How would you like to be FORCED to take extra, unwanted, and unnecessary taxable income that would ADD TO your taxable income for the year and potentially catapult yourself into a higher income tax bracket?

If you are 72 or older and own an IRA or tax-deferred retirement account and receive required minimum distributions (RMDs), this may be happening to you every single year. If you are not yet 72, take this as fair warning – you have time to plan and put some tax saving solutions in place!

Many individuals know well enough that RMD taxes are a “necessary evil” of contributing to, and investing in, retirement accounts such as 401(k)s, IRAs, 403(b)s, etc. However, what investors often fail to realize is that there are impactful and proactive tax planning strategies that can materially lessen the sting of these RMD taxes.

As discussed below, short of enacting a QCD every year for the full amount of your RMD (do the acronyms have your head spinning yet??!!), there is no way to outright avoid paying income taxes on your IRA and retirement account RMDs. However, at Towerpoint Wealth, we are proactive in working with our clients to reduce the pain associated with RMD taxes if and when possible, usually utilizing one or more of the following three planning opportunities, each of which can help:

Tax Saving Solutions

1. Accelerate IRA withdrawals

We get it, as this sounds counterintuitive. Take more money out to save on taxes?? The short answer – yes.

Subject to certain exceptions, age 59 ½ is the first year in which an individual is able to take a distribution from a qualified retirement plan without being subject to a 10% early withdrawal tax penalty.

Consequently, the window of time between age 59 ½ and age 72 becomes an important one for proactive RMD tax planning. By strategically taking distributions from pre-tax qualified retirement accounts between these ages, an individual may be able to lessen their overall lifetime tax liability by reducing future RMDs (and the risk that RMDs may push them into a higher tax bracket) by reducing the retirement account balance.

This strategy becomes particularly opportune for an individual that has retired before age 72, as it often affords the individual the ability to take these taxable distributions in a uniquely low income (and lower income tax) period of time.

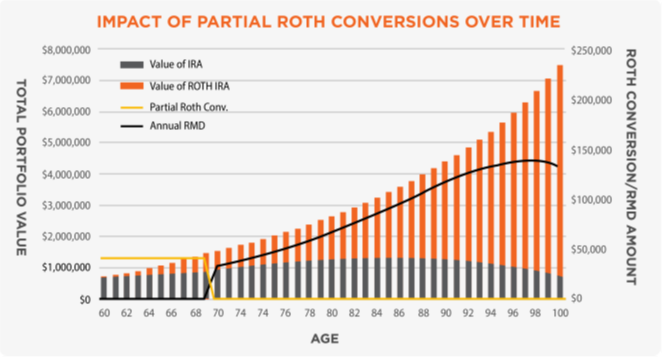

2. Execute a Roth conversion

A Roth conversion is a retirement and tax planning strategy whereby an individual transfers, or “converts,” some or all of their pre-tax qualified retirement plan assets from a Traditional IRA into a tax-free Roth IRA.

While ordinary income taxes are owed on any amounts of tax-deferred contributions and earnings that are converted, a Roth conversion, when utilized properly, is a powerful tax planning strategy to reduce a future IRA RMD, and concurrently, RMD taxes, as Roth assets are not subject to required minimum distributions since they generate no tax revenue for the government. Further, Roth conversions also 1) maximize the tax-free growth within a taxpayer’s investment portfolio, 2) provide a hedge against possible future tax rate increase (as Roth retirement accounts are tax-free), and 3) leave a greater tax-free financial legacy to heirs.

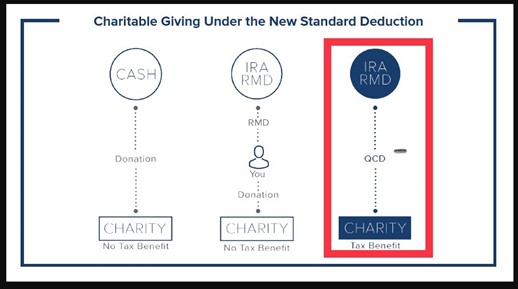

3. Use the IRA RMD to make Qualified Charitable Distributions (QCDs)

When an individual becomes subject to an IRA RMD, in lieu of having the IRA distributions go to them, they may consider facilitating a direct transfer from their IRA to one, or more, 501(c)3 charitable organizations (up to $100K annually). This is known as a Qualified Charitable Distribution (QCD).

As long as these distributions are made directly to the charity, they 1) satisfy the RMD and 2) are excluded from taxable income.

