Back in 2013, during an interview with Helaine Olen, University of Chicago social scientist Harold Pollack said, "The best financial advice for most people would fit on an index card." He then elaborated, stating, "If you're paying someone for advice, you're likely getting the wrong advice because the right advice is so straightforward."

After comments on his blog asked for the real index card with the advice, Pollack jotted down nine special money rules on a 4” x 6” index card, and took a photo of it. The photo and the special money rules immediately went viral, and we believe for good reason!

Whether or not you believe that mastering personal finance can be simplified to just one index card listing nine special money rules, the post went viral for a reason. These guidelines offered clear, actionable steps to manage and grow your wealth, with each money rule encapsulating a critical aspect of financial health, making complex financial concepts accessible and easy to follow.

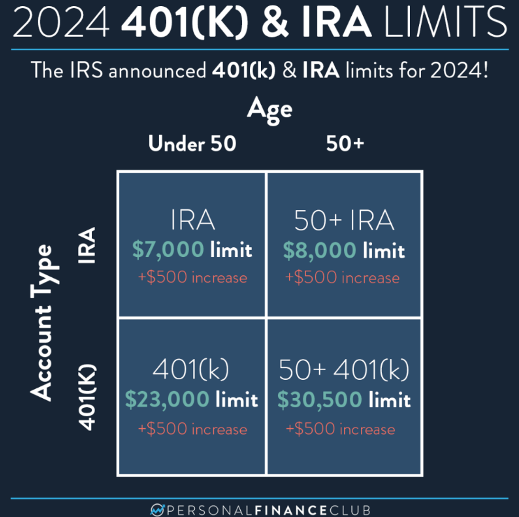

1. Max your 401(k) or equivalent employee contribution.

This money rule is #1 for a reason – you have to pay yourself first to secure a robust financial future. Contributing the maximum allowable amount to your company-sponsored retirement plan leverages employer matching funds, which essentially provides free money toward your retirement. Additionally, these contributions often come with tax advantages, reducing your taxable income and allowing your investments to grow tax-deferred. By consistently maxing out your contributions, you harness the power of compound interest, significantly boosting your retirement savings over time. Prioritizing this strategy ensures you're making the most of available benefits, setting a strong foundation for financial independence in your later years.

2. Buy inexpensive, well-diversified mutual funds (such as Vanguard Target 20XX funds).

Investing in inexpensive, well-diversified mutual funds is essential for building a solid investment portfolio. These funds offer broad market exposure at a low cost, reducing the impact of fees on your returns. By spreading investments across various asset classes and sectors, they minimize risk and enhance potential for relatively steady growth. Target date funds such as the Vanguard Target 20XX series automatically adjust their asset allocation as your retirement date approaches, aligning with your changing risk tolerance. This hands-off approach simplifies investing, making it easier to stay on track with your long-term financial goals while benefiting from professional management and strategic diversification.

3. Never buy or sell an individual security. The person on the other side of the table knows more than you do about this stuff.

Avoiding the purchase or sale of individual securities is a key principle in prudent investing. When trading individual stocks or bonds, you're often up against professionals with more resources, expertise, and information. This imbalance puts you at a significant disadvantage, increasing the risk of poor investment decisions. Instead, opting for diversified investment vehicles like mutual funds or exchange-traded funds (ETFs) spreads risk across a wide array of assets, providing exposure to the market's overall performance rather than the fate of a single security or company. This strategy mitigates the impact of any one stock’s downturn, promoting steadier growth and protecting your portfolio from the volatility and uncertainties of individual stock movements. By recognizing and respecting the expertise of professional investors, you position yourself for more consistent and reliable financial gains.

Click on the image and read more.

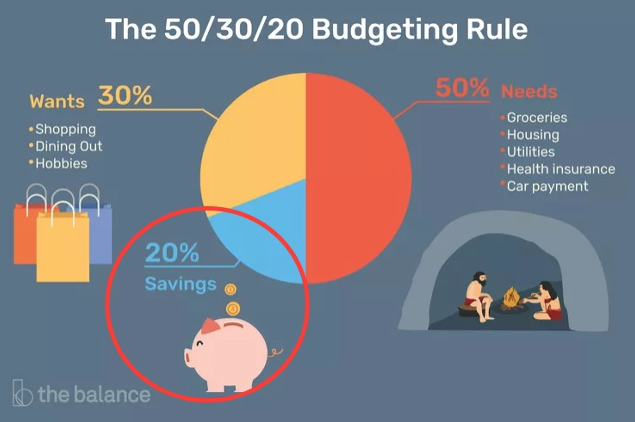

4. Save 20% of your money.

Paying yourself first is a cornerstone of financial stability and long-term wealth building. This disciplined approach ensures you consistently set aside funds for future needs, whether for emergencies, major life goals, or retirement. By prioritizing savings, you create a safety net that can absorb financial shocks, reducing the need for high-interest debt in times of crisis. Moreover, consistently saving 20% allows you to take advantage of compound interest, significantly enhancing your wealth over time. This habit instills financial discipline, encouraging mindful spending and better budgeting, ultimately leading to greater financial security and the ability to achieve your long-term aspirations.

