As you build your retirement nest egg, you’re probably wondering if you have enough set aside to fund the lifestyle you crave in your “golden years”.

You’ve worked your entire life to grow your wealth and to enjoy the fruits of your labor in retirement, so the last thing you want as you progress into that next phase of your life is not to have enough money to retire and enjoy this time of peace and leisure.

The key is to ensure that the money you’ve accumulated can provide for your needs throughout retirement, allowing you to live comfortably without the fear of outliving your savings.

It’s said that a million dollars is NOT enough for most to retire comfortably, which begs some questions: How much money do I need to retire? Can I retire on 2 million dollars?

Well, that depends… on many things. While $2 million can be a solid foundation, determining if it’s truly sufficient for a comfortable retirement depends on multiple factors like your lifestyle, healthcare needs, and investment strategy.

A 2023 survey from Schwab Retirement Plan Services found that the average worker expects to need roughly $1.8 million to retire comfortably… but it’s possible that you don’t know what to do with 2 million dollars, or what a 2 million retirement looks like!

That’s why, in this article, we’re going to break down the 5 steps to help you gauge whether you can retire on $2 million and what you can do to make it last, with helpful resources to make your retirement planning more attainable.

Step 1: Assessing Your Financial Situation

Step 2: Setting Realistic Retirement Goals

Step 3: Invest Wisely to Reach Your Retirement Goal

Step 4: Planning for Healthcare Costs

Step 5: Creating a Sustainable Withdrawal Strategy

Step 1: Assessing Your Financial Situation

The first and most crucial step in determining whether you can retire on $2 million is to assess your current financial situation. This starts by taking inventory of your stock of your assets, liabilities, income streams, and overall financial health. By understanding where you stand financially, you can work to identify any gaps or areas that may need to be addressed.

Evaluate Your Assets

Start by listing your assets. This includes things like savings accounts, investment portfolios, real estate, and other valuable possessions. This will give you a clear picture of your net worth and how close you are to achieving your retirement goal.

Review Your Liabilities

Next, you want to take a close look at all of your liabilities, such as outstanding debts, mortgages, and other financial obligations. Reducing or eliminating your debt is a critical aspect of your retirement planning, as it can significantly erode your retirement income and overall financial security.

Estimate Your Retirement Income

Now is the time to evaluate your retirement income. Consider all potential income sources during retirement, including Social Security, pensions, annuities, and any part-time work you may plan to do. This income, combined with your savings, will help you understand the cash inflow that you will have when you retire.

By taking an inventory of your current financial situation, you can understand how reasonable it is to retire on two million dollars.

Want to know if you will be able to retire with $2 million? Download our free checklist to help you evaluate your financial situation. This simple tool will help you get a clear snapshot of where you stand.

Step 2: Setting Realistic Retirement Goals

Everyone envisions retirement differently, and your unique lifestyle will significantly impact whether $2 million will be enough. Once you have a clear understanding of your financial situation, the next step is to set realistic retirement goals.

This involves defining what you want your retirement to look like and determining the lifestyle you wish to maintain. There are many financial complexities that you should be aware of as you set your retirement goals. Do you plan on traveling? Staying in a high-cost area? What are your expected healthcare costs?

Your personal goals will shape the amount of income you’ll need and help you understand whether $2 million will be enough to support your desired lifestyle. Estimating essential expenses like housing and healthcare and discretionary spending like travel helps you determine if $2 million will be enough.

You’ll also want to consider your retirement timeline. When do you plan to retire, and how long do you expect to need your savings? The earlier you retire, the more you’ll need in your nest egg to ensure that your funds last throughout retirement.

By setting clear and realistic goals, you will be able to understand if retiring with 2 million dollars is reasonable for you and your way of life. Understanding these goals will also provide you with a framework for making informed decisions about your savings, investments, and retirement strategy.

Step 3: Invest Wisely to Reach Your Retirement Goal

Having two million dollars sitting in a regular bank account somewhere is likely NOT going to support your retirement. Investing your 2 million dollars — or whatever your retirement target is — can help make this sum last throughout your golden years.

