Here we go! “How much do I need to retire? How much in retirement savings should I have?” – two questions virtually all of us have asked ourselves as our non-working, non-earning years draw closer.

If (or perhaps we should say WHEN) the Secure Act 2.0 becomes law, many pre-retirees will have a myriad of additional new options and opportunities to save and invest for retirement, and to build and protect their net worth. And while there is no such thing as a “sure thing” in Washington D.C., the Securing a Strong Retirement Act of 2021 has bipartisan support, and was approved unanimously by the House Ways and Means Committee just over two months ago.

What is changing, and what kind of new net worth building and retirement saving options and opportunities will be available? Click the link below to watch an engaging six-minute educational video that we just recently published, featuring our President, Joseph Eschleman, *jam-packed* with information highlighting six MAJOR ways your retirement savings plan may change (for the better!) if the Secure Act 2.0 becomes law:

Click HERE to watch Joe’s video.

Be sure to also click the SUBSCRIBE button to follow

Towerpoint Wealth on YouTube!

“How much savings do I need for retirement?” is a question we look forward to helping clients, colleagues, and friends (i.e., YOU) succinctly and tangibly answer. We specialize in retirement income planning, and – understanding how unique everyone’s personal and financial circumstances are – we encourage you to click HERE to contact us and begin a no-strings-attached dialogue about how to answer this important question for yourself.

Shifting gears, the June 23 cryptocurrency/Bitcoin webinar we hosted along with our partners at Eaglebrook Advisors was extremely well-received. Please click on the story tile below to read Eaglebrook’s latest white paper, Bitcoin’s Role in Model Portfolios, and if you missed our 6/23 webinar…Click HERE to watch the replay!

Be sure to also click the SUBSCRIBE button to follow

Towerpoint Wealth on YouTube!

What’s Happening at TPW?

Our President, Joseph Eschleman, and Director of Tax and Financial Planning, Steve Pitchford, couldn’t be happier being vaccinated and getting back out to spend IN PERSON face-to-face time with a number of important Towerpoint Wealth clients and colleagues!

Joseph and Steve Shaffer in downtown Davis, CA

Joseph, Dorace Lynch, and Johnny Lynch in Vacaville, CA

Joseph, Nancy Kendall, Bill Kendall, and Steve in Elk Grove, CA

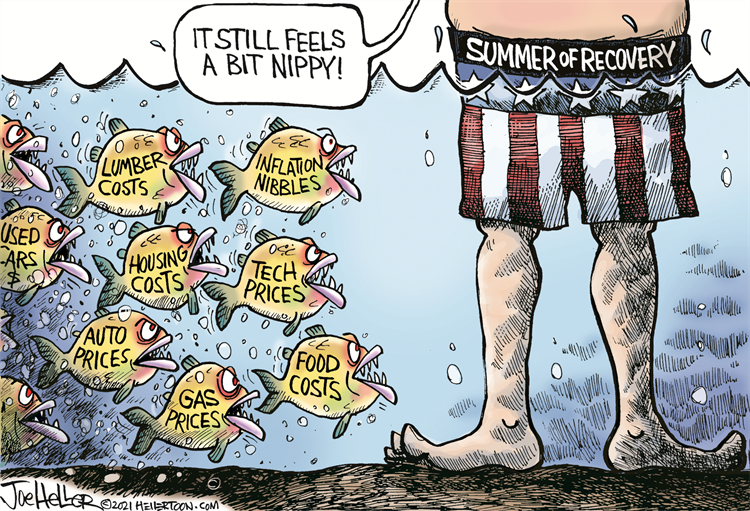

Cartoon of the Week

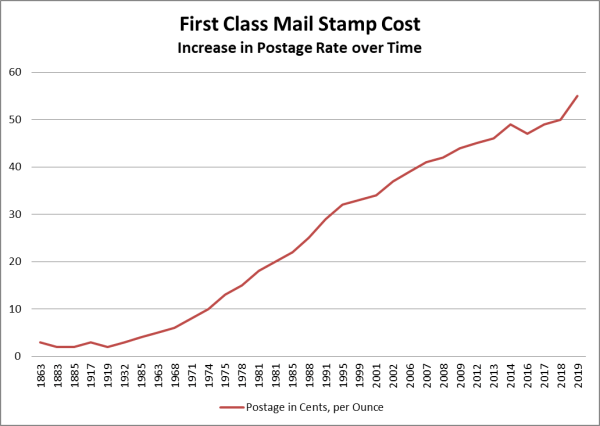

As the cartoon below illustrates, inflation is not always immediately visible, and not always “feelable” (although if you have purchased a tank of gas, a new home, or a new or used car lately, your wallet has certainly felt it!) and its insidious nature can be quite problematic when investing to grow your net worth. Trying to answer the question “How much do I need to retire?” cannot be done without considering the impact that inflation will have on the cost of your future retirement lifestyle.

At Towerpoint Wealth, we feel that avoiding risk when investing (i.e. prioritizing that your nest egg and retirement funds do not fluctuate up and down in value) by focusing on owning CDs, money market funds, and cash “safely” in the bank, is akin to letting inflation peck away and erode your net worth. We believe that “risk,” in and of itself, is not a bad thing – it is one of the few variables we have direct controlover. The binary question of “if” risk should be taken is inappropriate in our opinion – instead, we believe that evaluating, measuring, and justifying exactly howmuch and/or what level of risk should be taken is the more important consideration.

Highlighted by the deterioration in value (in REAL dollars) that “safe” investments can and oftentimes do experience due to inflation (and income taxes), it is important to understand that both “safety” and “risk” are relative terms, and to think critically about both concepts when developing, implementing, and managing a customized financial, investment, and retirement plan and strategy.

Trending Today

In addition to new legislation and inflation gyration, a number of trending and notable events have occurred over the past few weeks:

- Earthquakes rattle Northern California yesterday, “highlighted” by a magnitude 5.9 earthquake near Markleeville, in Alpine County

- Bill Cosby was released from prison after his sexual assault conviction was overturned by the Pennsylvania Supreme Court

- COVID-19 vaccinations have ground to a virtual halt in some areas of the United States

- A bi-partisan infrastructure deal is set to reach the Senate floor as early as the week of July 19

- A record-smashing heat wave baked the Pacific Northwest last week

- Spectators have been barred from Tokyo Olympics venues amid Japan’s COVID-19 state of emergency

- The Biden administration is launching a door-to-door effort to vaccinate Americans, causing backlash

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

– Joseph, Jonathan, Steve, Lori, Nathan, and Michelle