5. Pay your credit card balance in full every month.

Paying your credit card balance in full every month is essential for maintaining financial health and avoiding unnecessary debt. By clearing your balance each month, you eliminate interest charges that can quickly accumulate and lead to significant financial strain. This practice not only saves you money but also helps improve your credit score, as timely payments are a key factor in creditworthiness. Moreover, consistently paying off your balance demonstrates financial discipline and responsibility, fostering better money management habits. It ensures that you live within your means, allowing you to allocate more of your income towards savings and investments, rather than servicing debt.

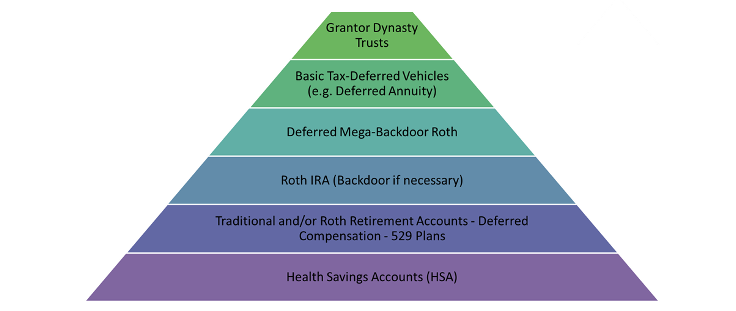

6. Maximize tax-advantaged savings vehicles like Roth, SEP and 529 accounts.

Maximizing tax-advantaged savings vehicles and accounts offers significant tax benefits that enhance your saving and wealth-building potential. Contributions to Roth IRAs grow tax-free, and qualified withdrawals are also tax-free, providing substantial tax savings in retirement. SEP-IRAs allow self-employed individuals to contribute large amounts pre-tax, reducing current taxable income while building retirement funds. 529 plans, designed for education savings, grow tax-free and withdrawals for qualified educational expenses are also tax-free, easing the financial burden of education costs. By fully utilizing these vehicles, you optimize your tax situation, accelerate your savings growth, and secure your financial future.

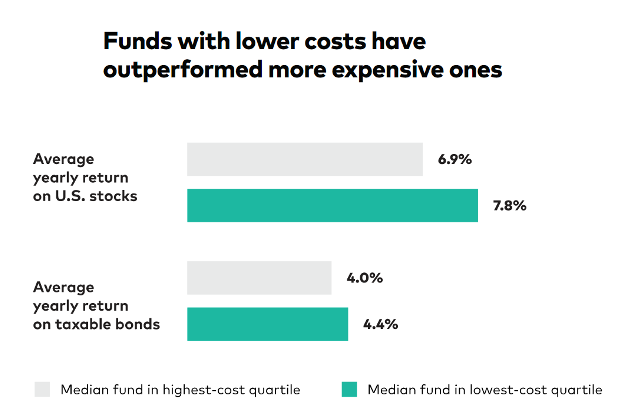

7. Pay attention to fees. Avoid actively managed funds.

Paying attention to investment fees and avoiding actively managed funds is essential for maximizing your investment returns. High fees and expenses can erode your gains over time, significantly impacting your overall portfolio performance. Actively managed funds typically charge higher fees due to frequent trading and management costs, yet they often fail to outperform low-cost, passively managed index funds. By choosing low-cost investment options, such as index funds or ETFs, you retain more of your investment growth. This cost-conscious approach enhances your returns through the power of compounding, ensuring more of your money works for you rather than being lost to fees. Prioritizing low-fee investments is a smart strategy for achieving long-term financial success.

8. Make financial advisors commit to the fiduciary standard.

Ensuring your financial advisor commits to the fiduciary standard is crucial for safeguarding your financial interests. Advisors adhering to this standard are legally obligated to act in your best interest, providing advice and recommendations that prioritize your financial well-being over their own profits. This commitment minimizes conflicts of interest, ensuring that investment strategies and financial plans are tailored to your unique goals and circumstances rather than driven by commissions or incentives. By choosing a fiduciary advisor, you gain a trusted partner dedicated to helping you achieve financial success with transparency and integrity, ultimately fostering greater confidence and security in your financial decisions.