This strategy, when executed property, results in a dollar-for-dollar income reduction compared to a “normal” RMD.

Fortunately or unfortunately, there is no magic bullet nor panacea when it comes to RMD taxes and the income tax obligation you will have when taking RMDs. However, we feel that you still have an obligation to be aware and/or mindful of the planning opportunities mentioned above, as potentially reducing your income tax liability is certainly better than paying “full boat” every year!

Video of the Week

As a follow up to the subject focus of our most recent 10.15.2021 Trending Today newsletter, click the thumbnail below to watch the educational video we just produced last week, featuring our President, Joseph Eschleman, as he discusses the THREE key ingredients that are crucial when working to successfully build and protect your wealth, and SEVEN specific long-term investing strategies and philosophies that need to be developed and internalized if you truly want to be a successful long-term investor.

What’s Happening at TPW?

We love and are proud of the work hard, play hard culture we have built here at Towerpoint Wealth, and in the spirit of that philosophy, the TPW family took a ½ day “Teambuilding Tuesday” earlier this week, enjoying lunch together at The Station Public House in Auburn, followed by fun and games (literally!) at Knee Deep Brewing Company!

Our President, Joseph Eschleman, gave two (!) pints of A- last week, with a “Power Red” blood donation at the American Red Cross in Sacramento.

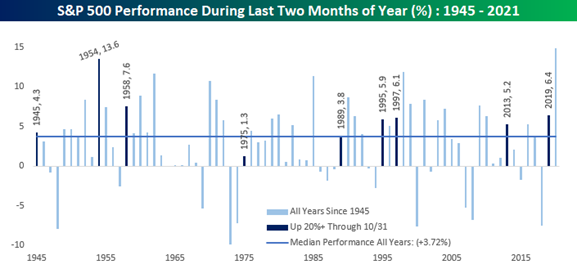

Graph of the Week

There are just under two months left in the year, and from strictly a seasonal perspective, November and December have historically been two of the better months on the calendar. The chart below shows the S&P 500’s performance during the last two months of the year in the post-WWII period. Overall, the median performance has been a gain of +3.72%, with positive returns just over three-quarters of the time (76.3%).

The S&P 500’s 22.6% gain this year is the strongest year-to-date reading through October since 2013. 2021 is just the tenth year since 1928 where the S&P 500 has been up more than 20% YTD through October. In the chart above we have highlighted each of those years in dark blue.

Quote of the Week

It is easy to be an investor when things are relatively “normal” and calm; it becomes much more difficult to be disciplined and stay objective when things get crazy…

Trending Today

As the 24/7 news cycle churns, twists, and turns, a number of trending and notable events have occurred over the past few weeks:

- Republican Glenn Youngkin defeats Democrat Terry McAuliffe in the closely-watched Virginia governor’s race on Tuesday night

- CDC now recommends that children between the ages of 5 and 11 years receive the Pfizer-BioNTech pediatric COVID-19 vaccine

- The Atlanta Braves won their first World Series championship since 1995, hammering the Houston Astros 7-0 on Tuesday night in Game 6

- Amid growing concerns about the technology, Facebook said it will shut down its face-recognition system and delete the faceprints of more than 1 billion people

- Investigation continues into Alec Baldwin’s fatally shooting of cinematographer Halyna Hutchins on a movie set October 21

- World leaders outline climate commitments at COP26 summit

- UK authorizes Merck COVID-19 antiviral pill, the first pill shown to successfully treat COVID-19

As always, we sincerely value our relationships and partnerships with each of you, as well as your trust and confidence in us here at Towerpoint Wealth. We encourage you to reach out to us at any time (916-405-9140, info@towerpointwealth.com) with any questions, concerns, or needs you may have. The world continues to be an extremely unsettled and complicated place, and we are here to help you properly plan for and make sense of it.

– Joseph, Jonathan, Steve, Lori, Nathan, and Michelle

We think social media is fun, and are always actively growing our social media community!

Follow us on any of these platforms you use, and then message us

with your favorite charity, and we will happily donate $10 to it!

Click HERE to follow Towerpoint Wealth on LinkedIn

Click HERE to follow Towerpoint Wealth on Facebook

Click HERE to follow Towerpoint Wealth on Instagram

Click HERE to follow Towerpoint Wealth on Twitter

Click HERE to follow Towerpoint Wealth YouTube

Click HERE to follow Towerpoint Wealth Podcast A Wealth of Knowledge