by the original deadline to minimize potential penalties and interest. Taking an extension can provide breathing room for gathering necessary documentation or seeking professional assistance to ensure accurate and timely tax filing.

If the April 15, 2024 tax season deadline passes, it's imperative to proceed with filing your taxes promptly. Delaying can result in penalties, especially if you owe taxes, with the penalty increasing the longer you wait. However, if you're due a tax refund and don't owe any taxes, you won't face penalties for filing late. Regardless, it's advisable to complete your tax filing as soon as possible to avoid any potential complications or delays.

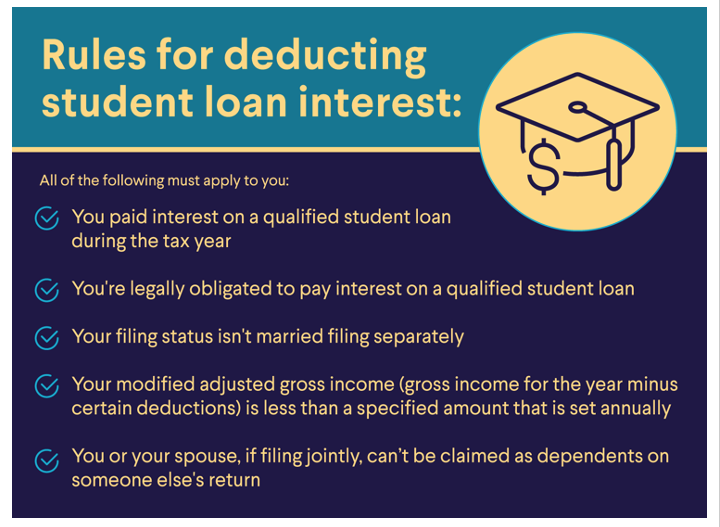

Can I deduct my student loan interest?

Deducting student loan interest can be a valuable tax benefit for many borrowers. The IRS allows eligible individuals to deduct up to $2,500 of interest paid on qualified student loans, even if they do not itemize deductions, except for married taxpayers filing separate returns. This deduction is available to taxpayers whose modified adjusted gross income (MAGI) falls below certain limits, which are subject to change each tax year. To qualify, the loan must have been taken out solely to pay qualified higher education expenses for yourself, your spouse, or a dependent, and the loan must be in your name or jointly with your spouse. Additionally, the loan must have been used to pay for expenses such as tuition, fees, room and board, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution.

It's important to note that not all student loan interest is deductible. For example, interest on loans from family members or employer-sponsored retirement plans typically does not qualify for the deduction. Furthermore, the deduction begins to phase out for individuals with MAGI above certain thresholds, and it is entirely phased out for those with MAGI above the maximum limits set by the IRS. Thus, while deducting student loan interest can provide tax savings for many borrowers, it's essential to understand the eligibility criteria and limitations to ensure compliance with IRS regulations.

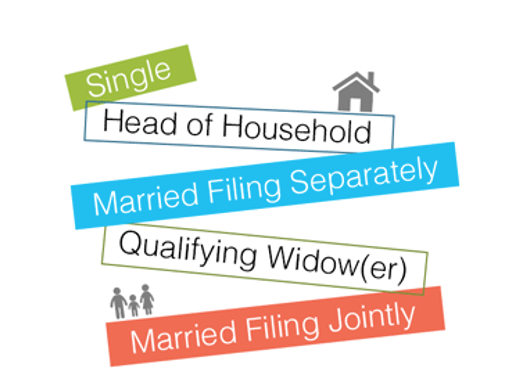

What filing status should I choose?

The IRS categorizes tax filers based on their household status, which plays a significant role in determining their tax obligations. Choosing a filing status is crucial as it informs the IRS of the specific tax rules that apply to you. There are five primary filing statuses recognized by the IRS: single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child. Each status carries its own set of rules and criteria, impacting tax rates, standard deductions, and eligibility for various deductions and credits.

Your chosen filing status can significantly influence your tax liability and financial outcomes. For instance, married couples have the option to file jointly, combining their incomes and potentially benefiting from lower tax rates and higher deductions. Conversely, filing separately might be advantageous in certain situations, such as when one spouse has significant medical expenses that could be deductible based on their individual income. Additionally, qualifying as head of household can provide certain tax benefits, including a higher standard deduction and lower tax rates compared to filing as single or married filing separately. To assist taxpayers in selecting the most appropriate filing status, the IRS offers an interactive tool that guides individuals through the process, ensuring they choose the status that best aligns with their circumstances and maximizes potential tax advantages.