Click on the image and read more.

9. Promote social insurance programs to help people when things go wrong.

Social insurance programs play a vital role in providing essential support and security to individuals and families during challenging times. These programs, such as unemployment insurance, disability benefits, and Social Security, act as safety nets that mitigate the financial impact of unforeseen events like job loss, illness, or retirement. By offering income assistance and healthcare coverage, social insurance programs help prevent individuals from falling into poverty or financial distress during periods of hardship. They promote social and economic stability by ensuring that basic needs are met, allowing people to focus on recovery and rebuilding without facing overwhelming financial burdens. Moreover, these programs contribute to a more equitable society, where access to essential resources and services is not solely contingent upon one's financial circumstances, fostering resilience and collective well-being.

Would you like to discuss these money rules, your own situation further with us, or learn more about our wealth management philosophy and how we help clients build and protect their wealth? Curious how we utilize and integrate digital assets for some of our clients as part of a properly-diversified investment portfolio?

We encourage you to schedule an initial 20-minute “Ask Anything” discovery call with us, as we welcome beginning to get to know you and learning more about your unique personal and financial circumstances.

Click the Wealth Management Philosophy banner image below to learn more about how we help our clients grow and protect their net worth.

2nd Annual TPW Spring Professional Social Mixer

A fun and prominent group of Sacramento-area financial advisors, professional fiduciaries, CPAs, EAs, mortgage brokers, real estate agents, wealth managers, bankers, and attorneys gathered last Thursday Towerpoint Wealth’s 2nd annual TPW Spring Social Mixer.

The event, held at The Sutter Club, provided an opportunity for business networking, and engaged a spirit of cooperation and collaboration among attendees, who discussed, yes, banking, real estate, and financial services, but also hobbies, families, and of course, the pleasures of wine.

Click the image below for a quick recap!

What is happening with the Towerpoint Wealth family? Click the banner below to find out!

What Makes Towerpoint Wealth Different?

Click the thumbnail image below to find out exactly what we are doing differently, to help you remove the hassle of properly coordinating all of your financial affairs, so you can live a happier life and enjoy retirement!

We are hopeful you will enjoy this educational video and encourage you to share it with any colleagues or friends who would benefit from watching it.

Click the image below to browse our robust library of other wealth-building and wealth-protecting educational videos.

The CA Taxpayer Protection and Government Accountability Act

In the upcoming weeks, the California Supreme Court will deliberate on whether to remove a measure from the November ballot that aims to impose stricter requirements for tax increases. This case involves a conflict between Democratic leaders and unions on one side and business and taxpayer groups on the other.

The CA Supreme Court faces a deadline of June 27th to finalize the November election ballot, prompting a timely decision on the fate of the proposed measure.

Learn more by reading this well-written Kiplinger article, as well as the Cal Matters article linked in image below!

State Income Tax Rates

California is known for its relatively high state taxes, which can be perceived as onerous by some residents and businesses. The state imposes progressive income tax rates that can reach up to 13.3% for the highest income earners, making it one of the highest state income tax rates in the nation. While these taxes fund important public services and initiatives, the perceived weight of California's tax system can sometimes be a point of contention among taxpayers and businesses alike, influencing decisions about residency, investment, and economic activity in the state.

Thanks to the Tax Foundation for the illustration!

In light of how unsettled the economy and markets are, are you concerned or worried about the overall level of risk in your portfolio?

Message us to discuss your circumstances.

While the global 24/7 news cycle churns, twists, and turns, here are a number of fun, local trending events of note:

- May 18 – Boyz II Men – Thunder Valley Resort and Casino

- May 18 – Bike Fest – William B. Pond Park

- May 22 – Paints and Pints - Family Friendly Painting – Porchlight Brewing

- May 24 – Candlelight: A Tribute to Adele – CA State Railroad Museum

- May 23 – 27 – Sacramento County Fair – Cal Expo

- May 27 – Memorial Day Community Event – Sacramento Memorial Auditorium

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to contact us at any time, or call or email us (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

Joseph Eschleman

Certified Investment Management Analyst, CIMA®

Jonathan W. LaTurner

Wealth Advisor

Steve Pitchford

CPA, Certified Financial Planner®

Lori A. Heppner

Director of Operations

Nathan P. Billigmeier

Director of Research and Analytics

Michelle Venezia

Client Service Specialist

Luis Barrera

Marketing Specialist

Megan M. Miller, EA

Associate Wealth Advisor

We enjoy social media, and are actively growing our online community!

Follow us on any of these platforms, message us there and let us know your favorite charity.

We will happily donate $10 to it!