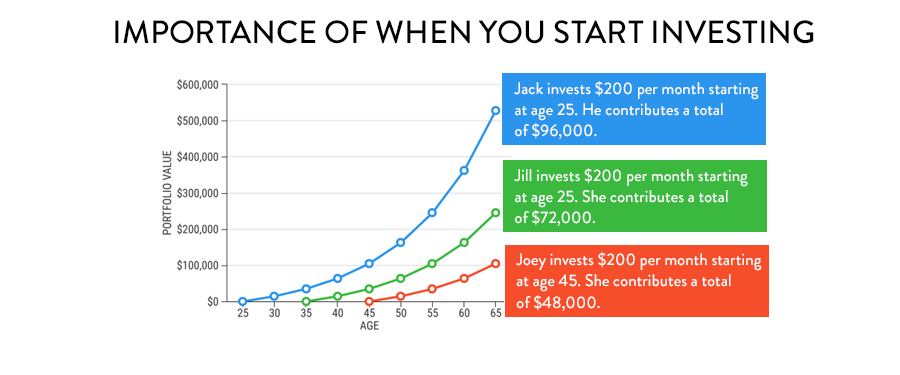

Building your retirement savings to cover all of your expenses requires long-term disciplined saving and strategic investing. Your investment strategy needs to work with your retirement timeline, risk tolerance, and financial goals to be effective for you. The earlier you start, the more time your investments have to grow and benefit from compound interest.

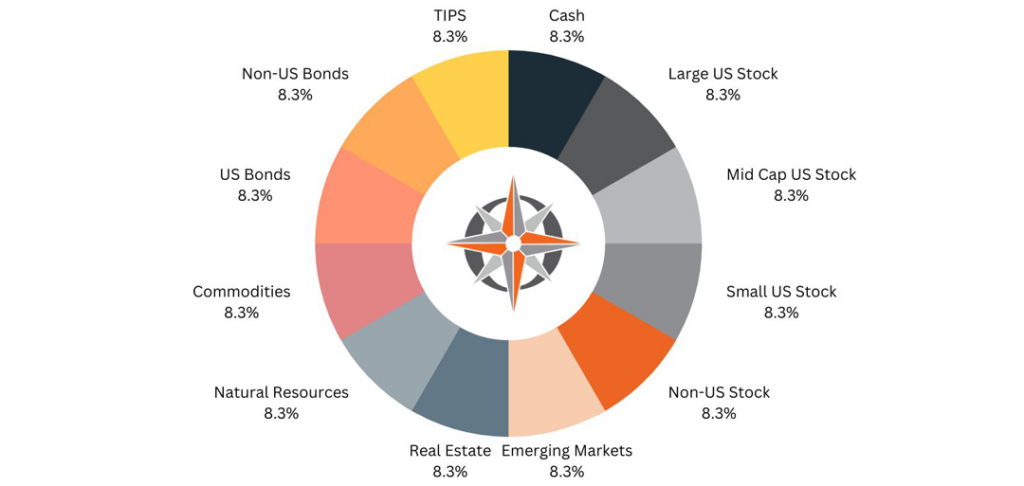

To reach your retirement goal, whether you’re looking to retire with $2 million or retire with $5 million, you’ll want to take advantage of key investment strategies. These include diversification, considering your risk tolerance, maximizing your tax-advantaged accounts, and staying the course of your retirement plan.

Most importantly, you want to start now!

By investing your assets as soon as possible, you get to benefit from compound interest. The younger you start, the greater the total return you can expect from your investments.

Want to learn how to optimize your investments for retirement? Watch our video with [ADVISOR NAME] on investing wisely for the future. You’ll discover key investing strategies from our expert team to help you reach your target and retire with confidence.

Step 4: Planning for Healthcare Costs

Healthcare is one of the largest and most unpredictable expenses in retirement. While Medicare helps cover some costs, out-of-pocket expenses such as premiums, deductibles, and long-term care can add up quickly. Not to mention, as you age, your healthcare needs are likely to increase.

It’s important to plan for these costs to ensure that they don’t deplete your savings. Allocating part of your savings specifically for healthcare needs, or considering options like long-term care insurance, can help protect your retirement nest egg.

Estimate Healthcare Costs

Start by estimating your healthcare costs in retirement. This includes premiums for Medicare or other health insurance, out-of-pocket expenses, and potential long-term care costs. It’s important to be realistic about these costs, as they can be significant, especially in the later years of retirement.

Consider Long-Term Care Insurance

Long-term care insurance can help cover the costs of nursing home care, assisted living, or in-home care. While it can be expensive, long-term care insurance can also provide peace of mind by protecting your savings from being depleted by high healthcare costs.

If you decide it’s best for you, it’s important to consider purchasing long-term care insurance while you’re still relatively young and healthy, as premiums increase with age and health conditions.

Create a Healthcare Savings Plan

Another way to prepare for healthcare costs is to set aside a portion of your retirement savings specifically for healthcare. You can do this through a Health Savings Account (HSA), which offers tax advantages for healthcare savings. Contributions to an HSA are tax-deductible, and withdrawals for qualified healthcare expenses are tax-free, making HSAs a valuable tool for covering healthcare costs in retirement.

Step 5: Creating a Sustainable Withdrawal Strategy

Even with $2 million saved, how you withdraw that money will determine how long it lasts. Knowing how to retire on 2 million dollars is another key part of the puzzle.

Without a strategy that is sustainable for you and catered to your needs, you will not get the most out of the money you set aside for retirement. The final step in retiring with $2 million is to develop a sustainable withdrawal strategy.

Creating a withdrawal strategy involves determining how much you can withdraw from your savings each year to cover your expenses — both essential and discretionary — without depleting your funds too quickly. A well-thought-out withdrawal strategy is key to ensuring that your money lasts throughout retirement and supports your lifestyle.

Many withdrawal strategies are used in retirement planning, such as the 4% rule, other fixed-percentage withdraws, adjusting your withdrawal amount for market fluctuations, adding annuities to your retirement plan, and the “bucket” strategy.

Creating a sustainable strategy is essential to ensuring that your $2 million nest egg lasts throughout retirement. Choosing the right strategy depends on your risk tolerance, life expectancy, and financial goals. Many retirees combine multiple strategies to tailor their withdrawal plans.

It’s important to remember that living off the interest of 2 million dollars takes careful planning and close monitoring, so you must stay on top of your financial planning as you plan to wind down from full-time employment.

Is $2 Million Enough to Retire?

So, can you retire with 2 million dollars?

Ultimately, the answer to “Is 2 million enough for retirement?” depends largely on your personal situation. By assessing your finances, setting realistic goals, investing wisely, planning for healthcare costs, and creating a withdrawal strategy, you can make informed decisions that set you up for a comfortable retirement.

Planning for retirement is complex, so it’s crucial to approach it with confidence and the right guidance. Working with a trusted financial planner who is a legal fiduciary — that is, legally obligated to act in 100% your best interest — can provide you with invaluable support! They can help you assess your financial readiness for retirement, tailor a withdrawal strategy that suits your needs, and adjust your plan as circumstances change.

For a more detailed, personalized roadmap to retiring with $2 million, download our full guide, “Is $2 Million Enough to Retire?”. This guide is packed with our expert insights and practical tips to help you retire on $2 million comfortably and confidently.

Frequently Asked Questions (FAQs)

Can you live off the interest of 2 million dollars?

Can I retire with 2 million?

How will inflation affect my retirement?

Is 2 million in my 401k enough to retire?

Can you live off the interest of 2 million dollars?

Yes, it is possible to live off the interest of $2 million, but it depends on your lifestyle, expenses, and how the money is invested.

If you were to invest in a diversified portfolio with an average return of 4%, you could generate around $80,000 annually in interest. This could provide a comfortable living for some, but it’s important to consider taxes, inflation, and market fluctuations. The amount of money needed to retire depends on your unique situation.

Can I retire with 2 million?

When it comes to specific and customized retirement advice, we recommend that you work with an advisor to analyze your financial situation, your goals, and the needs that you will have in retirement. While it may be possible for some to retire with $2 million, some may need to have more money invested to support their retirement.

At Towerpoint Wealth, we partner with Charles Schwab. They offer a Retirement Calculator tool that helps test out different scenarios to estimate your expected total retirement savings based on your annual contributions, and exploring this can be very helpful!

How will inflation affect my retirement?

The last thing anyone wants to do is fall short of their retirement plan. Whether you can retire comfortably on $2 million depends, as we’ve discussed, on a number of factors. A factor you don’t want to leave out in your retirement planning is inflation.

Inflation can erode the purchasing power of your savings over time, meaning you’ll need more money in the future to maintain your current lifestyle. Work with your financial advisor to ensure that your retirement plan takes inflation into account.

Is 2 million in my 401k enough to retire?

$2 million in your 401(k) could be enough to retire comfortably — that is, depending on your withdrawal rate, expenses, and expected longevity.

You need to consider healthcare costs, taxes on withdrawals, and any other sources of retirement income like Social Security. It’s important to assess your entire financial picture and consult with a financial advisor to ensure your 401(k) balance supports your retirement goals.

Bonus Step – AFTER You Have Retired with 2 Million Dollars – Pick the Right Place to Retire

Clearly, maximizing your lifestyle post-retirement requires attention to the cost of living. Stretching a dollar is always important, and retiring with 2 million dollars “buys” options, specifically, on where you choose to live.

Click the thumbnail below for the ThinkAdvisor.com slideshow that focuses on the 12 Best U.S. States for Retirement in 2024.

It is important to note that accumulating enough money is only Act One when determining whether retiring on $2 million is feasible. Figuring out how to properly, and sustainably, withdraw money (AKA decumulate) from your nest egg is Act Two, and is just as, if not more important to get right. A way-too-simplified back-of-the-envelope computation might look like this:

- $2,000,000 nest egg x 3.5% annual withdrawal rate = $70,000/year

- $70,000/year – 25% in assumed federal and state income taxes = $52,500/year net retirement income, or $4,375/month

Information is intended to be general in nature, for simplistic illustrative purposes only, and is not intended to serve as Investment advice, since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances.

However, there are a myriad of additional variables and considerations that factor into this “retirement calculus.” What about pensions? Inflation? Social Security? Income from part-time work? Variability in market growth and investment returns? Appropriateness and sustainability of a 3.5% annual withdrawal rate? Increases in health care and insurance expenses as you age? Legacy and philanthropic planning and objectives? So, when can you retire?

The list of important and yet very subjective considerations goes on and on. When developing a customized retirement income plan, the nuance in working through and deciphering each consideration cannot be understated.

However, what we can say with confidence is that if you have nearly accumulated $2 million for retirement, you have an excellent head start, and have probably secured yourself many attractive options. In our opinion, wealth is not defined by a set amount of dollars, but by the freedom it affords you. And having options and choices on how to live your life is the essence of what freedom, and retirement, truly is.

Watch our YouTube “Is 2 million enough to retire”

Our President, Joseph Eschleman, CIMA® worked with the team to put together a video reviewing what everyone should think about when they think about when can I retire and five steps to help folks get there.

Check out more YouTube videos

For more information on when to take Social Security benefits and how to reduce income tax as part of your retirement plan.

- Secure Act Explained

- How do 401 (k) loans work

- Roth IRA Conversions – How to Reduce Income Tax

- Retirement account rollovers

- When should you take social security benefits?

- Maximize the money your 401k and IRA beneficiaries

How Can We Help?

At Towerpoint Wealth, we are a fiduciary to you, and embrace the legal obligation we have to work 100% in your best interests. We are here to serve you and will work with you to formulate a comprehensive and tax efficient retirement strategy. If you would like to discuss further, we encourage you to call, Joseph Eschleman , 916-405-9150, or email jeschleman@towerpointwealth.com to open an objective dialogue.