How do I know my 2023 IRS tax brackets table and tax rate?

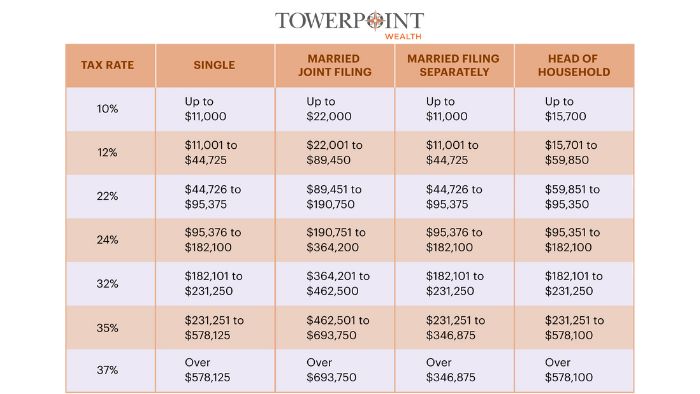

For the 2023 tax year, the IRS tax brackets underwent adjustments to account for inflation. These brackets determine the marginal tax rates that individuals and households are subject to based on their taxable income. The tax brackets are structured progressively, meaning that higher levels of income are taxed at higher rates. In 2023, the tax rates range from 10% to 37%, with seven different brackets based on filing status and income level. The income thresholds for each bracket vary depending on whether the taxpayer is single, married filing jointly, married filing separately, or filing as head of household. Taxpayers should consult the IRS guidelines or a tax professional to determine their specific tax bracket and corresponding tax rate for the 2023 tax year.

The 2023 IRS tax brackets table:

Additionally, understanding the 2023 IRS tax brackets table is essential for tax planning and financial decision-making throughout the year. By knowing which tax bracket they fall into, individuals can estimate their tax liability and take proactive steps to minimize their tax burden, such as maximizing deductions and credits or adjusting their withholding amounts. Taxpayers should stay informed about any changes to the tax brackets and related regulations to ensure compliance with tax laws and optimize their financial strategies in light of evolving tax policies.

At Towerpoint Wealth, we believe that navigating the complexities of tax season can be daunting, but having answers to the top 2024 tax season questions can alleviate much of the stress and uncertainty. Whether it's understanding filing statuses, deductions, credits, or the latest 2023 IRS tax brackets table, having clarity on these topics empowers taxpayers to make informed decisions and maximize their tax savings. By seeking out reliable information and guidance, individuals and businesses can approach tax season with confidence, ensuring compliance with tax laws while optimizing their financial outcomes. Remember, if you have any further questions or need assistance, consulting with a tax professional or utilizing reputable resources can provide the clarity and assistance needed to navigate tax season successfully.

Would you like to discuss your own situation further with us, or learn more about our wealth management philosophy and how we help clients build and protect their wealth? Curious how we utilize and integrate digital assets for some of our clients as part of a properly-diversified investment portfolio?

We encourage you to schedule an initial 20-minute “Ask Anything” discovery call with us, as we welcome beginning to get to know you and learning more about your unique personal and financial circumstances.

Click the Wealth Management Philosophy banner image below to learn more about how we help our clients grow and protect their net worth.

Happy 1st Birthday, Thompson!

This past Sunday the whole Towerpoint Wealth team joined our Partner, Wealth Advisor, Jonathan LaTurner, and his wife Katie, in helping the proud parents celebrate their son Thompson’s 1st birthday at Nitty’s Cider in East Sac!

We all had a blast, thank you for the invitation Thompson!

What is happening with the Towerpoint Wealth family? Click the banner below to find out!

Minimizing Common Investing Mistakes

Minimizing common investing mistakes is extremely important when working to build and protect your wealth and net worth and get your money’s best performance. Do you know what the 20 most common investing mistakes are?

Click the thumbnail image below for Part 2 of our series!

We are hopeful you will enjoy these educational videos, and encourage you to share this valuable information / share the video links with any colleagues or friends who would benefit from watching them.

Click the image below to browse our robust library of other wealth-building and wealth-protecting educational videos.

Returns to Recover Losses

Protecting your downside and minimizing losses during a temporary bear market / market pullback is just as, if not MORE important, than striving for outsized gains.

Thanks to The Investing Beast for the illustration!

In light of how unsettled the economy and markets are, are you concerned or worried about the bonds in your portfolio, and/or the overall level of risk you are taking in your portfolio?

Message us to discuss your circumstances.

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to contact us at any time, or call or email us (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist